For traders who want to exploit the best opportunities in the Forex market, the Forex Robots offer a big advantage. Automated trading software has taken the Forex market by storm. With the software, you can trade as easily as a professional thanks to the automated settings that take care of all the work for you. It is not surprising to find numerous such trading tools available now.

The problem arises in choosing the best Forex Robot. Should you focus on the trading results, the user reviews, or the strategy? Will an expensive robot be worth the investment? Or, are they simply a scam to rob you of your hard-earned money? There are several features that you need to consider before you make a decision.

Fortunately, we have made your task a breeze with our comprehensive guide. We have put a lot of effort into testing the different Fx robots and their various features in meticulous detail. After reading this guide, you can understand these automated trading tools better. You will find that choosing the best Forex Robot is easier and rewarding.

- Comparing 7 Best Forex Robots

- Our Choice Among The Best Forex Robots: 7 Profitable Systems

- What Is A Forex Robot?

- Automated Trading Vs Manual Trading

- How Do Forex Robots Work?

- Are Forex Robots Profitable?

- What Are The Types Of Forex Robots?

- How To Test Forex Robot Strategies

- How Much Do Forex Robots Cost?

- Where Can I Buy A Reliable Forex EA?

- Best Forex Robot Vs Scam Forex Robot

- Conclusion

Comparing 7 Best Forex Robots

Our Choice Among The Best Forex Robots: 7 Profitable Systems

Our list of best Forex Robots is based on important factors like security, reliability, and trade accuracy. We look for criteria like risk management, customer service, order execution, and pricing to determine the efficacy of the robots. Here are a few that have fulfilled our criteria.

1. Techberry

TechBerry is an automated social trading analytical platform using highly efficient artificial intelligence to gather and evaluate information from over 100,000 online trading accounts. As a result, users of the platform earn an average of roughly 12% more per month.

Founded in 2015, the social trading analytical platform has considerably revolutionized social trading. Currently, it is regarded as among the most advanced automated trading programs in the foreign exchange industry. The TechBerry algorithm uses deep learning in selecting the finest Forex market prospects from the available market activity.

TechBerry presents it as a user-friendly automatic trading platform. Interestingly its neural algorithm gathers and analyzes data from more than 100,000 trading accounts provided by the Forex community participants on the Internet. By gathering the best deals, AI generates its strategy. Anyone can join by purchasing a yearly subscription and receiving an AI-driven income.

