According to the exchange trading analysis, only up to 3-5% of traders receive regular income from this activity. It is impossible to profit in the forex market without a developed strategy, systematization of work, and compliance with established rules.

Therefore, newcomers who are in a hurry to make money on the currency exchange have no trading experience, not yet understanding the charts, quickly losing their deposit, and leaving this business. Let’s take a look at the top five forex trading strategies to become a better trader.

Forex scalping strategy

Many people consider the forex scalping strategy to be very profitable. It allows the trader to work tens and hundreds of trades per day, keeping the position open for just 10 seconds to 5 minutes.

Why is scalping so popular?

It is considered to be the safest method of trading. The minimal movements of the market will allow you to extract profit at the expense of many short-term transactions during the day. Scalping heavily relies on momentum indicators and the moving average (further — MA) to increase the accuracy of entries and exits by identifying a trend and its strength.

Where are the entry and exit points?

Identifying the trend is the first step. Many scalpers use indicators such as MA to check the trend. Using these key trend levels over more extended time frames allows the trader to see the whole picture. These levels will create support and resistance bands. You can try to scalp within that band on smaller time frames using oscillators such as RSI. Stops are placed several pips apart to avoid significant moves against the trade. The MACD indicator is another useful tool that a trader can use to enter/exit trades.

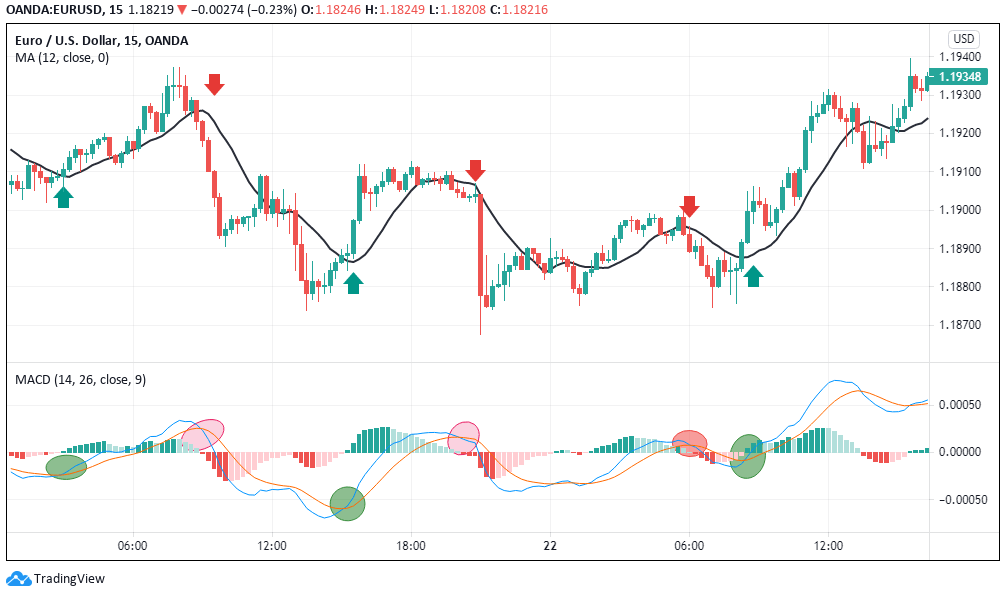

Chart 1

Typically, scalpers use SMA to determine the current trend of the price. As shown in Chart 1, you can use a combination of a 12-period SMA and the MACD indicator on a 15-min time frame. Wait for the price to go above the 12-period SMA, and sell when it goes below the 12-period SMA. In either scenario, points of entry can be affirmed using momentum indicators.

Advantages

- The highest number of entries and exits

- Higher earnings in times of high volatility

Disadvantages

- It takes longer to accumulate significant profits

- Most scalpers use higher leverage which poses a risk of wiping out the account balance, especially if stop-loss levels are not set

Price action trading

Here, the optimal entry and exit points are based on support and resistance levels from the most recent price fluctuation. Technical indicators are not necessarily required here. More important to consider the impact of economic news releases and geopolitics events in the forex market. All you have to know is that a particular event will significantly move the market. You don’t necessarily need to see the direction.

