Have you ever wondered what the best strategy that can help you succeed in FX is? We know the answer would be a definite yes. Every trader or investor around the globe wants to know about the best strategy that can help them win big in the market.

When it comes to any trading, every beginner searches for the best indicator or EA that works. However, according to many professional traders using EA or depending too much on indicators is not a good practice, as it makes you dependent. So instead, the advice is to learn price action or naked trading, wherein you don’t use any indicator and trade with just chart patterns.

This article will show why you should learn naked price action and why it is better than using so many indicators and consider it the best strategy.

What is naked price action?

Naked trading is simply trading any market by analyzing the price chart. The price movement in any market is because of billions of people trading together. Hence, any trading is sentimental and relies on the belief that history tends to repeat itself.

Naked trading is clean and clear chart trading with no indicator. The concept of price action is straightforward that teaches us the more superficial the strategy, the better the result.

Price action trading uses price levels like:

- Support

- Resistance

- Breakout

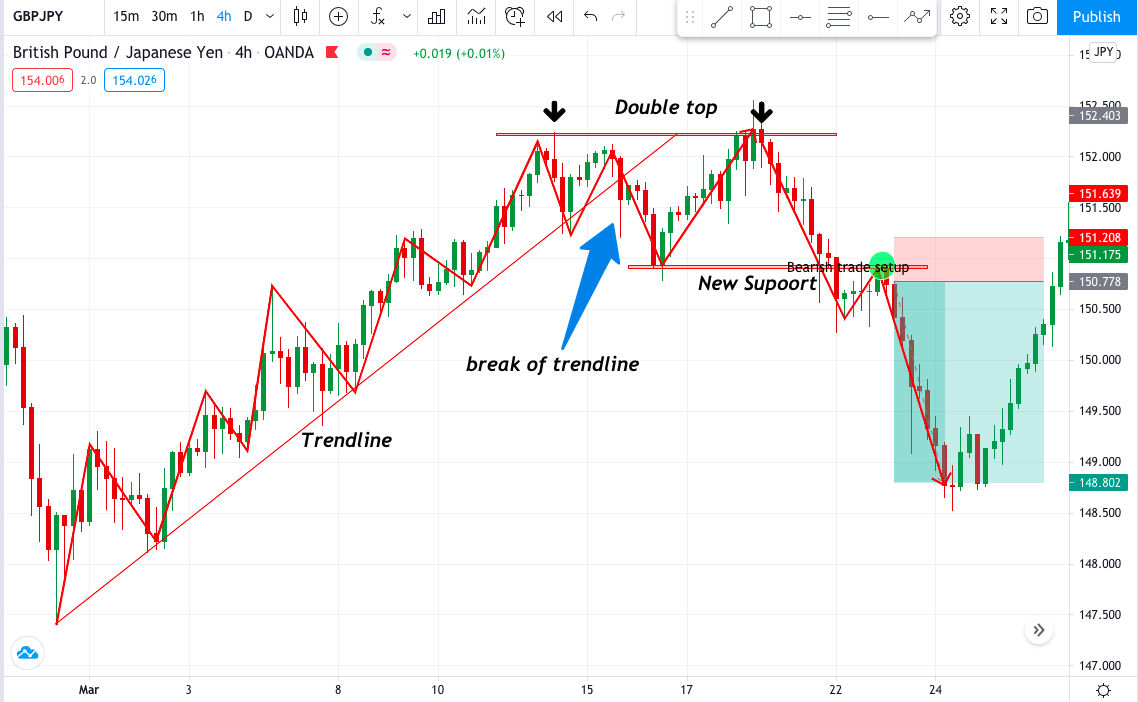

- Trendlines

- Candlestick patterns

Many traders have seen success and winning ratio just with price action trading as it helps to make a clear and better decision.

All you need to know about naked trading

We have to understand that trading is not easy whether you use indicators, price action, or any other strategy. Therefore, before trading any market, you need to know the risk.

Trading using price action is evident but not that easy. So you need to learn and also keep practicing the strategy until you get it right. Trading with price action will keep you ahead of any trader who uses indicators because most of it lags and gives you late entry.

For naked trading, one has first to understand the candlestick patterns and the overall market condition.

How can you trade without the indicator: try naked trading

Once you believe that you can succeed just by using price moments and candles on your chart, you need to understand how to use some strategies to make your trading more efficient.