2. Happy Forex EA

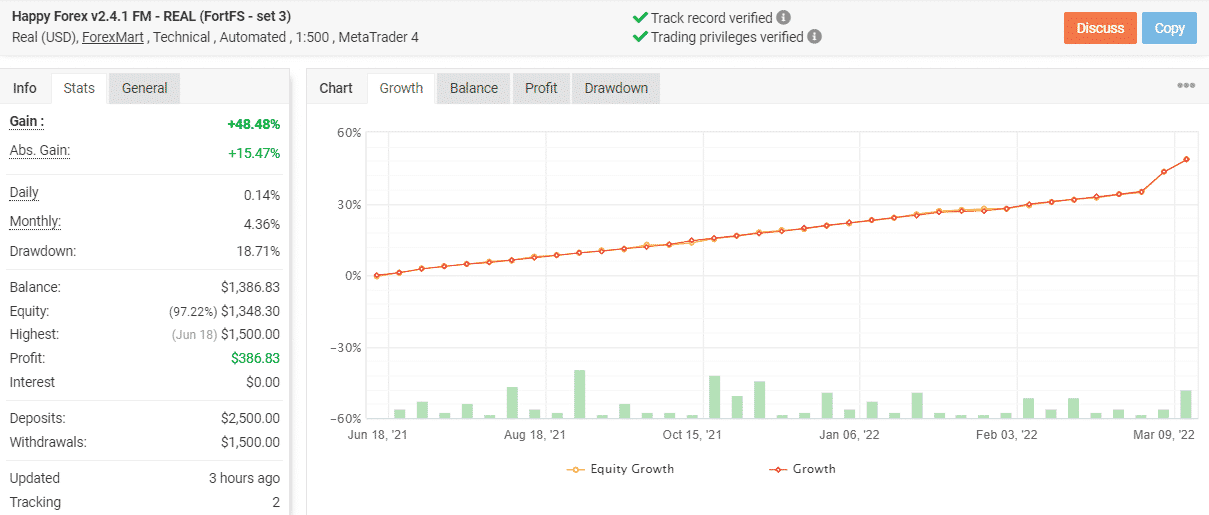

Happy Forex EA has been running a live trading account on Myfxbook since June 18, 2021. It is also supported by an 11-year backtest conducted from 1999 to 2010. The win rates for the backtest and the live results are 74.54% and 68%, respectively. Thus, it is evident that this EA can generate steady profits in various market conditions.

This robot uses reinsurance positions or grid strategy without increasing the size of the trading lots, as seen in martingale. It is compatible with any brokers with maximum of 4 spreads. The main features of the system are as follows:

- Auto-quotes detection of 4 or 5 digits

- Effortless setup process

- Compatible with Linux, Mac OS, and Windows

- Works with Standard, Mini, and Micro accounts

- Supports ECN brokers

There are two pricing packages for this EA. The first offers 2 real licenses for 299 Euros, while the second offers 5 real licenses for 499 Euros. You also get the Happy Forex Full Pack containing 10 EAs, free lifetime updates, a user guide in English, and licenses for an unlimited number of demo accounts.

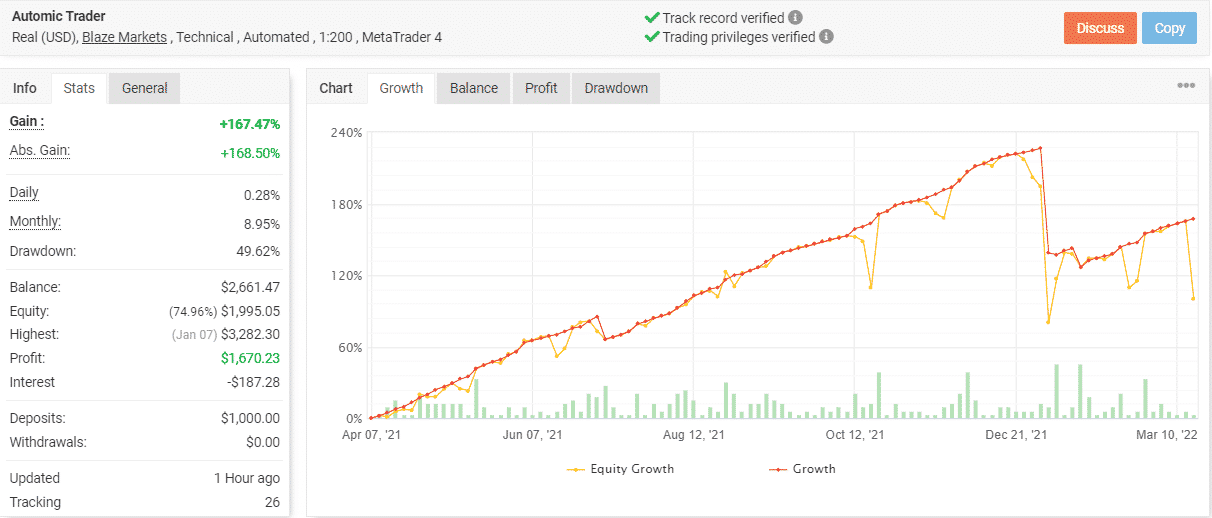

3. Automic Trader

Automic Trader allows you to build a steady source of passive income from the Forex markets. It is suitable for novice traders with no prior experience. According to the developer, it can generate 20-30% monthly profits with low risk and 50-100% monthly profit with high risk. It is a fully-automated system compatible with more than six currency pairs.

This robot conducts trades multiple times daily, slowly building up the account. It deals in trending pairs that move over 100 pips on average, daily. Automic Trader has a dynamic auto adapting trade management system that manages trades into profit. The features of this robot include:

- Internal settings optimization

- Free updates for a lifetime

- Full customer support

- $100 bonus money back if no profits are made after six months

- Account protection feature

- Deals in trending pairs like AUD/USD, EUR/GBP, EUR/USD, GBP/JPY, etc.

