Forex intraday trading is different from traditional swing or position trading as it requires a strong knowledge of market behavior, trading session, news impact, and intraday volatility. As a result, intraday traders should use trading tools like VWAP to add a layer of confirmation in finding the right direction.

The perfect use of VWAP might help you to reduce the unexpected false signals from moving averages. Moreover, considering the volume besides average price, an ideal use might make it an excellent tool for you. The following section will see the complete guide on using VWAP as an intraday trading tool.

What is the VWAP intraday strategy?

VWAP is a forex trading indicator that considers the average price of a trading instrument, not by looking just at a price. Instead, it considers both the average price and volume for a particular timeframe so that investors can define which direction is the most effective.

Besides moving to the core part of the VWAP intraday strategy, we need to know why we should choose it over the traditional moving averages. The conventional moving average counts the opening and closing price of several candles to get the average price. Therefore, it is hard to see where the maximum volume was present.

Why does volume matter in intraday trading?

Well, the volume represents the activity of traders. Although it does not say whether they were buyers or sellers, it indicates an area of interest. Therefore, the average of areas where traders became interested is a matter of consideration in VWAP trading. However, investors should consider the price action, trading levels, and candlestick formation with this tool to get the most reliable price direction.

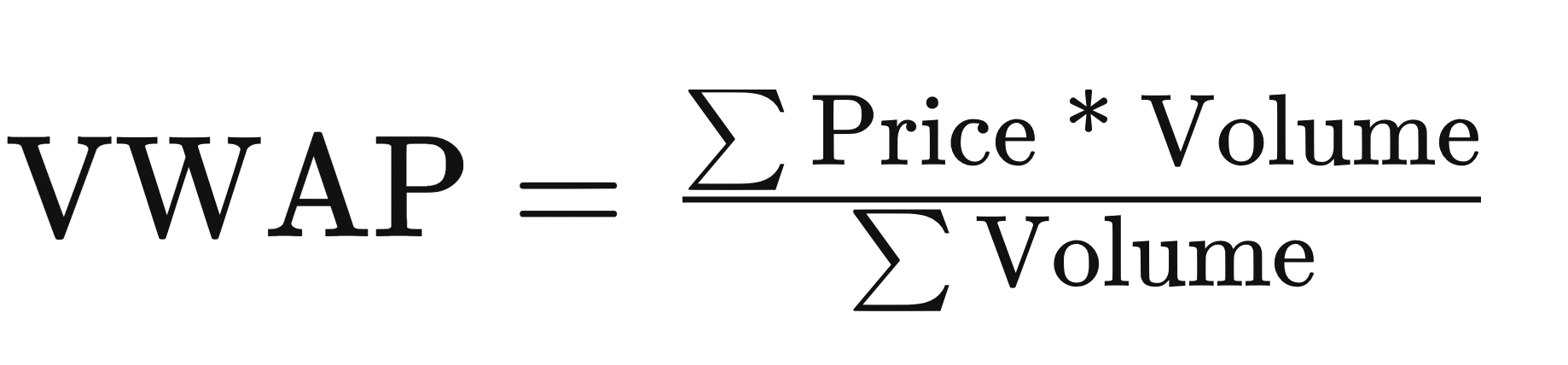

Let’s see how VWAP is calculated.

The main idea of calculating VWAP is to make an average of trading volumes for a specific duration. As shown in the above equation, the volume comes with the multiplication of dollar value and number of orders.

How to use the VWAP intraday strategy?

As this indicator considers the trading volume, the perfect trend direction may come from intraday trading. Institutional traders create the intraday market fluctuation by selling above the VWAP and buying below it. Therefore, when the price moves above or below the VWAP level, it becomes essential to traders.

However, in the intraday method, we will use other tools besides the VWAP, and we aim to open the trade when more than two indicators are showing the same direction. So, for example, if the VWAP is showing a sell, but MACD is showing, we will skip the trade and look for another opportunity.

