From beginners to professionals, all successful traders follow specific strategies to approach the FX marketplace. The 50-pips per day forex strategy is a profit-making valuable method for traders who like to make frequent trading positions.

This article is about a 50-pips a day forex strategy, a complete solution. However, choosing the right system requires checking the potentiality, opportunity, profitability, risk factors, etc.

Let’s check a short-term and a long-term trading strategy with charts for a better understanding.

Why is it worth using a 50 pips a day forex strategy?

This strategy is a potential for FX traders as it enables them to utilize opportunities to obtain profit every day. Market participants often face confusion during creating a sustainable trading method that will give continuous profits.

Moreover, sometimes using technical indicators leads them to make wrong decisions, involving some complexity and particular skills. It doesn’t require advanced skills to trade in the FX market with 50 pips a day forex strategy. It is a suitable method for day traders who like frequent dealing and can spend time monitoring the market.

However, choosing currency pairs is essential to apply these methods as all of them have different volatility. You can only make profits of approx 50 pips when the pair moves more than 50 pips. So the major currency pairs are suitable for this strategy as they move 70-100 pips daily on average.

Short-term trading strategy

Here we use support & resistance levels (S&R) and breakouts to sort out trading positions. This strategy works fine in 1-min charts.

Determine the S&R levels on your chart and wait until a valid breakout to make positions. Some levels often act as short-term support resistance levels that are pretty enough to make 30-50pips a day. Identifying them is essential for using this strategy, such as daily high, daily low, opening and closing price, historical support-resistance levels, etc. Determining these levels may require checking on upper time frame charts such as 15-min or hourly charts.

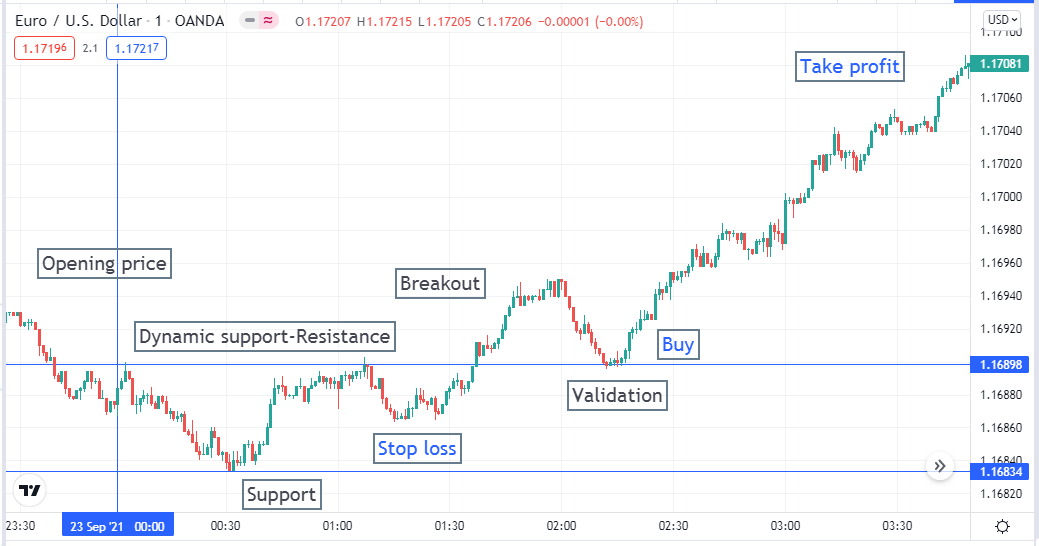

Bullish trade setup

When you seek to make buy positions, first confirm the currency pair remains at a bullish trend from the 15-min or hourly chart. Your executing chart will be the 1-min chart. Wait till the price comes on a suitable support level or a valid breakout to occur, then place buy position.

Short-term bullish setup

Put an initial stop loss below the recent swing low or below support resistance levels with a buffer of 5-10pips. Set a profit target above 30-50pips of the opening price. Wait until the TP gets hit, or you can manually close the trading position if you want.

