Scalping is a process to earn quick money from currency pairs’ price fluctuation. In forex trading, scalping is like a blessing as it does not require solid knowledge about the market structure or fundamental analysis. However, trading in a lower time frame often raises a question regarding the effectiveness of the strategy.

Higher time frames always provide a more reliable result than the lower ones. Therefore, many traders argue that 1-hour scalping is more profitable than 1-minute trading. On the other hand, many traders made their fortune just by trading in the 1-minute chart.

If you are new in forex trading and looking for an expert opinion regarding scalping strategy, the following section is for you.

Why is it worth using a forex scalping strategy?

Before proceeding to the exact buy and sell method, let’s get familiar with the effectiveness of the forex scalping system. The global forex market is a decentralized network where buying and selling happen through an electronic system without any centralized place. Therefore, due to the uncertainty, price anticipation is hard that often makes trading inaccurate. Moreover, there are big banks and financial institutes that have a significant impact on the market. As a result, even if you analyze the market, it has a chance of not working if it does not match the institution’s projected direction.

Here scalping might be a blessing to you. If you are a scalper, you don’t have to bother with what is happening in the broader market. Scalping aims to make money from short-term price change so, in case of uncertainty, you can get out of the market with a small loss and look for another opportunity later on. Another blessing of scalping is the result. You don’t have to wait hours or days to see the trading result. In most cases, scalping trade hits the profit level within a few minutes or hours.

Any profit target from 1 pip to 50 pips is often considered scalping. However, there is no limitation of time frame. You can choose 1 minute, 5 minutes, 15 minutes, and even 1 hour in scalping.

Using small time frames like 1 minute or 5 minutes does not show a reliable view of the market like the 1-hour chart. Therefore, trading in a 1-hour time frame is more effective than 1 minute. Anyways, you can trade on any time frame you want. The ultimate goal is to make money from trading.

