Your success or failure in trading will depend on several factors, one of which is the trading plan. If you have one, the next question is whether you follow it consistently.

In a zero-sum game like currency trading, there is an outstanding line separating trading and gambling. Trading without a plan is like gambling. A trading plan will give your trading activities a direction and is a hallmark of serious traders.

What is a trading plan?

This is an overview of your planned trading activities based on the parameters you selected. Or, in other words, a list of tasks that you have compiled to work more efficiently in trading.

You can also modify an existing strategy from other traders until you develop your own. Your trade plan should speak your inner voice as a trader.

Traders who implement a trading plan religiously can survive the market’s test of fire. These are traders who stay true to their strategy despite the temporary setbacks encountered along the way. A trading plan allows you to stay in the game even if your hit rate is slow.

The importance of a trading plan

You cannot discount the importance of having and following a trading plan. Among the benefits of such a plan are the following:

- It helps you build trading discipline, only taking trades that meet your criteria and passing up on mediocre setups.

- It keeps you from overtrading or revenge trading.

- It enables you to control your emotions and trade without stress.

- It facilitates evaluation of your trading performance to find better entries, understand quality setups, correct fallacious market beliefs, etc. You aim to reduce trading losses and maintain or increase the number of winning trades.

Mechanical trading system

Do mechanical trading systems work? You might have this question at the back of your mind. As the famous turtle trading experiment in 1983 proved, a fully automatic trading system can work. Also, that experiment showed that anyone could learn to trade.

For a mechanical trading system to work, each aspect of trading should have well-defined rules. It would help if you established rules in whatever market condition you are in. You have to define your actions before, during, and after a trade entry.

As already pointed out, following the trade plan is indispensable. The turtle experiment echoed this idea. The participants who followed the plan persisted and made millions, while those who veered away dropped early in the program.

Elements of a trading plan

There are many elements of a trading plan, and you must define them wholly and carefully. Your actual trading plan may vary, but it should have some of the following elements:

- News events and fundamentals

- Market selection

- Time frames to consider

- Market condition to trade

- Type of trade to take

- Indicators to use

- Market session

- Entry rules

- Risk management

Economic calendar

Will you consider fundamental factors? If not, will you at least check the economic calendar to know the schedule of news releases within the week? If so, you have to specify how many minutes before the news you will avoid trading. Also, determine how many minutes after the news release you will start trading again.

Market selection

Which markets will you look for trade setups? Will you put the 28 significant pairs on your radar? Or are you going to consider USD pairs only? Define this in your trading plan.

Time frames

How many time frames are you going to check in the process of identifying an entry? Utilizing multiple time frame analysis, some trading plans consider three time frames, one each for trend, setup, and entry.

See the examples below:

