Support and resistance levels are significant price levels from where a potential reversal happens. Besides other trading methods, investors can trade intraday utilizing support and resistance (S&R) levels. Nonetheless, S&R levels are zones, not a level.

Traders can use them for various types of trading, such as swing trading, intraday trading, and position trading. Support is a horizontal price zone from where a downtrend may halt because of a grouping of buying interest or demand. As the price of resources drops, orders for the asset expands, in this manner shaping the support line. In the interim, when prices have grown, resistance areas emerge because of selling interest.

Supports and resistances are very significant for technical analysis. Notably, it plays a vital role in supply and demand and market psychology. S&R levels are the levels at which plenty of traders will buy an instrument from the support level or sell trades from the resistance levels. When these static lines shift or break altogether, the market psychology and the supply and demand on the price move likewise go. In that case, it will create a new S&R level after moving some pips.

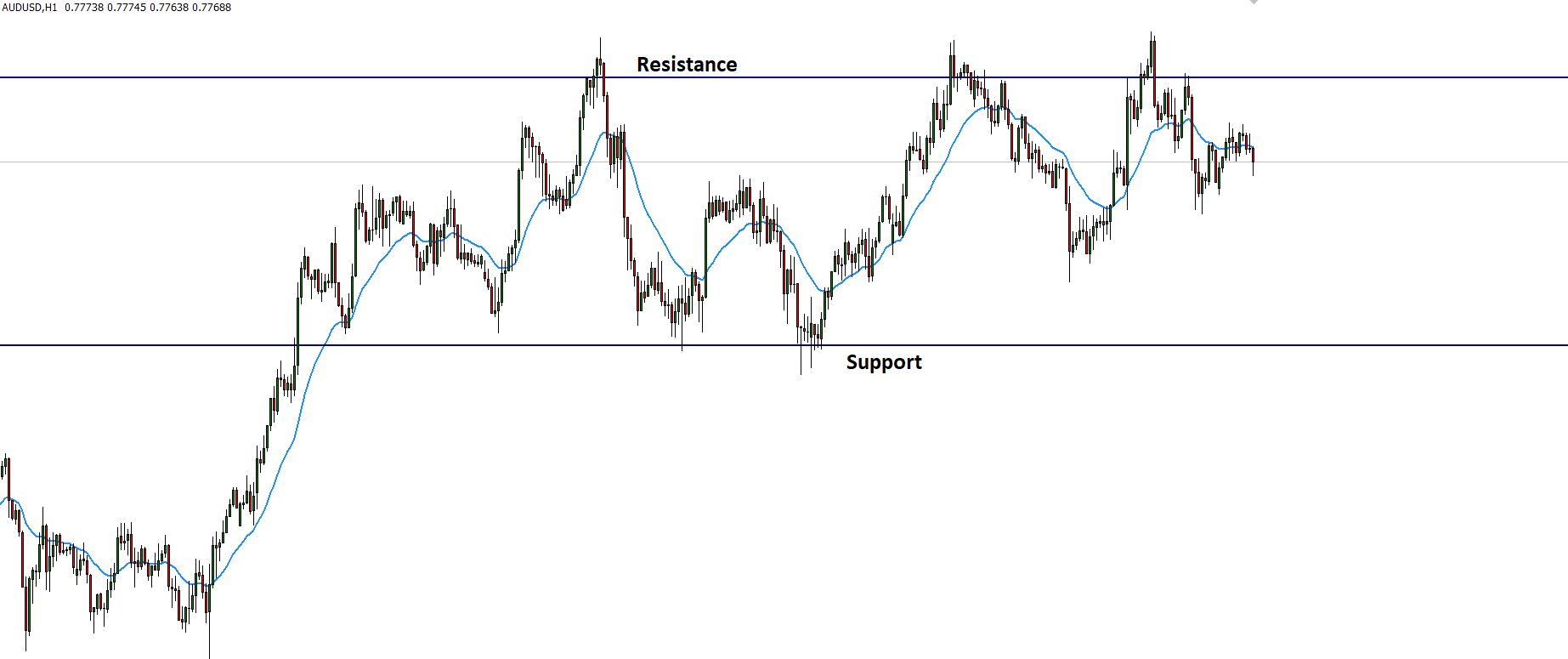

Here we can see the simple illustration of the critical S&R level in the price chart, where we can see that the price reversed from the support and resistance level.

Moreover, the significant support and resistances are meaningful patterns since it allows investors to change their anticipated price direction. For instance, if a trader distinguishes a substantial degree of resistance that has tried a few times however never broken. Then the individual may choose to accept profits as the asset advances toward this point since it is progressively more outlandish that it will move past this level. Thus, both support and resistance test and affirm patterns, and traders should check in on their technical analysis. It is significant to note, in any case, that a break outside of a degree of support and resistance doesn’t generally demonstrate an inversion in the pattern.

