There are tons of trading patterns. However, if you search each pattern, you’ll be misled by how much info is out there. But that’s not what we do. Instead, we cut through the noise to present you with complex topics with an easy explanation.

One of these topics is range trading. If you have not heard of it, then this guide is for you.

What is range trading?

Range means when a price is moving in a specific boundary. As we know, the price can move in two directions:

- Up

- Down

When the price fluctuates between these two directions, it is in the range.

Many traders employ range trading when they want to know about market volatility. If the price is fluctuating with a wider range, then there is high volatility during this period.

Just like any other volatility indicator, range trading can help you measure your risks per trade. If the price has a wider range, it is riskier for you to enter because you have no idea where the market will go.

The good thing about range trading is you can use it to identify support and resistance levels. If the market is trending within a certain range for a long time:

- The upper limit is resistance

- The lower limit is the support

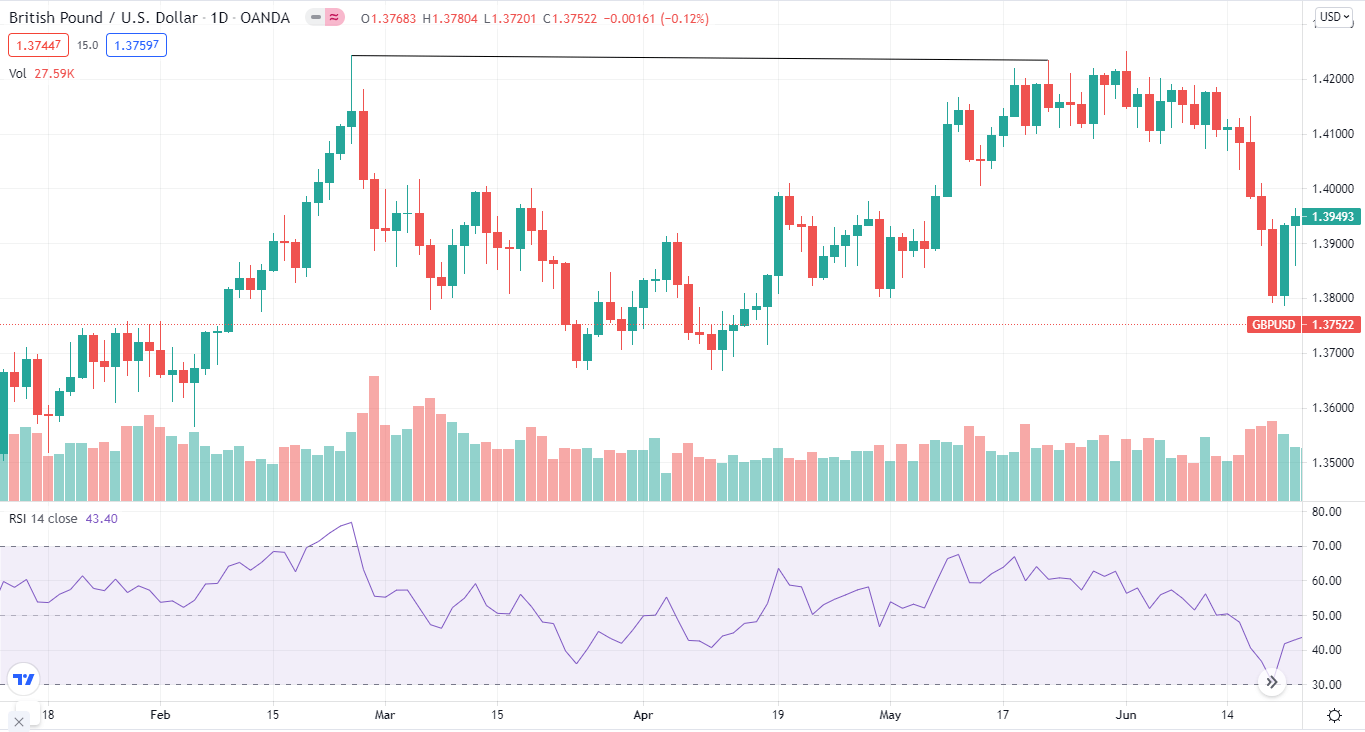

You know we love charts, so let’s give you an idea of range trading on the chart.

