In forex, we have a tremendous number of approaches and strategies that any trader can use. We have such a vast number of methods because every trader makes his techniques. Once these strategies work, traders share them in communities and forums for other market participants to use.

But the big question is how much of them always work?

This is using the top-down approach to master any trend trading. Now why trend trading? Almost all the traders and investors believe going with the trend is half the battle won. So, let us dive into the article to know how to use this top-down system to trade FX.

What is the top-down approach?

Retail traders make money from small fluctuations in the market, but it is not the same in institutions and banks. Big sharks can move the market in one direction for a long time.

Say, for example, the market is in the uptrend, and you took a sell trade, assuming the market will reverse. Still, it did not happen, and the market continued the up movement. Then, in hope, you started adding more sell positions by going against the trend, eventually blowing off your account in no time.

The top-down strategy is straightforward to understand and use. It revolves around the philosophy of using multiple time frames (TF) to know the overall market direction.

In this strategy, you will first see the trend in the weekly, daily time frame, followed by 4hr, 30 min, and 15min. We emphasize more on the 4hr time frame as it is where the patterns are more visible.

How to trade using the top-down approach?

You need to remove all the indicators from your chart and keep the candlesticks. It is that it will not conflict with the other signals and give you a reasonable market scenario. The best time to do this is on the weekend when the market is settled, and you can plan for the coming week.

For this method, you need to ensure what trading style you want to use — day trade, swing, or positional. If you are a scalper, this method is not for you; as in scalping, you need to use a lower time frame, say 5min or 15min.

For day trading, you need to use daily, 4hr, 1hr, and 30min or 15min, and for a swing trade, you need to use weekly, daily, and 4hr. For positional traders, you can use monthly, weekly, and daily charts. Here you would have noticed that the longer the position, the higher the time frame you will use.

Day trading using the top-down approach

First, you will check the overall trend by moving to daily TF and analyzing the highs and lows. If it’s a bullish trend, you will look for buys, and if it is a bearish trend, you look for sells.

For day trading, you mainly need to know what’s happening in the market daily. For this, you will first select the daily time frame, draw your support levels and bullish trend lines for a bullish market, and resistance for a bearish market, using horizontal lines.

The support or resistance on daily TF will give you the significant S&R level, so please do not remove or alter it while moving to the lower TF.