1-minute forex scalping strategy

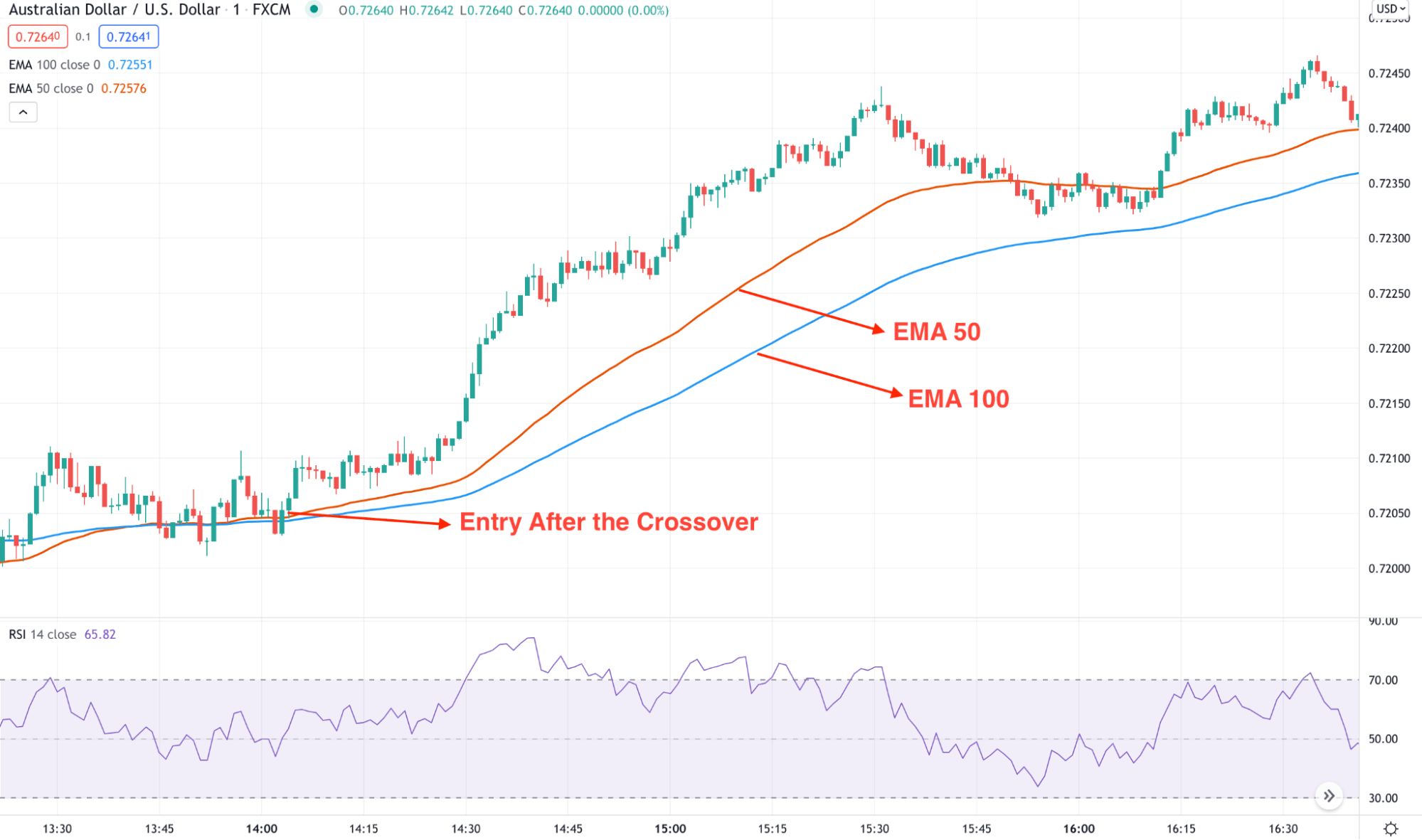

- Moving average exponential — 50

- Moving average exponential — 100

- Relative Strength Index (RSI)

When the price is above this MA line, we will consider the overall outlook as bullish. Similarly, if the price moves below these lines and becomes stable, we will change the view from bullish to bearish. In both cases, we will ignore what is happening in the higher time frame.

Remember that the moving average crossover will indicate a boost in the trend. For example, if the 50 EMA crosses over the 100 EMA, we can consider that short-term bulls became aggressive in the market. Similarly, the 50 EMA crosses down the 100 EMA; it will indicate extreme selling pressure in the market. However, MA also provides wrong signals, so using RSI will help to eliminate those.

Entry

The trading entry comes when the EMA 50 moves above the EMA 100 with a bullish candle close. At that time, the RSI should be above the 30 level, pointing higher. The same rules as for a sell trade where the entry will be valid after a bearish crossover with the support from RSI.

AUD/USD chart

Stop loss

The trade is valid until the price moves beyond the 50 EMA. The stop loss should be above or below the 50 EMA with some buffer in buying and selling trade.

Take profit

The primary take profit is based on 1:2 risk vs. reward. You can close full trade with this target, or you can hold more depending on the market condition.

