Currency trading is an enriching but very challenging endeavor. You cannot handle it without sufficient market experience and perhaps without burning a deposit or two. Because of this, you must consistently approach each trading day and not deal on a whim or gut feeling. So this is where a trading method comes in.

Let’s learn about the FX profit system — a mechanical trading strategy that uses a couple of indicators to define trade entries. While the strategy looks simple, you can trade it with success if you follow the plan consistently.

FX profit system guidelines

Before you learn about the basic strategy, there are essential guidelines you must know at the outset. These guidelines are your roadmaps when implementing the strategy so that you do not go astray. Below are the guidelines in trading the profit system:

- Follow one or two currency pairs only. The mantra “The more, the merrier” does not always work when trading the currency market. Monitoring too many symbols may harm your performance. The rule of thumb is that you should trade those pairs that show ideal trends or oscillations. Of course, it is better to stick with the major pairs, as they tend to have smaller spreads than other options.

- Be aware of the upcoming news affecting the currency pairs you are trading. This advice applies even if you do not trade the news or are not utilizing fundamental analysis.

- Keep in mind where the support and resistance levels are on your chart. Convincingly breaking support or resistance can give you a hint as to where price will likely go next.

- Trade your plan, do not digress and spend more time analyzing than trading. The moment a trade is live, there is not much you can do about it.

- Always use a stop loss to protect your account against disasters. Meanwhile, do not limit how much you can make on a trade. Trail your stop instead of setting a fixed target.

- Trade this system on a demo account first but think of it as a real account. Once you are profitable for some time, then you can open a small, factual account.

- Make sure that the lot size of a contemplated trade is correct. If you plan to risk two percent on every trade, then the lot size must reflect this. While you can certainly do a manual calculation, using a script can make the process quicker and more accurate.

Indicators to use

You will use two types of indicators when trading the FX profit system. These indicators are the following:

- Parabolic SAR (standard settings: 0.02 step, 0.2 maximum)

- Exponential moving averages (periods 10, 25, and 50)