How to read intraday levels?

The future price level has the potential that may change the condition of supply and demand and create a movement in the price. Hence, the price will go upward if the demand is beyond supply and keeps moving upwards until it touches a resistance zone. Then, it can deliver adequate supply to overpower the demand; afterward, the over-supply will take the price downwards. Therefore, the extent of the price level alludes to the resistance zone.

Furthermore, there is a precisely inverse rationale for the support level. If the supply is more prominent than demand, the price will be lowering and keep on lowering down until it touches a support zone. Then, it may give sufficient demand to defeat the supply. And afterward, this expanded demand will direct the price upwards.

To read the vital intraday support and resistance levels:

- Observe a 5-min intraday chart of earlier 5-10 days.

- Choose major and minor support and resistance tested from both sides over three times.

- Take trades from the event level that works as both support and resistance levels.

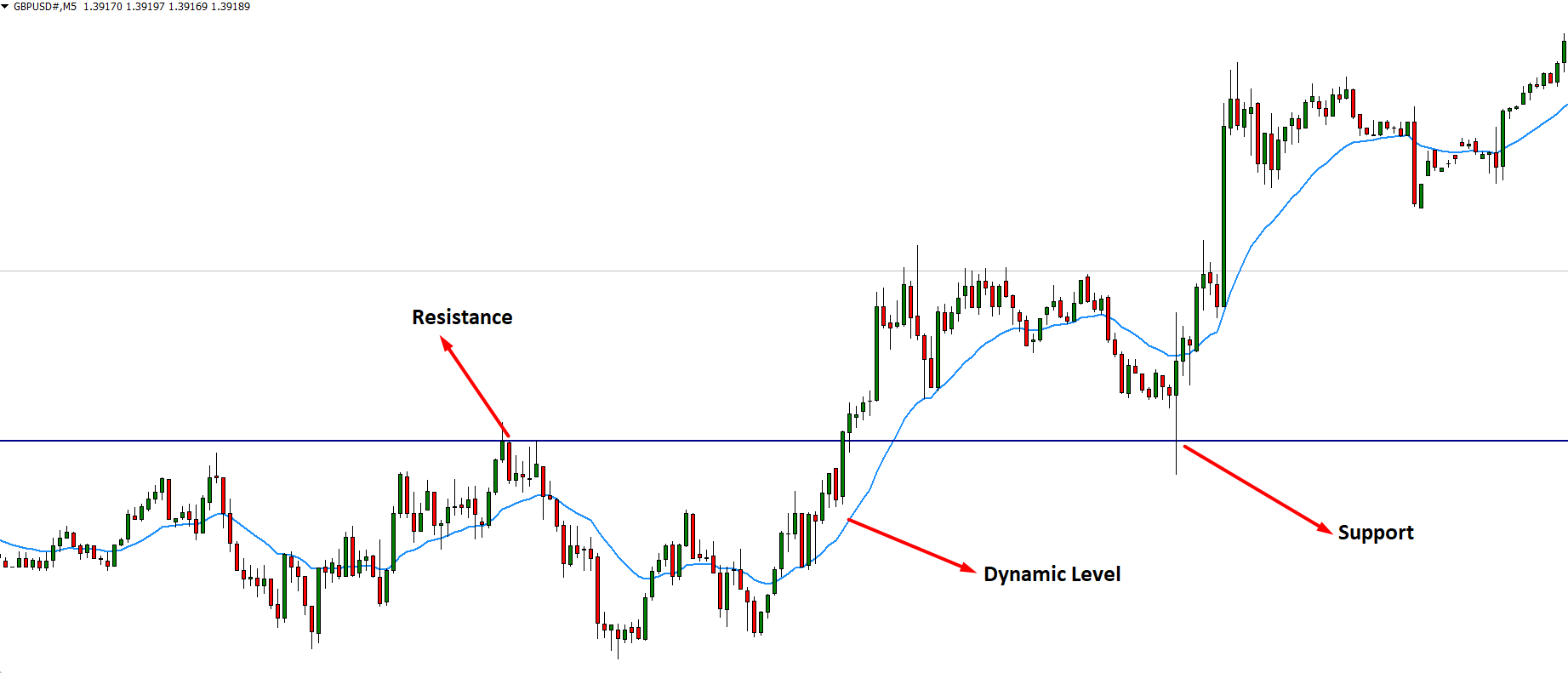

In the above image, we can see how a single line works as both support and resistance level at a price. Both buyers and sellers are active at this level that makes it valuable. Besides, a dynamic level that changes with the price works as another importance to the price. Here, in the image, we have used 20 EMA as an operational level.