- Trend chart – daily

- Setup chart – hourly

- Entry chart – 15 minutes

Market condition

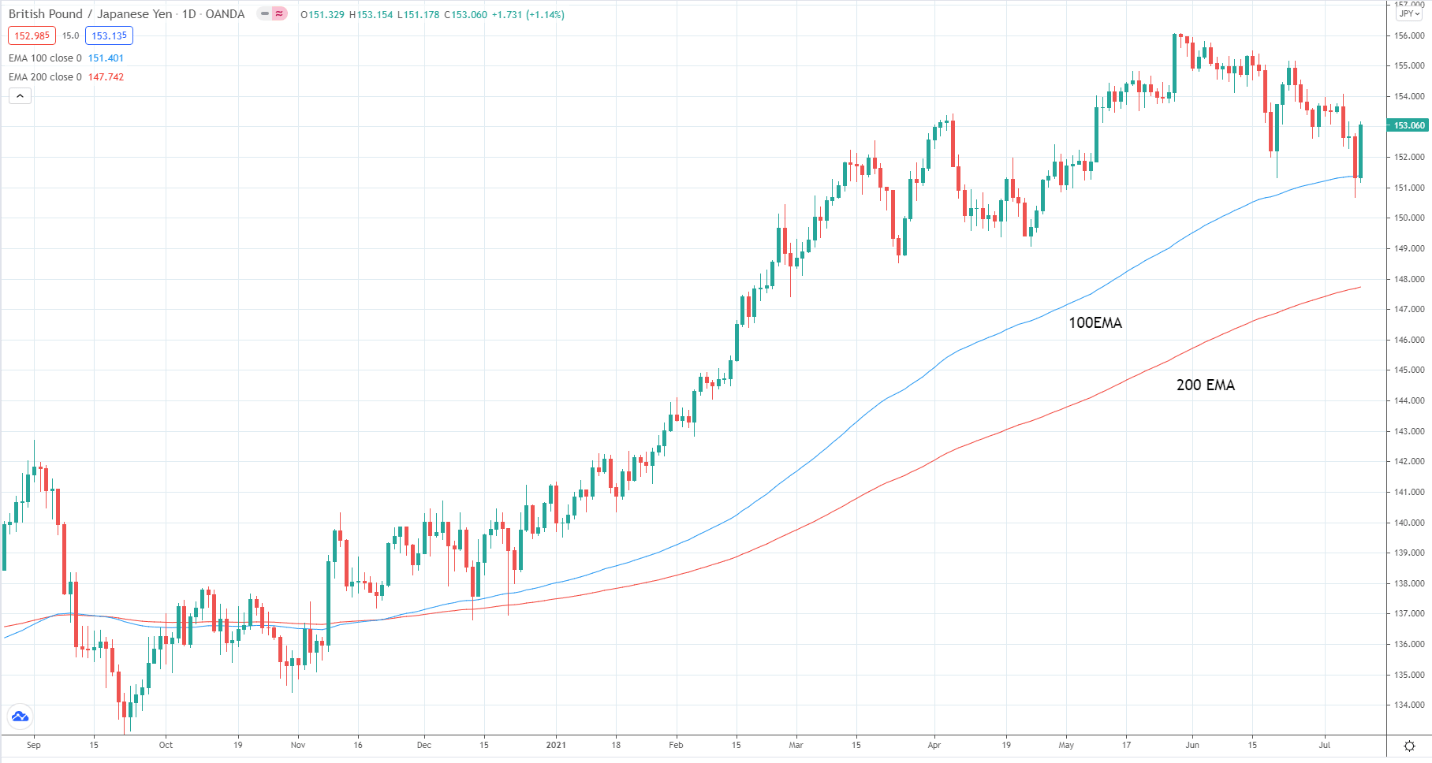

Will you trade a trending market on your chart? Will you consider a ranging market? What about choppy markets? Include this in your trade plan. The above graphic shows the daily chart of GBP/JPY with the 100 EMA and 200 EMA plotted. Is this a trending market for you?

Trade type

What type of trade are you going to take? This is a factor in your trading strategy. The three common types of trade entries are trend continuation, reversal, and breakout.

Indicators

What indicators are you going to use for entry analysis? List them down and specify the indicator settings:

- Exponential moving average (period 100)

- Exponential moving average (period 200)

- Simple moving average (period 20)

- MACD (12, 26, 9)

- RSI (period 14)

Market session

The forex market runs 24 hours a day and five days a week. Naturally, you cannot stay awake and check the market throughout the day. Not only is this stressful, but it can be counterproductive.

