Scalping is a process to earn money from the financial market without waiting hours. You have to sit in front of your trading chart in an active trading session, and you can make your daily targeted profit in a minute.

But wait a minute and don’t get excited by believing FX trading is a quick money scheme. It is a marketplace where making is tough, even if the time frame is low. All you require is a system and following it with patience.

What kind of scalping system should you know? How and when should you execute trades? Stay with us to see every inch of scalping in FX trading.

What is scalping trading?

It is a trading strategy where traders make money from short-term market fluctuations. In general, any profit from 1 pip to 50 pips can be considered scalping, but there are no specific rules.

Many online mentors or courses will say that scalping does not need to know what is happening in the broader market. You have to follow some rules and once they appear in the chart, open the trader; otherwise, ignore. However, this system is not correct. You should understand the broader market view to move the price from a bird’s-eye perspective to a street view.

The trading system for a range market will not work in a strong trending market. But the good news is that we can earn money from scalping, both the trending and ranging markets. In scalping, the core part is to identify the market phase.

Which opportunities do FX signals create in scalping?

When we talk about scalping, understanding the market structure or context is the key. We all know that the trending market makes aggressive higher highs or lower lows, and the ranging market shows highs or lows barely from the recent swing. When the market breaks out from the ranging phase, it may rebound or move the breakout side with an impulsive pressure.

In scalping, the core part is to identify the market phase. The trading system for a range market will not work in a strong trending market. But the good news is that we can earn money from scalping, both the trending and ranging markets.

Opportunities when a trader is uncertain

The FX market is full of uncertainties as large players like banks and big financial markets are vital participants here. They play with colossal money and alone can move the market, no matter how much retail traders are present. Therefore, the retail trading approach differs from the institutional one, where people should understand what big players are doing.

When we talk about market uncertainties, we should not ignore the fundamental events and the global economy. Remember what happened during the swiss market crash?

USD/CHF market crash

The Swiss Central bank changed the interest rate to a negative zone without showing any predetermined time. As a result, all CHF-related pairs have lost more than 2000 pips in a minute.

What if you were a long-term buyer at that time? Could you hold the 2000 pips stop loss? Of course not!

On the other hand, if you were a scalper, you can easily get off the market with a minimum loss. No scalping trading system uses more than 30-50 pips of stop loss. Therefore, no matter how the broader market moves, reducing the loss at a minimum level is essential, which is possible with scalping.

Large-range markets opportunities

Keeping our balance safe is the priority in scalping but making money is more important than saving. In the large-range market, buyers and sellers live happily as they buy from the bottom and sell from the top. Therefore, finding the market direction is easy compared to the trending market. Moreover, support and resistances work well in the ranging phase. Therefore, if you can find a good intraday event-level within the more extensive range market, there is a higher possibility of working out in any trading system.