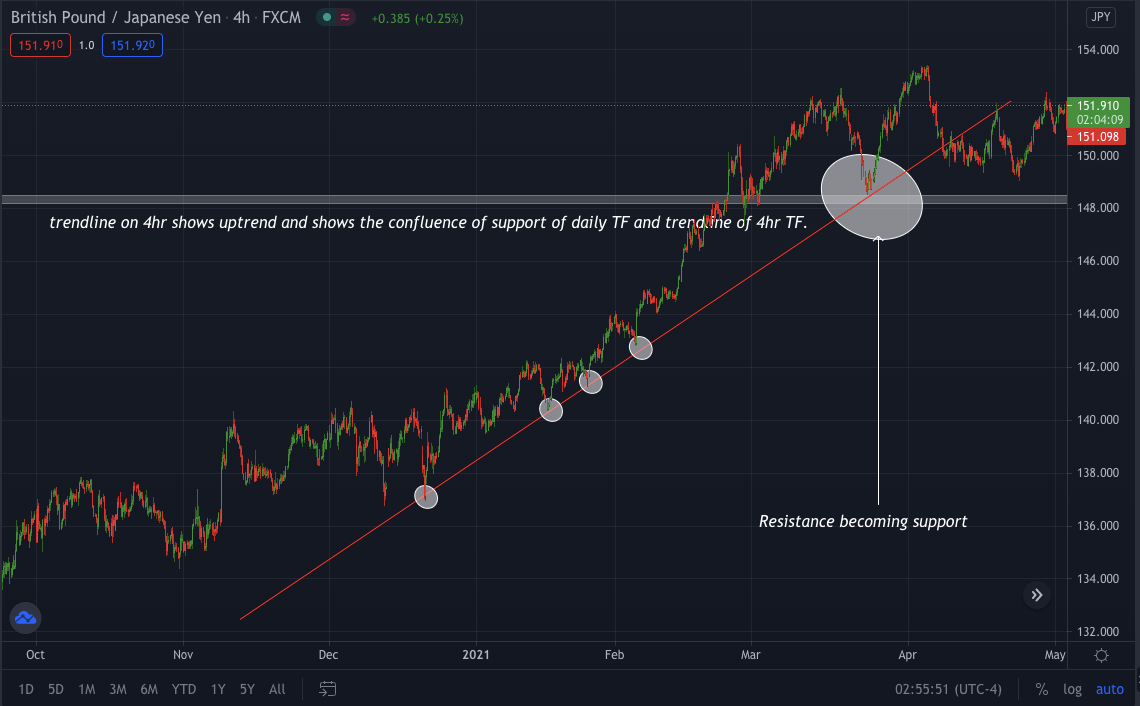

Once daily TF is marked, you can move to 4hr and draw your S&R levels according to the market trend using horizontal lines. Moving forward, you will change your chart to 1hr TF and mark your S&R levels, trendlines.

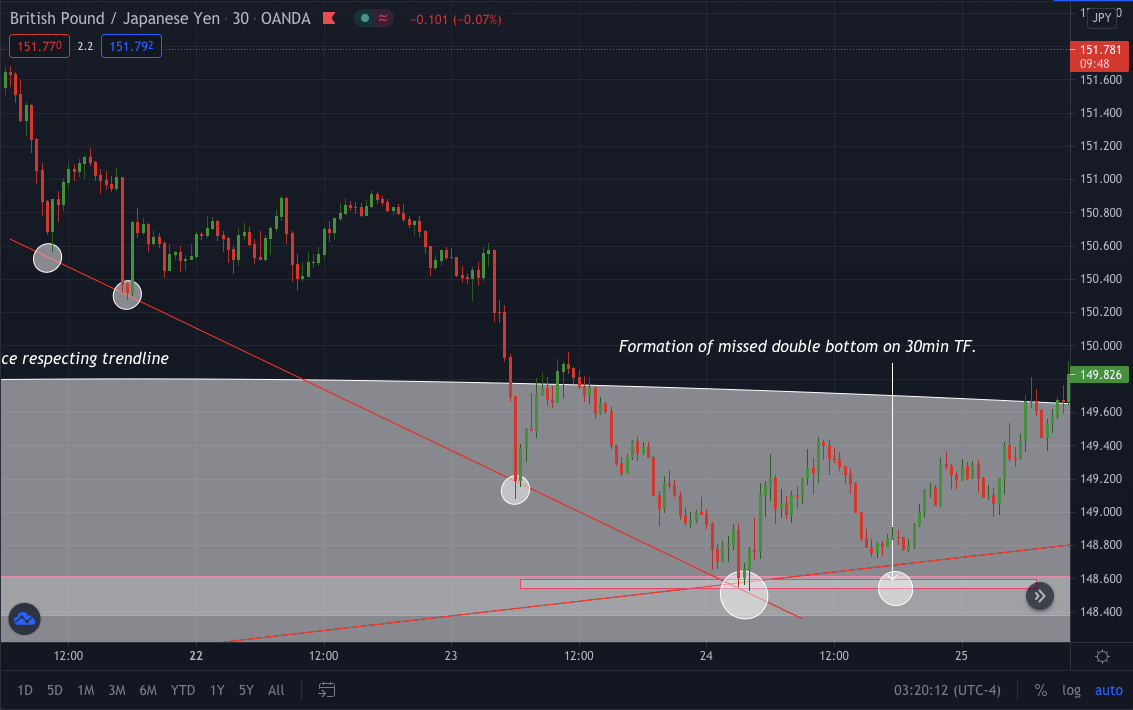

Finally, when you have your S&R and trendlines, you can move to 30min to look for rejections and execute your trades.

Swing trade using the top-down approach

For swing trade, you will use the same approach as day trading weekly, followed by daily and 4hrTF.