There is a yearly plan and a lifetime plan available for this robot. The prices for these plans are $497 and $697, respectively. There is a 30-day refund policy.

4. Forex Cyborg

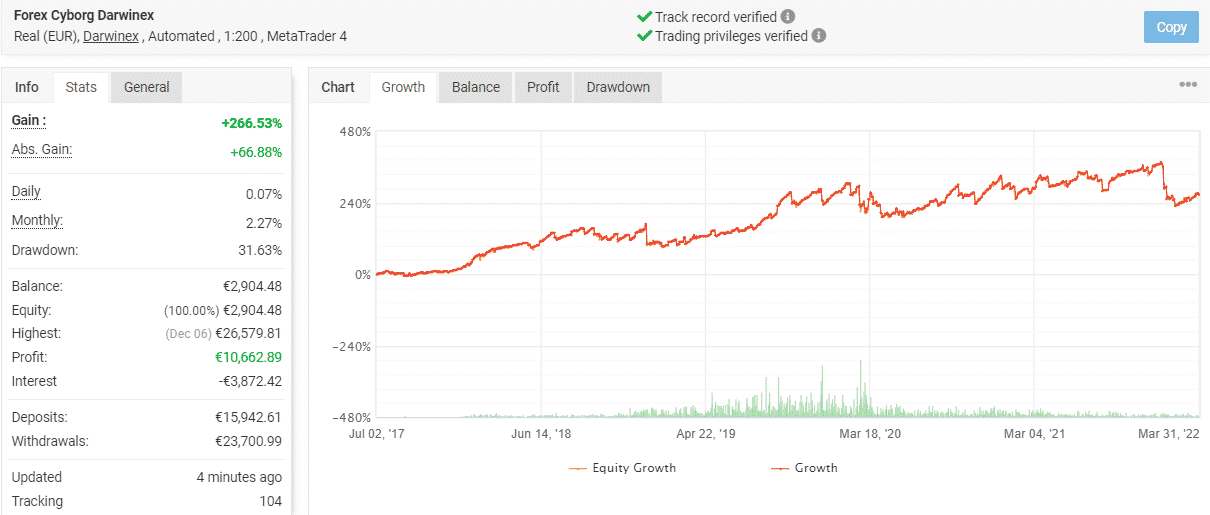

Forex Cyborg is one of the most innovative robots on the market. It can simultaneously trade in 18 currency pairs. It is supported by over 10 years of historical testing performed with real tick data, real spreads, and actual slippage. This EA uses technical analysis for making its decisions and has a high win rate of 69% on a verified live trading account. The daily and monthly gains of the robot are quite impressive at 0.07% and 2.27%, respectively.

Compatible with the MT4 trading platform, Forex Cyborg is a system specially designed for pro traders. Some of the key features of this system are given below:

- Free setup on VPS

- 30-days money-back guarantee

- No minimum leverage or account size

- In-built money-management system

- Lifetime updates

- Simple installation process

There are two pricing plans for this EA, namely Gold and Premium. The Gold plan costs 499.99 Euros and offers a single license for a real account. With the Premium plan, you get 3 real licenses in exchange for 599.99 Euros. The vendor provides lifetime software updates and dedicated support.