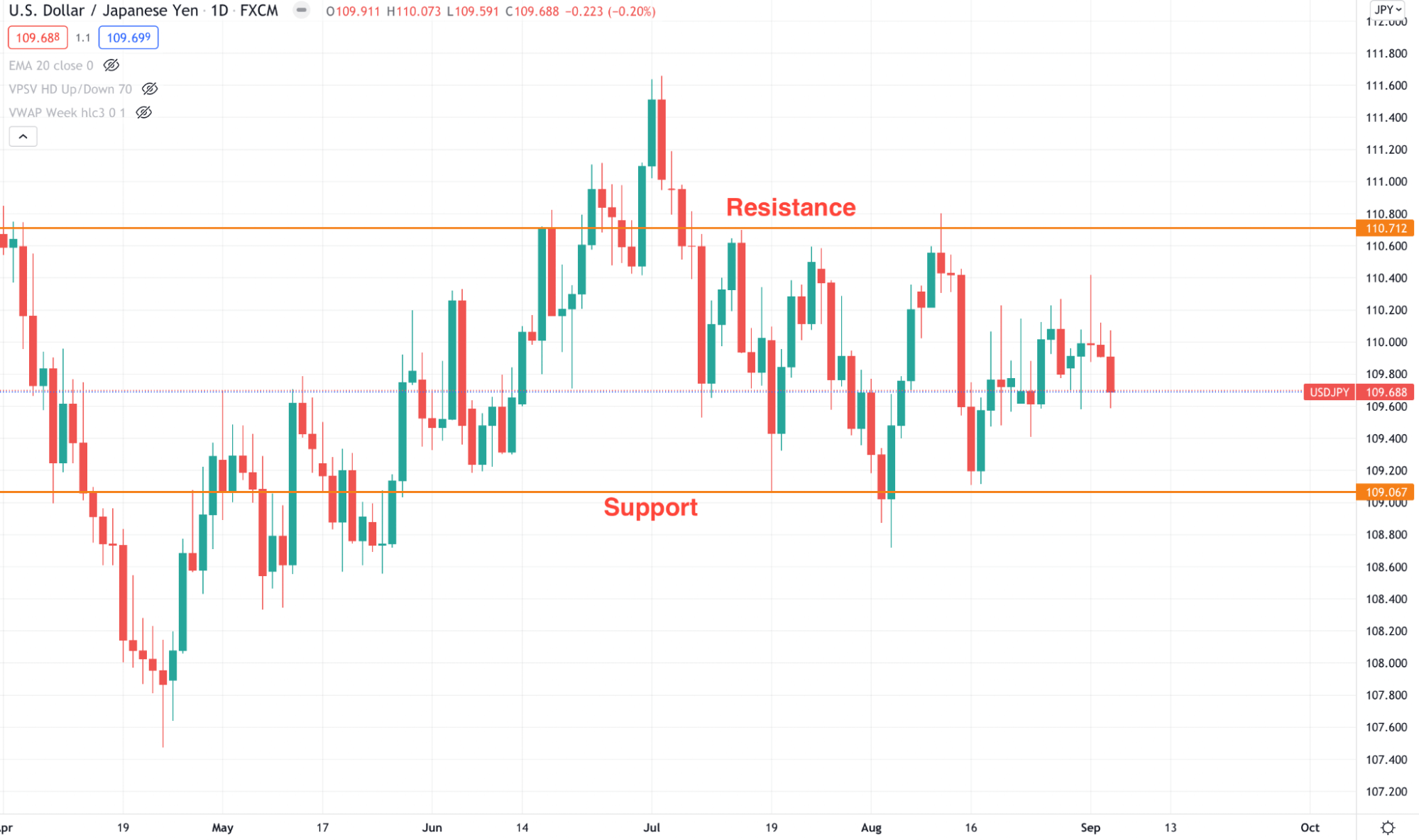

Let’s see an example of the large-range market.

USD/JPY daily chart

The above image shows the daily chart of USD/JPY where the price is trading between 110.71 level to 109.00 level. Therefore, any scalping strategy with a sell setup from the 110.71 area is more likely to provide profits.