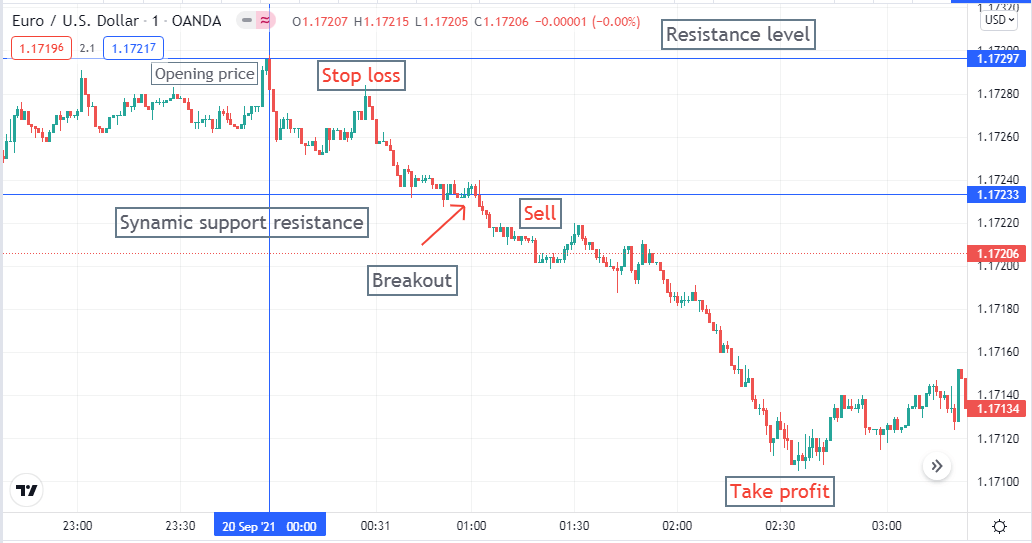

Bearish trade setup

First, confirm the current trend is bearish from the 15-min or hourly chart. Seek your trading position at the 1-min chart. With thill, price rejects from good resistance, or a valis breakout occurs. If the price movement meets the conditions, place a sell order.

Short term bearish setup

Put the initial stop loss above the recent high or above the current resistance level with a buffer of 5-10pips. Set a take profit below 30-50pips of the opening price. Wait till the take profit gets hit or close the position manually.

Long-term trading strategy

It is an intraday trading strategy that gives the best results in all major currency pairs. You don’t need to use any technical tool or indicators to implement this strategy. Moreover, you don’t need to be a pro trader to use this strategy.

It would help if you found the 7 am GMT candle by searching on google or asking your broker what the forming time is at your local time. You may check the upper time frame charts to confirm the current trend, such as 4-hour or 1-day charts.

Make positions at the major currency pairs by following these rules below:

- Mark the 7 am GMT candle on your 1-hour chart.

- At the closing of the 7 am GMT candle opens pending orders.

- Pending buy above two pips of that candle range and pending sell below two pips of that candle range.

- Any order gets hit close to the other pending order.

- Set stop loss and take profits and wait to get hit.

- Repeat this process the next day on an average price movement.