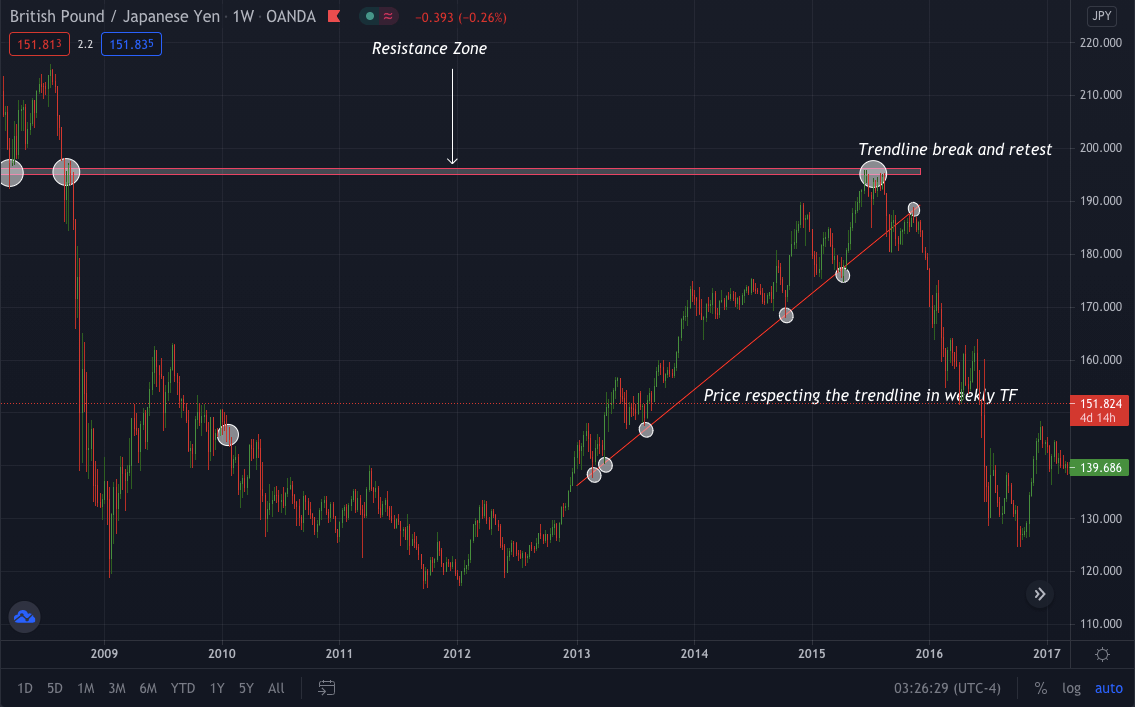

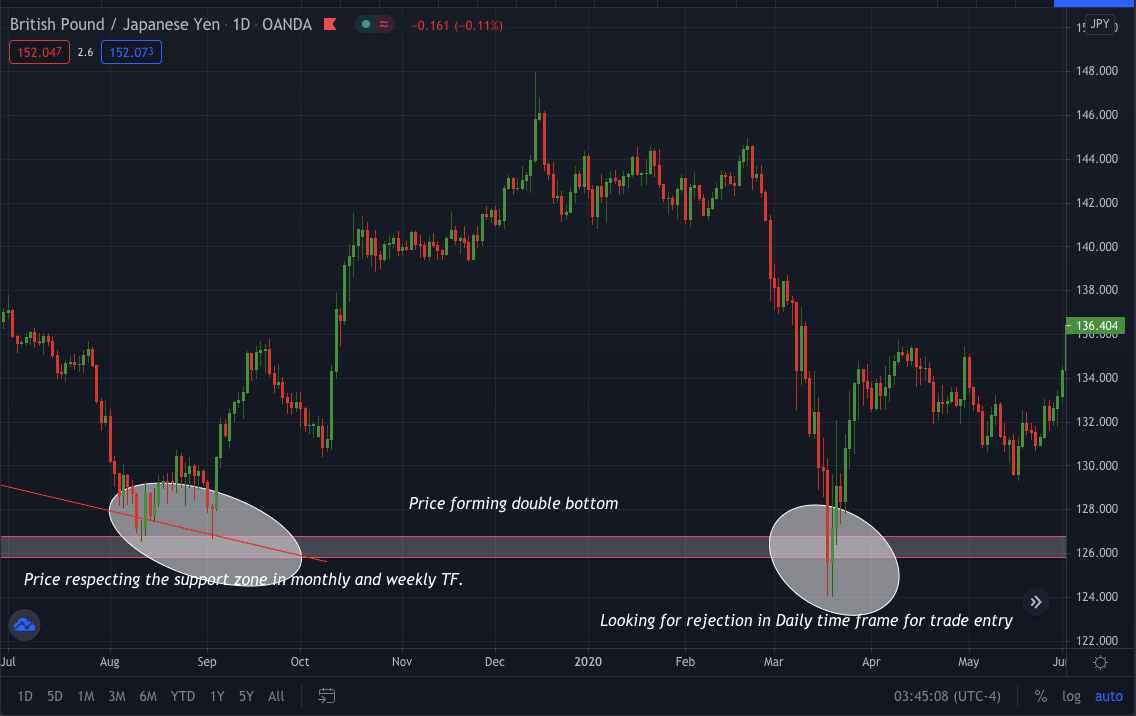

| Weekly TF analysis |

|

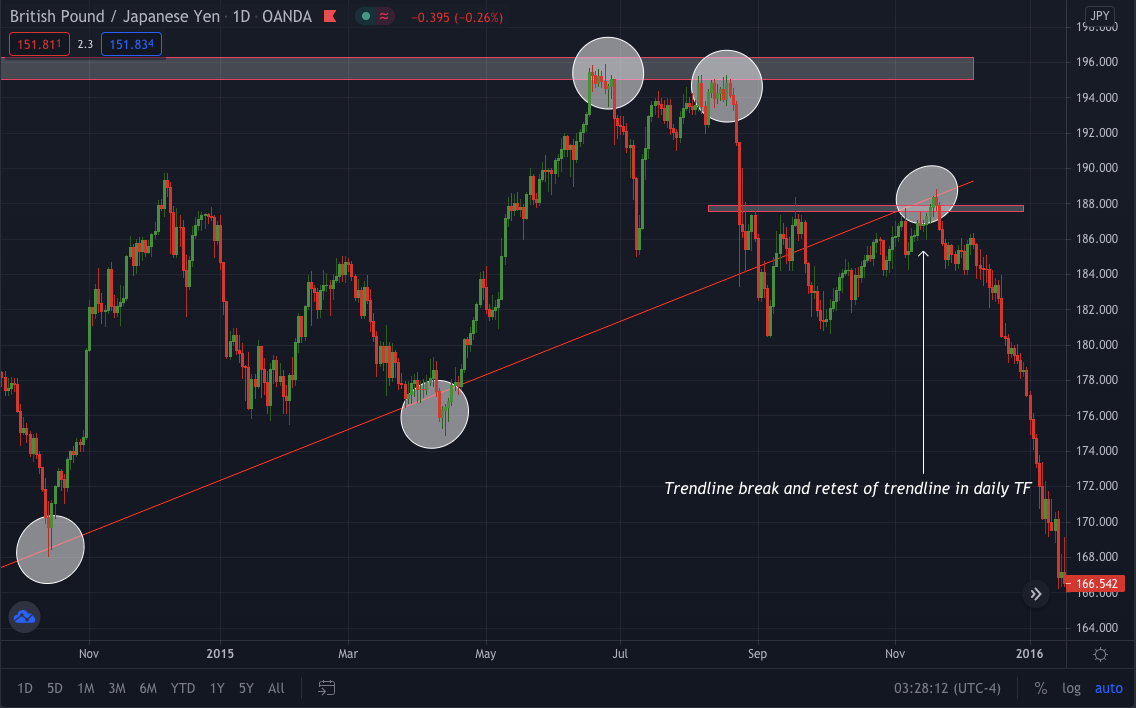

