Are you trading the news? If not, you are missing out on an opportunity to make quick profits. News announcements generate huge volatility, driving prices up or down in significant ways. If you have placed the right trades beforehand, you could have closed those trades in profit very quickly.

Making the wrong calls can hurt you, though, or worse, liquidate your account if your risk exposure is not regular. Because of this risk, traders shy away from news trading completely. They exit any open trades well ahead of the news announcement, move their positions to breakeven if possible, or hedge positions.

If you do not belong to the above camp and are brave enough to give news trading a try, read on to learn how. As always, know the risk before you put real money on the line.

Risks of news trading

Stop-loss hunting is a common stratagem bad brokers use to defeat traders. You can often hear this unethical practice being conducted by brokerage firms known as market makers. These types of brokers may trade against you by taking the opposite side of the trades. During news events, these brokers may widen the spread far enough to hit the stop losses of big trades.

You will find it hard to enter and close positions during news events. This is due to the quick variation of slippage at these times. That is why it is better to place orders before the news than during the news. If you carry a prominent position and want to secure your trade, hedge your deal a few minutes before news time.

Losing your grubstake is a possibility in currency trading, especially if you do not practice sound money management. The risk for account wipeout increased several times during the news announcement.

This is more so if you do not put a protective stop to your open trades. That is why having a good grasp of proper lot sizing is crucial for traders. This knowledge alone can make or break you as a trader.

Critical news releases to consider

Economic factors drive the financial markets. Even if you prefer technical analysis over fundamental analysis, you have to be aware of this fact. The three strategies presented in this article do not attempt to trade fundamentals.

Instead, they are technical strategies you can apply to take advantage of volatility during news releases. What is important are the following things:

- Which news events affect which currencies

- The impact of the news event (i.e., high, medium, or low)

- The scheduled release of the news event

When you look at the economic calendar, you will see various types of news announcements. Not all of them are going to make an impact in the market. Therefore, you should focus on those that are market movers. The following list contains the news that matters.

Gross domestic product

Gross domestic product (GDP) is a good measurement of how an economy performs overall. It provides a figure of the total services and goods a country has produced within a specific period.

Employment condition

The employment condition is another yardstick for determining the health status of an economy. If there are more jobs at a certain point in time than previously, then it means the employment situation is good, and the economy is getting better.

The most critical news event about employment conditions is the non-farm payroll, a report released on the first Friday of the month.

Consumer Price Index

The Consumer Price Index (CPI) measures inflation. While moderate inflation is good, high inflation is generally bad for the economy. The government controls inflation to maintain certain levels just enough to stimulate economic activity and keep the retail prices of basic commodities affordable.

Retail sales

Retail sales measure consumer spending. It represents the number of products sold by retailers.

Trade balance

The trade balance is another critical metric of economic health. This metric talks about the difference between export and import of a particular country.

Other high-impact events

- Central bank interest-rate decisions

- Minutes of the Federal Open Market Committee (FOMC) meetings

- Speech of the head of central banks

Top 3 news trading strategies

Here are three common strategies used by news traders to capitalize on the volatile nature of markets during news time. They do not try to predict which direction price will go next in the wake of a news event. They are tactics to enter trades during news-times.

№ 1. Straddle strategy

You can use the straddle strategy to trade the news even without knowledge of fundamentals. Wherever the market will go after a news announcement does not concern you. You want to capitalize on the volatility that comes during news events.

