When it comes to forex trading, price candles are common elements that professionals follow. Successful forex traders always seek potential candle formations to make trade decisions. Each candle contains info besides reflecting participants’ sentiments on any specific period. It becomes easier to execute the most potential trading positions when you learn to read that candle info.

However, many candles generate trade signals by appearing in different phases of the price movement, such as “the hanging man.” This article will introduce you to the hanging man candle. Additionally, we describe trading strategies with chart attachments using this single candle pattern.

What is a hanging man candle?

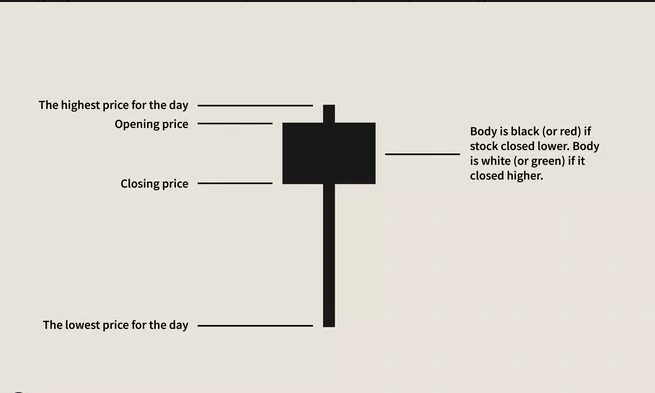

The hanging man candle is a single candle that signals an upcoming declining price movement by taking place near any resistance level or finish line of an uptrend. This candle is also potential during the consolidation phase. The hanging man candle has wicks on both sides. The lower wick is at least twice the candle body, whereas the upper wick will be smaller than the lower wick.

A hanging man candle

Traders define the same candle as a hammer when it takes place near any support level. The candle body can be either red or green; the red one is always better. Hammer with a green body signals an upcoming bullish price movement.

How to trade using the hanging man candle

The hanging man is a typical formation of the price movement that you can mark on any phase of price movements. Making trade decisions is precisely using this pattern if you combine the market context with other technical indicators and tools reading.

In this way, making a complete trade setup will be easier and more accurate. To execute trades, you can use popular indicators like MACD, MA crossover, RSI, ADX, Parabolic SAR, etc. So trade executions can take place following some simple steps as below:

Step one

In the first step, identify the hanging man candle near the ending line of an uptrend or resistance level.

Step two

When you mark the candle, wait for the subsequent candle formation and combine the technical market context through technical indicators of your trading strategy.

Step three

Execute trades at levels when your strategy suggests. Complete trading strategies will suggest proper entry/exit positions of your trades.

A short-term trading strategy

In this short-term trading strategy, we use two different EMA lines. So this trading method will be an EMA crossover strategy, which will declare trend directions and price shifting points through crossover style. When the EMA line with a smaller value crosses above the EMA line with a bigger value, that indicates bullish pressure on the asset price.

Meanwhile, the exact opposite crossover between these lines will declare a declining pressure on the asset price. This trading method contains EMA 30 (red) and EMA 10 (green). We recommend using a 15-min chart and financial assets with sufficient volatility to obtain the best results.