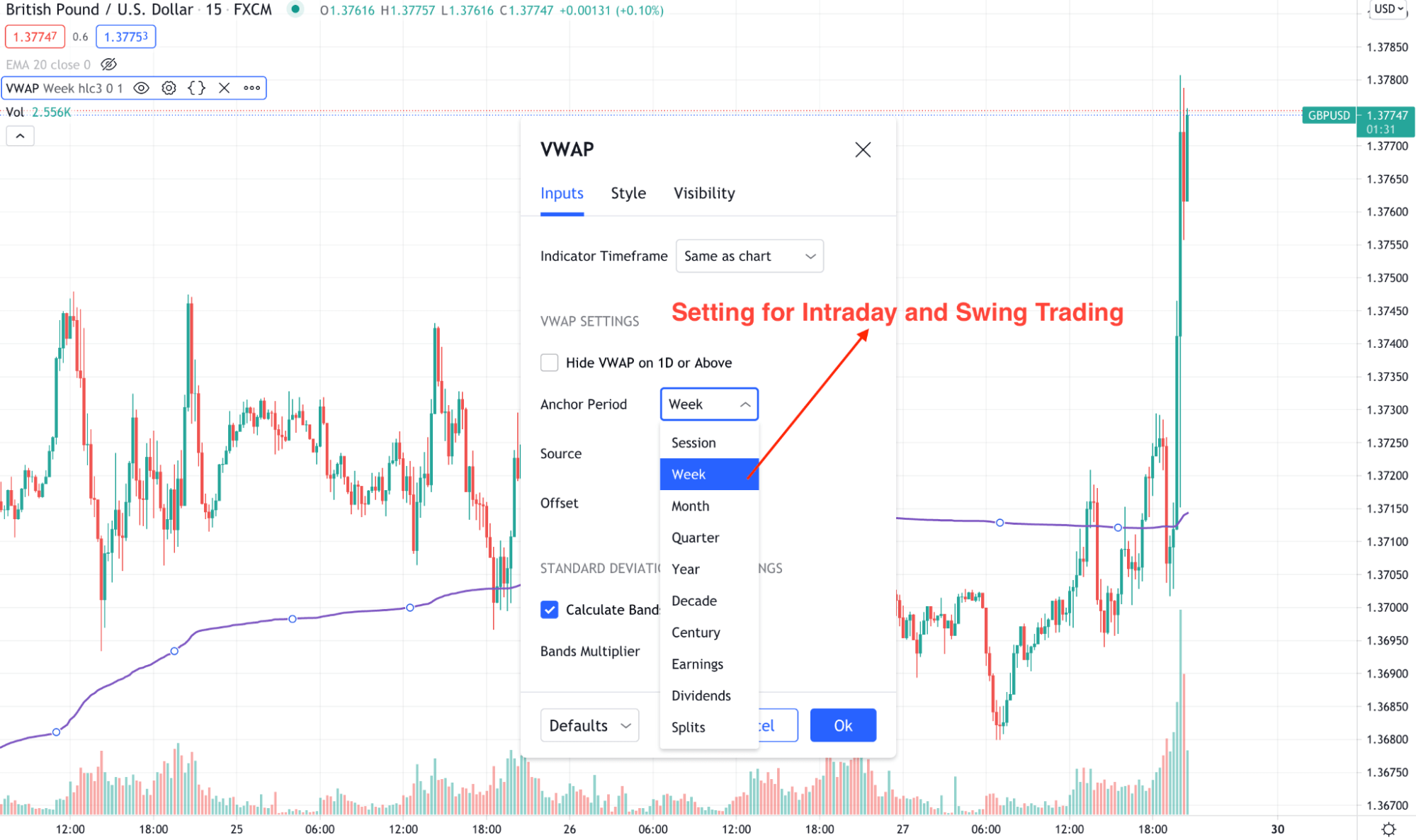

Besides, the perfect setting on the VWAP is important where traders should set the Anchor Period to Week and source to HLC3.

GBP/USD chart

This indicator has an upper and lower band from where the significant price reversal happens. Therefore, we will use the VWAP to find the minor reversal and major continuation trade in the long-term trade. On the other hand, in short-term trading, we will stick to the main bar.

A short-term strategy

This method is straightforward, where we will use the VWAP and dynamic 20 EMA to find the most reliable price direction. But, first, we need to find the market direction by looking at the chart. You can easily do it by focusing on where the movement started and where it may go.

Let’s see trading elements on this strategy:

- VWAP (weekly, HLC3)

- 20 MA (exponential)

- MACD (default)

Besides, we will use support-resistance levels and market context to eliminate the unusual market swing.

Best time frames to use

As an intraday method, you can use it on the m5 and m15 time frames.