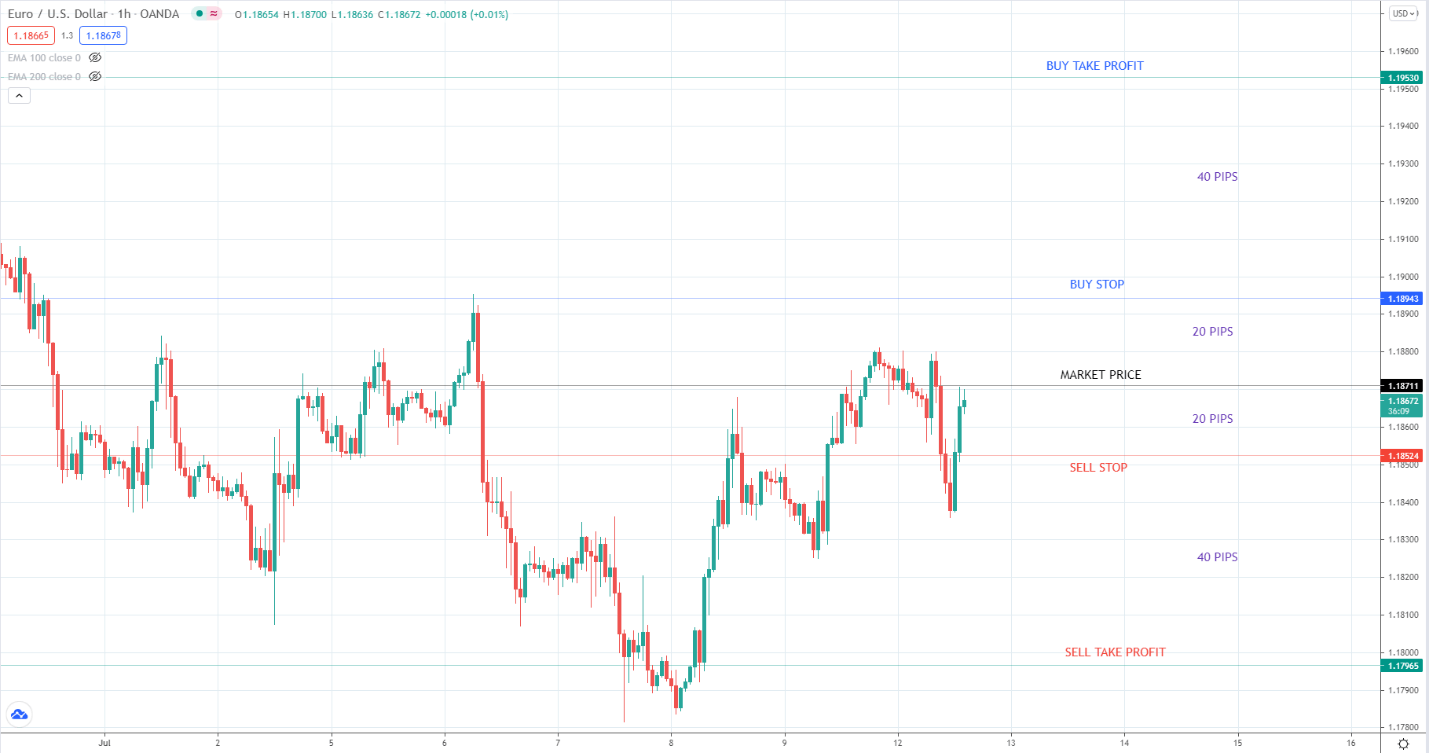

To execute this tactic, place two pending orders above and below the current price. Typically, you execute such orders a few minutes before the news. Since the market tends to fluctuate bigger than usual, the best way to implement this strategy is to use an expert advisor even before the news release.

With an expert advisor, you can place buy stop, say, 20 pips above market price, and sell stop 20 pips below market price. If the price fluctuates a little before the news, your orders may adjust by oscillating up and down. When the price explodes after the news release, the robot will not keep up with the sudden jump in volatility. The result is that either one of the two pending orders becomes a market order.

Another advantage of using a robot to manage your orders is that it can close the other order if one of them becomes a trade. Therefore, you will trade only one side of the market. In addition, the robot can trail the stop of the winning trade. You could make a profit quickly using this strategy. The hourly EUR/USD chart above shows an example mapping of a straddle trade.

