The price of a currency pair remains within a range most of the time. Therefore, in any range trading system, there is a possibility of getting a higher number of trades than a trending system.

Ranging allows traders to follow the market momentum repeatedly. It lets us trade more frequently.

However, the trading method in a range-bound market is different from a trending environment. If you don’t know the basic concept of range trading, you might miss an ample opportunity from financial trading. If you are new in the FX market, following a range trading method would bring enough profit in your portfolio.

The following section is for you if you want to know the easy way to trade and make money from FX trading. Here we will discuss the core facts of range trading strategy that will enrich your trading career.

Why is it worth using a range trading strategy?

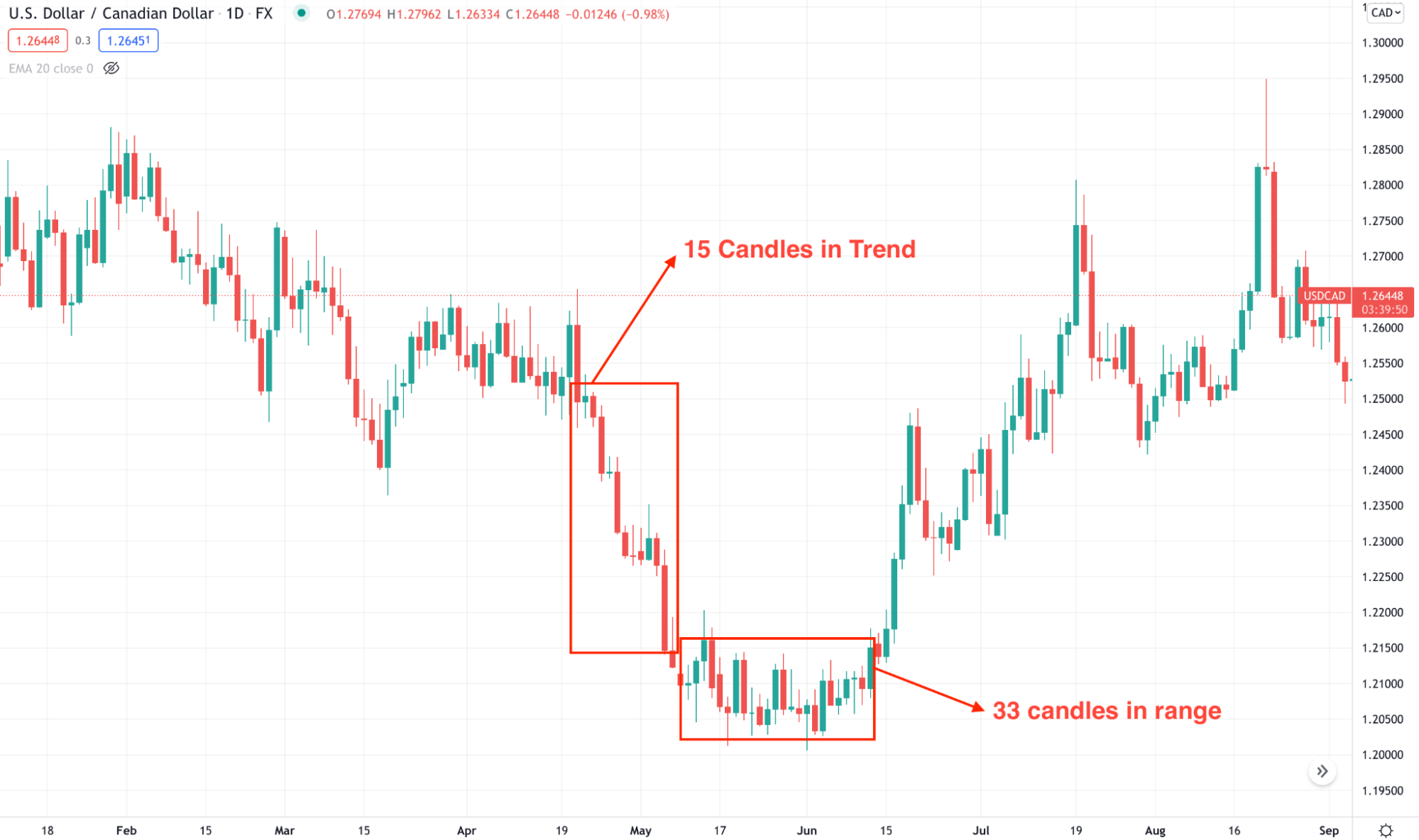

When you open a chart in any time frame, you see the price move up and down by creating swings. Most of the traders are attracted to that trending movement as they like to see the price moving. On the other hand, when you calculate the number of candlesticks, you will see that more candles will remain in a range.

Ranging and trending market

Experts say the FX market spends more than 70% of the time in a range and only 30% time it moves. We can consider the range-bound market as a happy market where buyers and sellers remain active, and both can earn money by buying at low and selling at high.

Buying at low and selling at high

This simple concept is the basis of a range trading strategy. However, you should follow a systematic approach to benefit from range trading, including entry, exit, and trade management. Moreover, it would help if you understood the logic behind the ranging behavior.

Buyers and sellers remain active in the forex market as it is a decentralized marketplace where no one is here to control the price. As a result, it would stay in a range unless there was a significant reason for the price change. As the significant event does not come very often, we often see the ranging behavior.

You cannot blindly take trades in the range-bound market. Instead, you should follow a method. The short-term process applies to full-time traders who remain present in the active session. On the other hand, the long-term way is suitable for traders who consider passive trading income.

