As a rookie trader, you probably have not determined what trading style you should acquire. Terms like scalper, day, swing, or position trader might be foreign concepts. We refer to these as trading styles; there are clear distinctions between each of them.

The duration that you opt to hold your positions will aid you in determining your trading style. In addition, your character has a lot to do with choosing the appropriate style. We will explore the distinct types of trading and what characteristic qualities suit it best.

Scalping

It is a trading style adopted by those who opt to trade the market in a short time frame. Their objective is to catch small price movements with high volumes. A scalper can trade hundreds of positions in a session and keep trades from seconds to minutes.

Because you are required to place many positions, scalping requires you to closely monitor the charts as you will need to identify where to exit your running trades and analyze your next moves.

Characteristics of scalpers

Scalpers enjoy the rush of fast trading and can make quick decisions. If you have an impatient nature and cannot hold trades for long, this style is suitable. You do not stress easily and can react rapidly to market changes. On the other hand, if you enjoy an adrenaline blast, it might be an appropriate option.

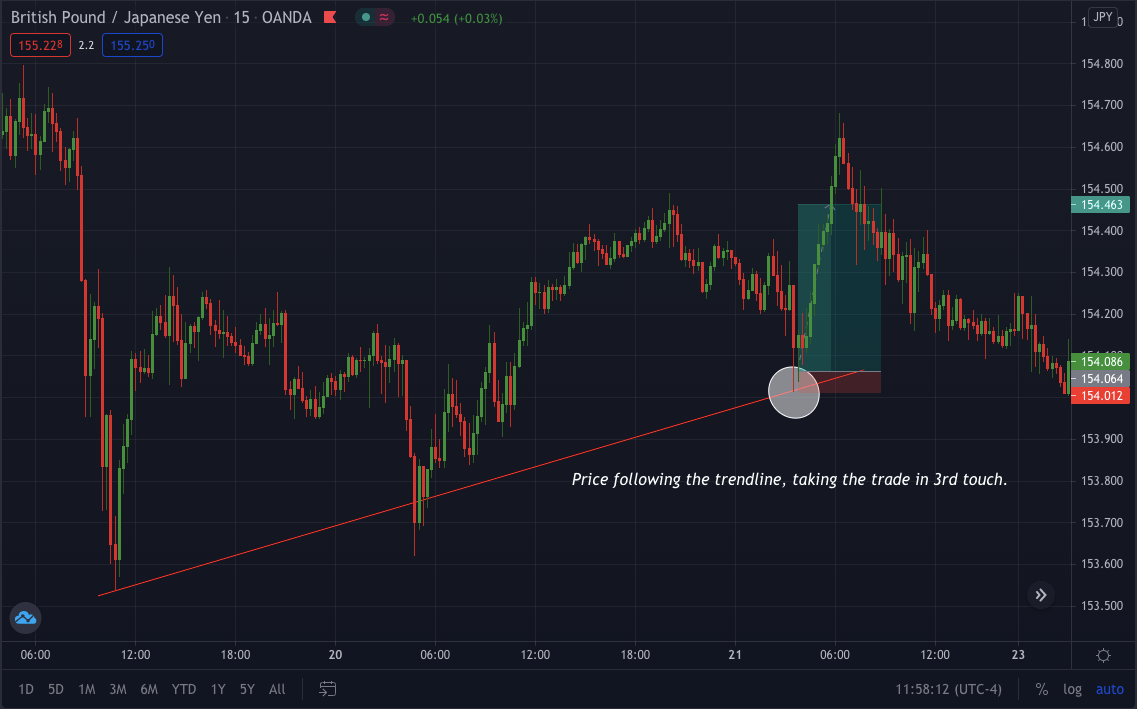

It would help if you always were quick in scalping, so you must use a lower time frame, say 15min or 30min. The below GBP/JPY chart shows trading using scalping.

Pros

- Collect small profits quickly.

- You can place numerous trades in a day.

- Benefit from small movements instead of waiting hours or days for a trend.

- A good strategy can be very profitable in the long run.

Cons

- You have to be in front of your screen most of the day.

- Trading on lower time frames makes it challenging to determine the trend.

- Stressful due to the fast nature of the trading.

- Broker fees and commissions can be costly.

- Lack of discipline can lead to overtrading and greed.

Day trading

The concept of this style is buying or selling assets within a day and avoiding holding trades overnight. As in scalping, intra-day traders close all positions by the end of the session, but they take fewer trades than scalpers. They also rely on technical analysis to speculate the market’s direction. Due to this, they have to deploy trading ideas, abide by their trading plan, and deploy multiple strategies to garner profit.