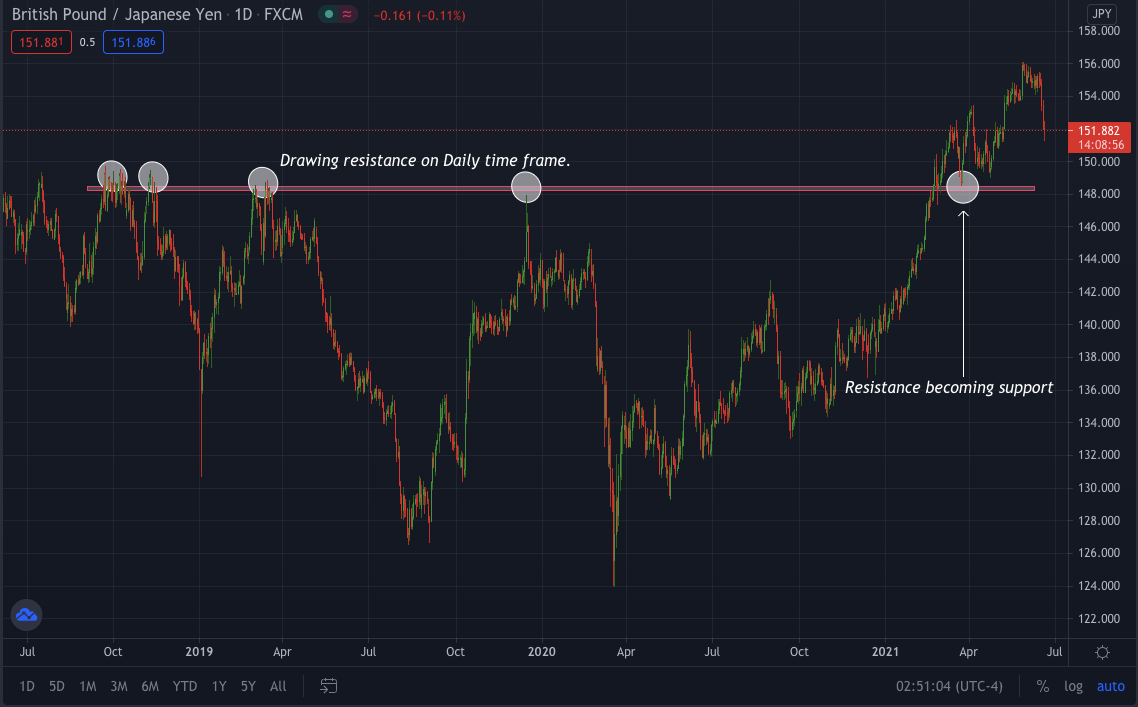

| The daily TF for trade confirmation |

|

Positional trade using the top-down approach