1. Analyzing the trend

“The trend is your friend,” you probably must have heard this phrase many times in your trading career. We first will apply this phrase in our trading. It is the most important thing to follow the trend. Going against the trend will make you lose if you are not an experienced trader.

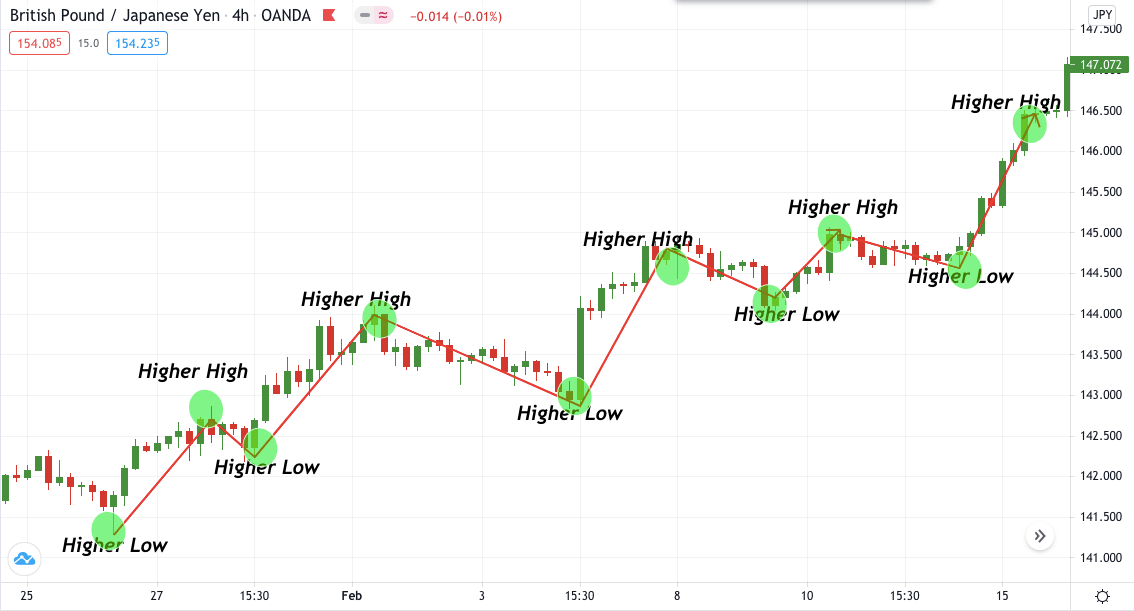

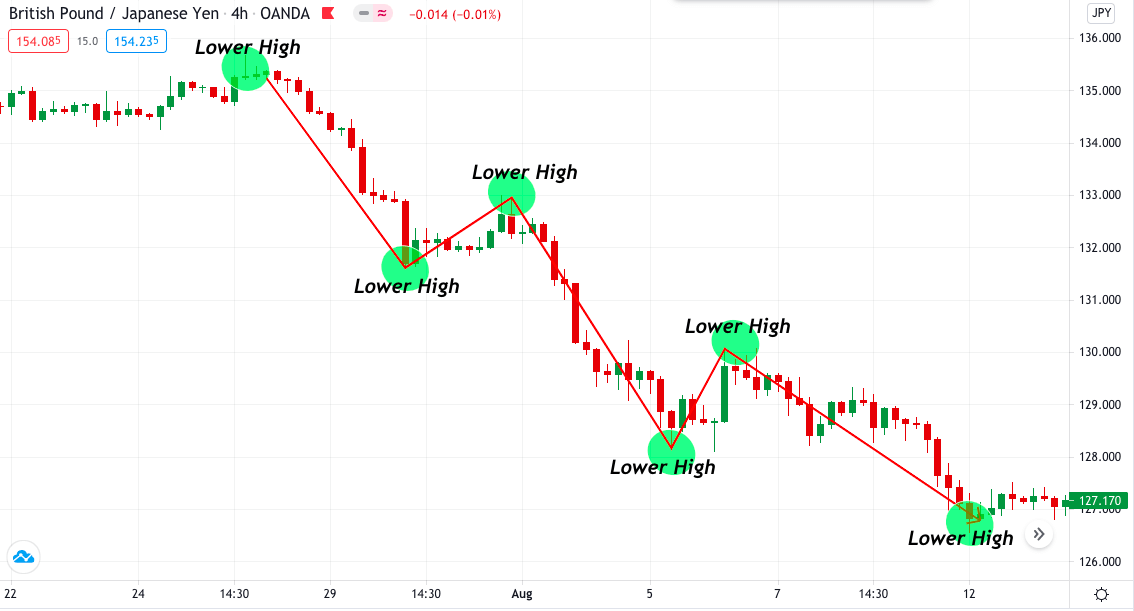

A trader first has to identify market structure, making swing highs and lows to understand a market direction. The market moves in three directions:

- Up or a bullish

- Down or a bearish

- Sideways or a choppy market

|

When the price makes a higher high and higher low, it is an up or bullish trend |

When the price is making a lower high and lower low, it is a down or bearish trend |

When the price is not making any high or low and is moving in a sideway direction, it is called a choppy market |

|

|

|

Now the key here is to decide what type of trader you want to become. You can either be a bullish trend trader, bearish trend trader, or both.

If trading in a bullish trend, you will take buy calls, and if you are trading in a bearish, you will take sell calls. But, of course, you also choose to trade in both directions.

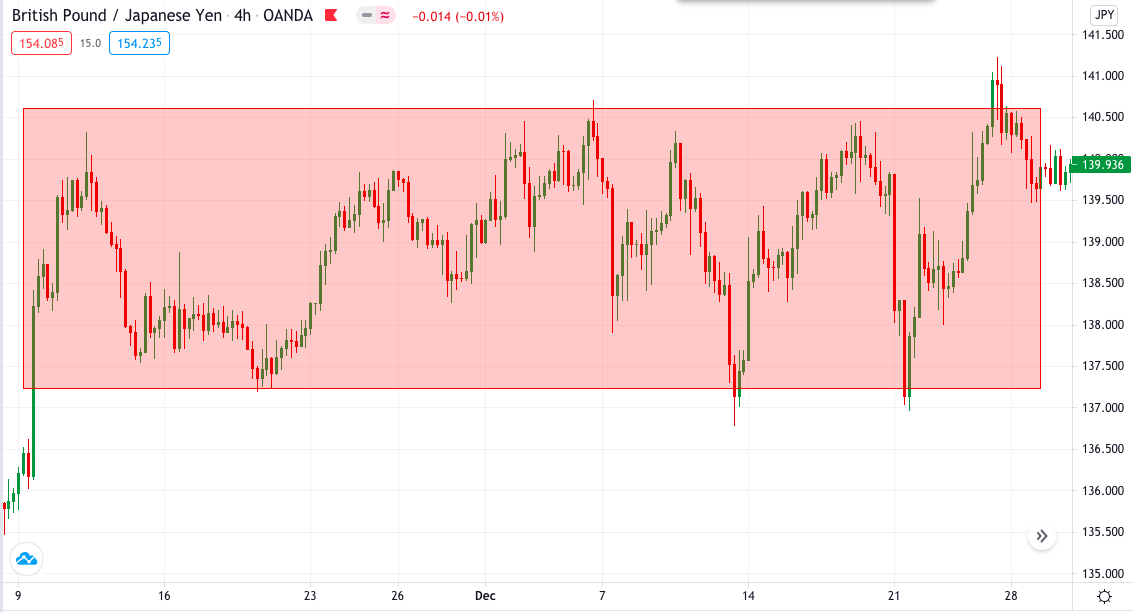

As a beginner, you have to stay away from the choppy or sideways market as it does not have any true sentiments and is a state of confusion or battle between the buyers and sellers. But if you are an experienced trader, you can use the breakout and retest strategy to trade sideways.