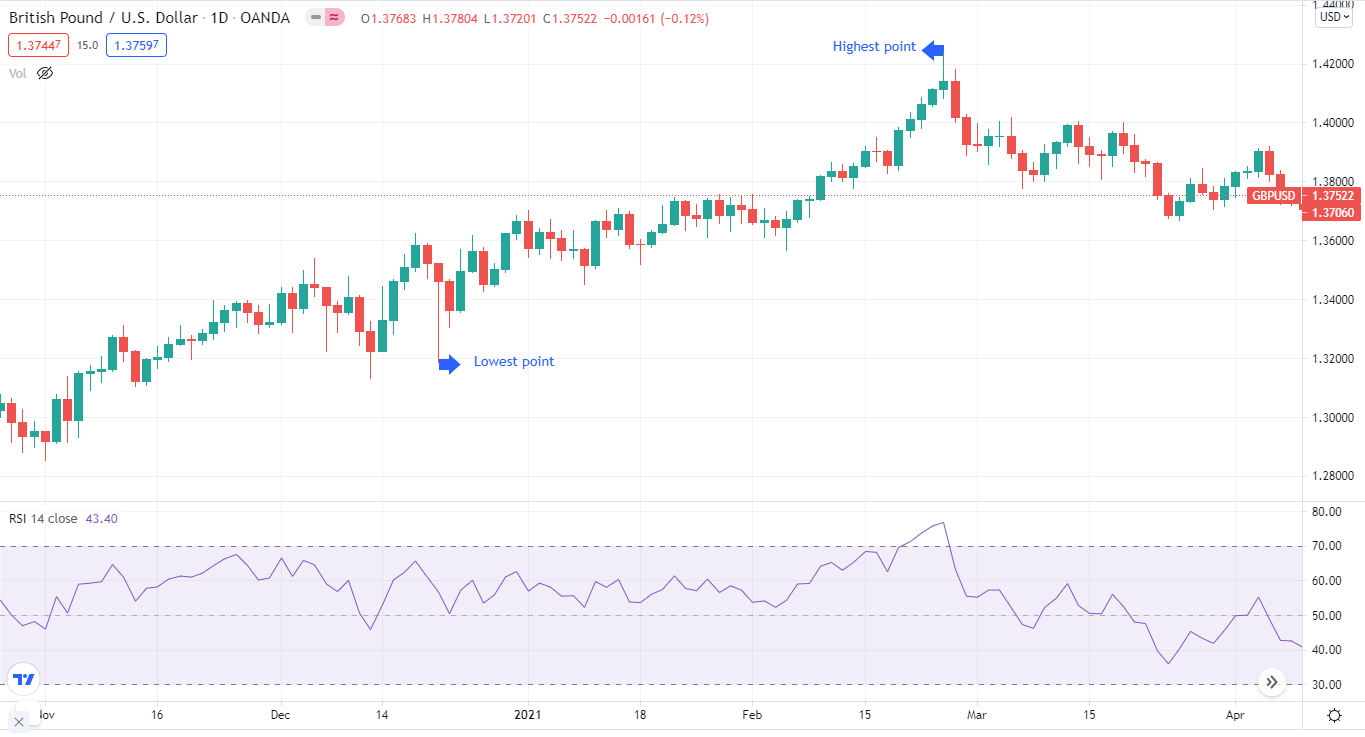

The question that arises here is how you can calculate range? Like if you want to adopt as your next trading approach, how can you calculate price ranges? There is a simple formula for that.