Entry

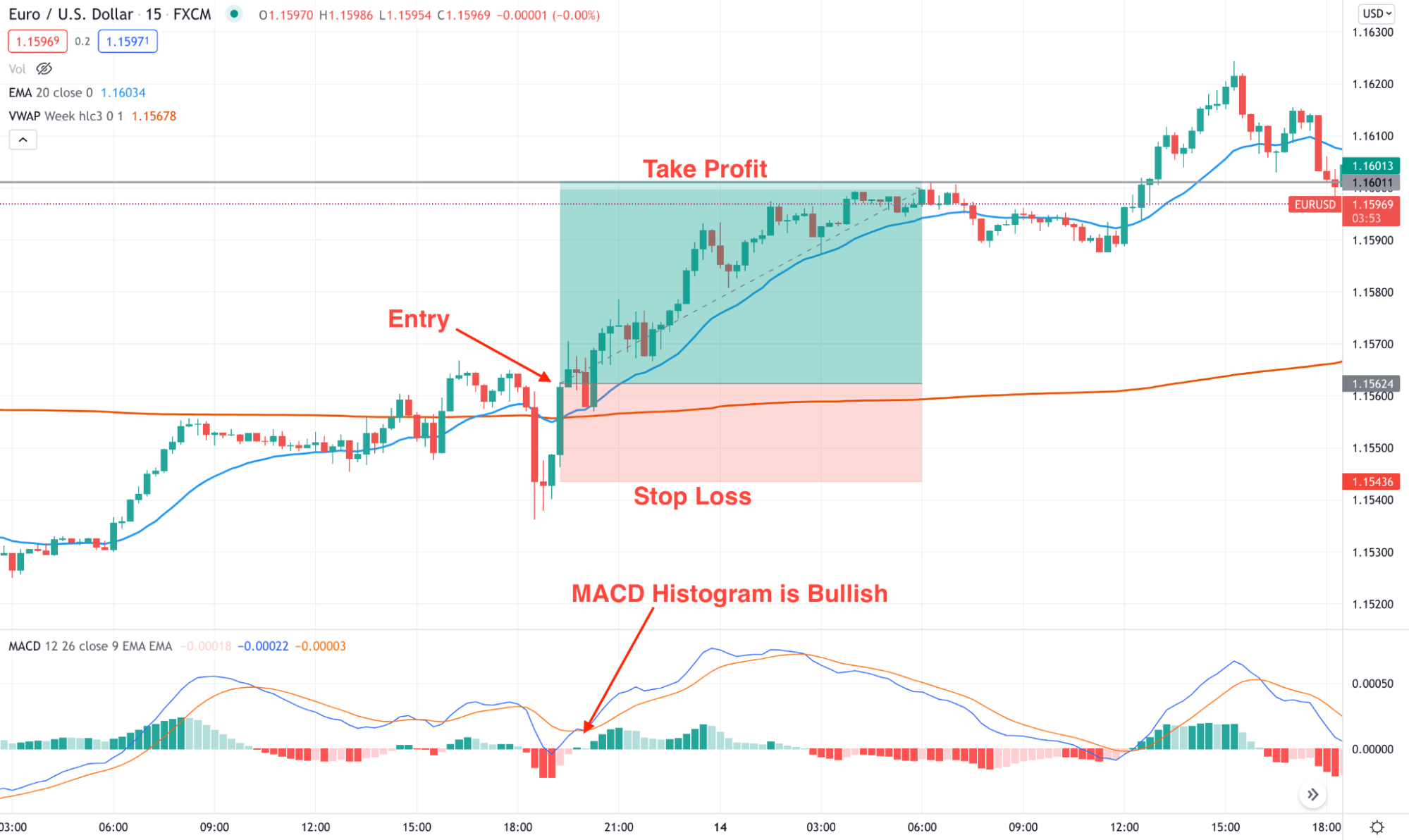

Conditions for a valid buy entry:

- A candle moved above the dynamic VWAP and closed with bullish pressure.

- 20 EMA supports the bullish movement.

- MACD histogram turned bullish/ regular, or hidden divergence formed.

- The activity should come after the London open swing.