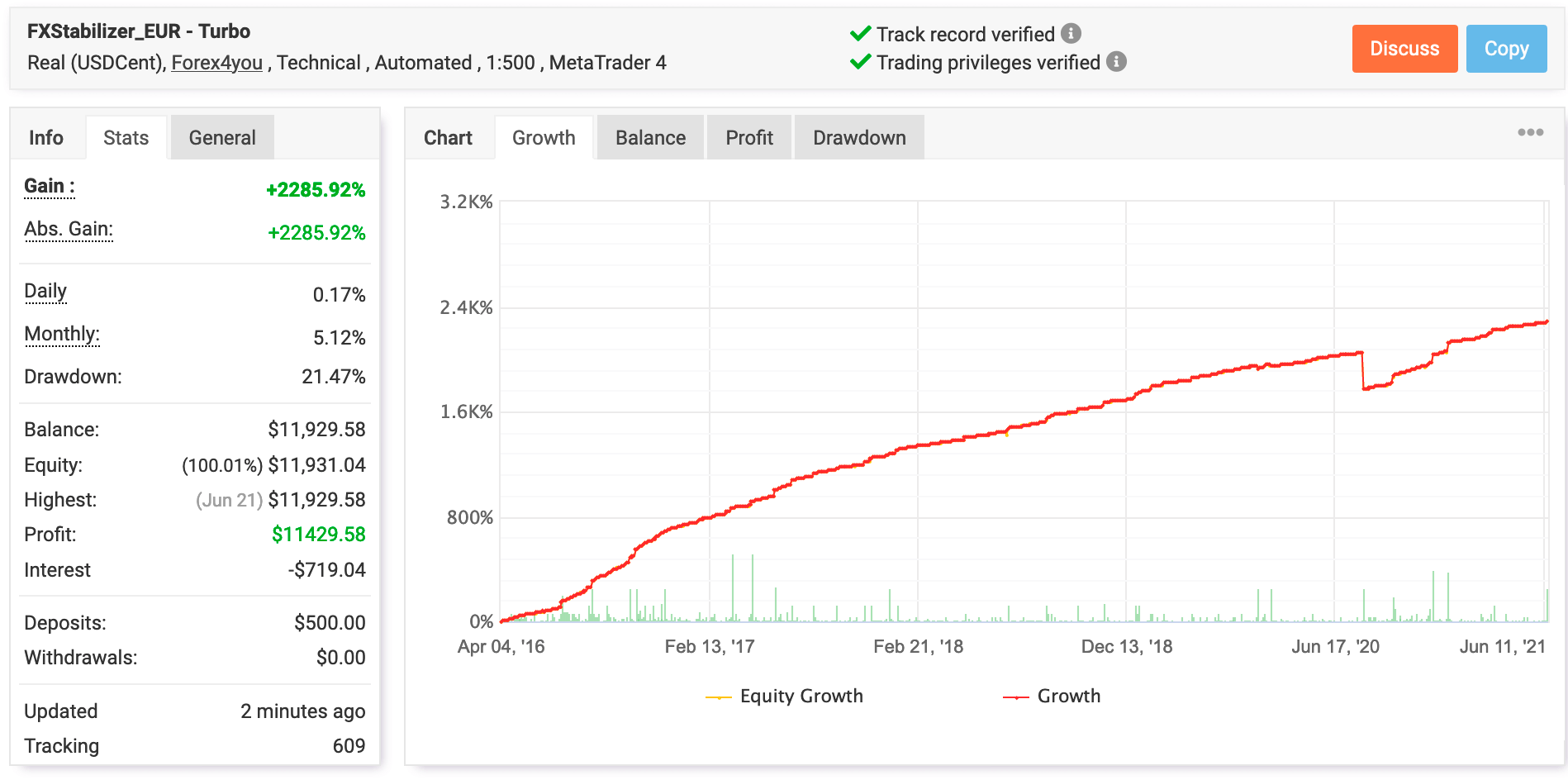

5. FXStabilizer

Founded in 2015, FXStabilizer is an automated system that assures stable profits without heavy drawdowns. Since its inception, it has shown high reliability and durability registering consistent monthly profits without any losses.

This FX robot uses an absolute trading security mechanism by accurately calculating the best trade execution. Focused on beginners and professional traders, this EA has the following features:

- Trades on multiple currency pairs

- Compatible with MT4 and MT5 broker

- Has two mode settings – Durable and Turbo

- A 30-day money-back guarantee is provided

- Hard drawdown control

- Has backtested from 1997

- Live results from 2015 verified by myfxbook

This FX robot is available in two different packages, the Pro and the Ultimate packages. The Pro package costs $739 and the Ultimate package costs $539. With the purchase of the ATS, you get an unlimited license for using the EA on an MT4 or MT5 account, a user manual, 24/7 technical support, and free updates for a lifetime. When you buy the pro version of this FX EA, an additional license FXStabilizer Unlocked is offered.