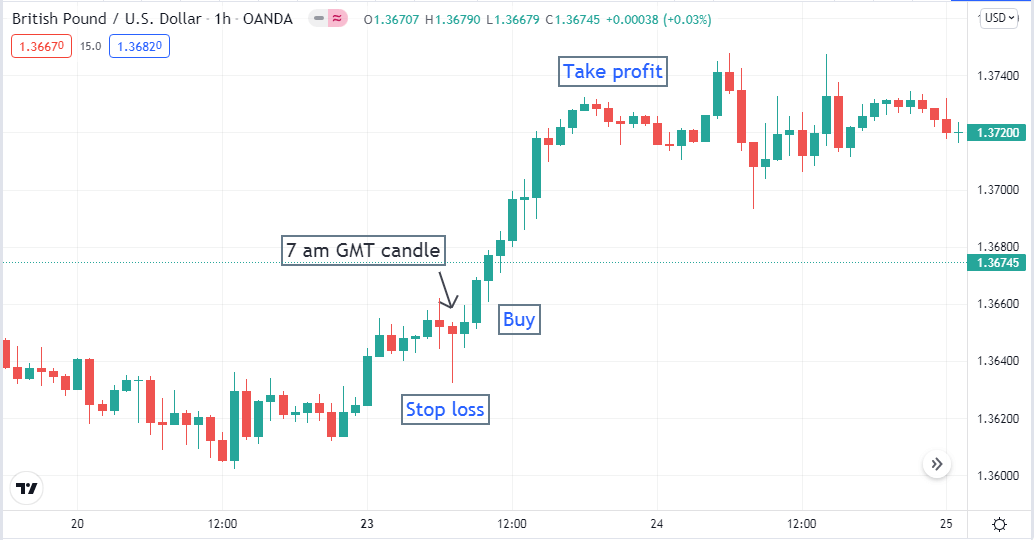

Bullish trade setup

Identify the 7 am GMT candle at the hourly chart. Wait till the candle closes, then place pending buy and sell orders above and below two pips of the GMT 7 am candle. When the pending buy order gets hit by the price movement, immediately close the other.

Bullish setup

Set a stop-loss below 5-10 pips of the 7 am GMT candle and take profit above 50 pips of the opening price. Wait till any of these stop loss or take profit gets hit.

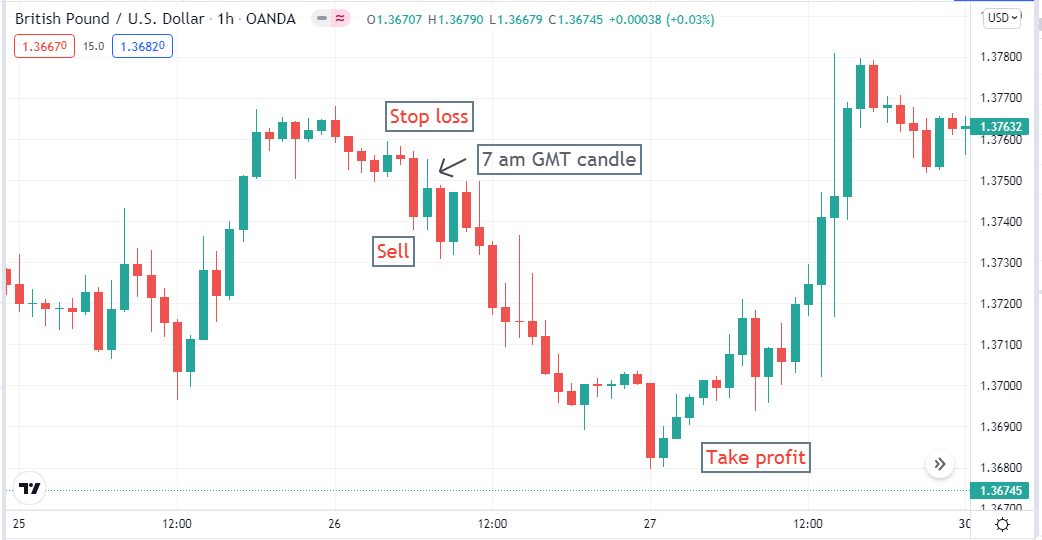

Bearish trade setup

Bullish or bearish, the concept is the same and straightforward. Identify the GMT 7 am candle and wait till the complete formation of the candle. Palace pending buy and sell order above and below two pips of that candle range. When the pending sell order hits by the price movement, then immediately close the other pending order.

Bearish setup

Place an initial stop loss above 5-10 pips of that 7 am GMT candle, and take profit will be below 50 pips of the active order. Wait till take profit to get hit.

Pros and cons of the 50 pips a day forex strategy

Although these are simple, effective, and profitable trading strategies, there are some limitations.

Pros |

Cons |

|

|

|

|

|

|

Final thoughts

We suggest practicing this strategy on the demo chart before applying it in the real trading account. 50-pips a day forex trading strategies are very potential to make continuous trading positions. Be careful to make trading positions by these strategies during significant economic event days.

Comments