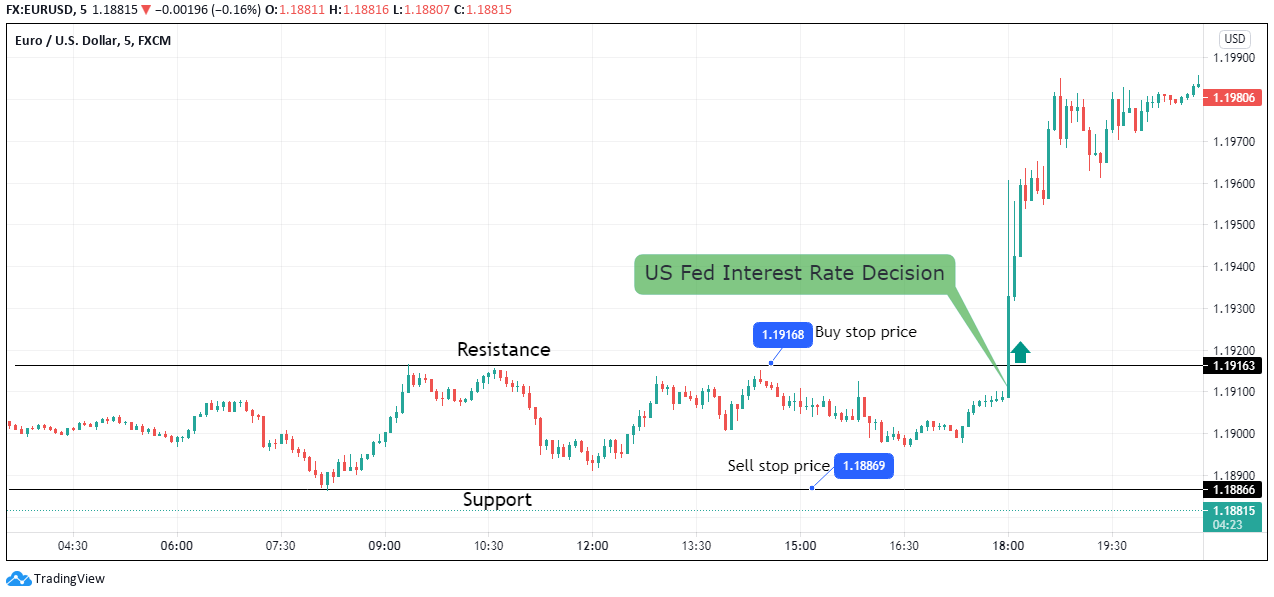

Let’s take the US Fed Interest Rate Decision. In this example, the most recent scheduled release was on March 17, 2021, at 1800 GMT. Using price action, you can establish the support and resistance of EUR/USD for the past few hours, which can be used to set stop orders. The buy stop price is set at the resistance level, and the sell stop price is at the support level.

After the news release, if the pair adopts an uptrend, the buy stop order will be triggered, as shown on the second chart. If it embraces a bearish trend, the sell stop order is triggered.

Chart 2

Advantages

- Support and resistance are easily identified

- No in-depth knowledge of economic or geopolitical analysis is necessary

Disadvantages

- Market volatility may be unpredictable upon the news release

- Forex pending orders are not guaranteed to be executed

Day trading strategy

Day trading is one of the slowest Forex strategies. The deals may not be closed not only for several days but also for months. There are not many liquid trading instruments on Forex, and an exchange trading participant usually opens positions on contracts for differences or currencies.

This strategy is considered less profitable (although comparative analysis refutes this) than intraday trading or a scalping strategy. If this strategy provides a rigid installation of stop loss and takes profit, one ten-minute session is enough.

