The technical ratings use a unique rating score through an anonymous study to obtain the market context. This concept uses five different calculations of price-performance for any particular asset while suggesting trading positions. Many financial traders use this concept frequently in stock trading. So it makes sense that crypto investors also find it attractive to use this unique technical concept to make their trade decisions.

However, it is mandatory to have a clear concept of any technical method while starting to use it for live trading. This article introduces the technical rating strategy and describes complete trade setups with chart attachments to better understand.

What is a technical rating crypto strategy?

It is a unique method that considers measuring five different criteria of the price movements to detect potentially profitable trading positions. Markos Katsanos is the developer of this technical concept. Meanwhile, the five technical factors this technical concept considers are:

- Money flow

This technical concept checks the volume flow indicator, either positively or negatively.

- Trading above average

This technical concept considers if the price is trading above or below a specific average or SMA value.

- Overall market condition

This technical concept checks whether the price is above or below at least two bars of an EMA value.

- Trend quality

It checks the crossovers types between the MA and the price during a particular period to determine the trend quality/type.

- Uptrend or downtrend

This trading method tracks the last four bars if the price increases or decreases.

Any crypto trading method that uses this concept to generate trade ideas is a technical rating crypto strategy.

How to trade?

You already know the components or calculation criteria of the technical rating crypto strategy. When applying it to live crypto trading, you will get different indicators based on the concept. Apply it to the target asset chart and seek opening trading positions when it suggests either direction of price movements. You can use this concept independently or other technical indicators/tools to identify trading positions.

Short-term trading strategy

We use a trading indicator that relies upon the technical rating strategy in this trading method. It results in an independent window containing histogram bars of different colors on both sides of a central line. You can use this technical indicator in many trading instruments, including cryptos, to generate any buy/sell idea. We suggest applying this method on a 15 min or an hourly chart to get the best results.

Bullish trade scenario

Bullish setup

Try executing buy trades near support levels. When seeking to open buy trades, set the indicator to your target asset and observe the readings as below:

- Blue histogram bars take place above the central line of the technical indicator window.

- Check the box and match at least two (60 min and 1D or H4) boxes to confirm the buying pressure on the asset price.

Entry

Match these conditions above and open a buy position.

Stop loss

Place an initial stop loss below the current swing low with a 5-10 pips buffer.

Take profit

Continue your buy order till the price continues to rise. Close the buy position when the scenarios below occur:

- Red histogram bars take place below the central line.

- The boxes on the right side of the window declare sellers’ domination at the asset price.

Bearish trade scenario

Bearish setup

Try executing buy trades near resistance levels. When seeking to open sell trades, set the indicator to your target asset and observe the readings as below:

- Red histogram bars take place below the central line of the technical indicator window.

- Check the box and match at least two (60 min and 1D or H4) boxes to confirm the selling pressure on the asset price.

Entry

Match these conditions above and open a sell position.

Stop loss

Place an initial stop loss above the current swing high with a 5-10 pips buffer.

Take profit

Continue your sell order till the price continues to decline. Close the sell position when the scenarios below occur:

- Blue histogram bars take place above the central line.

- The boxes on the right side of the window declare buyers’ domination at the asset price.

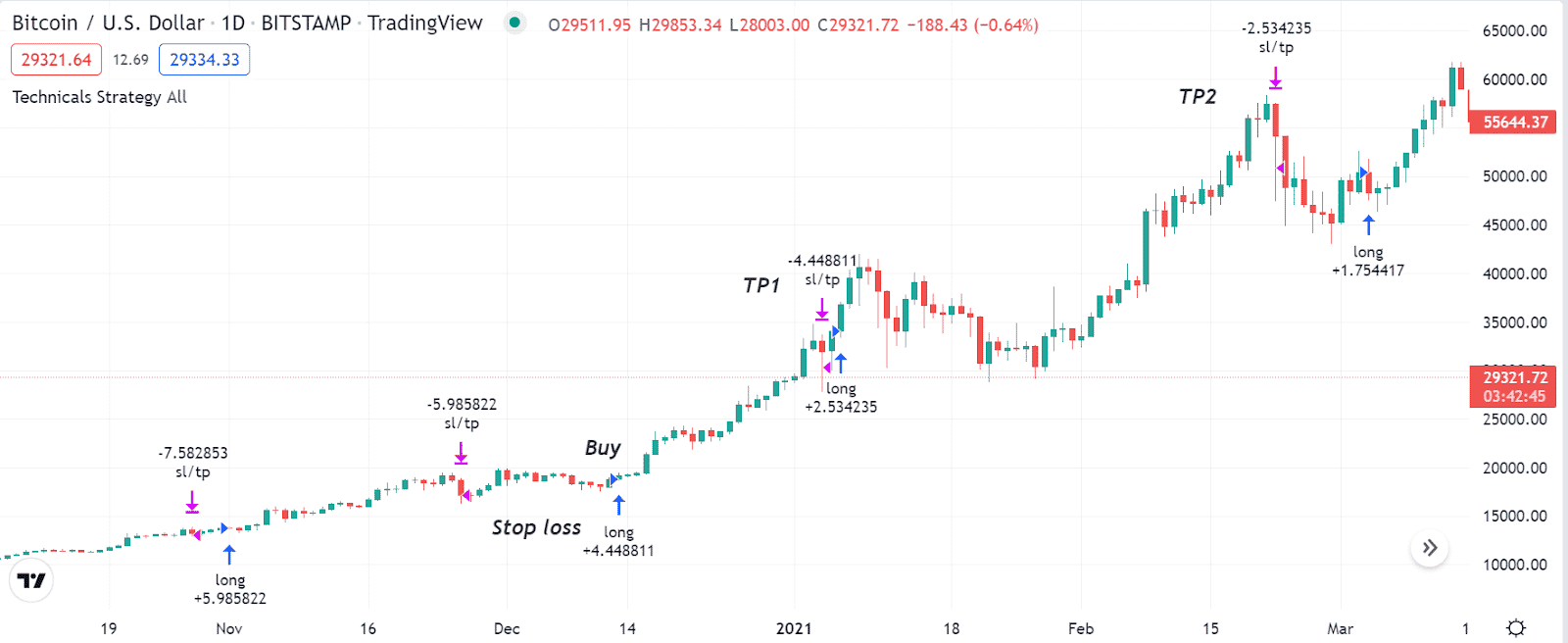

Long-term trading strategy

We use the same concept in this trading method; only the appearance is different. This case shows trading positions in the existing chart, including SL/TP levels. We recommend using this concept daily or at least an H4 chart to detect the best long-term trading positions.

Bullish trade scenario

Apply the indicator to your target asset chart and observe when opening any long position.

Bullish setup

Entry

When seeking to open long positions, a blue arrow appears below price candles with a positive value. Wait till the current bullish candle closes and open a buy order.

Stop loss

The initial stop loss level will be below the current bullish momentum.

Take profit

Close the buy position when the blue arrow turns on the top side of price candles with a negative value.

Bearish trade scenario

Apply the indicator to your target asset chart and observe when opening any short position.

Bearish setup

Entry

When seeking to open short positions, a red arrow appears above price candles with a negative value. Wait till the current bearish candle closes and open a sell order.

Stop loss

The initial stop loss level will be above the current bearish momentum.

Take profit

Close the sell position when the blue arrow turns on the bottom side of price candles with a positive value.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

Finally, the technical rating crypto strategy is an ultimately valuable trading approach for technical investors. Master the concept before applying it to crypto trading and always follow proper money and trade management guidelines to remain profitable.

Comments