Characteristics of day traders

Accomplished day traders have in-depth knowledge and understanding of the market. Traders who are disciplined and have a high patience tolerance to hold trades for several hours prefer day trading. This style is also suitable if you follow fundamentals as these news events can create opportunities within the intra-day time frame. Finally, if you are flexible, this will suit you as you need to monitor the charts and make decisions quickly.

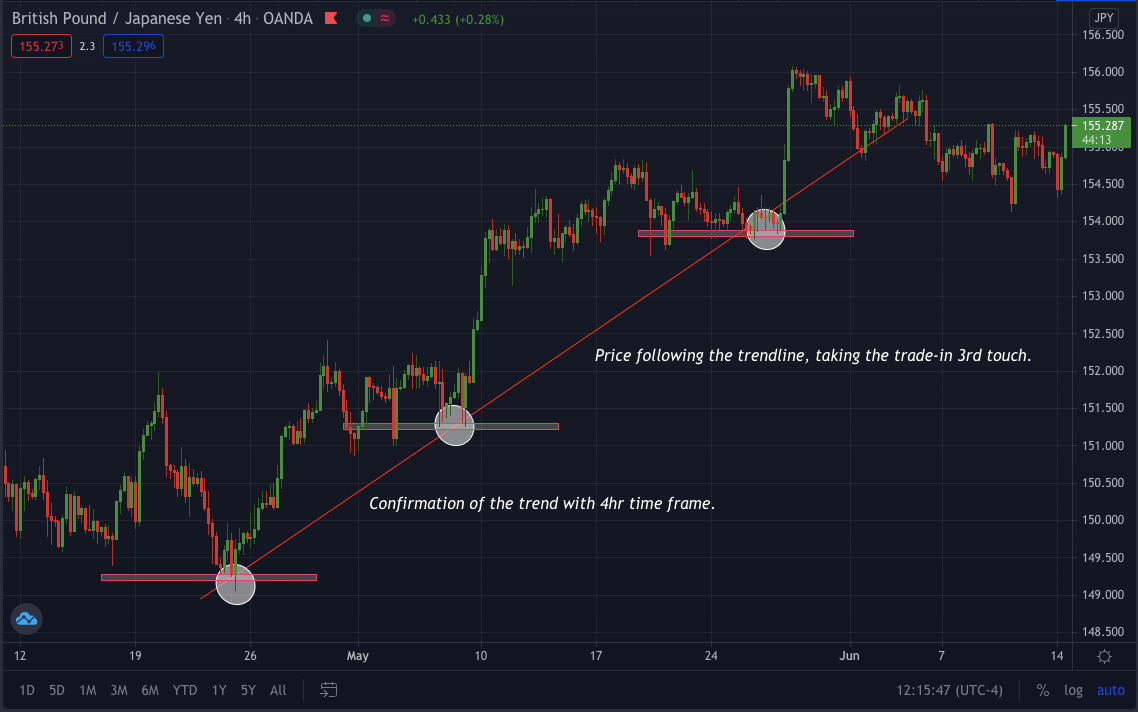

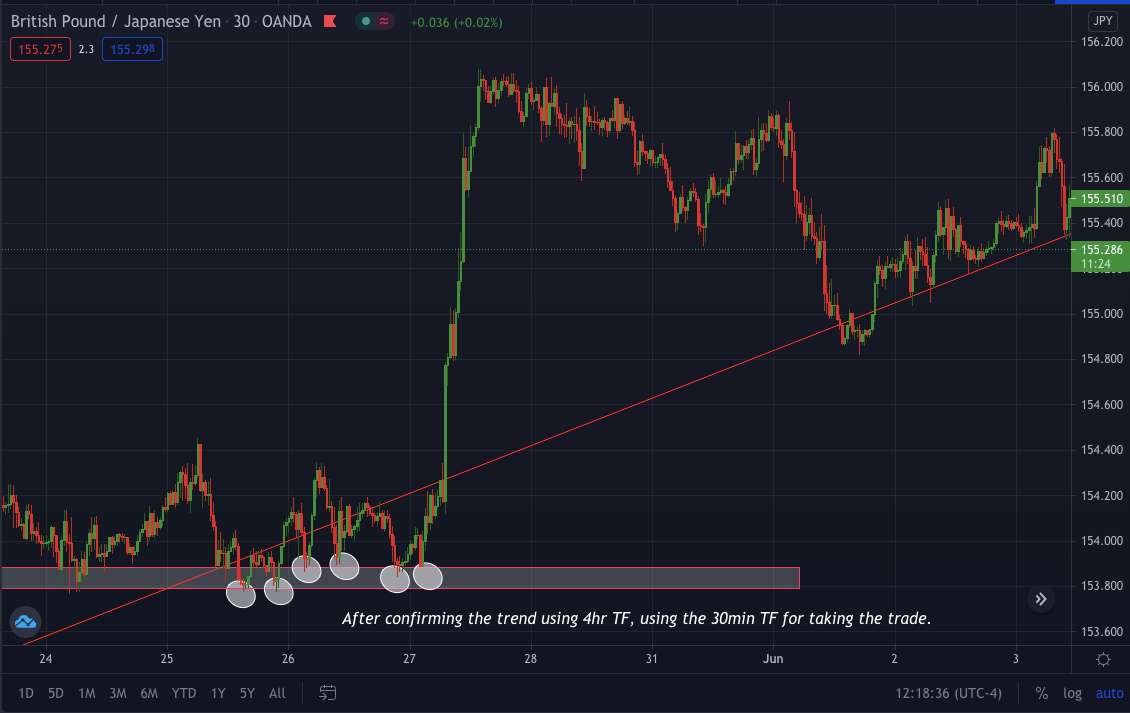

The best time frame to use in day trading is 4hr, 1hr for trend confirmation, and 30min or 15min for trade setup confirmation. The below GBP/JPY chart shows trading as a day trader.

Pros

- There is no risk of holding trades overnight, avoiding swap fees.

- You can make profits fast, from minutes to a few hours.

- You can speculate the trend better.

- Technical indicators are more accurate when day trading.

Cons

- You need an adequate margin level and, therefore, a significant investment.