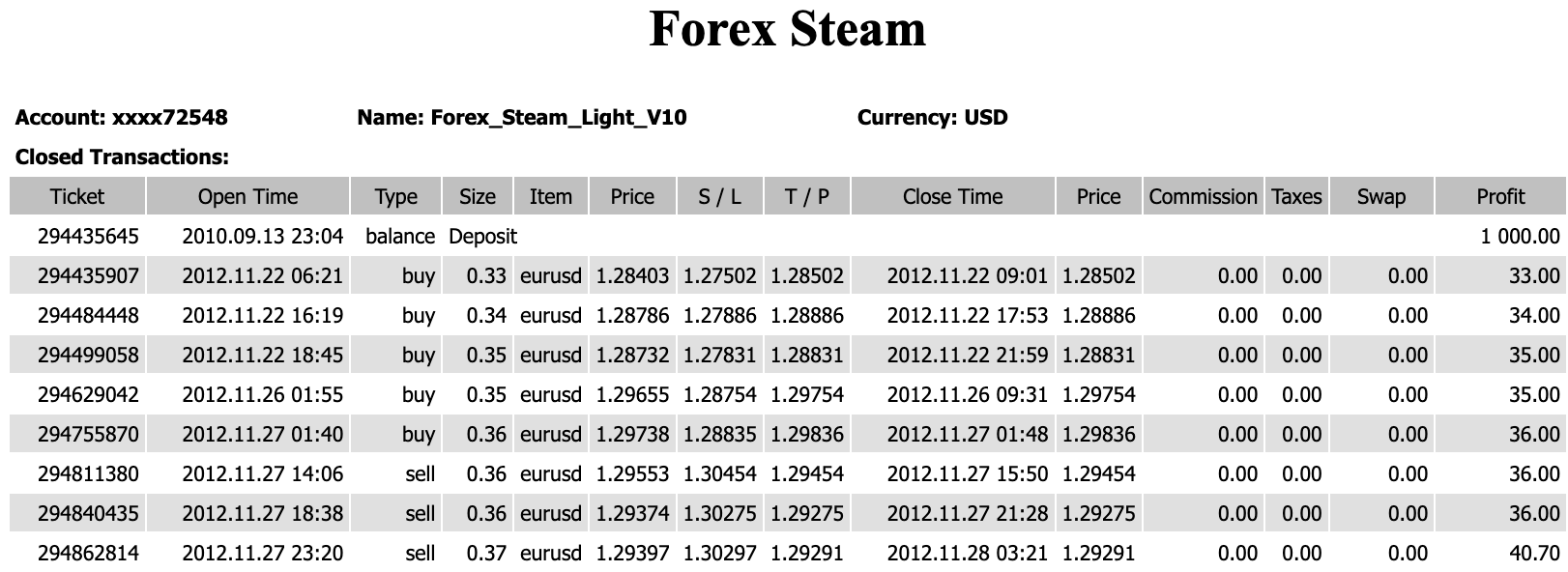

6. Forex Steam

With 10 years of experience, Forex Steam prides itself on being the longest-running FX robot in the industry. It claims to have a consistent increase in its winning rate by 55 to 10%. The company focuses on providing long-term profits to its customers spread across 100 countries. This EA uses the Steam Retrace technology. Based on this technology the ATS can secure big wins and limit its losses.

Features of this FX robot include:

- Easy setup with video guides and instant download feature

- Free updates and optimizations are done regularly

- Four licenses are provided enabling to run the program on four different accounts simultaneously

- Special holiday filters are used to avoid the days when market movement cannot be predicted

- Spread filters make sure the FX robot trades during perfect trading conditions.

- Risk management features like trailing stop ensure larger wins safely, while the breakeven setting uses a hard SL which does not budge after the trade reaches the specified pip amount.

The pricing of Forex Steam is $119.99, which is a single upfront payment with a lifetime membership. It includes instant access, free lifetime upgrades, 4 licenses, free installation, and all versions of the FX robot.