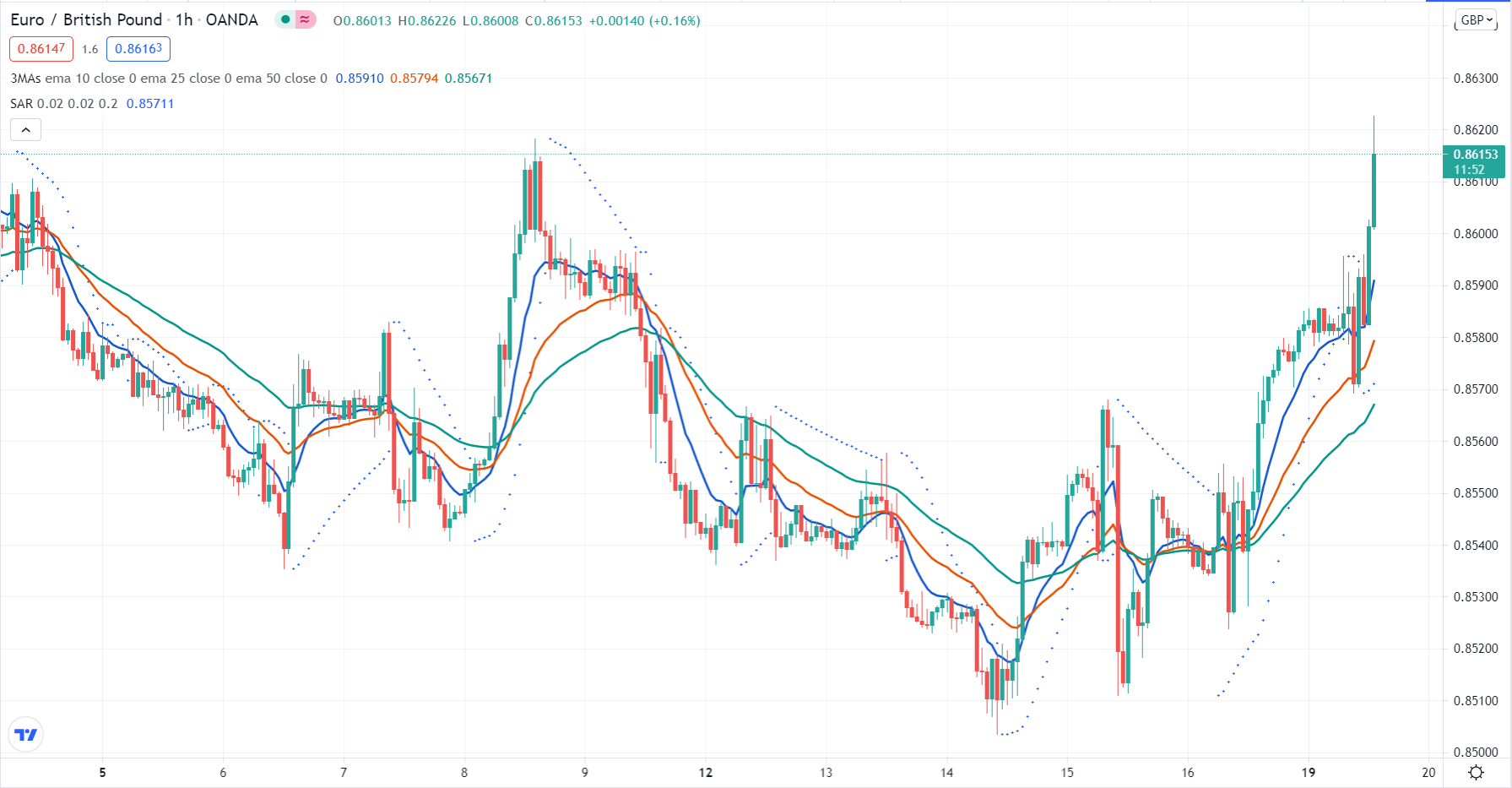

Setting up your chart

You should set up your chart in a certain way. To do that, follow these steps:

- Open a chart of your choice and set the time frame to hourly.

- Find a symbol that shows elaborate swings in both directions.

- Avoid trading a choppy or sideways market.

- Add the parabolic SAR indicator to the chart.

- Add the three exponential moving averages. Use different colors to identify each period easier.

- 10 EMA is blue

- 25 EMA is orange

- 50 EMA is green

You can use any color combination you prefer. The dots above and below price are objects drawn by the parabolic SAR.

When to enter a trade

The FX profit system setup is easy to find and qualify. You would be trading every day with this system as there are plenty of opportunities available to you.

Buy trade

See that the following condition is present before you take a buy trade:

- On the hourly chart, 10 EMA crosses above the 25 EMA and 50 EMA from below.

- Parabolic SAR is below the price on the hourly chart.

- Parabolic SAR is below the price on the 15-minute chart.