A short-term strategy

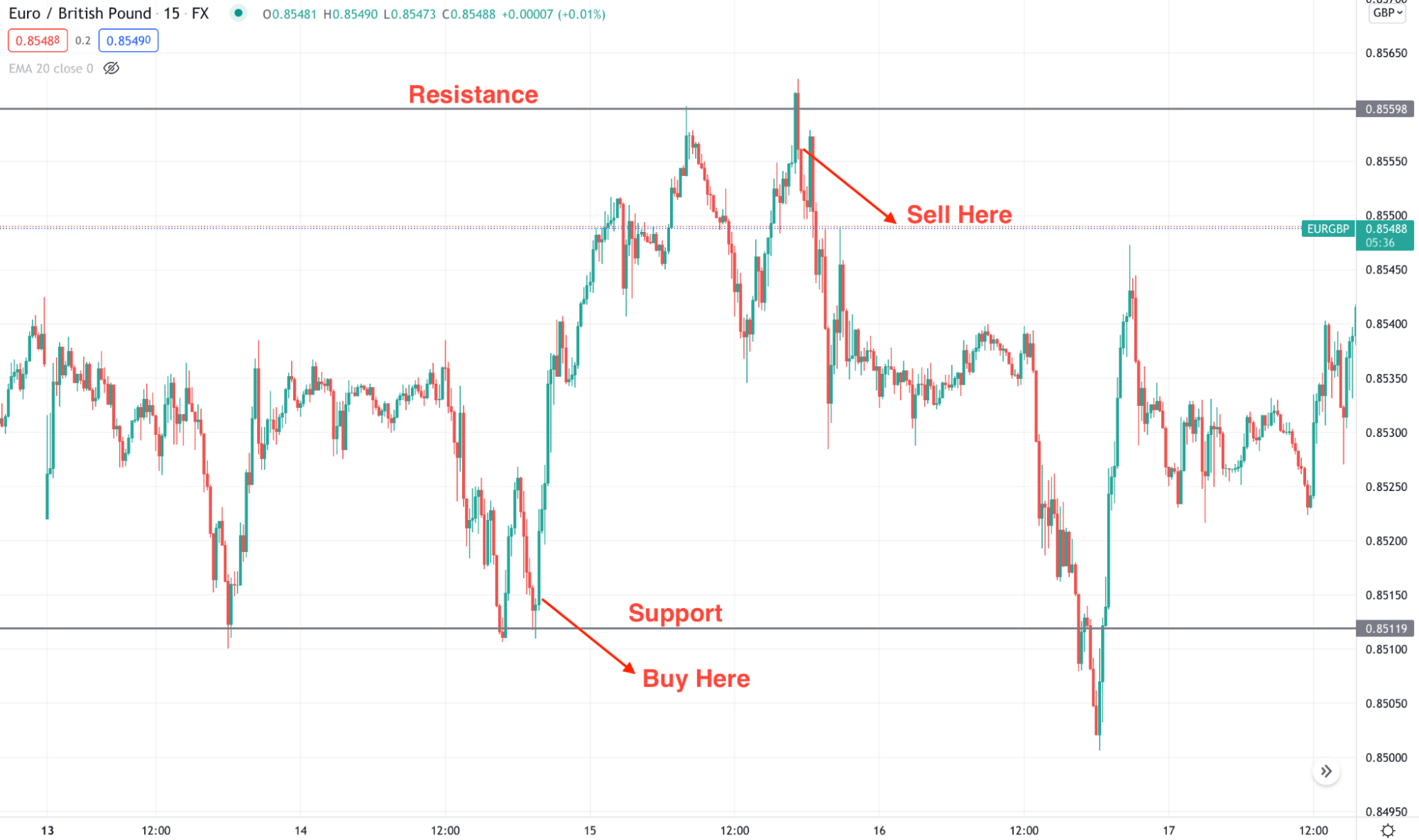

Even if we are talking about the short-term method, the core idea is to follow what is happening in the higher-time frame. Short-term market conditions are a small part of the long-term trend. Therefore, the primary aim is to find what is happening in the higher time frame. For H1 trading, make sure to follow the H4 momentum and for 15-min trading, follow the H1 momentum.

Best time frames to use

This strategy is applicable on the 15-min time frame, and the ideal time of taking the trade is during London and New York sessions.

Entry

If the higher time frame is bullish, we will focus on buy trades only. Similarly, for a sell trend, we will focus on selling opportunities and ignore any buying opportunity. The entry is valid from an event level only. Once the price rejects the level with a proper candlestick formation opens the trade immediately.

Stop loss

For an aggressive approach, the ideal stop loss is below the candlestick high or low. However, the best approach is to set the stop loss below or above the range with some buffer.

Take profit

In this method, the buy trade comes from the lower part of a range, and the sell trade comes from a higher part. Therefore, the take profit should be at the opposite zone with some buffer.