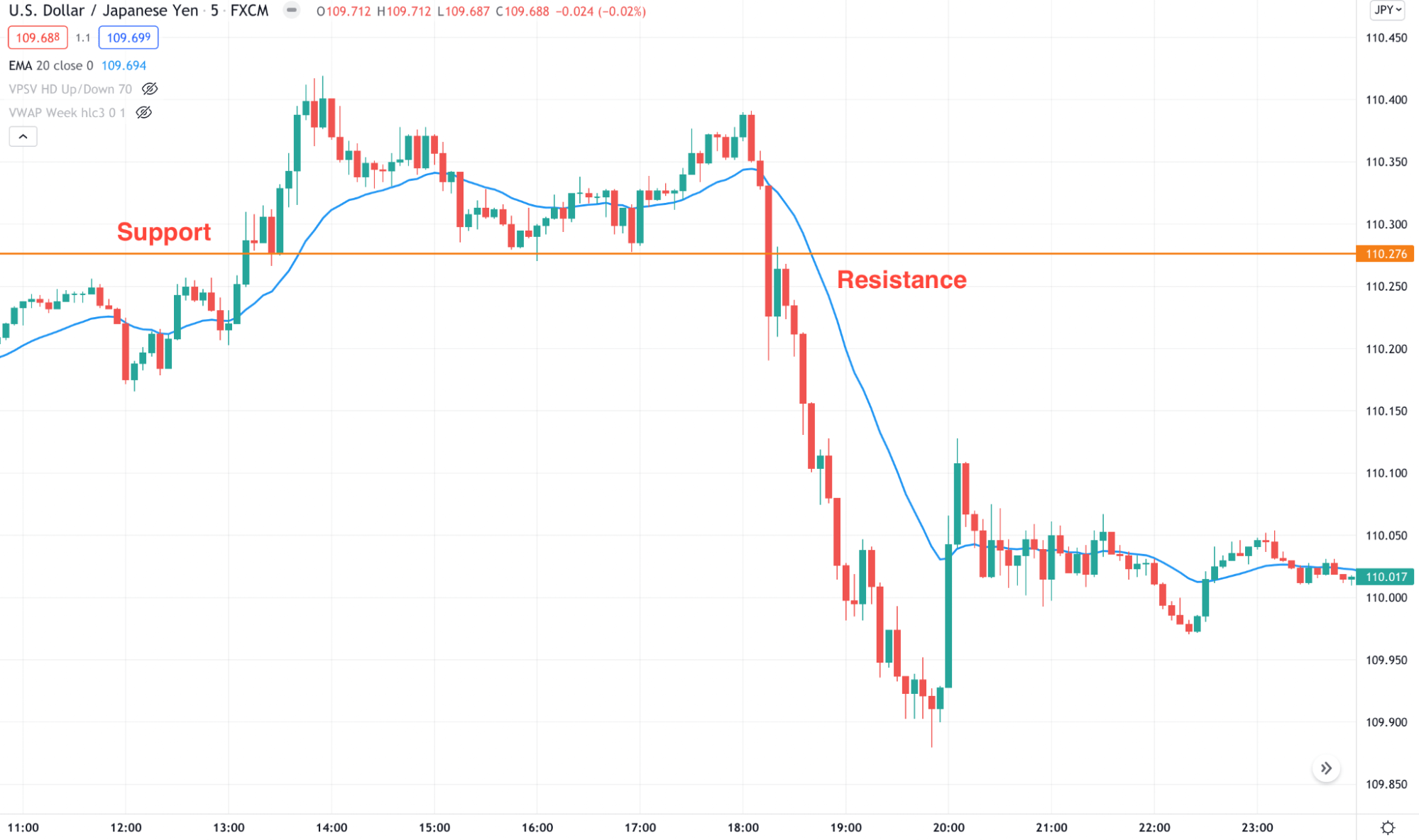

USD/JPY 5m chart

The above image shows the 5 minutes chart of USD/JPY where the price made an intraday event level at 110.27 level. Once the price breaks below the level with a retest, it collapses lower with more than 100 pips. Therefore, making 50 pips of profit within 30 minutes is easy in this market context.

