The financial market involves many trading techniques to make money from certain investments. Some methods enable making quick profits or mislead you to be a loser depending on your skill to deal with the asset price. The technique “pump and dump” is one of the exotic strategies that pro traders follow.

However, it is illegal for any individual investor or investor group to perform this on vulnerable stocks. Moreover, it requires an acceptable level of understanding to trade forex using this technique. This article contains forex trading methods using the “pump and dump” strategy besides explaining the method.

What is the pump and dump strategy?

The “pump and dump” strategy is a manipulative scheme that creates a fake boost on a particular stock price through counterfeit recommendations. Usually, the insiders have the most significant stakes of the assets they want to pump, and after raising the value of that asset, they sell it to victims who are the highest bidders.

The investor or investor group takes a significant stake in the asset that they want to pump and hires promoters to create attention to that asset for various investors. The asset price rises sharply for colossal buying pressure, which is the pump. Then the insiders dump the asset by rapid sell. The consequence is a massive decline in the price of the stock. So the dumping caused an enormous loss to the participants involved in buying that asset after the spike.

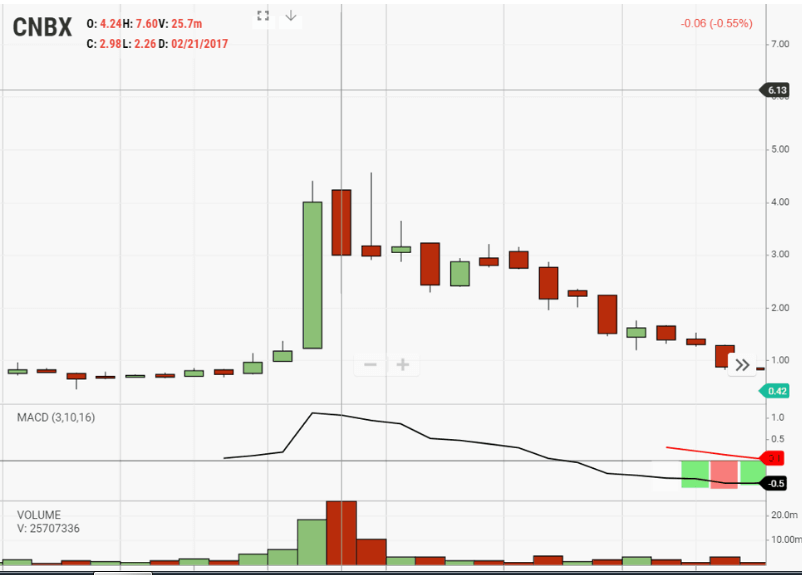

Pump and dump on CNBX

This trading method relates to momentum and volume that cause both pumping and dumping scenarios on the asset price.

How to trade with the pump and dump strategy

This trading technique isn’t allowable for small stocks as the scheme involves significant risk of losing money. Meanwhile, when it comes to trade forex through this strategy, it enables opportunities to make considerable profits to traders with proper skills and knowledge. The “Wolf of Wall Street” is a real-life example of this trading method.

Pump and dump scheme

They make a hype of stocks with low value and push the price higher, then dump those stocks and make massive money. In forex trading, you can use this method as no one controls the forex market, and it’s nearly impossible to create a spike in asset price for any individual investor or group of investors.

The big boys of this market are banks and financial institutes. You can use technical indicators to identify volume and momentums and make entries.

A short-term trading strategy

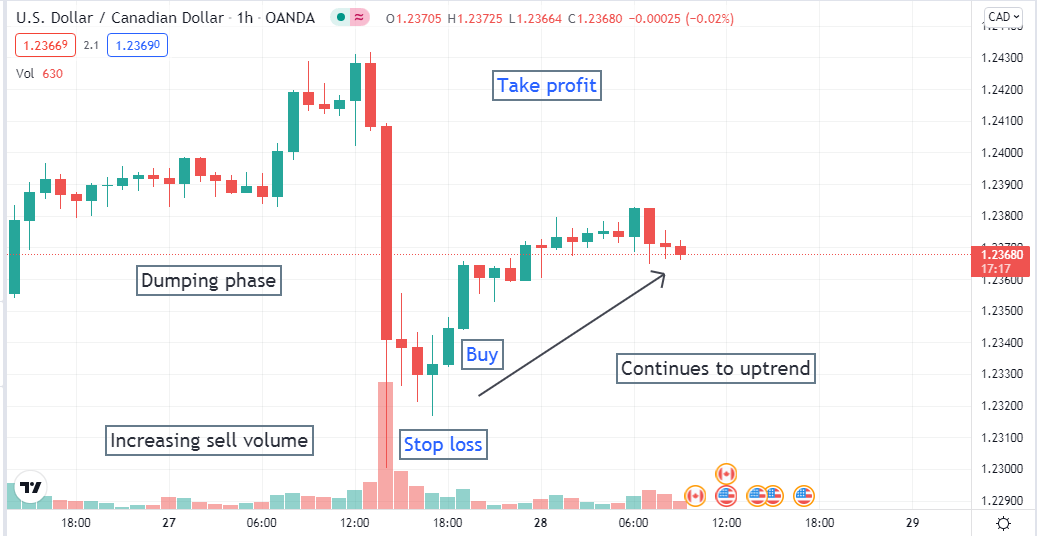

You can trade in the forex market for the short-term using the pump and dump strategy. News trading is a common approach for forex traders to make trade decisions. You will see many spikes and quick declines in currency pairs during or depending on significant news data. For example, look at the recent chart of the USD/CAD.

