The forex market is the largest, rapidly developing, highly liquid financial market. Forex is not traded in commodities but currencies. One currency is always bought and sold in exchange for another.

This article will learn all the necessary basics to set the suitable vector for your development as a trader.

Forex history

The forex market is the youngest among the markets. It is much younger than the stock and even more so the commodity market. In 2000, the forex market turned 29 years old, since it emerged in 1971. Then the President of the United States decided to abandon the gold standard. All this pushed to the final collapse of the Bretton Woods system and led to the possibility of free change in exchange rates.

As a result of these changes, a new type of activity was born — foreign exchange trading, which began to be carried out on the international foreign exchange market.

It is now the most significant international market, and in 2021 it celebrates the 50th anniversary. Trading volumes on it range from one to $3 trillion per day. Сompare that to the stock market, for example, with a $300 billion trading volume per day.

Forex market terminology

Novice traders taking their first steps in this market should pay attention to the basic terms. You can find them on the website in the glossary or the training section.

Of course, the list of terms covers many areas: principles of trading, financial instruments, methods of technical analysis, etc. But let’s focus on the most important ones.

- Currency pairs

In the forex market, traded currencies are paired: the one that is bought in the pair is called the base currency, and the second is the quote currency.

- Exchange rate

The exchange rate is the value of one currency expressed in a certain number of units of another.

- Overnight lending/loan rate

If a trader left a position open, then at the end of the trading session, the broker transfers it to the next trading day, charging a fee for this, commonly called a swap.

- Spread

The difference between the currency purchase rate — ask and its selling rate — bid. It can be fixed or floating.

- Pip

Pip is the minimum value of the price change in forex.

- Pledge

The amount of funds is the collateral or margin required to open a position and secure it. The funds available to open additional positions are called free margin.

- Leverage

The ratio between the margin required to open a position and the volume of the transaction.

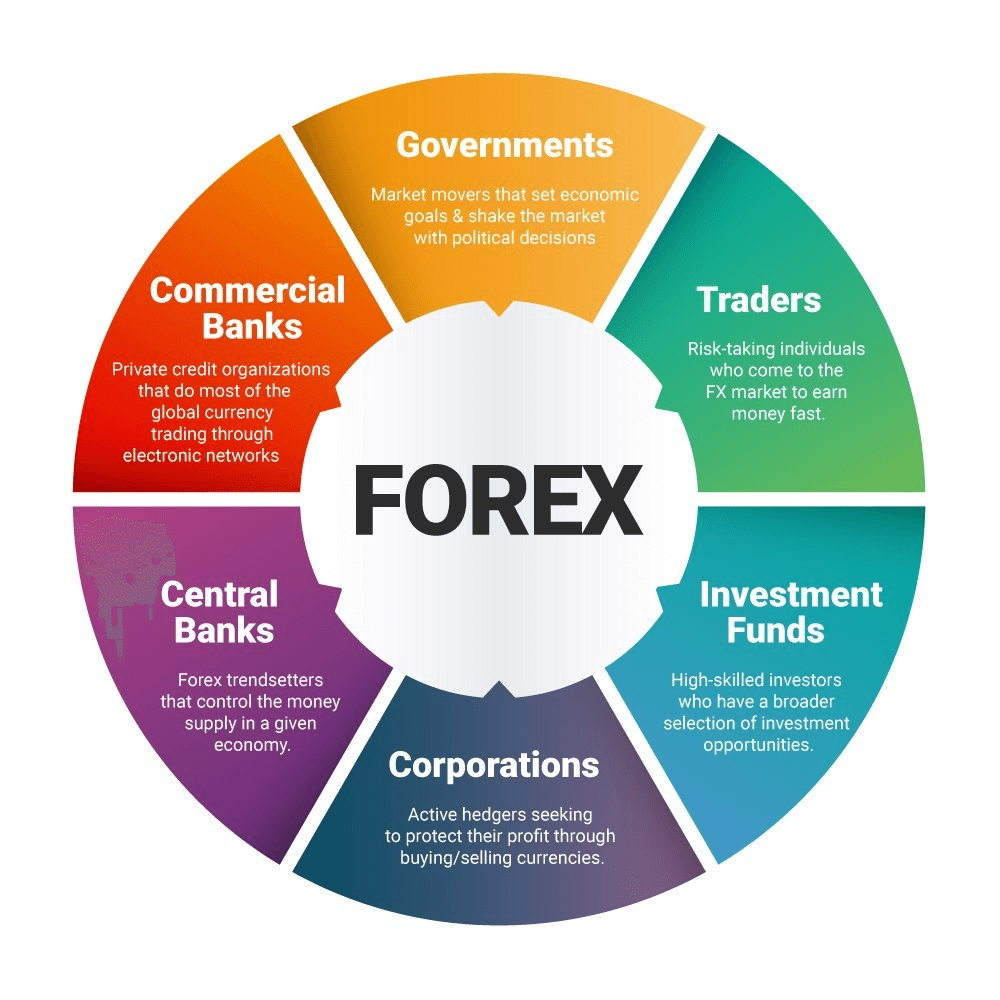

Forex market participants

Who works in this market? Those who need to make currency transactions.