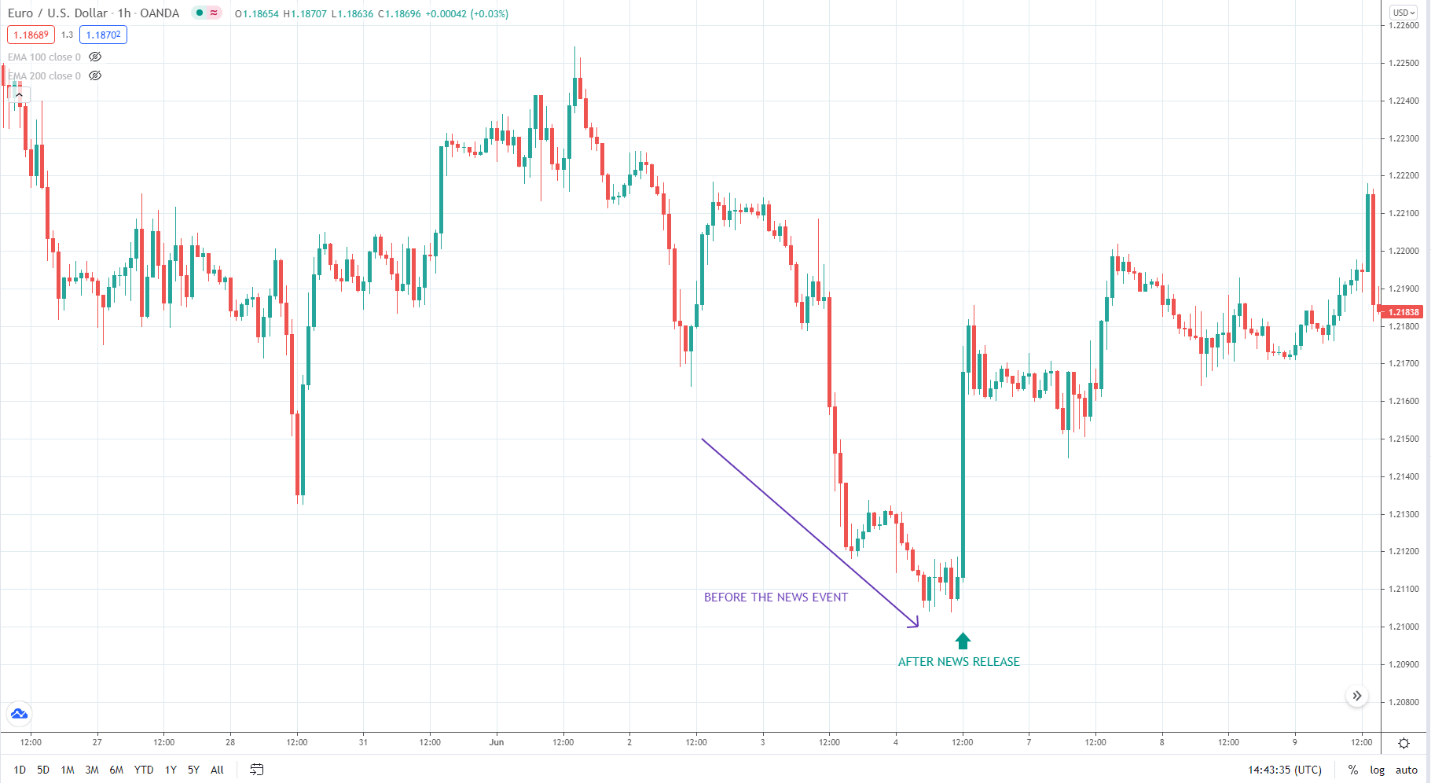

There is a theory that says market factors speculation into the price even before the news release. If people expect negative figures for upcoming news, they will sell the market before the event. You might wonder why even if the news brings wrong figures, prices can still go up.

If you have not figured it out, the market already incorporated the news into the price. That is why prices could go lower and lower before the news event and then take off the other direction at the news release. This is one of the things that can happen if you trade the news, so be aware of it. Something like the above scenario can occur before and after a news announcement.

