ALMA stands for Arnaud Legoux moving average, an indicator that came into existence in 2009. The moving average (MA) got its name from a person. This person is Arnaud Legoux, one of the two market technicians who invented this indicator.

The other inventor is Dimitrios Kouzis Loukas. A new member of the moving average family, ALMA is not as popular as the mainstream counterparts, but it is slowly gaining supporters.

You can utilize the ALMA indicator as you would any type of moving average around. However, some users claim that ALMA is better than its more familiar siblings, such as exponential, simple, linear weighted, and smoothed moving averages. They arrive at this conclusion by comparing the amount of lag.

Compared to the MA’s mentioned, ALMA lags less. You will see the difference later when we compare ALMA with EMA and SMA.

The moving average problem

If you have been using moving averages for a while, you might have realized that while a short-term MA reflects price changes more quickly, it has the drawback of providing many false signals.

On the other hand, a long-term MA gives more dependable signals, but they often come late. As a result, you will find yourself in a difficult situation. Will you use a short-term MA that provides many low-quality signals? Or will you use a long-term moving average that generates fewer high-quality signals?

You might combine a MA with a price action strategy, candlestick patterns, and other technical indicators to filter out false signals. Also, you might have explored the possibility of using multiple moving averages with varying periods. To end the problem, the inventors came up with a different type of MA using a different mathematical calculation. The result is the ALMA indicator. This indicator provided a solution to the issue of moving averages being unresponsive and erratic.

A moving average innovation

When looking for a MA, traders typically consider two factors:

- Responsiveness

- Smoothness

The responsiveness factor is critical for timing the trade entry. The goal is to enter trades as early as possible without much delay. Meanwhile, the smoothness factor is crucial for determining the existence of current trends versus market noise.

The ALMA indicator excels on both accounts. By doing two price computations, ALMA emphasizes the trend and disregards minor price fluctuations.

- The first calculation involves moving to the left from the current candles.

- The second calculation entails moving to the right from the beginning of the oldest candles on the chart.

The result is a MA with a substantially low lag.

