To trade at the FX, you need a proper style or strategy of trading. Most of the newcomers’ individuals end up losing their capital within a short time of their first deposit. Many reasons are behind this, but the main are proper trading style, good strategy, punctuality, money management, trade management, etc.

However, the problem arrives when it comes to trade management or placing orders in price action. More specifically, the stop loss (SL) is a crucial fact for forex trading. Therefore, in this article, we will discuss SL and why it matters in trading and lists the top three SL guides for price action trading.

Why does stop loss matter in price action?

SL minimizes uncontrollable and significant losses that happen due to volatility at the changing price. Volatility in the FX is widespread as several macroeconomic, fundamental, technical, and socioeconomic factors affect the market. The forex market’s remarkable fact is that you can make money from both ways, whether the price shifting is bullish or bearish.

Price action traders are brilliant in FX. The simple definition of price action is that billable negotiation in price changing levels gets priority when analysis occurs with other market data such as technical patterns, fundamental strength, or weakness.

Price action is suited for both short-term or medium-term traders but not for long-term trading. Anyway, if you don’t use SL in your trading, it is just a matter of time that your losing position will get out of your control. You can’t win at every trade you make. So the losing trades will wipe out your previous profits and may damage your trading capital also.

SL reduces the chance of being wiped out or being stopped so early. It helps traders to reduce emotional trading that may drive traders to end up losing money. Moreover, it is effortless to implement, and you can modify or shift your SL positions anytime you want.

Top 3 stop loss guide

In this part, we make a list of the top three SL guides for price action traders.

Swing level with buffer

Price action traders are smart who make trades at the level where many institutions also take their positions. So it is a common thing that price action traders often catch swing trades. This strategy is for that type of trade.

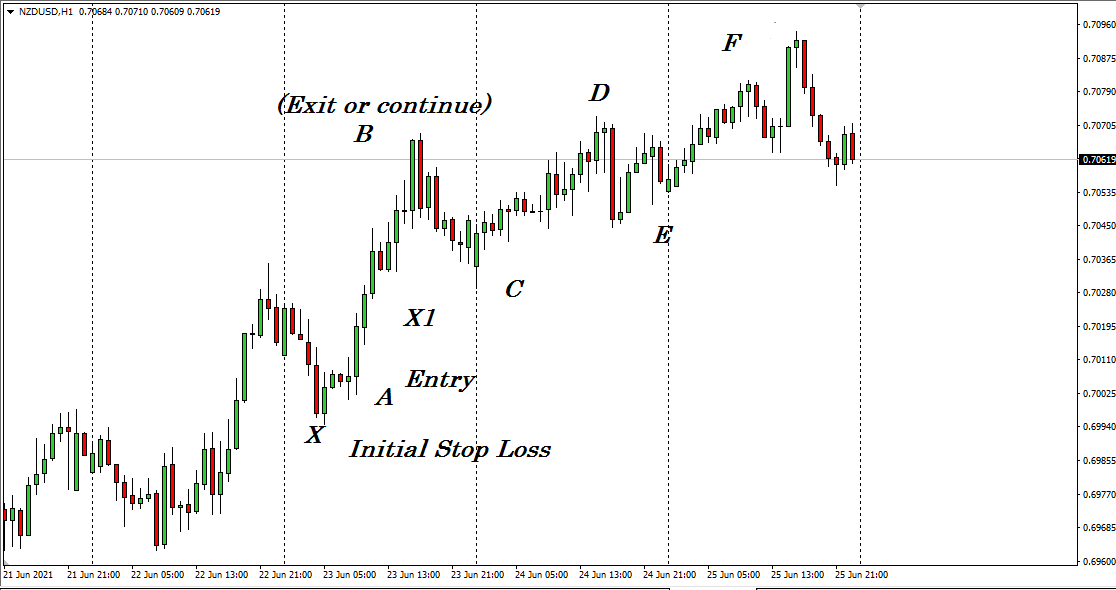

The figure above shows a 1-hour chart of NZD/USD.

- Price is at an uptrend — we suppose you catch the trade from A.

- The initial SL position is below the recent low with a 10-15 pips buffer near X.

- The price makes the first higher high near B and takes a minor retracement near C.

- You can shift your SL at the break-even point near point A or close your position with profit. At this point, if your SL gets to hit, your position gets close with zero profit or loss.

- If you continue to carry your order until the second higher position by the price movement near D or the retracement after that near E, you can again shift your SL above the entry point near X1.

- At this point, if your SL gets to hit, your position closes with a profit, or you can close your order with profit at near F.

Moreover, swing trading is the art of looking at individual candles to make trading positions.