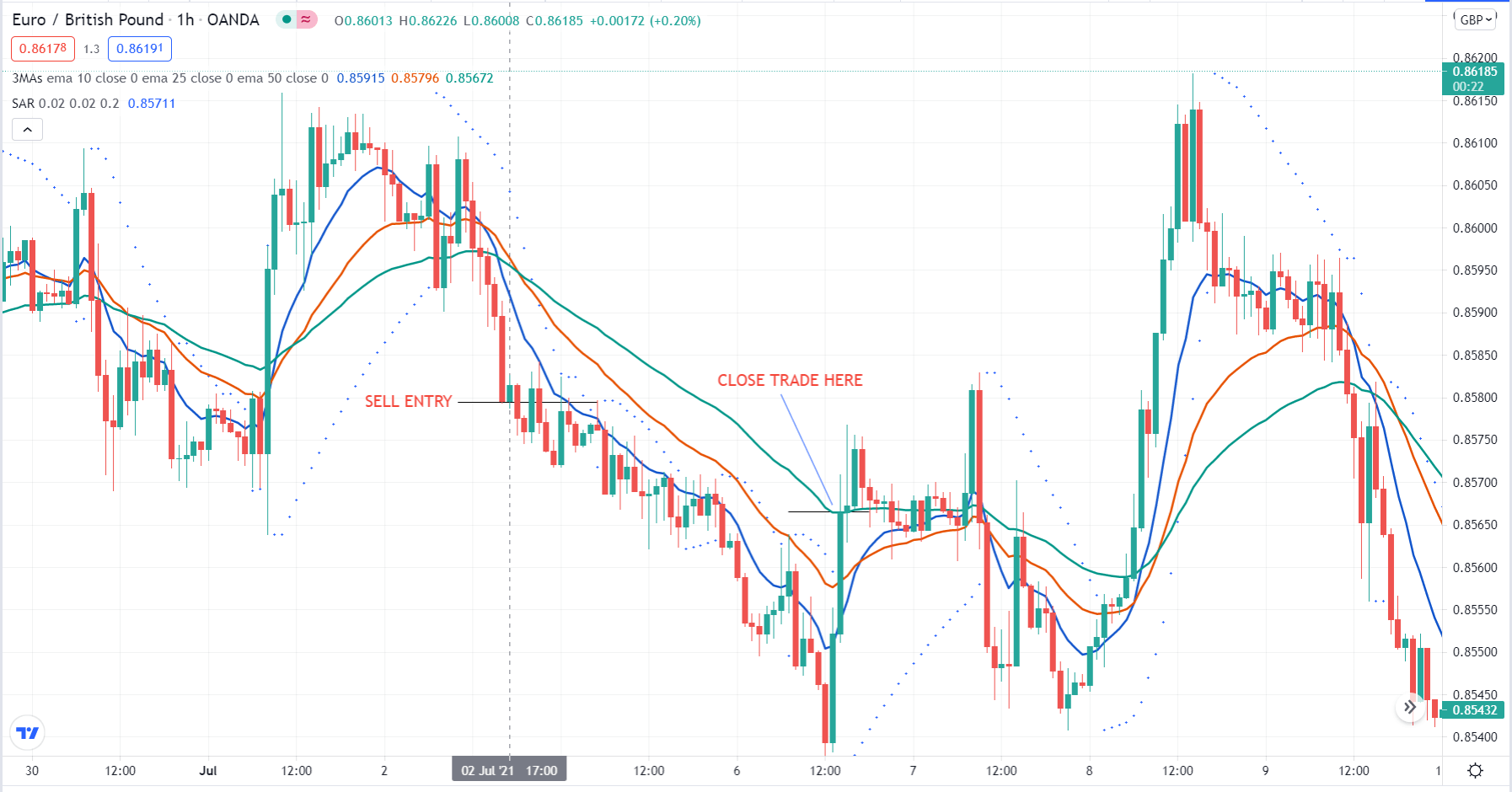

Sell trade

Make sure that you open a sell trade only when the following condition exists:

- On the hourly chart, 10 EMA crosses below the 25 EMA and 50 EMA from above.

- Parabolic SAR is above the price on the hourly chart.

- Parabolic SAR is above the price on the 15-minute chart.

When to exit the trade

Since this system is trend trading in nature, you will exit the trade when the trend has reversed. To avoid prematurely exiting the trade during pullbacks, you should wait until a specific condition arises. Close the trade when the price has violated all three moving averages. You do not need to consider the parabolic SAR for trade exit.

It would help if you closed the trade when the price touches the 50 EMA from above for a buy trade. For a sell trade, you should complete the trade when the price touches the 50 EMA from below. There is no need to wait for the price to close beyond the 50 EMA. Please take note that we are talking about the hourly chart here.

Where to set the stop loss

You can put your stop loss at the 50 EMA level at the time of the trade entry. You can add the spread to the stop loss price if you prefer. As your trade gets profitable, you can use a trailing stop after bringing the trade to breakeven. You are determining the ideal time to break even and need practice. You can do this later but not sooner.

On the other hand, you can use a trailing stop technique of your choice. Your options include the following:

- An arbitrary number of pips

- An arbitrary number of candles

- 50 EMA line

- An average true range (ATR) of the traded symbol times a factor

- Swing highs or swing lows

Final thoughts

As you can see, the FX profit system utilizes a simple trade setup. You can execute this strategy immediately in your trading. If you have doubts about the effectiveness of this system, try it first on a demo account. After you have been profitable in the demo, that is the time to trade for real.

Comments