Short-term range trading

A long-term strategy

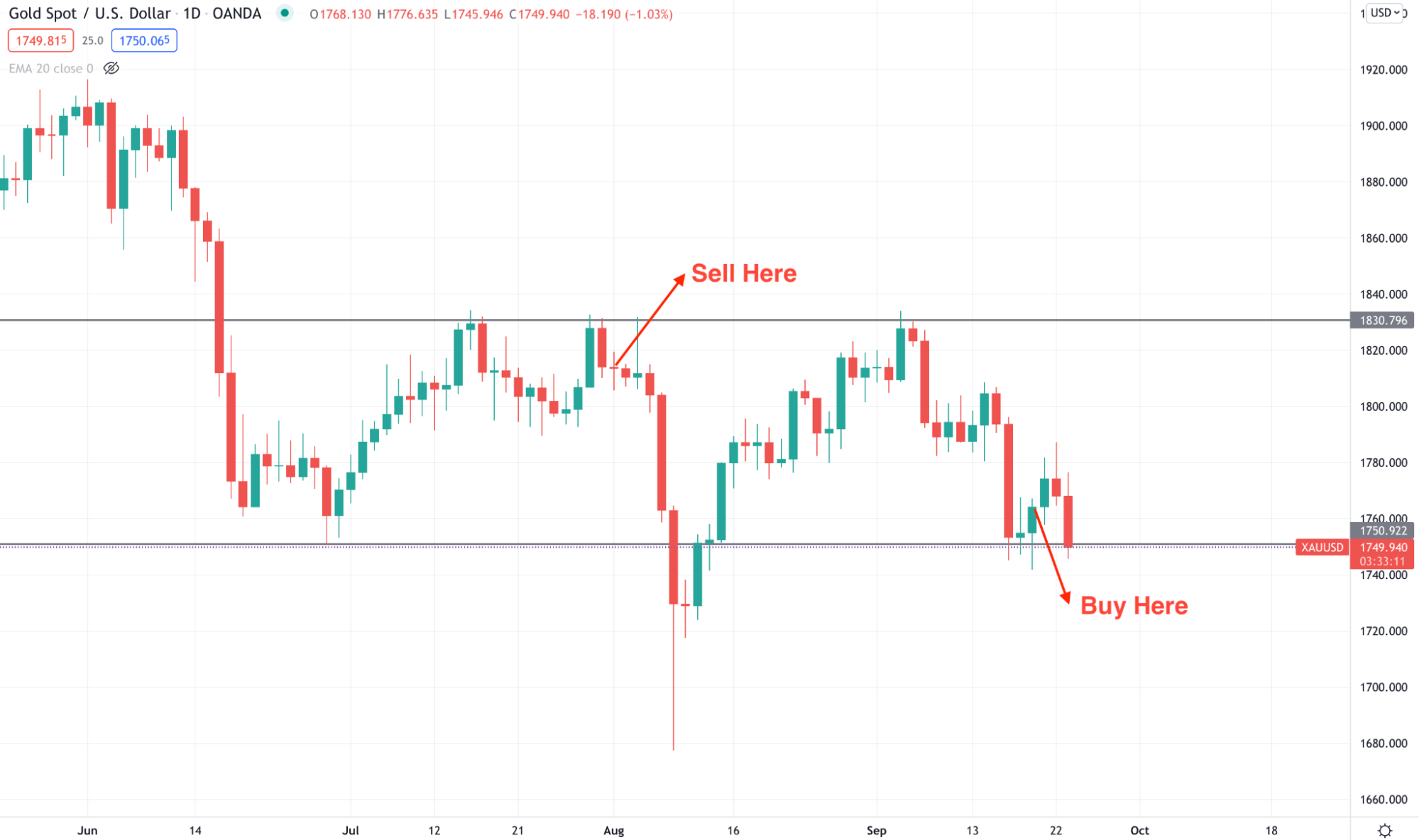

This method is to find higher time frame trends in the daily chart. Open the price chart and mark critical price levels or zones. In that case, consider the support level for buying and resistance levels for selling. These levels rely on the area once the price rejects the level with a reversal candlestick formation.

Best time frames to use

The ideal time frame is a daily chart that will allow you to skip the intraday market volatility. However, this method is also applicable on the weekly chart, but moving to a higher time frame will increase the risk tolerance.

Entry

This method is easy to try and best to use. The ideal approach is to make money as long as the range is expanding. Open a buy trade from the support with an indecision or reversal candlestick formation. Similarly, open a sell trade from the resistance with candlestick formation and follow the overall market direction.

Long-term range trading

Stop loss

The ideal stop loss is below or above the recent swing level with some buffer. If the stop loss level is not suitable, you can skip the trade and focus on other pairs.

Take profit

Like the short-term method, the take profit should be at the opposite part of the zone with some buffer.

Pros and cons of range trading strategy

No trading strategy is perfect in any financial market, but a trader can effectively use it at the right time. In that case, understanding the strength and weaknesses of the trading method is essential.

Pros |

Cons |

|

|

|

|

|

|

Final thoughts

We concluded the range trading strategy. Now it is time to apply the method on the chart. But before following any strategy, make sure to perform enough demo testing to justify the potency. Risk management is a core part of trading, and the ultimate success depends on how you minimize the risk.

Comments