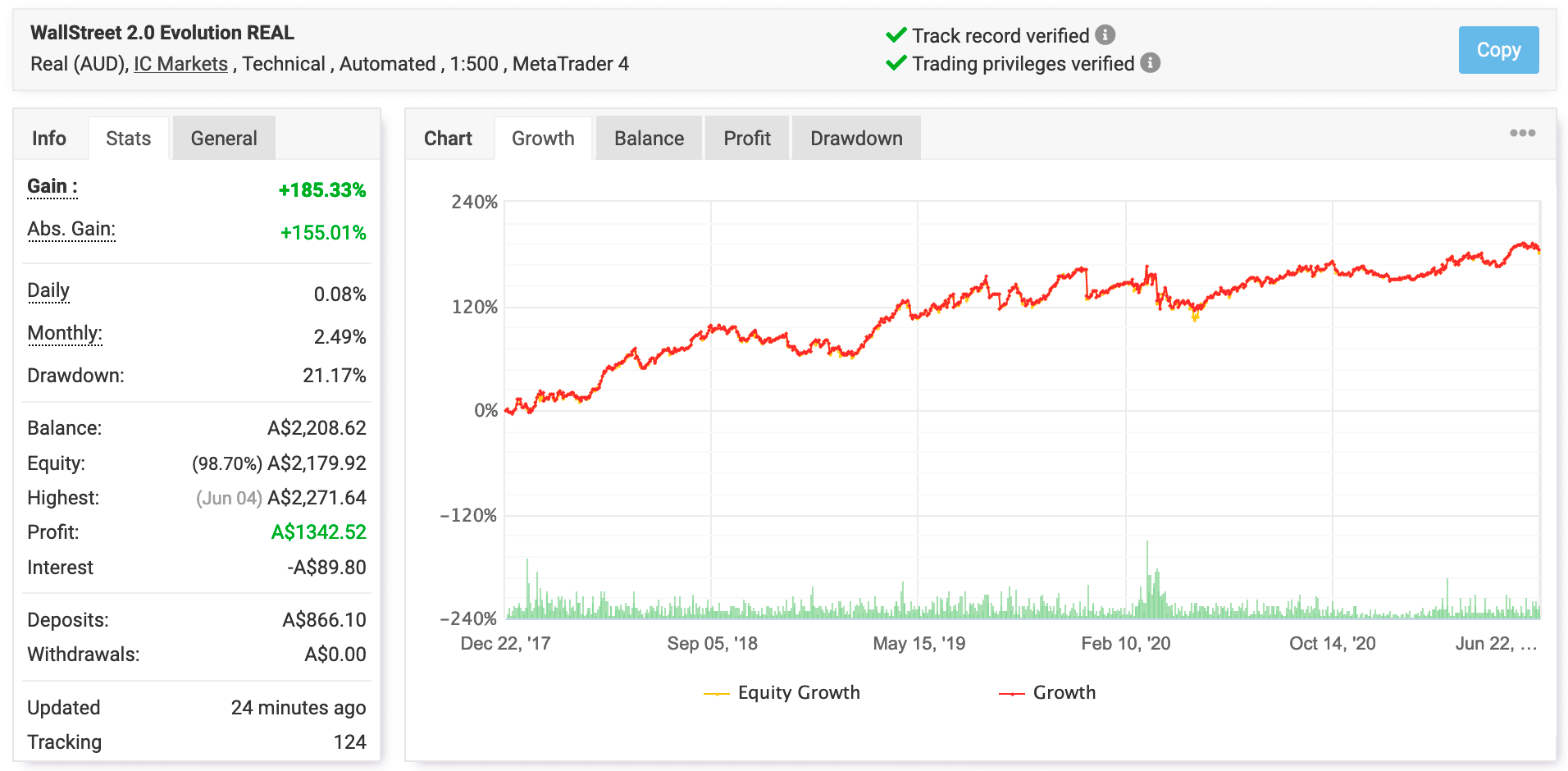

7. WallStreet Forex Robot 2.0

As an FX Robot with a winning performance for more than ten years, WallStreet Forex Robot is a ready-to-trade system. Since its inception, the company has been making improvements to the profitability of the system which includes improved exit logic, increased frequency of trading, reduced risk, enhanced profit protection, and use of Limit orders and Pending Stop features. Some of the important feature highlights include

- Myfxbook verified trading results

- Backtests have been done for 20 years on four different currency pairs

- Uses a scalping strategy that can boost client profits without the risks associated with scalping.

- Designed for the currency pairs that have high liquidity and narrow spread like EURUSD, USDCAD, GBPUSD, and more

- Has inbuilt broker protection feature to ensure profits do not dwindle due to factors like slippage, spreads, and off quote faults.