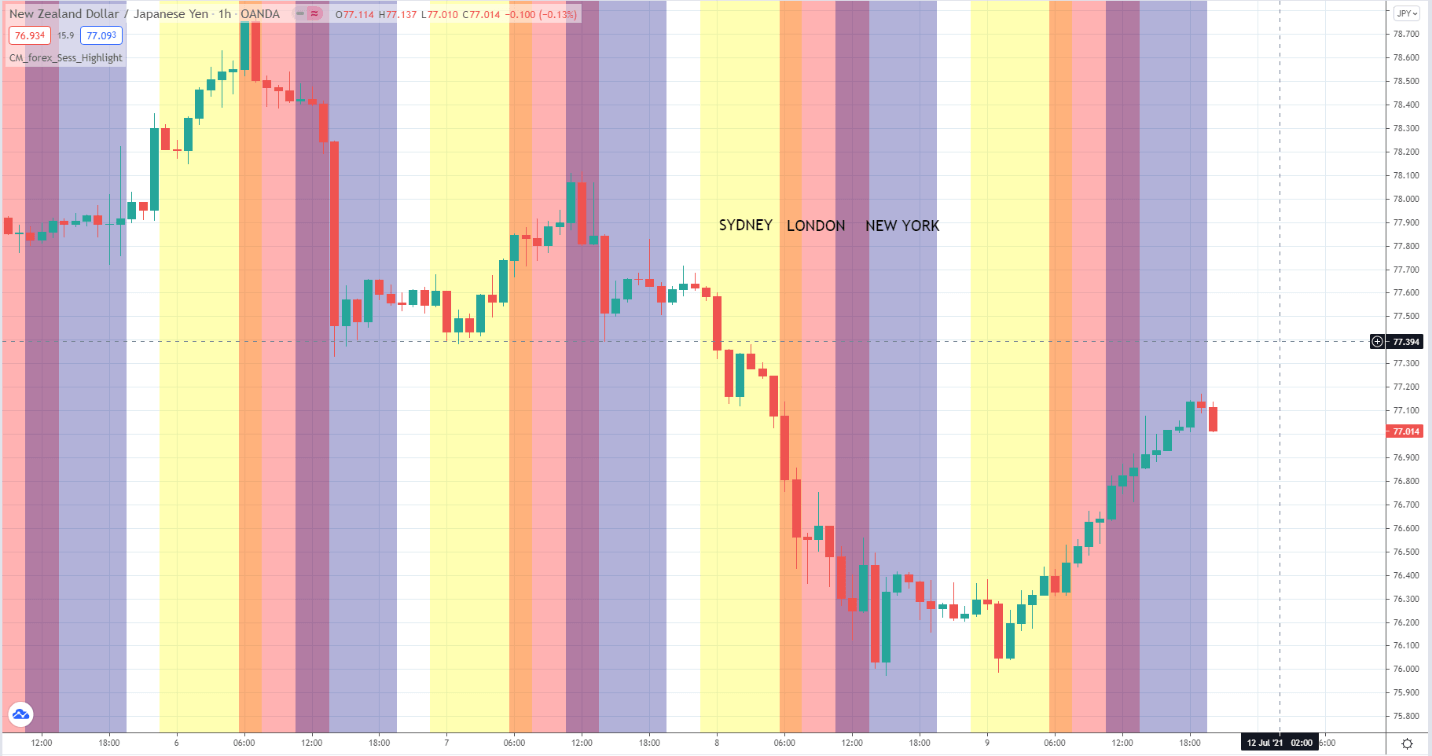

You can divide the forex market into four sessions:

- London

- New York

- Sydney

- Tokyo

Define in your trade plan which sessions are you going to sit on your trading desk. The above chart shows three market sessions.

Entry rules

This is one of the essential elements of your trade plan, but it is not everything. Outline your primary trading strategy here. List down the steps that will lead you to make a trading decision. Below is an example.

- Check the economic calendar if there is no high-impact news due for release in an hour.

- Go to each market on the list one by one.

- At the market open, identify the trend on the daily chart. Note it down in your trading planner. If the price is above the 100 and 200 EMAs, the trend is up. If the price is below the EMAs, the trend is down.

- Find entries on the hourly chart during the London session.

- If the daily trend is bullish, check-in the hourly chart if MACD lines are below zero and crossing upward. If the daily trend is bearish, check the hourly chart if MACD lines are above zero and crossing downward.

- For a buy trade, enter long when RSI crosses 50 from below and price breaks and closes above 20 SMA in the hourly chart. For a sell trade, enter short when RSI crosses 50 from above and price breaks and closes below 20 SMA.

Risk management

How many open trades would you handle at any one time? What percentage of your account would you allocate to each trade? Based on this percentage, you will get the risk equivalent in terms of the deposit amount. The actual lot size depends on the distance of the entry point to the stop loss.

After determining the trade lot size, decide how you will exit the trade when it is profitable. These are some of the questions you must find answers for:

- Will you use a fixed risk-reward ratio?

- Will you trail your stop loss and not set a take profit at all?

- How are you going to trail your stop? You can use an arbitrary number of candles or pips or swing points.

- Will you scale out of position when the trade has reached the initial target? One strategy is closing half of the position, putting the remaining half at breakeven, and letting it run.

Final thoughts

If you want to succeed in trading, you must develop a game plan before you engage. This is true in any venture. If you put up a traditional business, you have to plan out everything from the get-go. While the plan is not set in stone, it can help you understand which area is not performing well and needs improvement. You will have to adjust the trade plan gradually over time to bridge any gap.

Comments