- Fundamentals could throw off your strategy.

- Need in-depth knowledge of technical analysis.

- You will need to spend more time monitoring the charts throughout the day.

Swing trading

Swing and day trading differ in that swing traders hold trades for more than a day up to numerous weeks. The term ‘swing’ comes from the fact that traders identify significant swings in the market. They buy at swing highs and sell at swing lows. These trades run more prolonged, and the market can sometimes move against you during this period. Swing traders aim to make large profits over a prolonged period.

Characteristics of swing traders

If you do not have free time to trade and work full-time, this style is suitable. A patient and calm nature are critical attributes of swing traders as they do not allow the rapid market movements to faze them.

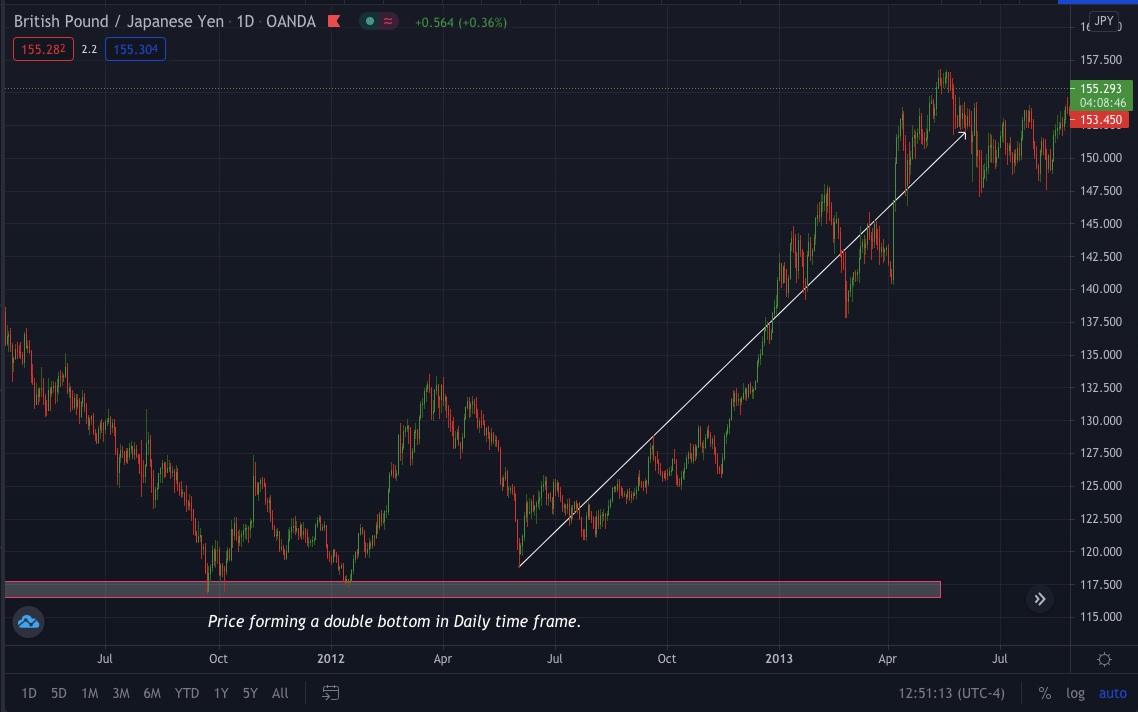

For swing trade, it is essential to always go with the deal, here weekly, daily, and 4hr time frame is critical. Below, GBP/JPY charts show an example of a swing trade.