- Provides push notifications via mobile and email

- Uses time management system

The price of this FX robot is $237, which includes three other EAs besides the WallStreet 2.0 version. The package includes a single real account and 24/7 support. A 60-day money-back guarantee is offered for the product, which includes the use of unlimited demo accounts.

What Is A Forex Robot?

A Forex Robot is a software package designed to generate trading signals from special settings. With these signals, you can decide on whether to sell a specific currency pair or buy it at any given time.

Also called expert advisors or EAs, such software systems are popular among newbie traders because they help bridge the expertise and experience gap they lack in the field. Most traders find the technical analysis and other research needed to make successful trades monotonous and time-consuming. The FX robots eliminate such tedious tasks with their programmed setup that helps deliver ready-to-use signals.

Professional traders also find such EAs useful as human emotions do not come into play when you use these robots. Due to their pre-set design and automation, they do not sidetrack from the rules laid down in the program.

Automated Trading Vs Manual Trading

Manual trading has been in use for a long time and has proven results. The automated form is a relatively new concept that intends to make trading effortless. In order to appreciate the benefits that the two formats offer, you need to know what they are and their differences.

Manual Trading

The entire process of analyzing the market and arriving at the decision of buying or selling a currency pair is made by the trader. So, all the work falls on the trader and the outcome rests on the knowledge and expertise of the trader.

Automated Trading

In this method, pre-programmed software helps to assess the market conditions, and the decision to trade is made by the program. A set of instructions are written in the program, which is triggered to execute trades under favorable conditions.

Here is a comparison table that will help you know about the features that are best in each of the formats.

| Automated | Manual |

| The emotional decision-making is completely removed and traders gain a statistical edge by consistent trading patterns. | Most often traders are influenced by their emotions and resort to gambling. Lack of discipline in managing the risks results in inconsistent trading and big losses. |

| Traders can diversify their trading approach by using different systems to cover different market situations. | Traders can know which approach is working and which is not, and put in efforts to improve the outcome. |

| Demo accounts help traders to test the different approaches and identify which specific software is ideal for them | Traders need to do a lot of research and spend a major part of their time to reviewing their trades and achieve good outcomes. |

| There is the danger of over optimizing the settings and making historical data look exceptional. However, this does not impact the future price movement | Manual traders are solely accountable for the risks involved and they fail to consider their approach and skills regarding decision making. Instead, they place the blame on the platform, broker, or strategy. |

| The systems are expensive and there is no guarantee that they will work | Experience and skill are needed to succeed in manual trading |

How Do Forex Robots Work?

As a software program, the EAs are coded to scan tons of Forex charts and quotes in an efficient way which is not possible by human analysis. They scan and also interpret the charts. Here is how they work:

- They follow market changes closely, take into account every price tick, and identify the right trading opportunity.

- On finding the right trades, they send the signal to the trading platform of the user to open a position.

- The position is kept open by them until the price change indicates that the setup is not valid any longer.

- Now the robot closes the position, which will bring the user a profit.

- For identifying the appropriate trade, the robots use mathematical algorithms and technical indicators like moving averages to decide on the entries and exits.

There are basic types of such programs that perform simple tasks like sending trading signals. Other types can make decisions based on the signals like give recommendations on the right time for entry or exit.

The advanced software programs are capable of finding successful trades in market conditions where a specific trend is not found. Such programs are designed to spot the most favorable trend that can bring returns and limit losses.

Are Forex Robots Profitable?

To understand the profitability of the automated trading tools, you need to know the extent of their help in trading. The main task of an FX robot is to remove the mechanical work you do in analyzing and finding the right trades.

If you have a manual trading approach that works for you, you can use a Forex robot to set up the trades automatically. But the program will not be able to create new strategies on its own. So, the robot will not be able to adapt to the market changes. The technical analysis mainly relies on historical data to predict future price trends.

To know how profitable the bots are, you need to rely on the reviews and unbiased testimonials found online. Even if the robots are proficient in perusing innumerable charts in seconds, a majority of their analysis can be false. This is due to the lack of original discerning in them. While they are endowed with artificial intelligence, they are effective only to the extent to which they were programmed primarily and from past results.