How to take a buy trade?

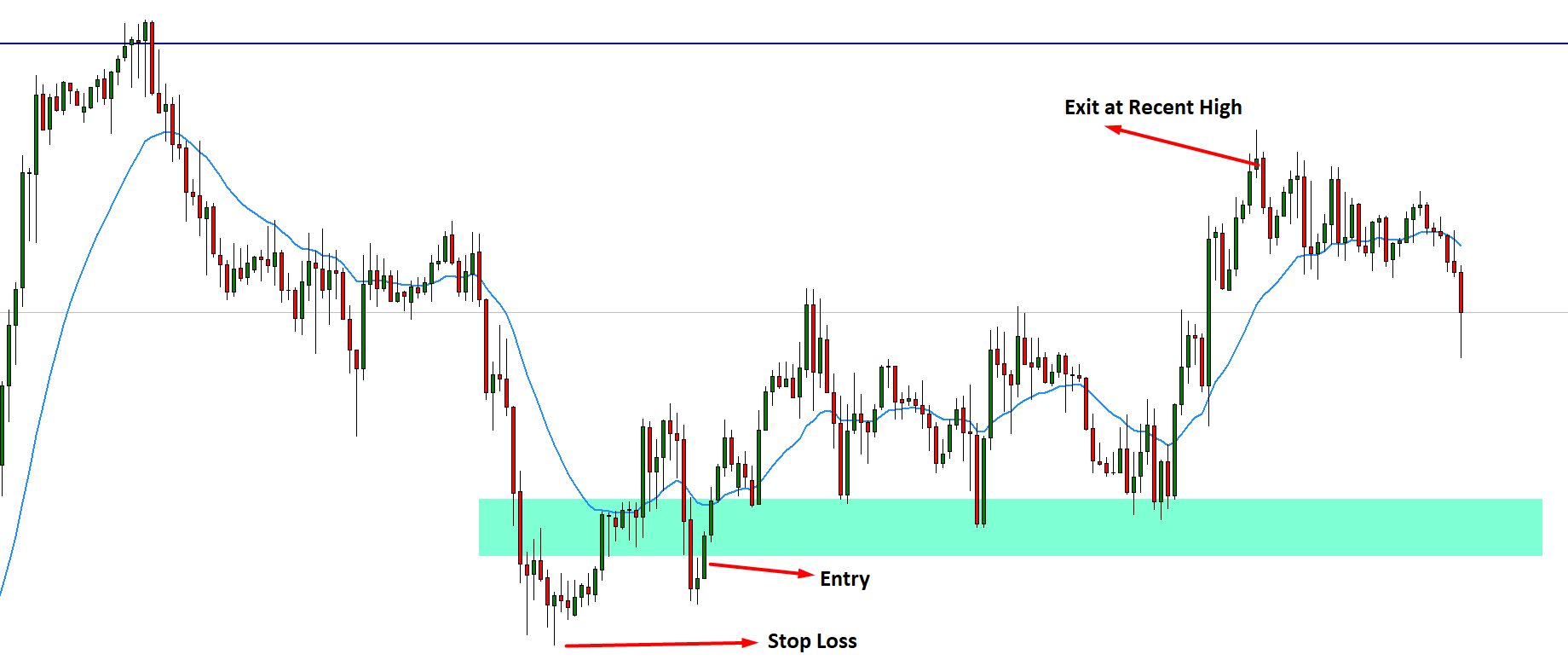

The primary method of taking a buy trade is to buy as close as from support levels where the price moves upwards in the chart pattern. It assists with secluding a long-term pattern, even while trading a chart pattern or range. The pattern leads in the direction to trade. If the trend rises upwards and develops a triangle pattern, it will indulge buying the trade near the support of the triangle pattern.

In the case of buying closer to support, hang tight for integration in the support zone, and afterward, when the price breaks over the peak of that little integration zone, go for a buy trade. When the price moves that way, it means that it is as yet touching the support zone, and the price is moving higher from support.

In a buy trade, set the SL (stop-loss) a few pips less than the support. In case you’re expecting an integration, place SL several pips underneath the integration. Keep an aimed price in mind for a beneficial exit while entering a trade. For example, for a buy trade closer to the support, try to exit immediately before the price touches a solid resistance level.

How to take a sell trade?

