Naked forex is a process to take trades from a chart where there is no indicator. You might wonder how a trader opens buying and selling positions without any indicator. But the truth is that most professional traders use the naked chart in their strategy. Even if they use indicators in their system, they use the naked chart analysis in the first place.

If you are eager to know how naked chart trading works, the following section is for you. Let’s discuss everything a trader should know about this trading system with a proper guideline.

What is the naked forex trading system?

It is a process to open a trade based on the information available in the price chart, nothing else. Therefore, in naked forex, traders don’t need to use any indicator to find the price direction.

In FX trading, simplicity has a strong position. Traders with solid knowledge of charts can easily explain what is happening in the price and what may happen in the future. Every candlestick in the price shart indicates the story where it is easy to say what bulls and bears have done within the candle session.

Moreover, the price of a trading instrument does not change at once. Instead, the price creates swings that help traders to find the market trend.

Let’s see the practical example of swings in the chart.

Market swings

Overall naked forex trading can release fast trading decisions than indicator based system, but trading with this method needs the following knowledge:

- Market context

- Trend

- Support and resistance

- Candlestick, etc.

How to use the naked forex in trading strategy?

Naked forex is very profitable if traders can implement the trading knowledge accurately. There is no rocket science behind it, and traders from all levels can start trading using this method. In this section, we will see the step-by-step approach to implementing the naked FX knowledge in creating a trading strategy.

Step 1. Identify trend

Finding trends is the primary requirement in any retail trading method where investors should follow the strategy towards the major price direction. Usually, people use indicators like moving average, RSI, MACD, etc., to find the market trend, but it is firmly possible to find the movement by zooming in and out the price and focusing on swings.

Step 2. Support and resistance

Support levels are horizontal zones from where a strong bearish pressure came, and the resistance level is valid if the bearish pressure can make a new swing low in the price chart. On the other hand, the opposite version of the resistance is the support from where bullish pressure appears.

- In a buy trend, focus on finding the price to move up from a support level.

- In a sell trend, focus on finding the price to move down from the resistance level.

Let’s see an example of the S/R levels in naked chart trading.

The daily chart of GBP/USD

In the above image, we can see the daily chart of GBP/USD where a strong resistance level formed at 1.3952 level. After making a new swing low, the price returned to resistance and opened a selling opportunity.

Step 3. Candlestick analysis

It is the final step that does not involve the complex candlestick analysis. When the price reaches critical support or resistance level, find any appropriate reversal candlestick pattern or indecision candle and open the trade as soon as the candle closes.

Reversal candlestick formed from the resistance

The above image shows how a reversal candlestick formed from the resistance. It might be a single candlestick or a series of candles.

A short-term strategy

Short-term trading is suitable for scalping and intraday trading. But make sure to follow where the primary trend is heading. Moreover, the intraday market is often volatile due to news releases requiring additional attention to the chart.

Best time frames to use

This method works well in the 15-minute chart during the London and New York session.

Entry

Open a trade once the following conditions appear:

- A clear trend is available from the price swings.

- Price reached a necessary support or resistance level.

- A reversal candlestick appeared.

- There is no important news in the running hour.

Stop loss

Put the stop loss above or below the rejection candle.

Take profit

The final take profit is based on the near-term horizontal levels, but a partial closing is vital after getting at least 1:1 from a trade.