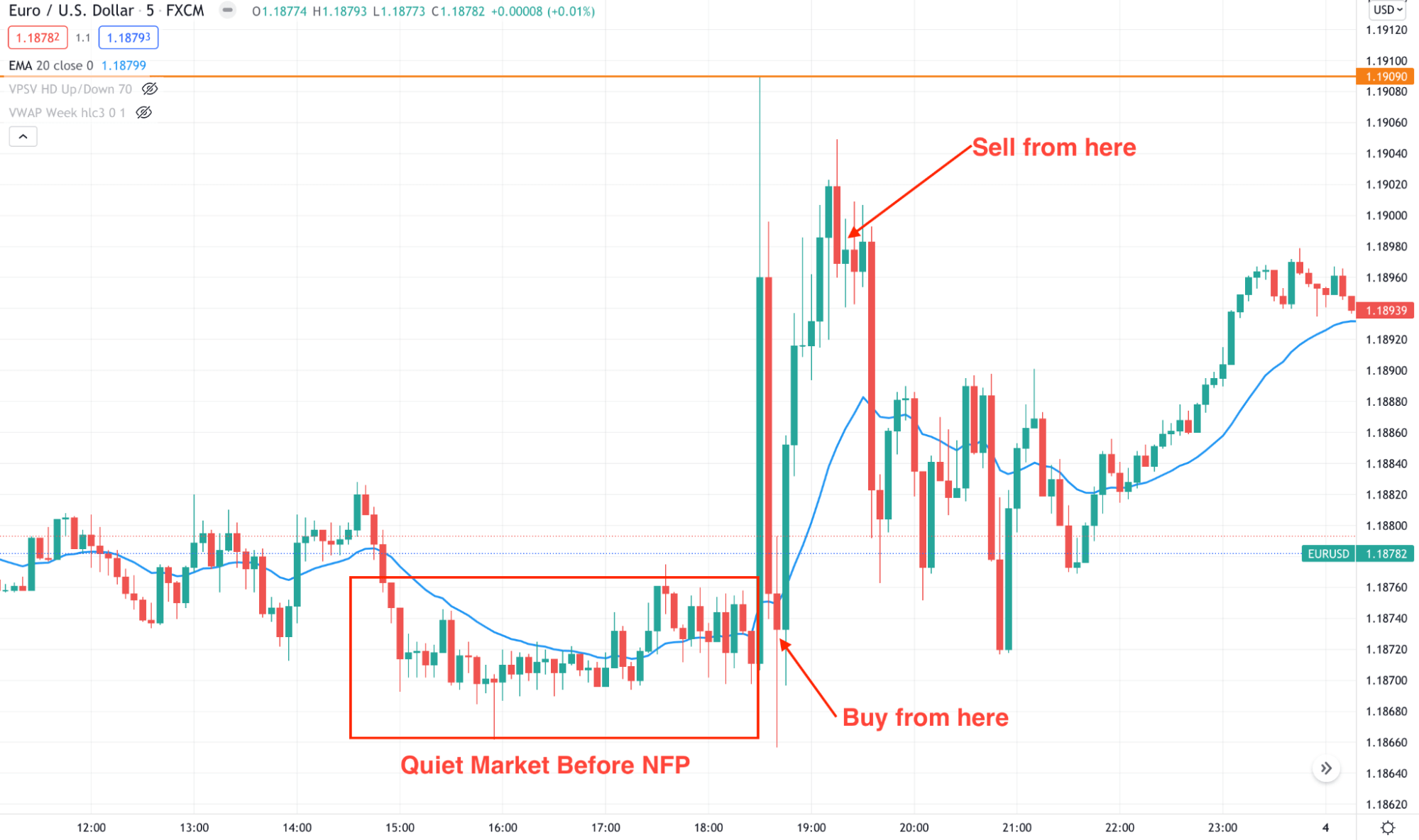

Quiet markets opportunities

Usually, the quiet market comes before any significant news release or event. At that time, the price remains quiet in both lower and higher time frames; once the news is released, the price spikes and sets a direction.

Scalping aims to catch those breakouts during the news release and make money from the short-term price fluctuation.

EUR/USD 5m chart

The above image shows the intraday chart of EUR/USD, where the price remained quiet before the non-farm payroll release. However, once the news comes, price spikes higher to the resistance and provides an opportunity to both buyers and sellers.