Range = highest price of the period – lowest price of the period

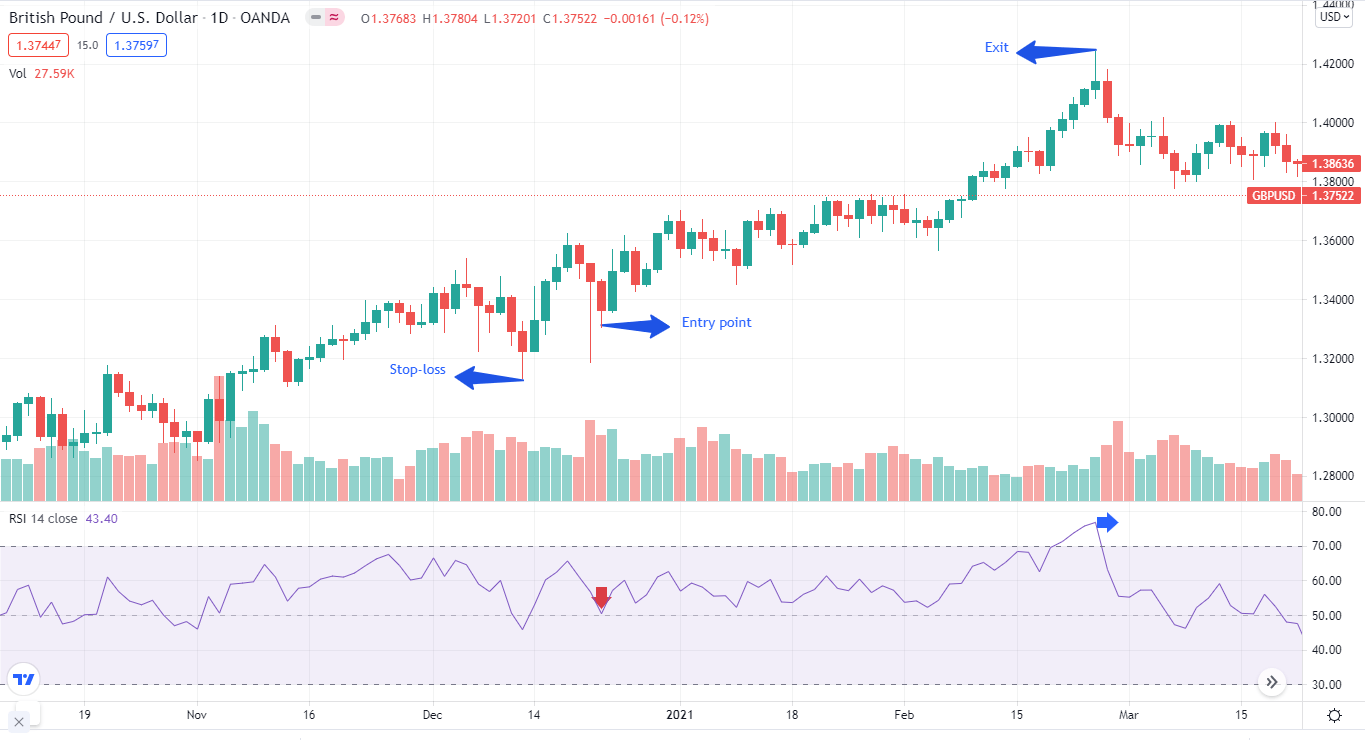

On the GBP/USD chart below, the highest point is at 1.42630, and the lowest point is at 1.31903, so the range between that period is: 1.4263 – 1.3190 = 0.1073