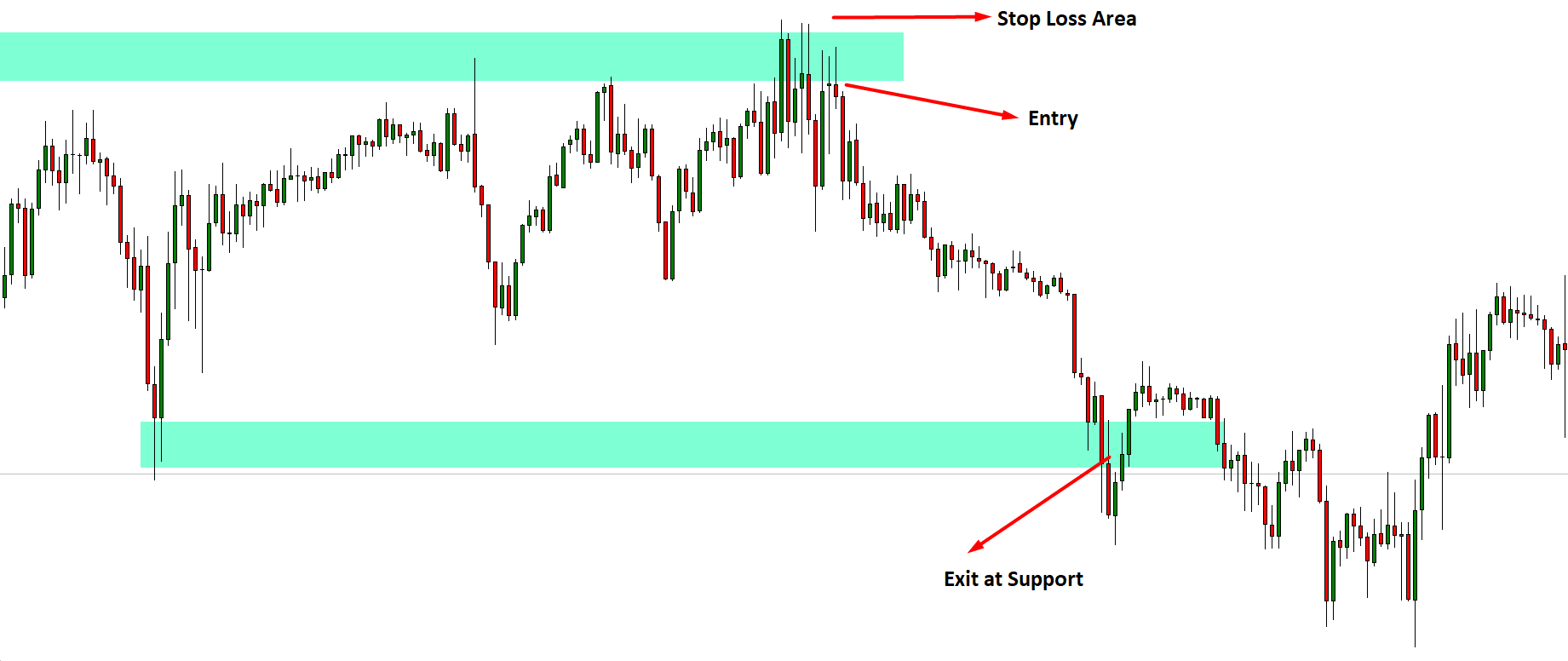

To take a sell trade:

- Sell closer to resistance in downtrends where prices drop down in the chart pattern.

- Hold back for an integration closer to the resistance zone.

- At that point, enter a sell trade when the price falls under the law of the little integration.

- Set the SL a few pennies or pips more or above resistance in a sell trade.

In case you’re expecting integration, the SL goes a few pips or pennies over the integration. In the case of a sell trade at resistance, exit right before the price arrives at solid support. You can likewise exit at a minor resistance level.

How to manage trades?

The difficult segment for a trader is managing trades since the financial market is highly unpredictable. Therefore, things you learn from a trading technique are only the possibility to foresee the price moves. Accordingly, to make a viable development to your account, maintaining a proper RRR (the risk-reward ratio) is necessary for each trade. Unfortunately, there is no existing methodology that can get you to the assured profit.

In that case, you must keep up the standards as the money management rules. First of all, never invest the money you kept for your living, and you can not afford to lose it. Also, try not to take trades by taking a chance with the entire amount of your investment. No matter what, try to risk 1-2% in per trade and don’t hop into the market to recuperate right after making a loss. Lastly, always try to comprehend the trading strategy inside and out. And don’t make the trade until it meets all conditions.

Summary

Support and resistance are vital in intraday trading. You can spot significant S&R levels with drawing tools on your trading chart as they may become pertinent if the price approaches those territories. You can refresh them once per week after a decent movement occurred.

Additionally, spot and mark support and resistance levels on lower time frames on your trading chart to get a clearer view of the price. These will help you in settling on trading choices. Finally, maintain a solid money management strategy for all the trades. And, always try to keep up excellent trading psychology that will assist you with freely settling on the trading choice.

Comments