While the unstable trends or false data can affect their predicting capability, they can give you an edge in trading with their automated trade settings.

What Are The Types Of Forex Robots?

You can find many types available now which you can purchase, download, and use. Based on the analysis model they use the FX robots are of the following types:

Indicator Based Bots

FX robots often use multiple indicators for the trading strategy or use the moving average alone for deciding on the market entry and exit points. Many of the bots use the moving average as the standalone indicator for the strategy. Combination, however, reduces errors as it requires a trade to meet multiple conditions before it can be executed.

News Trading Bots

The robot uses parameters that help you make trade entries during economic releases. You can use the high volatility span during news updates to improve your profits.

Forex Charting

Advanced traders find such robots ideal as it allows easy account management with a single program. Constant real-time updates by the ATS ensure efficient trading.

The FX robots are also categorized based on the strategy they use as seen below:

Signals

With Forex signals, you receive daily signals along with updates and reports on the trading field. This helps you trade successfully and increase your profit.

Scalping Bots

A scalping robot opens multiple positions to ensure short-term profits. It exploits minor market movements to see high returns.

There are other types based on factors like the currency pair they focus on and more. Here are a few such types:

Micro accounts

For traders who want to trade on a low budget, this is ideal. You can start trading with $100 or even less.

Various Currency Pairs

The robot focuses on a specific currency pair like the EURUSD pair, which is a popular pair that traders prefer. The volatility of the pair and its reliance give profit-making opportunities. Nearly 25% of the traded volume on average in the market is on this currency pair.

How To Test Forex Robot Strategies

Before purchasing an FX robot, you need to test it and verify its efficacy. Backtests also known as strategy tests are done on the bots. The test is done by running the program in all unfavorable modes of the tester. This will help you understand the system in a better way. For instance, the MT4 strategy tester can test and optimize a trading robot before you use it for real trading.

In the test, the robot evaluates the quotes that perform virtual transactions based on the software’s algorithm. You will be able to know the past performance and simulate the pattern in your current trading efforts.

The inbuilt optimization feature of the tester helps you choose the working parameters that give the best results.

By using the strategy tester, you can assess the performance of the robot before the real trading. It takes just a few minutes to perform as against analyzing your strategy in a real trading situation.

How Much Do Forex Robots Cost?

Prices of Forex Robots vary to a wide extent. You can find systems with costs ranging from $100 up to $1000. There are subscription plans that offer a better advantage as they are updated regularly to ensure members continue with the subscription.

Some of the programs are based on commission percentage. The platform promoting the FX robot takes a cut of the pre-decided commission that you make with every successful trade execution done by the system. For instance, a 10% commission requires you to provide an amount equivalent to the 10% based on the trades performed during a specific span.

Where Can I Buy A Reliable Forex EA?

Since there are numerous products available many of which are scam EAs you need to be careful while choosing the best Forex EA. Choose a Forex EA from a reputed site that has the following features:

- Conducts effective backtesting of the FX robots it promotes so you get your money’s worth when you select an EA.

- Exemplary customer support that is always ready to respond to your queries and complaints and resolve them effectively

- An expert team of FX analysts to identify the effective and feasible FX EAs from the numerous choices available in the market.

Best Forex Robot Vs Scam Forex Robot

Identifying the best product from among the numerous scam FX robots is a difficult task. We have put together a comparison table to help you identify the signs for the good and the scam systems.

| Good Signs | Bad signs |

| Speed of order execution | The vendor offers the robot for free or the price is cheap |

| Capable of trading multiple currencies | Guarantee of profit |

| Offers good security and reliability features | It can create its own strategy |

| Employs risk management tools | Uses sophisticated technology for its strategy |

| The experience and reputation of the development team | Set it up and forget systems. |

Conclusion

Using a Forex robot will give you a definite edge in your Forex trading. You can generate more accurate trades and replicate them across different markets and timeframes. Unlike manual trading where there is the danger of emotional errors, FX robots help in making precise trade execution. With our guide to the best Forex Robots, you can easily identify the reliable and effective systems from the scam robots. Making an informed decision is easier with our guide and list of best Forex EAs.

Comments