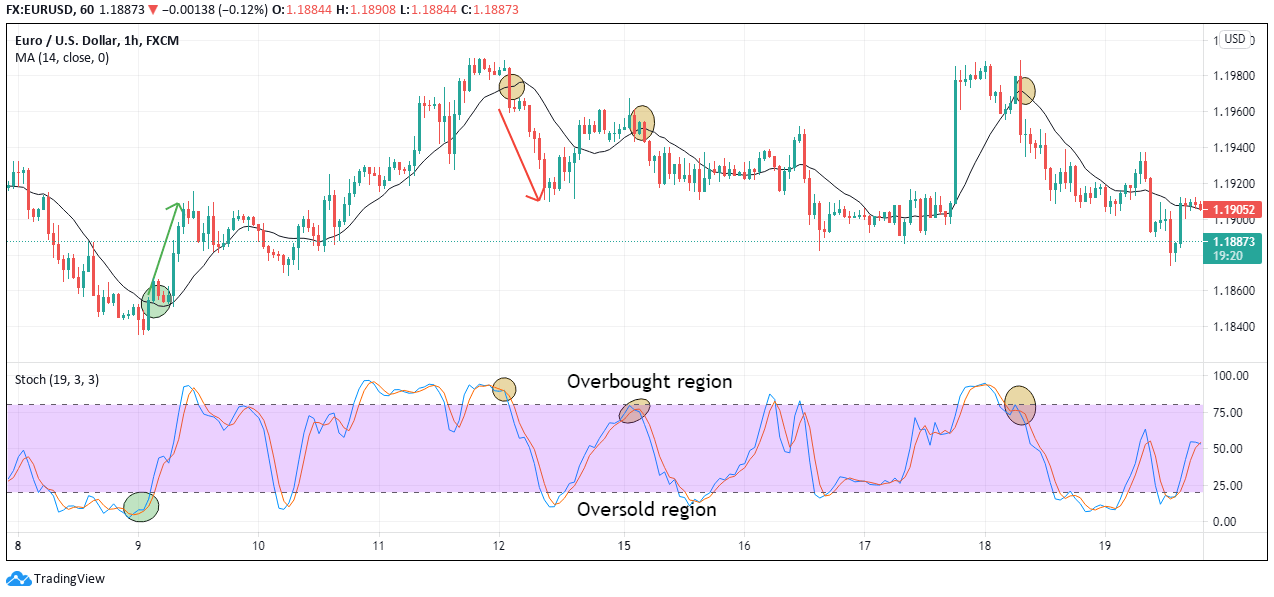

Day traders heavily rely on indicators applied on a medium-term timeframe ranging from hourly to daily charts. Momentum indicators are ideal to set the optimal entry and exit points while the MA confirms the direction.

Chart 3

Advantages

- Higher reward compared to scalping

- It isn’t time-intensive since a single analysis is done for a trade that could last the whole day

- It doesn’t take a lot of psychological toll on a trader

Disadvantages

- It gives fewer entry points

- Longer trading periods

- Susceptible to unplanned volatility from news releases and geopolitical developments

Range trading strategy

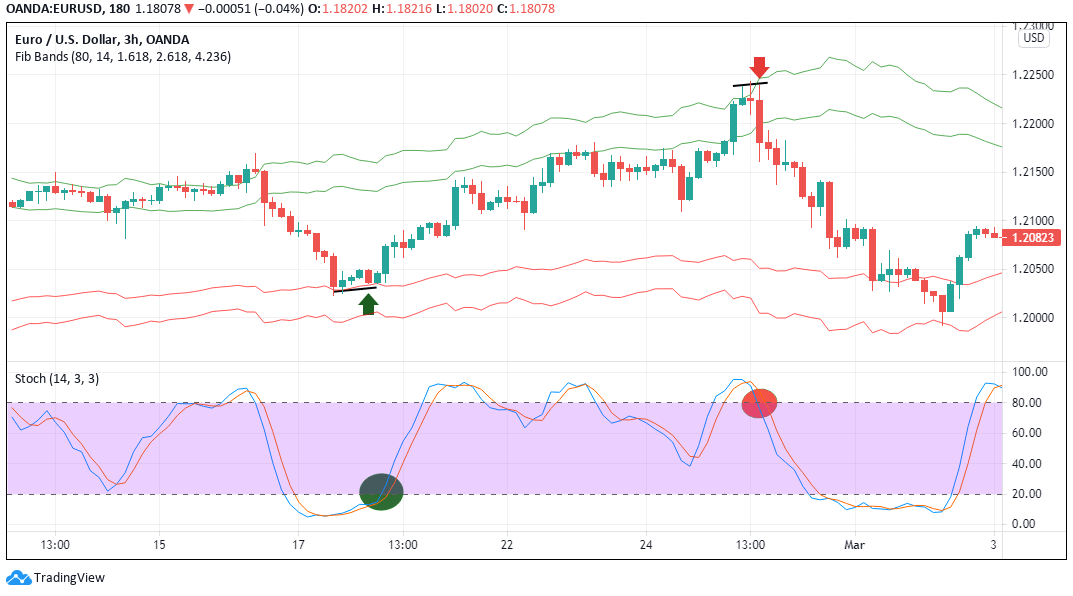

With this strategy, entries and exits are based on support and resistance drawn from technical analysis indicators. As seen in chart 4, Fibonacci bands establish the price range. The upper bands form the resistance level, while the support level is the lower bands.