2. Making your strong support, resistance, and trendlines

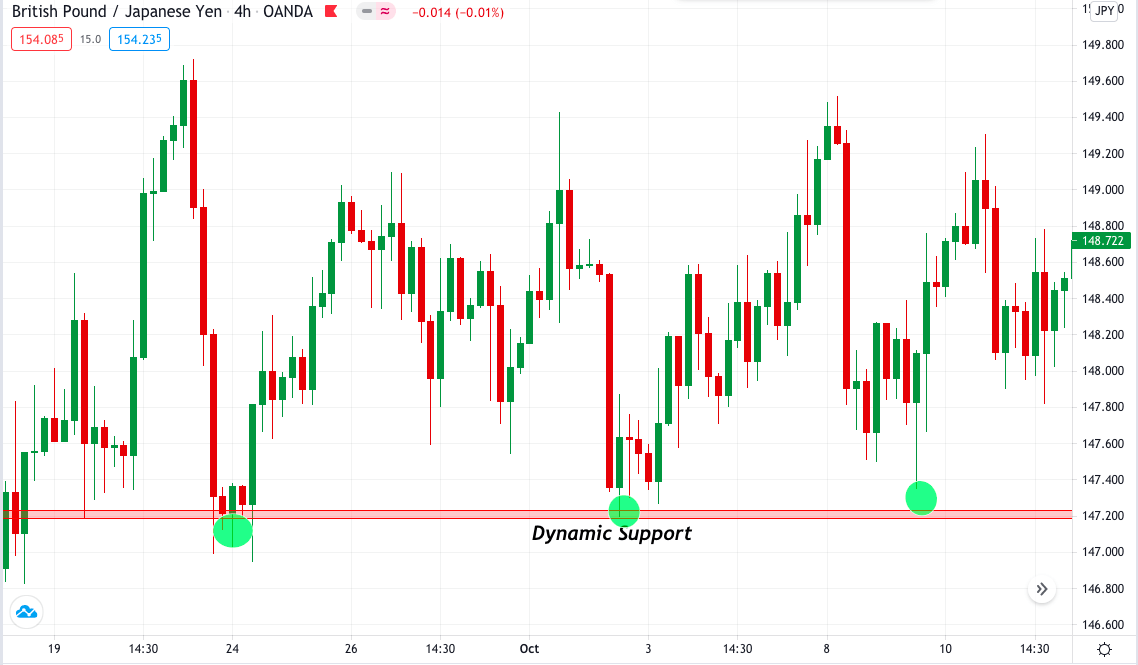

After you know the trend by analyzing the swing high and lows, you need to draw your dynamic support and resistance. For drawing it, you first need to reset your chart and focus on the current price moments.

Once you reset your chart, select a horizontal line from tools and place it so that you get the maximum number of touches.

- In support, the candles should touch the bottom.

- In resistance, the candle should touch from the top.

A diagonal line on the chart with the same concept as S/R is a trendline. When the price touches these S/R or trendlines, it shows the price might reverse or continue.