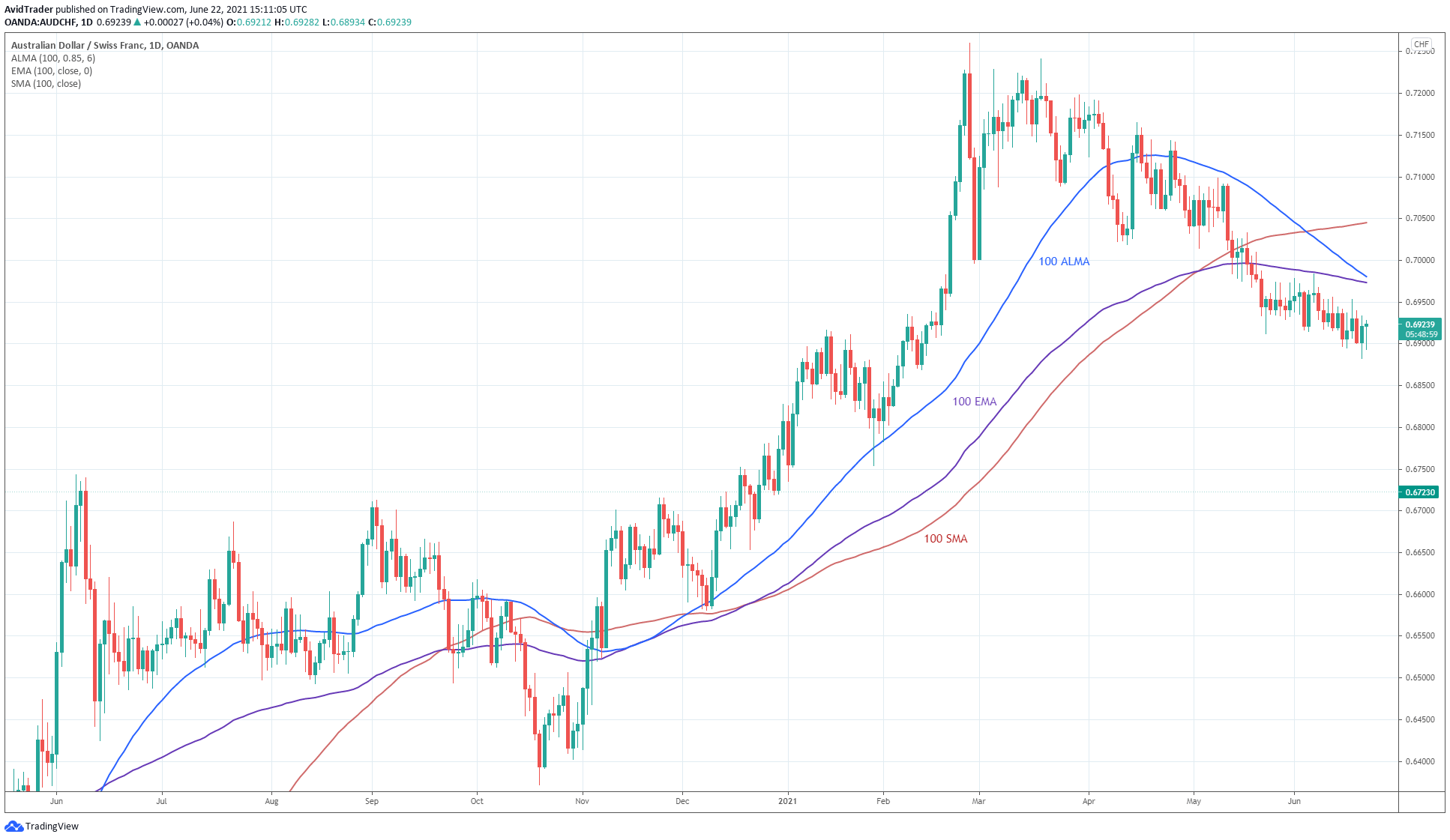

ALMA versus common moving averages

In comparison, EMA is a bit on par with ALMA. Both appear to move in almost the exact angle of inclination in a trending market. Of course, ALMA is closer to price than EMA. This makes ALMA more responsive to price action. As in the case of SMA, when the market decides to reverse the trend, EMA reflects this event relatively late.

On the contrary, ALMA has signaled the trend reversal way earlier. In addition, the above pair shows price bouncing more often from ALMA than EMA. This indicates that ALMA pinpoints the swing points better than EMA.