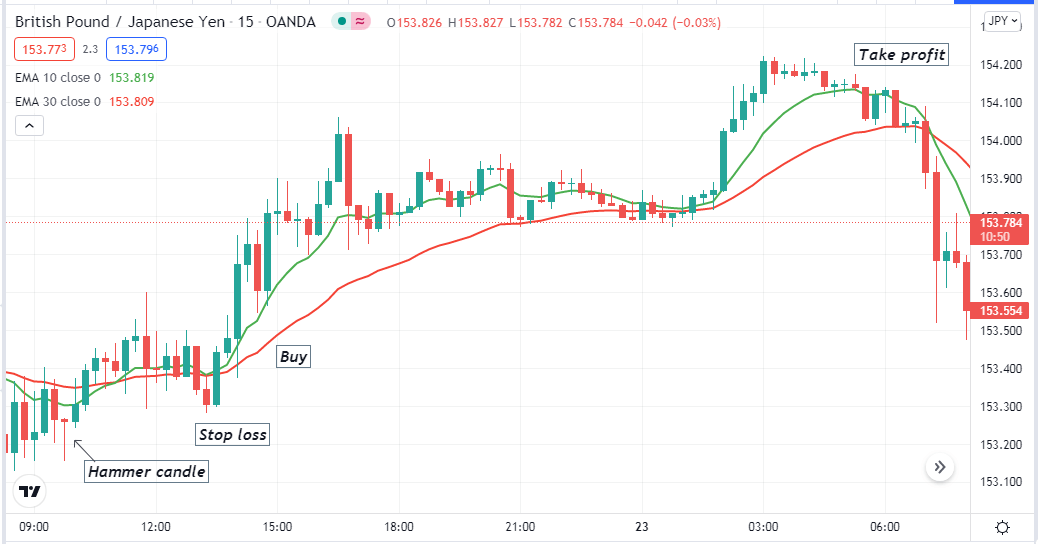

Bullish trade scenario

When the hanging man candle appears near any support or the candle formation occurs at the ending line of a downtrend, it is a hammer candle. Seek the hammer candle and observe EMA lines.

Bullish setup

Entry

Enter a buy trade when the green EMA line crosses the red EMA line on the upside.

Stop loss

Place an initial stop loss below the current swing low of the bullish EMA crossover.

Take profit

Close the buy position when the exact opposite crossover occurs between those EMA lines; the green EMA crosses below the red EMA line.

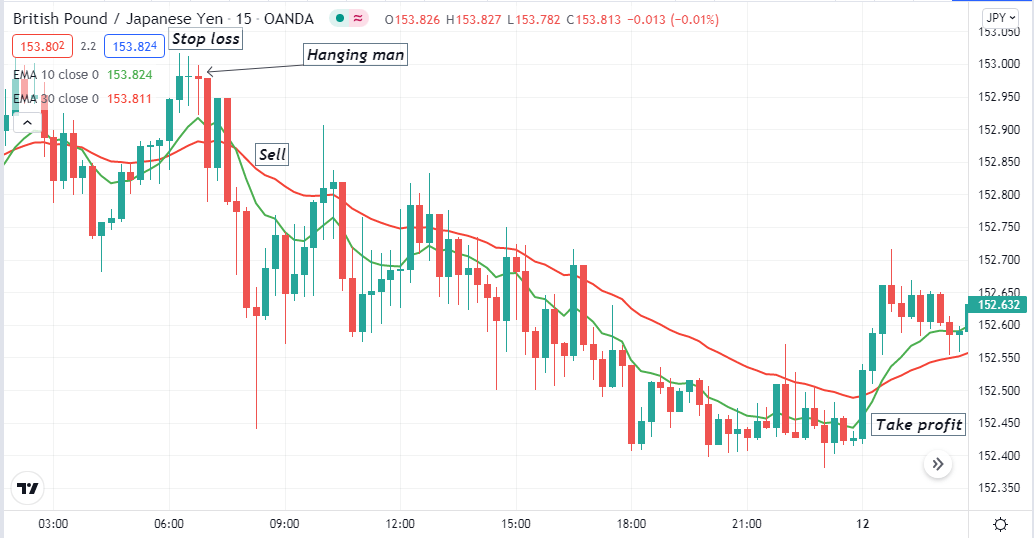

Bearish trade scenario

Mark the hanging man candle near any resistance level or at the ending line of an uptrend, observe EMA lines.

Bearish setup

Entry

Enter a sell trade when the green EMA line crosses the red EMA line on the downside.

Stop loss

Place an initial stop loss above the current swing high of the bearish EMA crossover.

Take profit

Close the sell position when the exact opposite crossover occurs between those EMA lines; the green EMA crosses above the red EMA line.