Short-term entry

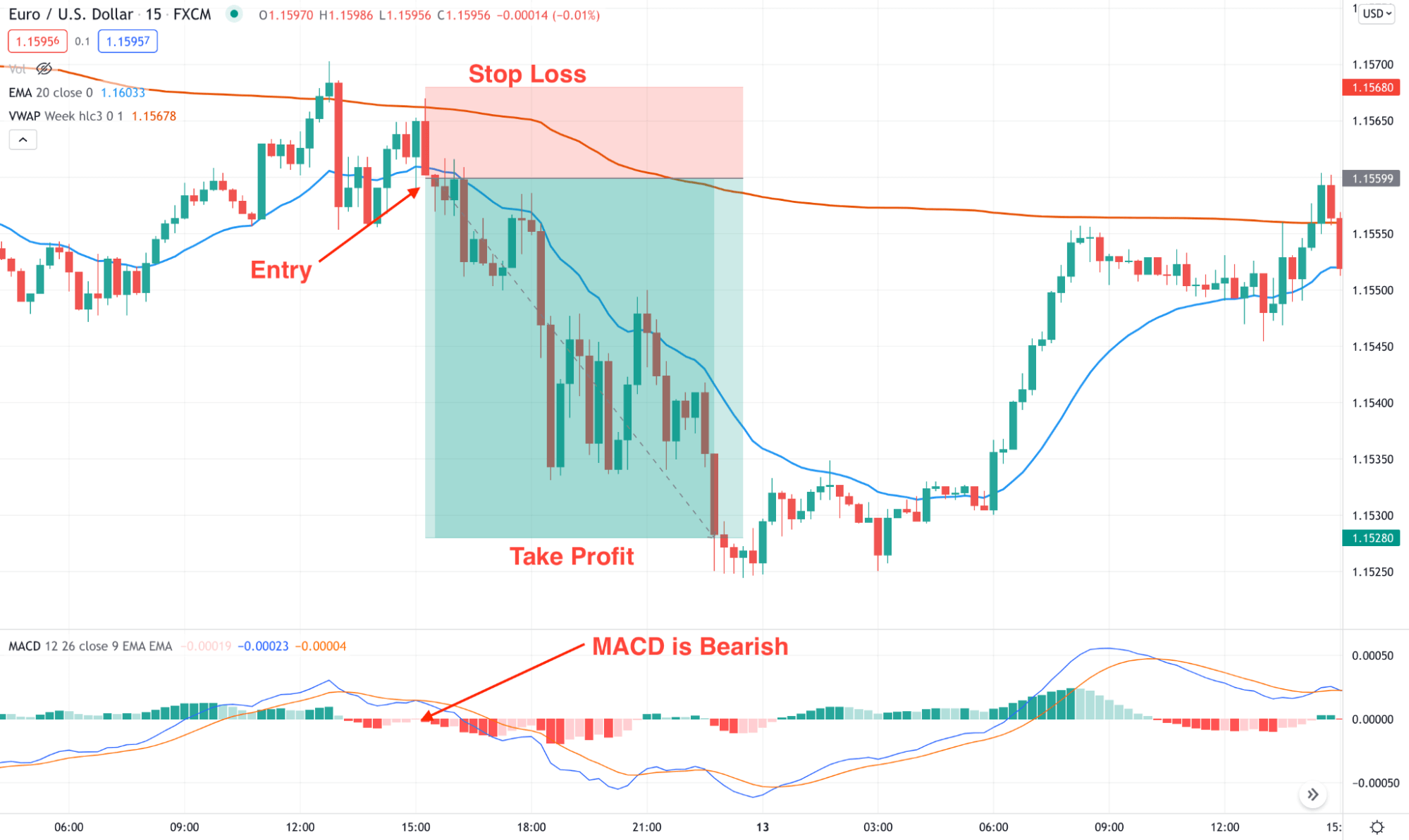

Conditions for a valid sell entry:

- A candle moved below the dynamic VWAP and closed with bearish pressure.

- 20 EMA supports the bearish movement.

- MACD histogram turned bearish/ regular, or hidden divergence formed.

- The move should come after the London open swing.

Short-term entry

Stop loss

The aggressive approach sets the stop loss above or below the candle that breaks the VWAP level. However, traders can choose intraday swings to set a conservative stop loss.

Take profit

As it is a short-term trade, try to close it within the US closing. However, you can close immediately after getting a considerable profit.