Pros

- Make large profits from significant swings.

- Speculate trends better since its medium-term.

- You require fewer hours to watch the charts.

- Ideal if you work or study full-time.

Cons

- You have to wait longer to exit in profit.

- Use more considerable stop loss to counteract market movements.

- Market gaps up or down could affect your position negatively.

Position trading

It is whereby you hold trades for long periods, from several months to even years. The fleeting price movements do not affect them, and they depend on fundamental analysis to identify trends. However, like swing trading, as a position trader, you should expect the market to go against you as well. You, therefore, require a considerable investment.

Characteristics of position traders

You have to be extremely patient and calm when choosing this type of style. Investors or traders who understand the fundamentals and macroeconomics combined with technical skills are ideal for this trading style.

Since you will be holding trades for many months, you have to withstand the pressure from large movements in the market as there will not be minor retracements. Therefore, position trading is ideal for investors with significant capital.

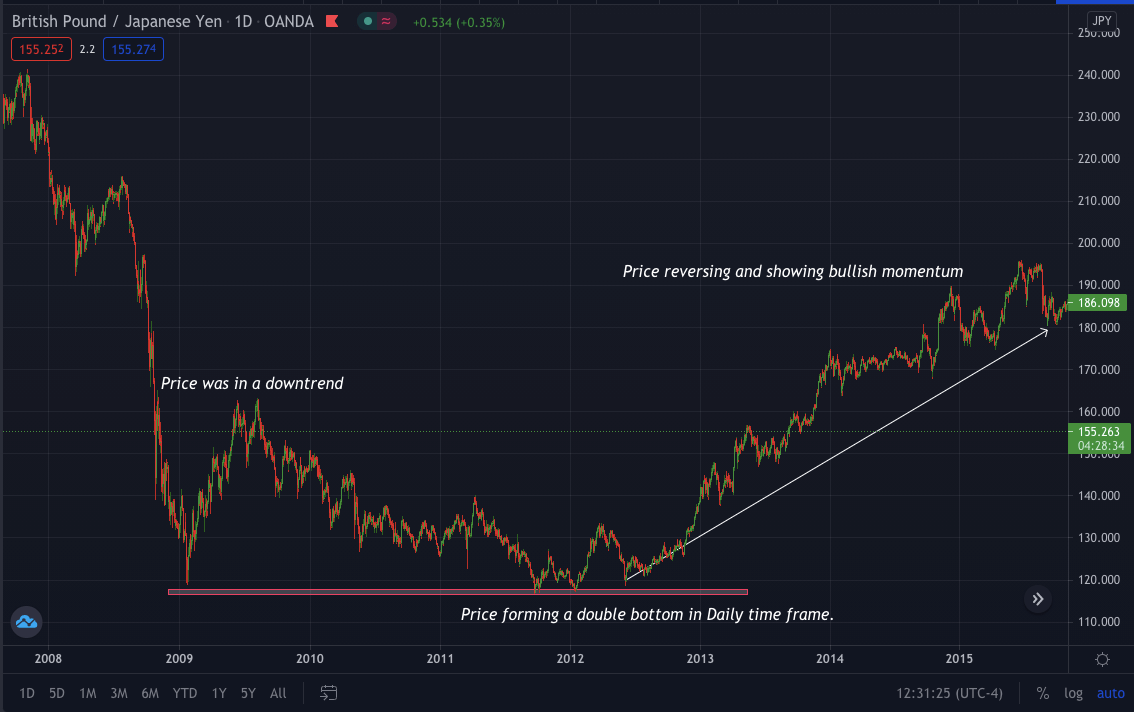

Trading position trades you need to go for a higher time frame like monthly. Mostly this style is a form of investment and not trading as you are waiting for a long time to take benefits. The below GBP/JPY chart shows the position trading style.

Pros

- You can bank large profits if your accuracy is good.

- Less stressful as you do not react to small price movements.

- Market speculation is more accessible as it’s over a long time.

Cons

- Risk of losses due to market fluctuations.

- Brokers fees add up over a long period.

- Lack of patience and discipline could prompt you to exit earlier and cut your gains short.

- Requires significant capital investment to meet the margin requirements.

Conclusion

Since trading is such a stressful endeavor on its own, it would be helpful to know the trading style you prefer. There’s no rule against using multiple techniques, and some traders switch between day and swing trading, and they adapt strategies accordingly. Others stick to one type, and it works for them. Matching your trading goals with your persona will ultimately assist you in choosing the perfect trading style.

Comments