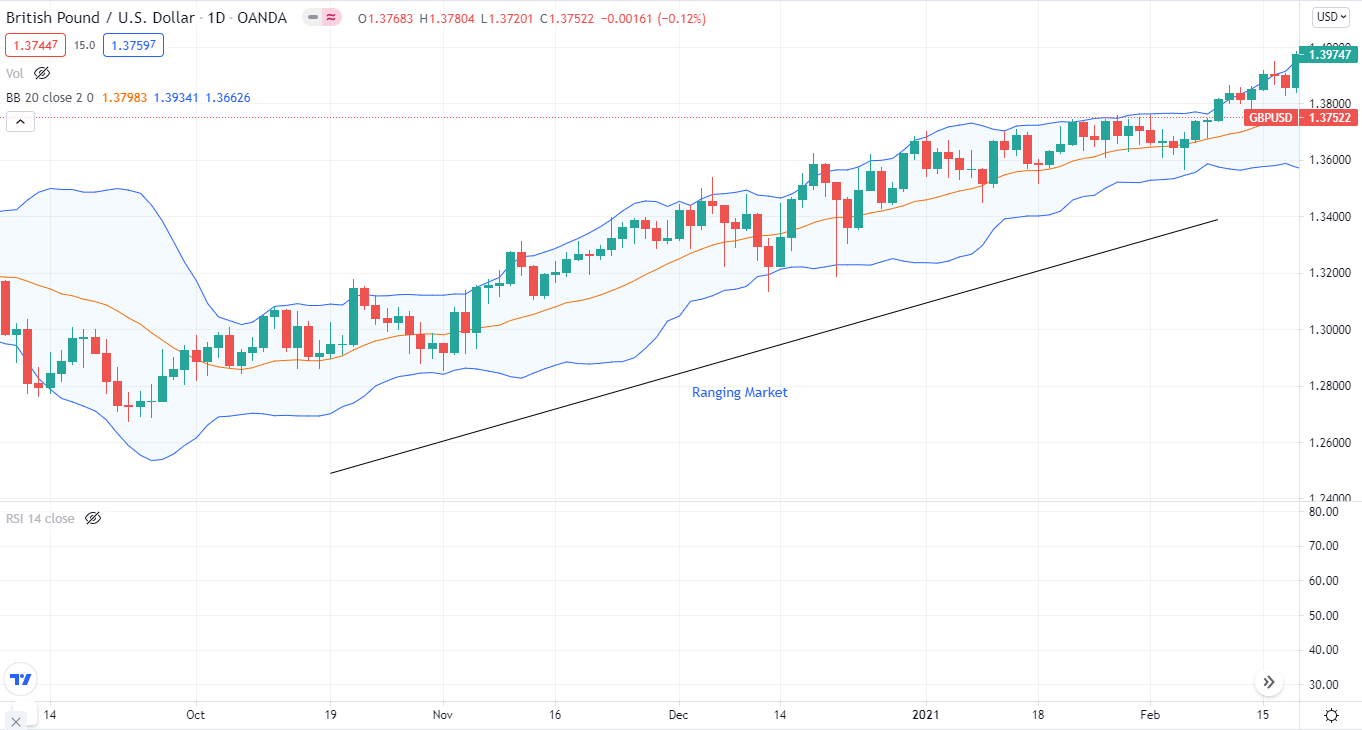

The market does not take orders from us. It moves wherever it likes — in trending or ranging periods. So when the market moves up and down, it creates a lot of false signals. You can use oscillators like moving averages or Bollinger Bands (BB) with range trading to avoid false bounces. For instance, the BB with a flat slope suggests a ranging market.

Many market participants do range trading, but they lack a certain trading edge, as we call it, to build an ideal range trading strategy.

Step 1. Pinpoint the range

The first step is to find the range on the chart. You can pinpoint a ranging market with the help of BB and oscillators.

The theory behind the ranging market is if a currency pair recovers from the support level two times or more, and if a pair recovers from the resistance level twice or more, the market is ranging. The price does not have to be similar, but it should form a certain pattern.

Many traders refrain from entering after the price creates two lows and highs. However, it depends on your personal preference.

- If you are an aggressive trader, you can enter after the two highs and lows.

- If you are a conservative trader, you can wait for the price action to continue making its moves.

After these highs and lows, you can draw a line to mark a ranging market.