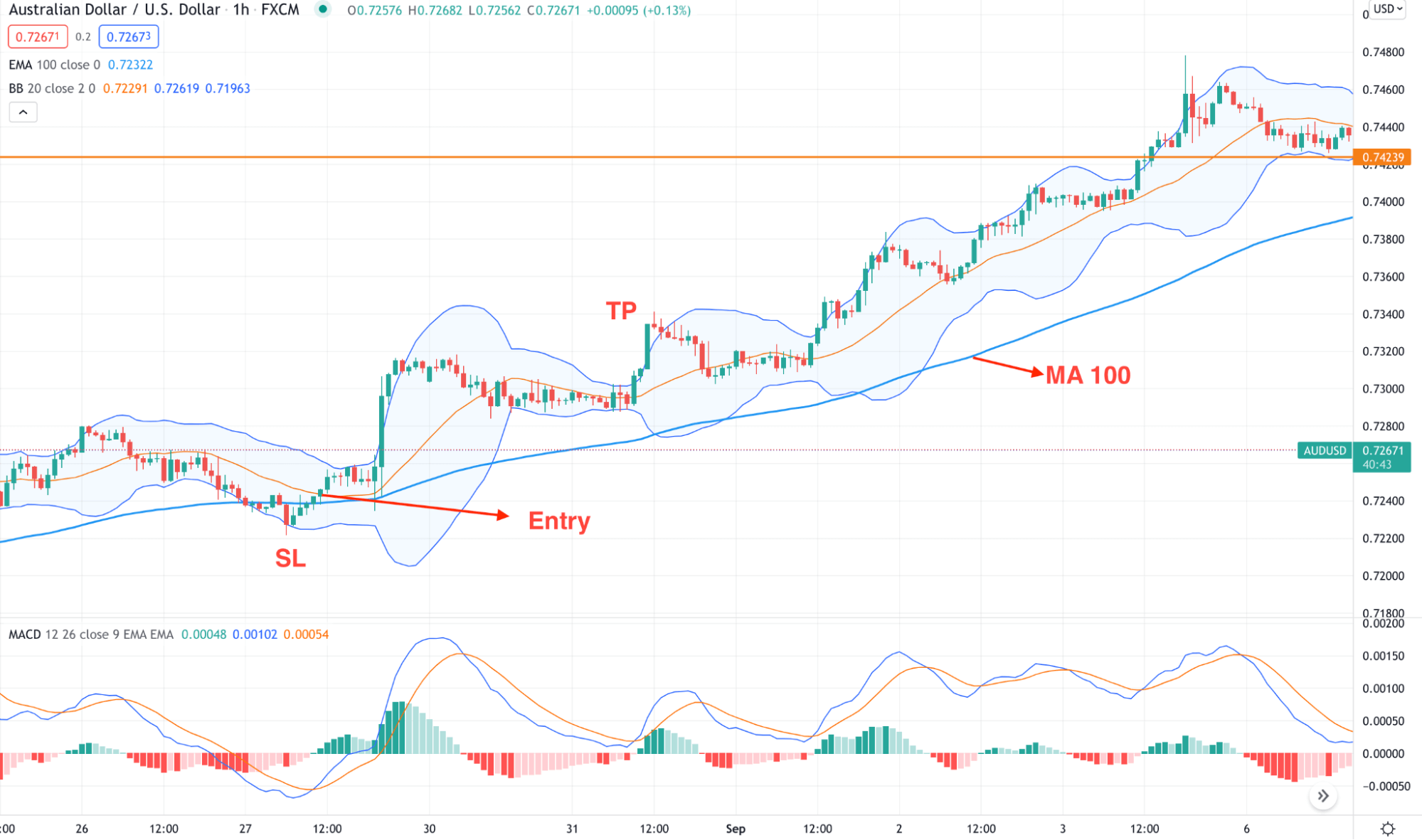

1-hour forex scalping strategy

As said above, the higher time frame often shows the more accurate result. Therefore, the 1-hour trading system that we will see here has higher accuracy than the 1-minute system.

In this method, we will use three indicators:

- Bollinger Bands — default setting

- Moving average — value 100

- MACD

Entry

For long trade:

- Wait for the price to move above the BB and 100 SMA.

- Wait for the MACD histogram to move to the bullish zone.

For short trade:

- Wait for the price to move below the BB and 100 SMA.

- Wait for the MACD histogram to move to the bearish zone.

Besides, you can use ADX and find the ADX line to move above the 25 levels to filter more accurate results.

AUD/USD chart

Stop loss

The ideal stop loss is below or above the most recent swing level.

Take profit

You should close the trade when the price moves to the opposite side of the Bollinger Bands.

Pros and cons of forex scalping strategy

The perfect scalping strategy comes with perfect timing. It would help if you had a clear idea about the strengths and weaknesses of this method.

Pros |

Cons |

|

|

|

|

|

|

Final thought

The above section shows the exact buying and selling guidelines using the 1 minute and 1-hour trading strategy. Now it is time to implement those methods in your trading account.

First, you have to understand the logic behind every trade and start trading in a demo account. Then, once you can handle risks and uncertainties, you are ready to use this method for your regular earning.

Comments