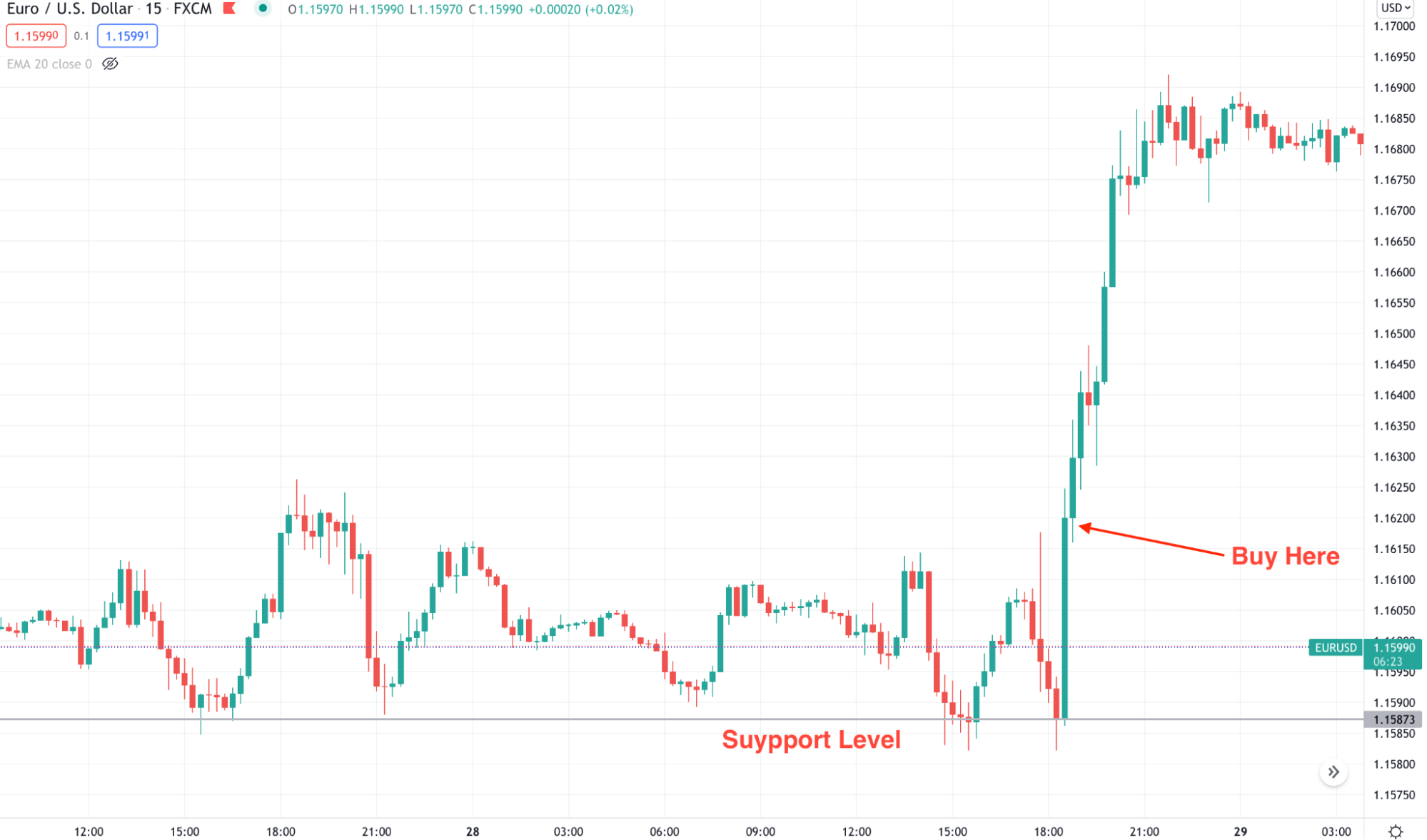

Short-term example

A long-term strategy

The long-term naked trading method is similar to the short-term but applicable to higher time frames. Moreover, if you want to eliminate the intraday volatility, you should focus on taking trades on daily charts. Market trends and support resistance works well in the daily chart. Therefore, this method is more reliable than short-term trades.

Best time frames to use

This method applies to any time frame but sticking to the daily chart has a higher success rate.

Entry

Open a trade once the following conditions appear:

- A clear trend is available from the price swings.

- Price reached a necessary support or resistance level.

- A reversal candlestick appeared.

Stop loss

The stop loss above or below the rejection candle.

Take profit

The final take profit is based on the near-term horizontal levels, but a partial closing is essential after getting at least 1:1 from a trade.