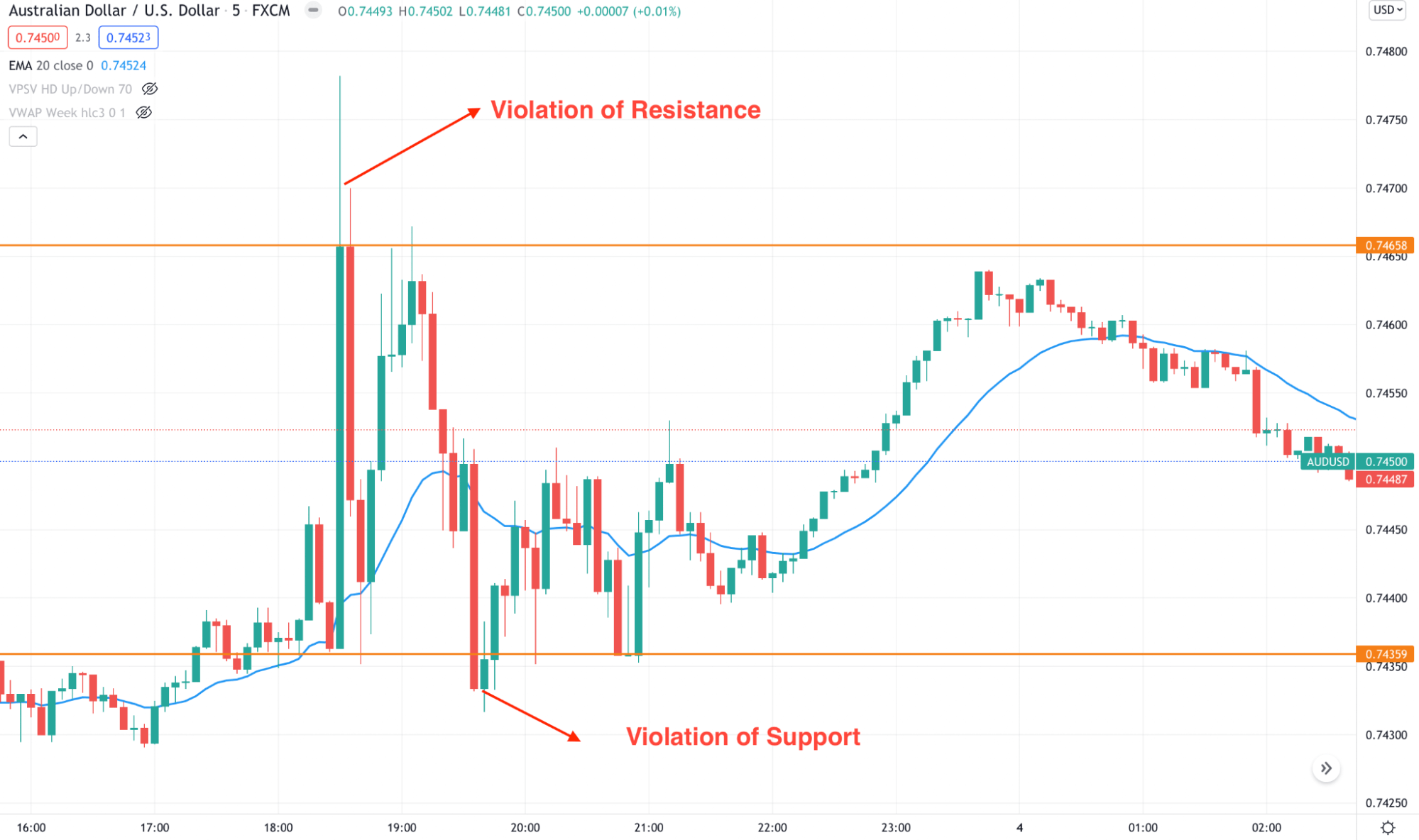

Volatile markets opportunities

In the volatile market, the price moves aggressively higher and lower and violates the near-term level. However, instead of breaking out from these levels, the price comes back within the zone and resumes consolidation.

Therefore, any scalping method to follow the simple rules of buying from demand and selling from supply works well.

Let’s check an example.

AUD/USD 5m chart

The above image shows that the price spiked higher above the support and below the resistance and bounced back.

What strategies are scalping forex signals based on?

There are many scalping systems in the world. Some of them are based on technical tools, and some use price action. Moreover, you can combine the price action, technical indicators, and fundamental events to make trading more effective. When any significant news releases or speeches come, it creates a short-term spike in the price chart where making quick money is possible.

You should check its effectiveness in the past price chart before implementing it with real money in any trading strategy. Moreover, using the balance between risk and reward is necessary from any scalping.

Final thoughts

We have seen how the scalping strategy works in the FX market, including an extensive trading guide. We have also mentioned the uncertainty of financial trading that a trader should consider while trading.

Overall, scalping is a sophisticated way to earn money from forex. It requires patience and practice to see the effect on the trading account. You can achieve this success by making mistakes and recovering from wrong decisions.

Comments