As soon as a new trader comes to the forex currency market, everything seems complicated and unknown to him. Therefore, beginners tend to start their trading journey with something familiar. So it turns out that the main trading instrument is currency pairs, among which the most popular are EUR/USD or GBP/USD.

At the same time, young traders can experiment with other currencies. Let’s see what kind of couples they are and how to work with them.

What is a currency pair?

The pair consists of two different currencies: the first one is the base, and the other is the quote. Before selecting a couple to start trade, the beginner should discover a suitable forex pair for him. There are some significant components, such as trading objectives volatility, strategy, and spread. In addition, a beginner needs to gather appropriate knowledge, experience, and discipline.

How currency pairs form?

The currencies are classified according to the international ISO standard. Thus, there are always two currencies in a currency pair. Usually, currency symbols consist of three letters.

The codes consist of the first two letters that define the country’s name, and the last letter is the name of the currency. Therefore:

- USD is the US dollar

- GBP is the Pound Sterling

- JPY is the Japanese yen

Two codes make up a currency pair. All currencies are listed in two. The reason is that to express the value of one; you need the other. For example, in the Euro/Dollar pair, we will measure the euro’s value in dollars.

The forex currency couple also has three different types in it:

-

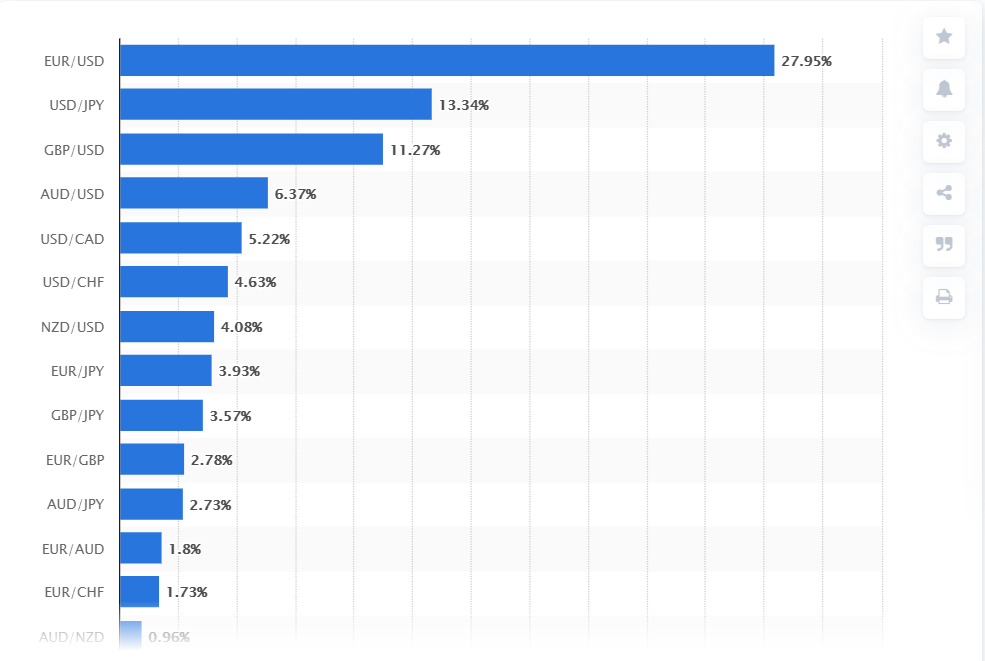

Major currency pair

The most favorite worldwide. Therefore, a wide range of traders finds these as alluring pairs. For example, the EUR/USD is the most liquid pair so far as it covers almost 28% of the market liquidity.

Besides the EUR/USD, USD/CAD, GBP/USD, USD/JPY, AUD/USD, USD/CHF, NZD/USD, these couples are examples of the central pair.

-

Cross currency pair

If any currency pair does not consist of the USD, it is called a cross-currency. For example, EUR/GBP, EUR/CAD, EUR/CHF are cross-pair or minor currency pairs.