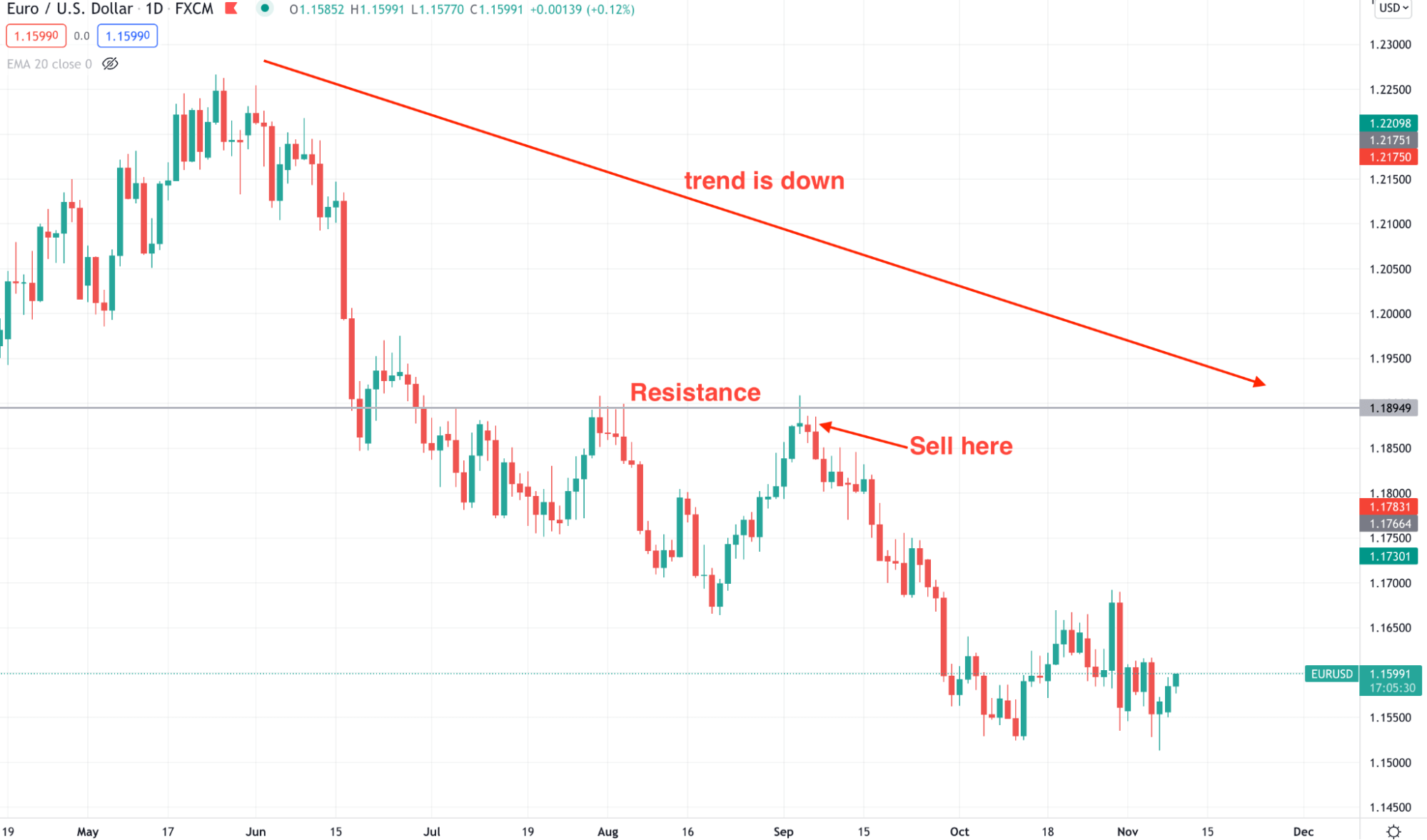

Long-term example

Pros and cons of this trading strategy

| Pros | Cons |

|

|

|

|

|

|

Final thoughts

In the above section, we have seen how to make profits from this system. It is easy to follow and profitable than any indicator-based system. However, this method needs additional attention to the price action and strong trade management to avoid unexpected market behavior.

Comments