How to interpret the ALMA indicator

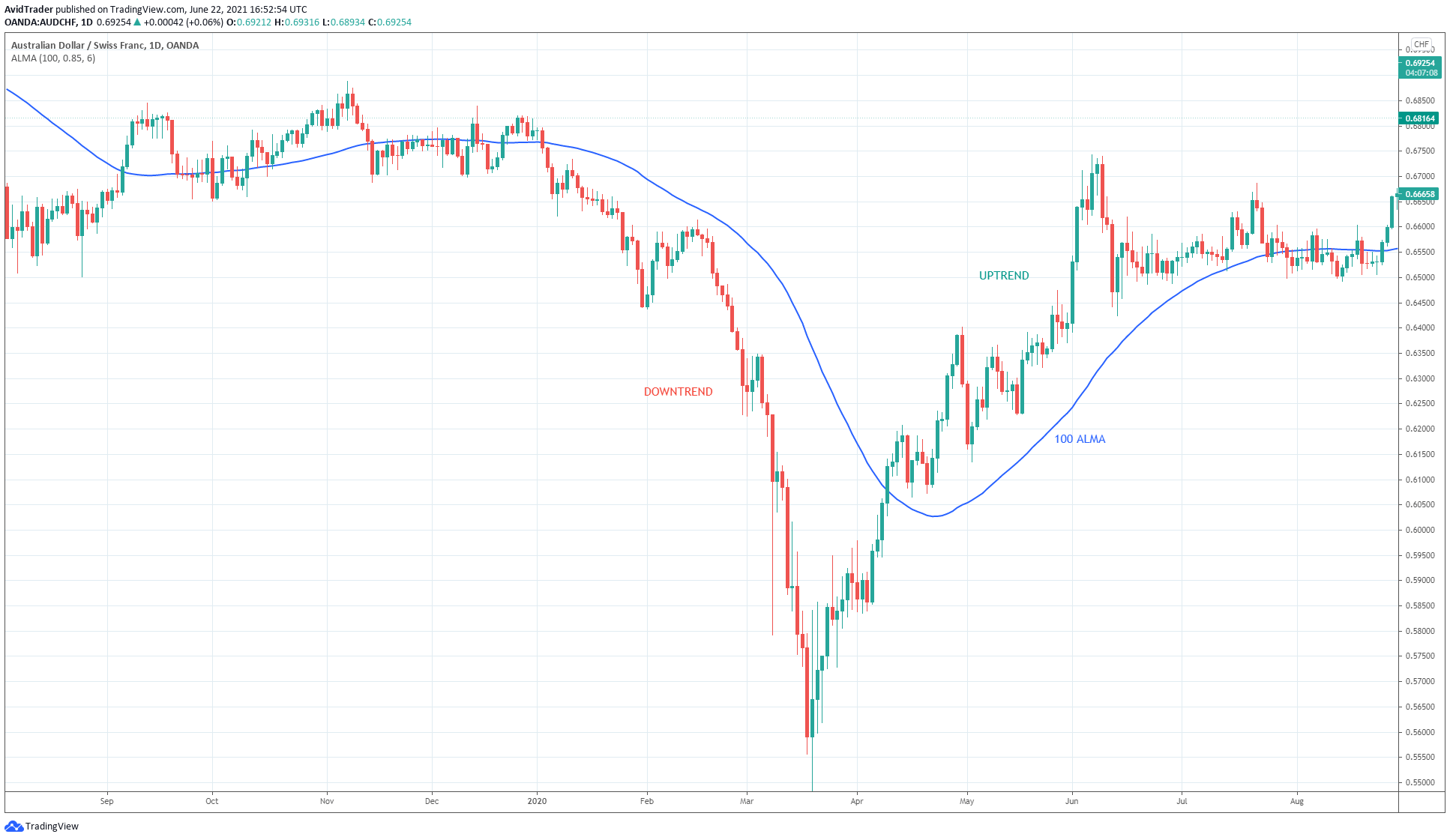

Like other moving averages, ALMA is a valuable tool for identifying trends, breakouts, market reversals, and places of support and resistance in any time frame and symbol. Be aware of the market context where ALMA works best. It is an effective trading tool for trending markets. In ranging market conditions, it would not be constructive.

- When the market under consideration is trending upward, you can see that ALMA is moving upward.

- When the market is trending downward, ALMA is also moving downward.

Refer to the above AUD/CHF daily chart. ALMA is a trend indicator like all

MA’s. Looking at how ALMA interacts with price, you can say it lags. This is no big deal, though. Other moving averages do lag behind price. The ALMA difference is that the lag is significantly lower.

How to trade the ALMA indicator

You can use ALMA in your trading in numerous ways:

- When the underlying asset moves up and is trending strongly, the price may stay above ALMA for a long time.

- When the underlying asset moves down and trends strongly, the price may remain below ALMA for an extended period.

With this knowledge, you can calibrate your trading system based on the prevailing market environment. When you know the trend is up, you should look for buy trades only. When you notice the trend is down, you should focus on finding sell trades.