-

Exotic currency pair

It incorporates the currencies of developing market economies combining significant coins. For instance, EUR/TRY, USD/SGD, GBP/ZAR. However, exotic currency pairs are not liquid, and the spreads are a lot more extensive. Therefore, it makes this type of pair risky.

Why are major currency pairs best for beginners?

The major currency pairs are the top forex pairs. Also, these are the most traded currency pairs that incorporate the USD — the currency of the most economically developed nation. The major currency pairs portray the highly liquid and stable global economies. The principal feature that makes these forex pairs conceivably solid is the USD in the couple.

Therefore, these couples are the best choice for a beginner because of minor risks from the market volatility. Moreover, the major pairs represent over 80% of the total turnover of the entire forex market. In this way, major currency pairs are very favorable for beginners and expert traders as well.

The significant pairs include some features that make it very easy-going with beginners, such as:

-

Liquidity

Liquidity is the capacity of a currency pair to buy and sell without significantly affecting its swapping scale. Thus, when traders can buy and sell a currency pair effortlessly, we can consider the pair as a high liquidity pair.

-

Availability in brokers

Major currency pairs are readily available with most brokers since the significant pairs cover up most of the market. In addition, the major couple covers around 80% of the total daily volume of trading.

-

Price action

Price action is the quality description of a currency’s price movement. Traders can anticipate the future price movement by observing recent price changes. Dependent on the actual and recent price movements, price action helps the trader settle on their trading choices.

However, the major currency pairs are inclined to be the most liquid and least volatile pairs. This is because the significant currency’s national economies also influence the market. As a result, it pulls in trading volume and, in turn, works with important price stability.

-

Fundamental events

A few components influence the market moves like geopolitical instability, the country’s financial strength, interest rates, international instability, and FDI level in the homegrown market. In addition, the economic strategy controls the interest rate of a currency and influences the causes of reinforcement or deterioration against the pair.

What are the features of popular currency pairs important for beginners?

- EUR/USD is one of the most popular among all the pairs. However, its volatility is high. The US and the Eurozone play a significant role in the global economy with an eventful economic calendar. Therefore, traders can easily find suitable movements using technical and fundamental analysis.

- USD/JPY is one of the most reliable couples as the US Dollar is the reserve currency in many countries, while JPY is a safe-haven current. Dollar—Yen often shows quite sharp jumps and spikes on the chart that make the trading possibility for traders.

- AUD/USD is a reasonably calm pair with moderate volatility. The Australian economy mainly depends on commodities that allow this currency pair to be known as a commodity currency.

- GBP/USD is a currency pair that reacts quite strongly to UK news. As a result, the pound-dollar team is quite volatile; breakdowns of protection and resistance levels, false breakouts are frequent on the chart.

- USD/CAD is a pair with moderate volatility and tight correlations. The Canadian dollar exchange rate primarily depends on the crude oil price. Therefore, while analyzing quotes and forecasting, it is necessary to consider the dynamics of oil prices.

- EUR/JPY — like any pair with the Japanese yen, it is the most eventful currency pair as Japan is an export-oriented country, and the Eurozone is a global business hub.

What are the disadvantages of trading the most popular EUR/USD pair?

- The charts of this pair are complicated to computer analyze, which makes the use of indicators impractical.

- There is a more significant number of false breakouts on this pair even when working with time frames from H1 and higher.

- The specification of contracts of most brokers does not imply a positive swap when the transaction on this instrument is carried over to the next day.

Final thought

There is no need to split into many pairs immediately. Many traders generally concentrate on just one instrument and at the same time earn good money. Nobody canceled specialization. And when trading many currencies at the same time, you pay less attention to each chart, and you may well miss some critical detail in the analysis. However, when using a currency portfolio, you can get a smoother yield curve due to many trades.

Comments