- Commercial banks

The main group of participants in the international forex market is commercial banks. They carry out the bulk of foreign exchange transactions at their own expense and on behalf of clients. Other participants in the forex keep their accounts in commercial banks and send them orders to buy and sell one currency for another. This is called conversion operations. And also credited and vice versa keep their deposits in banks. This is called deposit and credit operations.

- Investment funds and companies making foreign investments

International investment funds, as well as large commercial corporations operating overseas, manage their own portfolio of securities. For example, government bonds and bonds of private companies. They also keep large deposits in commercial banks in order to extract profit from investments.

- Central banks

The functions of central banks include maintaining the smoothness of fluctuations in the exchange rate of the national currency, managing reserves, reaching inflation goals, regulating rates, and maintaining the liquidity of the countries’ financial system.

- Currency exchanges

Currencies are also traded on domestic national exchanges. In addition, a significant part of standardized derivatives for currencies is traded on exchanges.

- Brokerage companies

Brokerage companies are engaged in bringing together the buyer and seller of currency in the event that there are no stable counterparty agreements between them.

- Retail traders and individuals

Individuals carry out a wide range of conversion and arbitrage operations, demand foreign currency for tourism purposes, purchase goods abroad, convert wages, and conduct speculative transactions.

How traders make money on forex?

Suppose we expect the euro’s value to rise and the value of the US dollar to fall in the forex market. Then we will buy the euro for the dollars. In other words, buy the EUR/USD pair.

Suppose we bought 1000 euros at the rate of 1.1000 for 1100 dollars. A week later we sell these 1000 euros at the rate of 1.2500 for 1250 dollars. Due to the increase in the euro’s value against the dollar, we will receive a profit of 1250 – 1100 = 150 dollars.

If we expect a rise in the value of the dollar and a fall in the euro’s value, we will buy the dollars for the euro. In other words, sell the EUR/USD pair.

How are transactions made?

A three-letter code expresses any currency in forex. For example, the British pound/US dollar pair looks like this: GBP/USD. The currency on the left is called the base currency. In this case, it is GBP. And the one on the right is called the quote currency. In this case, USD.

Since any asset can be sold or bought, there are two prices:

- Bid — the offer price. According to it, the seller is ready to sell the base currency — in this case, GBP, and purchase the quote currency — USD.

- Ask — the asking price. According to it, the buyer is ready to buy the base currency — GBP, and sell the quoted one — USD.

The spread is the difference between the bid and ask. This is the earnings of the brokerage company, the commission, without which trading is impossible.

What strategy to trade?

When starting to trade manually, a forex trader is faced with the question, “What strategy to trade?”. Choosing the right strategy is not easy. There is no single and straightforward answer to this question. But how to choose a forex trading strategy that is right for you?

Forex trading strategies

To find the most suitable trading strategy, you need to consider all aspects of your trading: preferred instruments, your own model of behavior in the market, psychological factors, etc. A systematic approach will help you choose precisely the trading strategy that will work for you and increase your efficiency on forex.

The most profitable Forex strategy should consider both technical and fundamental factors, that is, be combined.

Forex strategies based on fundamental analysis

The fundamental analysis is assessed based on financial information analysis: news, statistics, geopolitical factors, etc.

Working forex strategies are built on:

- Publication of statistical data on the state of the economy of a country or a particular industry. The leading fundamental indicators include the Central Bank’s discount rate, GDP, inflation, etc.

- Analysis of financial statements of individual companies, their management, and development plans.

- Assessment of the geopolitical situation and determination of the leading world trends.

Forex strategies based on technical analysis

Technical analysis is a set of methods for assessing and forecasting the market, based on the assumption that the market is cyclical and everything repeats itself. Analysis of price behavior in past periods allows us to make assumptions about price movements in future periods.

Forex trading strategies are based on the following types of technical analysis:

- Indicator analysis

The strategy can be based on one or several indicators. Then there are two types of strategy: using one indicator with different periods. Or using several different types of tools. For example, a combination of trend indicators and oscillators.

- Trading by levels

Support and resistance levels, Fibonacci levels, etc. These forex trading strategies are built on the psychology of the majority.

- Analyzing charts and candlestick patterns.

Final thoughts

The forex trading world comes with several critical concepts that you should know before investing. As a forex trader, consider reading, studying, and enhancing your knowledge to become a professional forex trader who can generate huge profits quickly.

Forex trading is a complex beast, but you can overgrow as a trader if you equip yourself with the required education and proper tools. Try your best to understand the concepts we have covered so that you can easily predict what’s happening whenever a forex pair rises or falls on the chart.

Comments