There are basic steps involved in setting up the range trading strategy:

- First, set the price range. The resistance level is identified when, after a sustained uptrend, the price reaches the upper bands and unsuccessfully attempts to breach it at least twice. The support level is formed when an asset unsuccessfully attempts to breach the lower bands twice after a sustained bearish trend.

- Second, establish the entry point. The ideal entry point for short selling is when the price drops from the resistance level and goes long when the price rises from the support level. The entry points are confirmed using momentum indicators like the stochastic oscillator, RSI, or CCI.

In chart 4, the sell signal is confirmed when the oscillator leaves the overbought region. In contrast, the buy signal is confirmed when the oscillator goes to the oversold area, placing a stop loss above the short trade resistance and below the buy order’s support.

Chart 4

Advantages

- Positions can be closed any time targets are hit

- It can be used to place market orders and pending orders

Disadvantages

- Time-consuming investment

- Good knowledge of technical analysis is needed

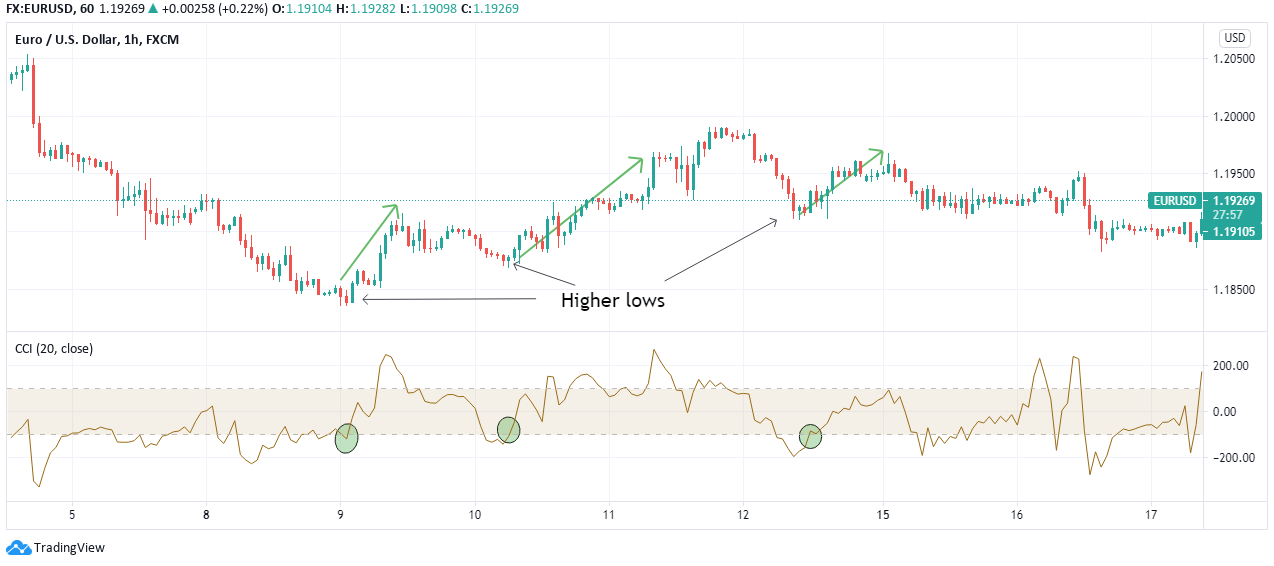

Trend trading strategy

This strategy involves opening a position at the start of a trend and exiting when the trend weakens. An uptrend is defined if an asset has higher highs and higher lows, while a downtrend is identified when the support forms lower lows and lower highs. The CCI can be used to determine when to enter and exit. In an uptrend, entry opportunities arise when the CCI emerges from the lower bound. Downtrend entry positions appear when the CCI drops from its upper bound, and the price forms lower lows and lower highs.

Chart 5

Advantages

- Trends are relatively easier to identify

- It has the potential to generate high returns

Disadvantages

- Advanced technical analysis skills to identify optimal entries and exits accurately

- A single trade might last for days

Conclusion

Profitability in forex trading almost always depends on having a good trading strategy. Before using any trading strategy, you should try on a demo account to determine which ones work best for you.

If you want to trade short-term, then forex scalping, day trading, and trend trading strategies work well. However, if you have a longer-term view, then range and price action trading strategies would be best. Note always to set the take profit, stop loss, and trailing stops, as they are the most straightforward risk management techniques.

Comments