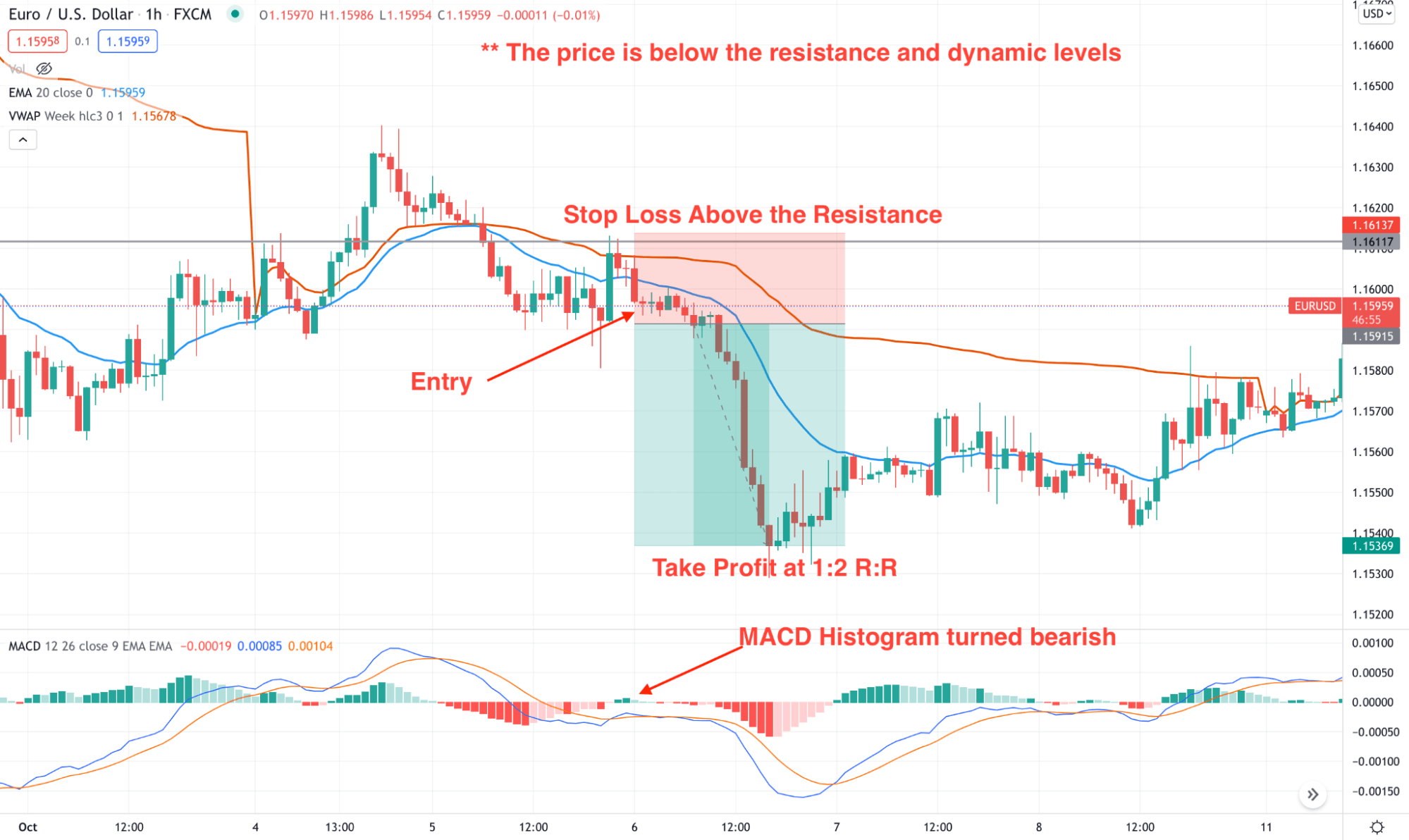

A long-term strategy

The long-term method works well in the H1 time frame by allowing investors to eliminate the intraday price fluctuations. Therefore, we will open the trade when the price moves above or below the VWAP and 20 EMA on the H1 time frame. Moreover, using indicators like MACD or RSI would increase the probability.

Best time frames to use

This method is suitable for swing traders and day traders, so using the H1 time frame is recommended.

Entry

The trading entry is valid if an H1 candle moves above or below the VWAP and 20 EMA close. First, however, traders should match the direction with the major trend by using the support and resistance and MACD.

Long-term entry

Stop loss

The stop loss should be above or below the breakout candlestick with some pips gap.

Take profit

Traders should close 50% of the trade if the price reaches the upper or lower band of the VWAP. Then, later on, you can close the full-trade after finding a reversal point.

Pros and cons of the VWAP intraday strategy

The VWAP strategy is very profitable, but it needs to have a clear idea about the pros and cons to make a proper trading decision.

Pros |

Cons |

|

|

|

|

|

|

Final thoughts

Now we are at the end of today’s lesson. We have seen the details of VWAP with the exact buying and selling method. However, it would help if you remembered that success in financial trading depends on utilizing your fund in any trading method. Therefore, a good risk management and trade management system might bring you a win from the VWAP trading.

Comments