Dynamic and static level

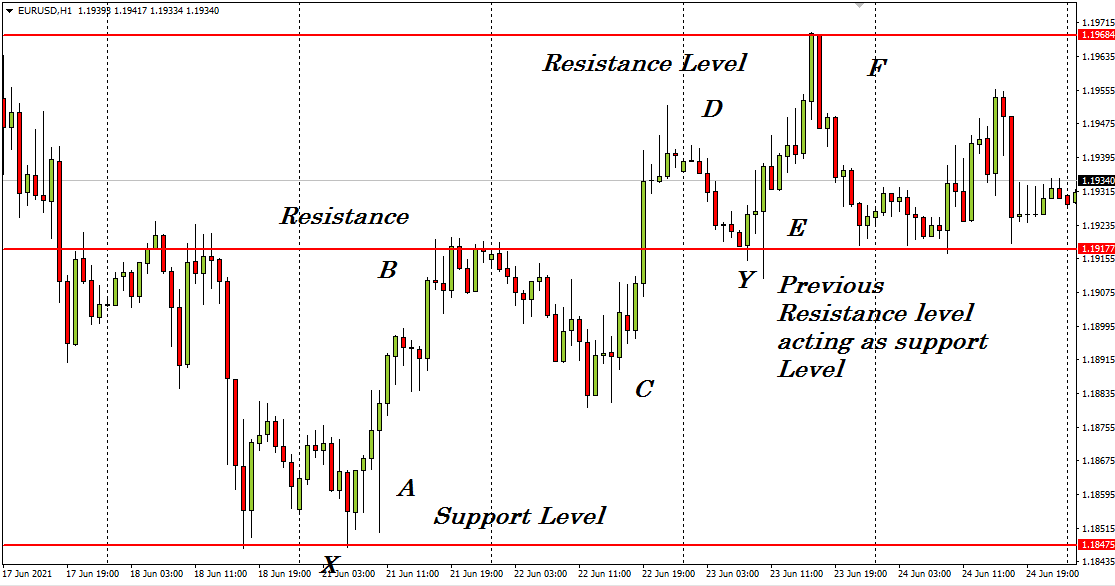

Price at the FX moves by following some patterns, and history repeats itself in this market. The figure below shows a 1-hour chart of EUR/USD, and the dynamic/static support resistance levels are defined.

- When the price reaches point A, the support level below is valid.

- For any buy position between point A and point B, SL will be below the support near X, and the take profit level will be near B.

- When the price breaks the resistance by CD and comes back toward E, the previous resistance level works fine after reaching point E.

- So any buy position at the range from E to F, the SL position will be below the support near point Y, and the exit will be near F.

Trading session

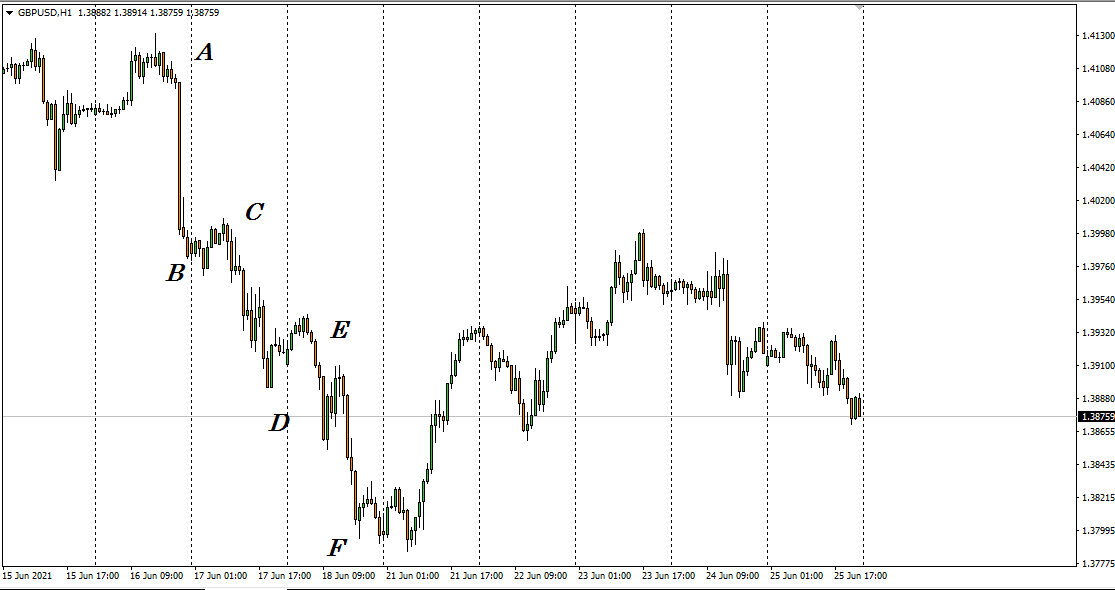

The trading session is an essential factor to the price action traders as they continually seek to enter the market with the institutions. For example, the figure below shows a 1-hour chart of GBP/USD.

- Price made a sharp downward move from point A to B.

- The next day, the price action trader may catch a sell position near point C at the beginning of the London session with an initial SL near X.

- The exit position will be near point D at the end of the Newyork session or may continue till the next day near F.

- If you continue the sell order, place your SL below or at the break-even point the next day when the price starts to go toward F from E.

- If you close the position near point D with profit, you can easily make another sell position the next day near point E at the beginning of the London session with an initial SL near X1.

- The exit position will be near F at the end of Newyork session.

Final thoughts

Finally, to increase your profitability and reduce losses, there is no such thing as money management and trade management. SL is the term that is useful for both money management and trade management.

However, it is different and changes with the strategy. Therefore, we suggest doing more research and test strategies before implementing that on your trading chart.

Comments