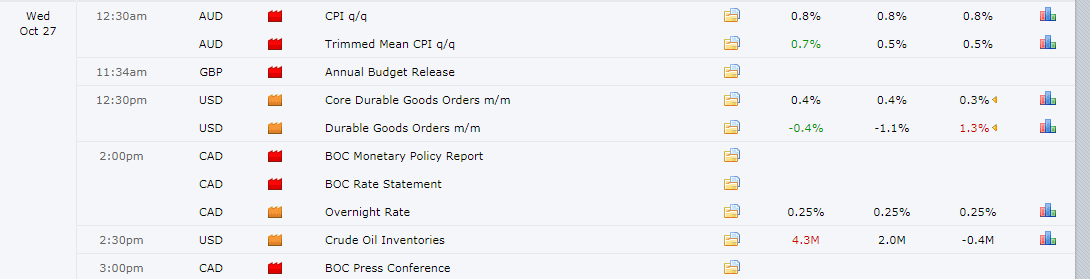

Economic calendar

Last 27 Oct was a news release for the Bank of Canada monetary policy statement and BOC rate statement; meanwhile, participants dumped USD against CAD before the news release and continued to sell off CAD until the press conference. The USD/CAD pair declined for 2-3 hours as there were possibilities of a rise in the interest rate of the Canadian dollar.

USD/CAD hourly chart

However, there was no interest rate rise from BOC, and regular press conferences took place. After the event price continues to uptrend, the interest rate remains the same, and there is no significant change in BOC policies.

This quick fall of the USD/CAD pair creates opportunities for traders to take buy positions. Short-term traders can profit from this type of movement when the event ends without any difference and the price changes quickly against the current trend. We suggest using the pump and dump strategy by performing some technical analysis besides fundamentals.

Moreover, if the central bank fills the participants’ expectations, a spike can also occur but won’t reach the same level as before. After retracing, the price will continue in the same direction it should go.

A long-term trading strategy

Currency price depends on several key factors, and the forex market is nearly free from manipulations as a decentralized marketplace. Several microeconomic, socioeconomic, and macroeconomic factors include interest rate, CPI data, inflation, deflation, GDP data, etc., indicating the future direction of the currency.

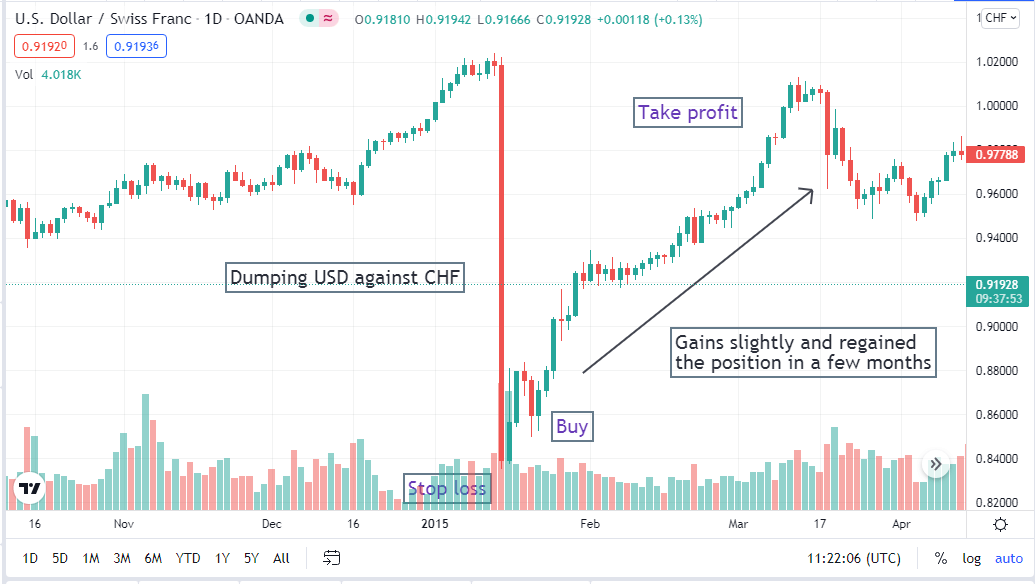

In the forex market, currency pairs have some complications as the pair direction depends on the weakness or strength of both participant currencies. A long-term ‘pump and dump’ example is the CHF crash of 2015.

USD/CHF daily chart

Back in 2015, the Swiss Franc decided to remove the peg with the Euro. That cost investors billions of dollars across the world. Many small firms were wiped out following this decision. The USD/CHF pair was doing well till making this decision. After removing a peg, the decision was made to drop the pair for approximately 1850+ pips in a single day.

There is another example of pump and dump in the forex market, which is remarkable. In 2016, the Brexit caused the GBP to decline against other major currencies, although the pound has enough potentiality. Then the pair USD/CHF started to recover and regained the position in a few months.

Pro tips

When you want to trade FX using this scheme, carefully check the fundamental and technical observations that will support your logic. Follow the money and trade management rules carefully as it is a risky method to practice for individuals. Most traders who use this technique give attention to the short side. When the price reaches the top, they wait till the bottom to take out.

Pros and cons

| Pros | Cons |

| Allow having considerable profit. | Requires sufficient knowledge to trade using this technique. |

| This scheme is suitable for penny stocks. | Many consider this as an illegal and scam trading technique. |

| Allow quick profits. | Practicing this method involves risks. |

Final thought

Finally, now you know all the pump and dump strategy basics besides learning when to pump or dump any asset. In this case, when to place buy or sell on any forex pair through this strategy. We suggest using technical methods and tools such as Fibonacci retracements, support-resistance levels, pivot points, etc., before placing any order to get accurate entry positions.

Comments