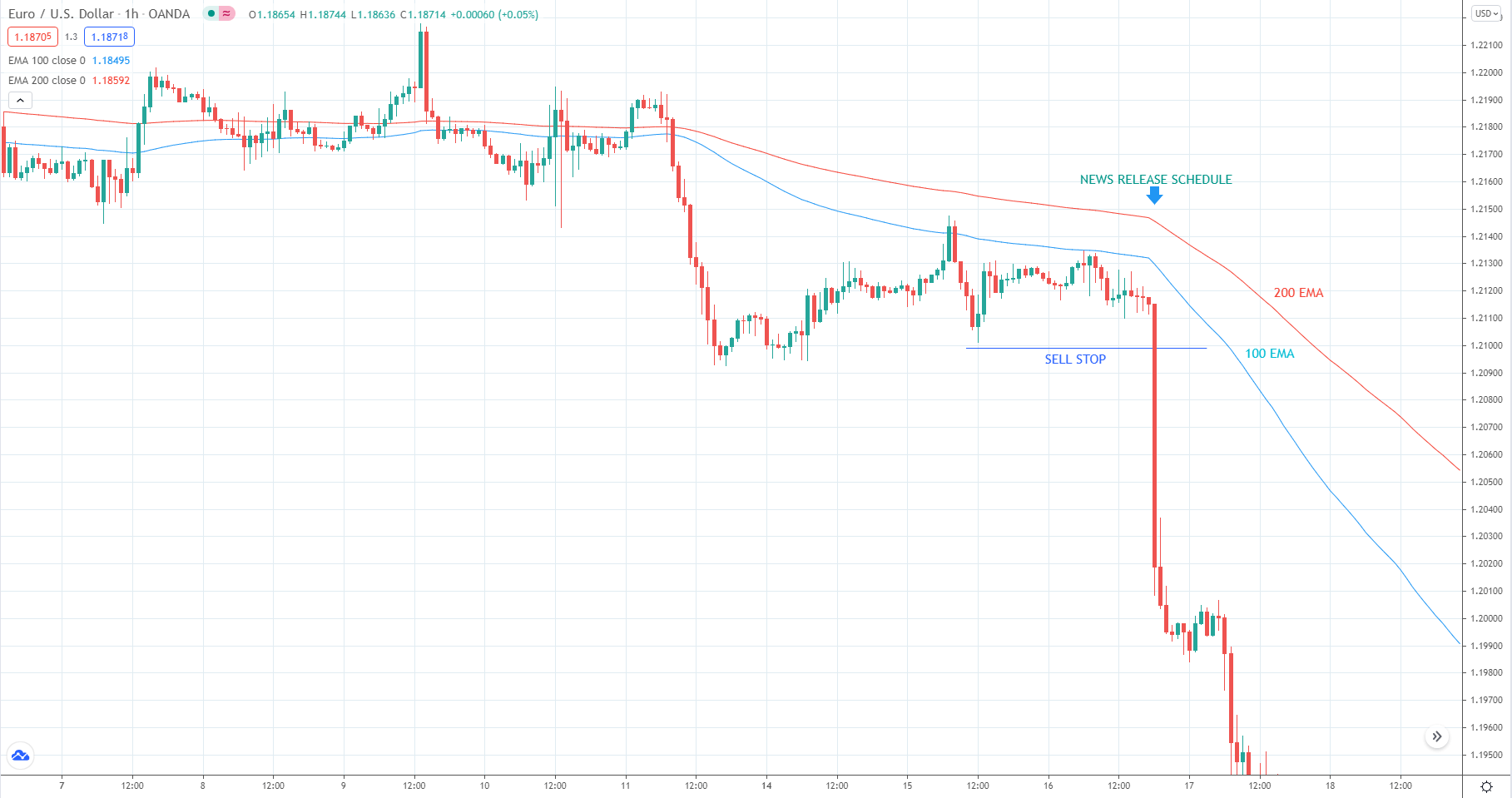

№ 3. Trend trading

Not only is trying to figure out which direction price would go during news events a difficult task, but it will unnecessarily waste your mental resources and gain nothing in the end. Sure, some analyses work, but they do not work all the time.

One idea you can adopt is to trade with the overall trend. If you have traded long enough, you must have come to realize that price respects the trend. More often than not, the price goes in the direction of the prevailing trend during news events.

Final thoughts

News trading is a challenging route to take. It is not suitable for all traders. However, if you have gained enough experience and have developed a working method to trade the news, then you are free to engage. When you do this, assume the mindset of a trader rather than that of a gambler. Always protect your capital. If you cannot find a way to put this in place, you better not trade the news.

Comments