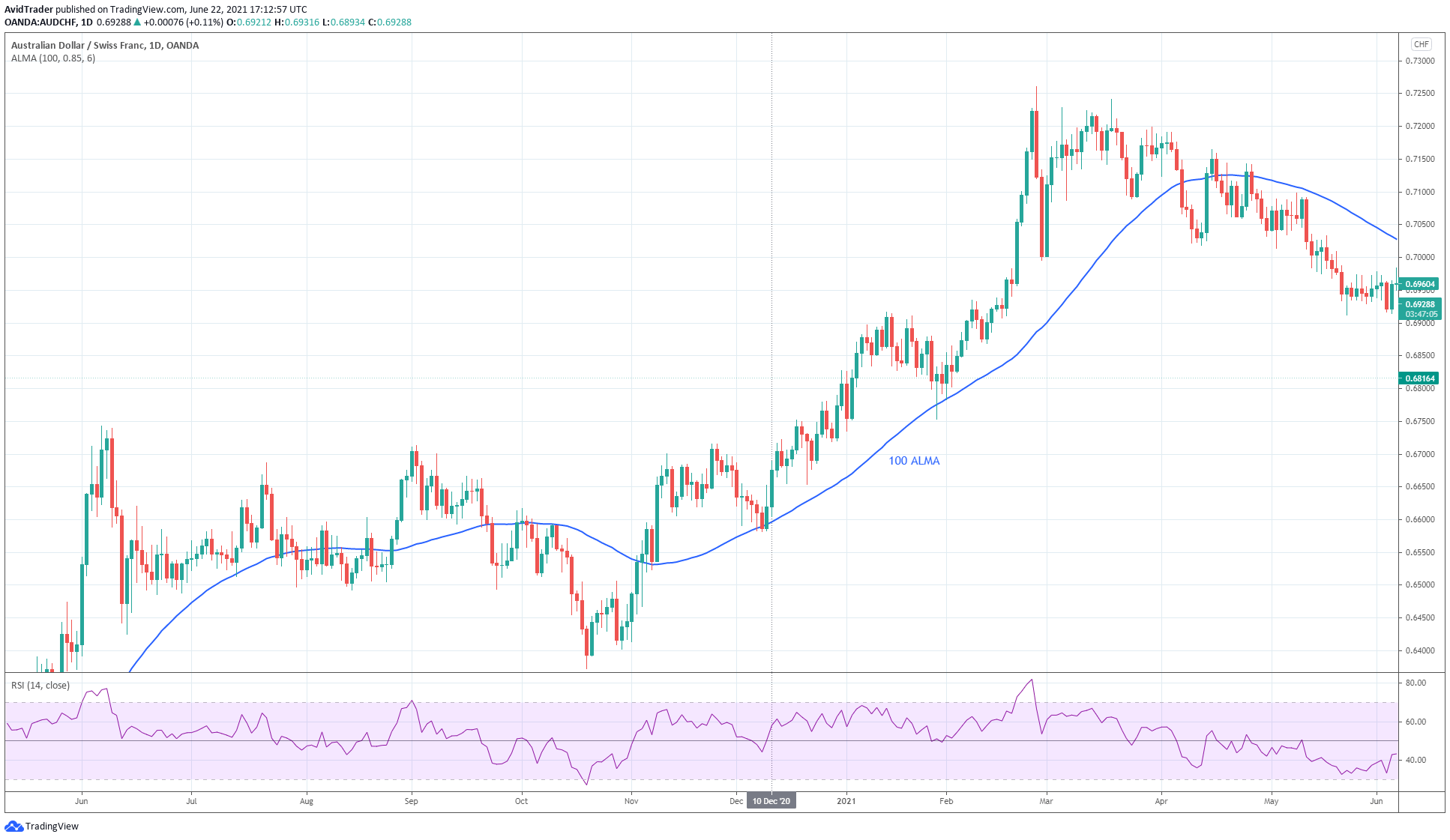

The best way to do this is to trade on a pullback in line with the dominant trend. Here you can use two ALMA indicators, one with a shorter period and another with a more extended period.

Let us use the RSI. Consider the above scenario. The best entry after the pullback happens after:

- Price retests the 100 ALMA from above

- RSI dips below 50

- Then RSI moves above 50

You could have entered a buy trade on 10 December 2020 and made money.

Final thoughts

You might have appreciated the advantage of using ALMA compared with the more common alternatives such as EMA and SMA. It closely follows the trend and then tells you if the trend has changed direction. Because there is not much lag, you can enter trades at better prices. If you have not used ALMA before, try it out for some time. This might add a new flavor to your trading strategy.

Comments