|

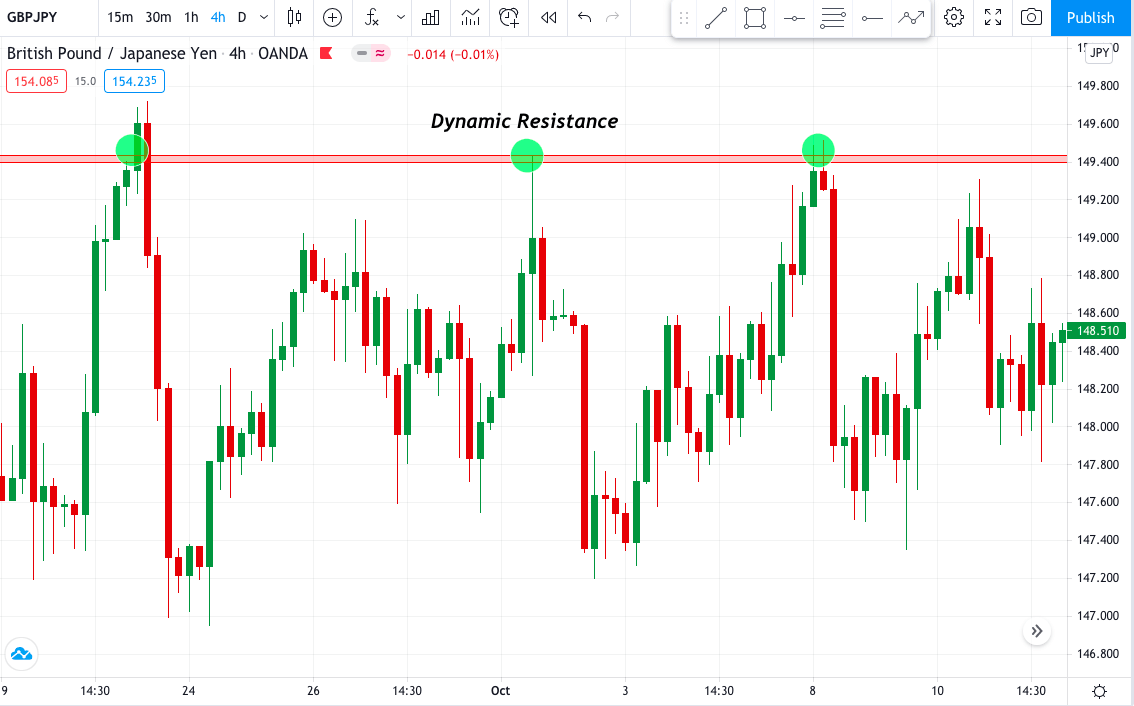

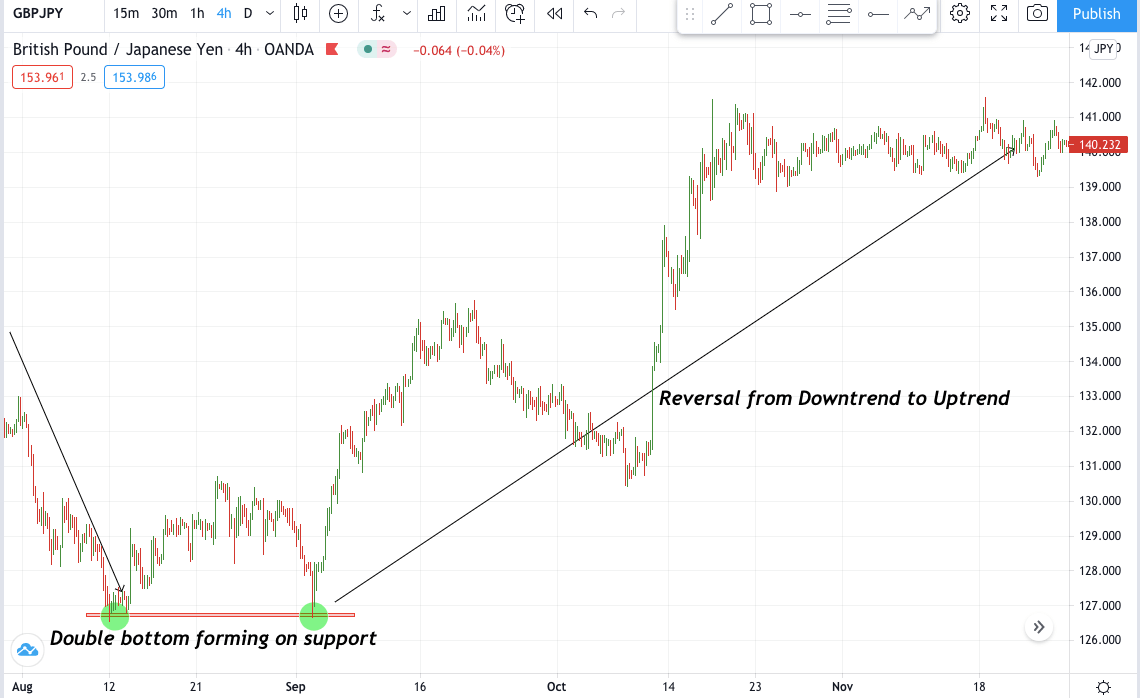

Drawing strong support |

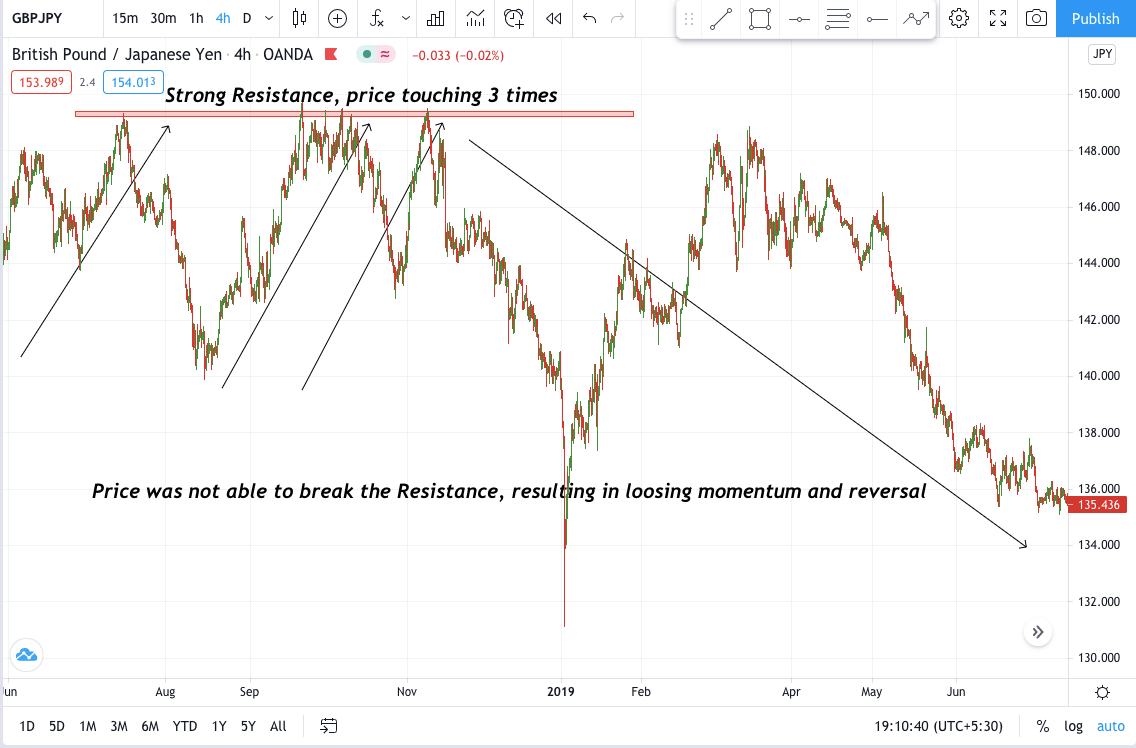

Drawing strong resistance |

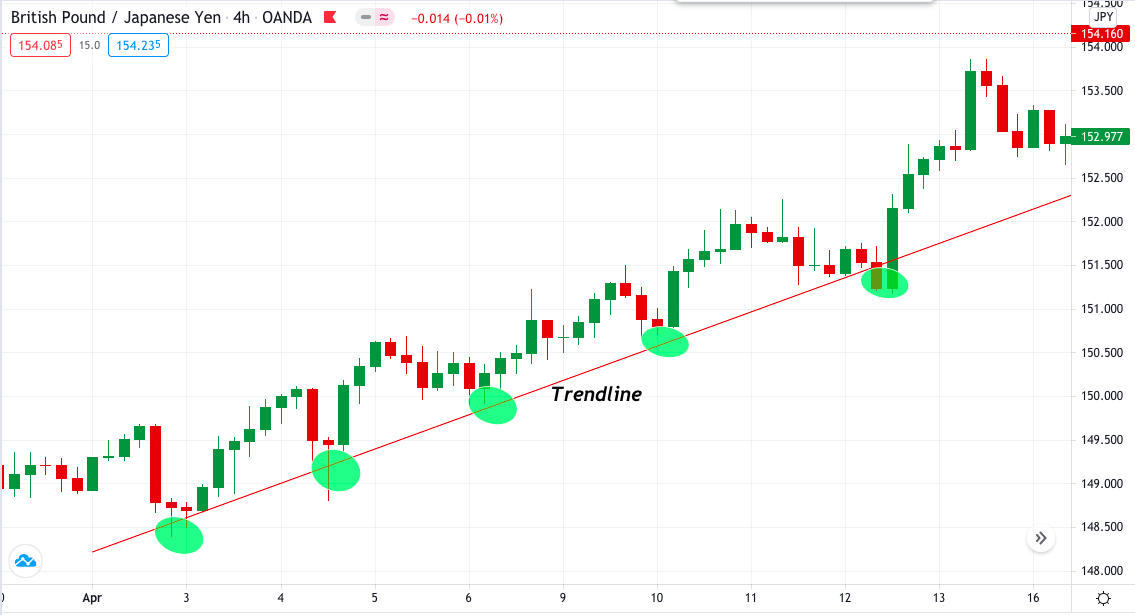

Drawing bullish trendline |

|

|

|

3. Notice the spotting reversals, breakout or breakdown

Once the price is near any S/R or trendline, it shows a potential buy or sells opportunity. But, again, you can apply some candlestick patterns to make these opportunities accurately worth taking.

|

If you see it is an uptrend, and the price is about to touch a trendline making a higher low, this could be a potential buy and vice-versa. |

While a market touches S/R, it can be reversed based on the price momentum. |

|

|

4. Taking the trade

Once you identify the trade, you can use it based on your analysis. Again, identifying different candlestick patterns is a must. Trading with confluence is one of the best strategies you can use.

The area of confluence is the zone where many conditions are met that signify the same potential signal. It makes the signal more accurate as you know you have completed specific criteria for a winning trade.

Conclusion

Trading naked chart/price action is one of the best and most potent strategies by itself. You don’t need an indicator to trade any market. Some people can use significant “hands” like ATR or moving average to measure the volume and overall trend.

It is always advisable to see the overall market momentum. Trading with the area of confluence will give you a better trade setup.

Comments