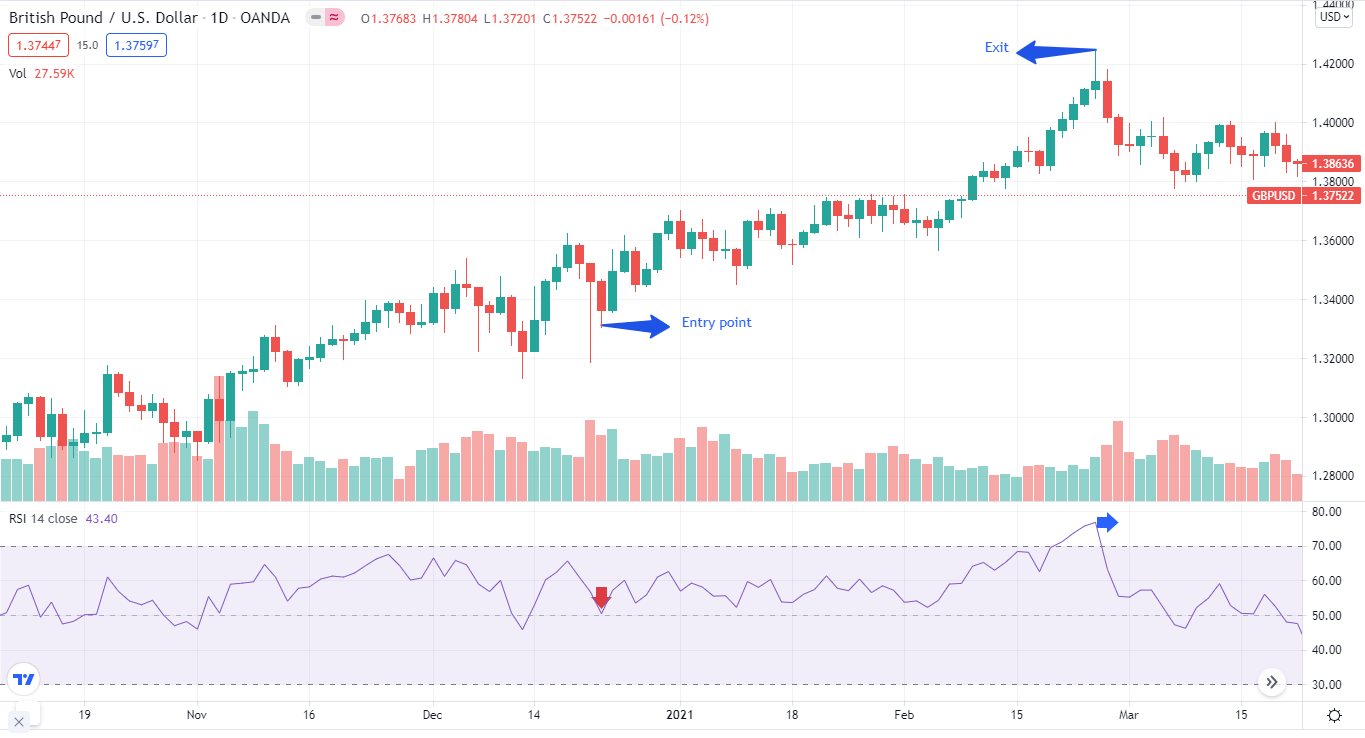

Step 2. Setting up an entry point

After identifying a ranging market, the next step is to set up your entry point. The simple method is to buy near the support level and sell near the resistance level.

You can use indicators like the RSI or BB to find exact entry and exit points.

- When the RSI is at the oversold level, it gives us an entry point.

- When the RSI reaches the overbought level and the price reverses after that, the price starts to reverse, thus giving us an exit point.

Step 3. Use risk management

After identifying the range and setting up your entry and exit points, the last step is to define your risks. Without proper risk management, no FX strategy is effective, let alone range trading.

If the price breaches the support and resistance level, you don’t want to stay in the trade, right? That’s why placing a stop-loss is the ultimate solution.

In the previous chart, we mentioned entry and exit points. In the chart below, you can see we added the stop-loss.

- When going long, you set a stop-loss at the recent low.

- If you are short, you place a stop-loss on the recent high.

Factors that can affect your range trading strategy

Like any other FX strategy, range trading carries certain risks. When you are finding the range, the timing has to be perfect. This means that you have to know how much time the currency pair will move in that range.

In addition, what if the market doesn’t move in your favor? Then with range trading, you’ll be at the losing end.

Final thoughts

Range trading isn’t complex like other FX trading strategies. So when the market isn’t volatile, you can apply range trading comfortably. Just remember the steps we pointed out earlier, and you are good to go as a range trader.

Comments