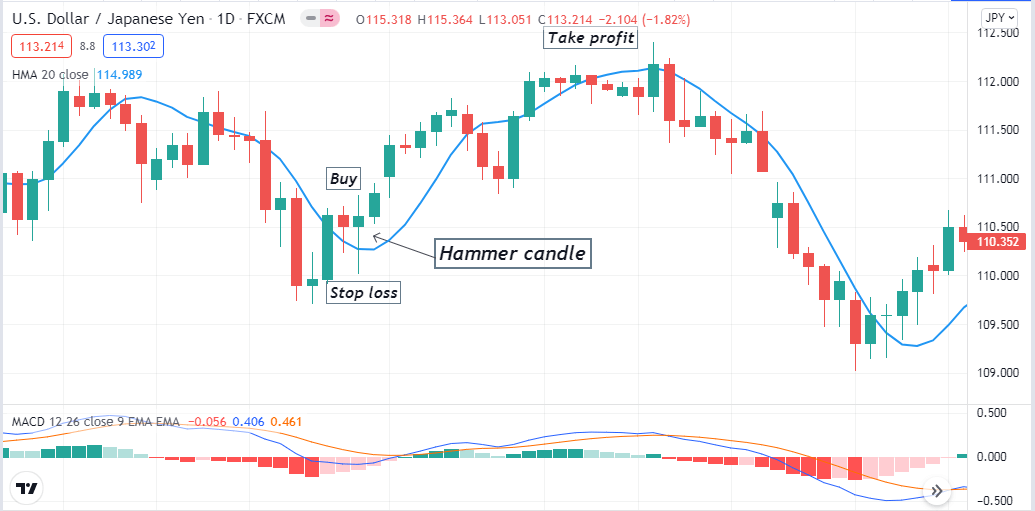

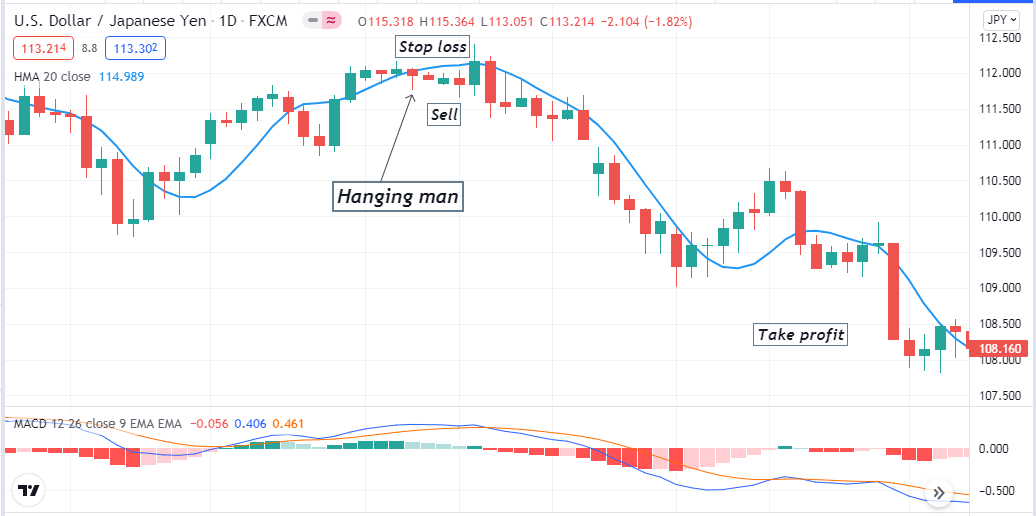

A long-term trading strategy

In our long-term trading technique, we use the Hull moving average and the MACD to determine trading positions besides using the single candle pattern. When the HMA (20) line slops toward the upside, it declares bullish pressure on the asset price and vice versa.

Meanwhile, the MACD indicator shows reading on an independent window containing two dynamic signal lines besides histogram bars on both sides of the central line with different colors. This trading method suits any financial asset; we recommend using an H4 or above timeframe chart to catch most potential long-term trades using this trading method.

Bullish trade scenario

Mark the hammer candle at any support level and observe indicators:

- The HMA line is sloping toward the upside.

- MACD dynamic blue line crosses the dynamic red line on the upside.

- MACD green histogram bars take place above the central line.

Bullish setup

Entry

After matching these conditions above, you can place a buy order.

Stop loss

The initial stop loss level for your buy order will be below the current swing low.

Take profit

Close your buy order when:

- The dynamic blue line crosses the dynamic red line on the downside.

- MACD red histogram bars take place below the central line.

- The HMA line starts sloping on the downside.

Bearish trade scenario

Mark the hanging man candle at any resistance level and observe indicators:

- The HMA line is sloping toward the downside.

- The MACD dynamic blue line crosses the dynamic red line on the downside.

- MACD red histogram bars take place below the central line.

Bearish setup

Entry

After matching these conditions above, you can place a sell order.

Stop loss

The initial stop loss level for your sell order will be above the current swing high.

Take profit

Close your sell order when:

- The dynamic blue line crosses the dynamic red line on the upside.

- MACD green histogram bars take place above the central line.

- The HMA line starts sloping on the upside.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

Finally, we explain trading strategies using the hanging man candle besides listing the top pros and cons of this candle. Now it is your turn to check the potentiality of this candle formation on successful trade executions after practicing some demo trading using this candle to master the concept. You can also use other technical indicators, such as RSI, ADX, etc.

Comments