For swing trade, you will use the same approach as day trading but monthly followed by weekly.

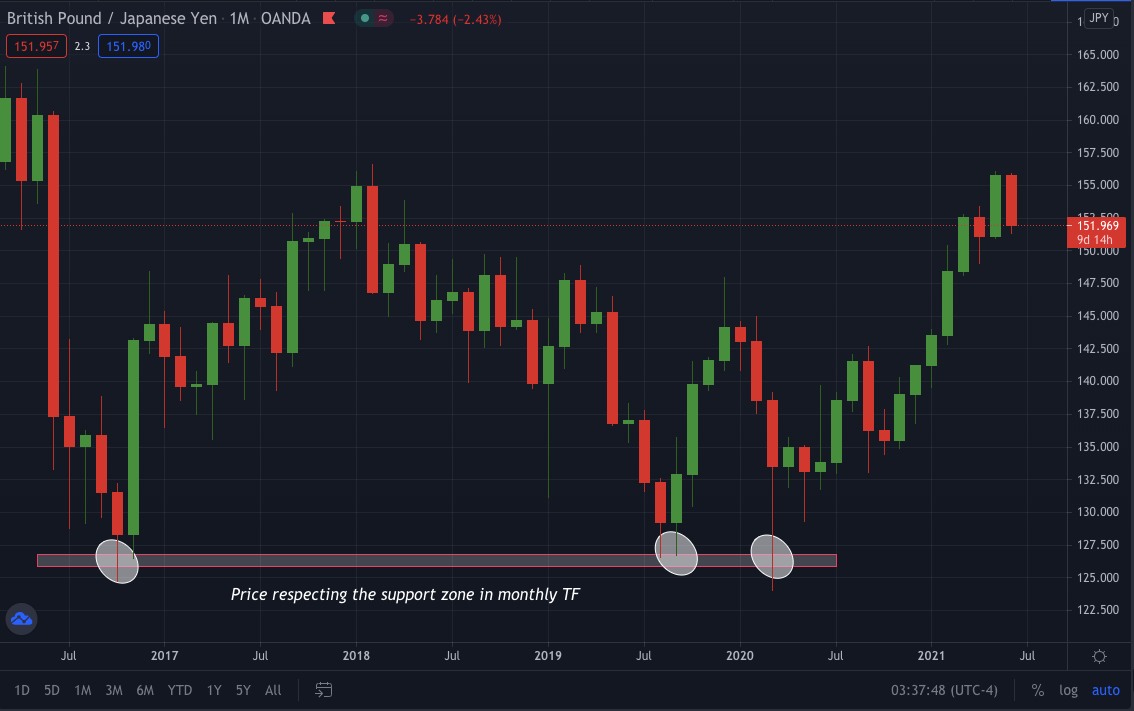

| Monthly TF analysis |

|

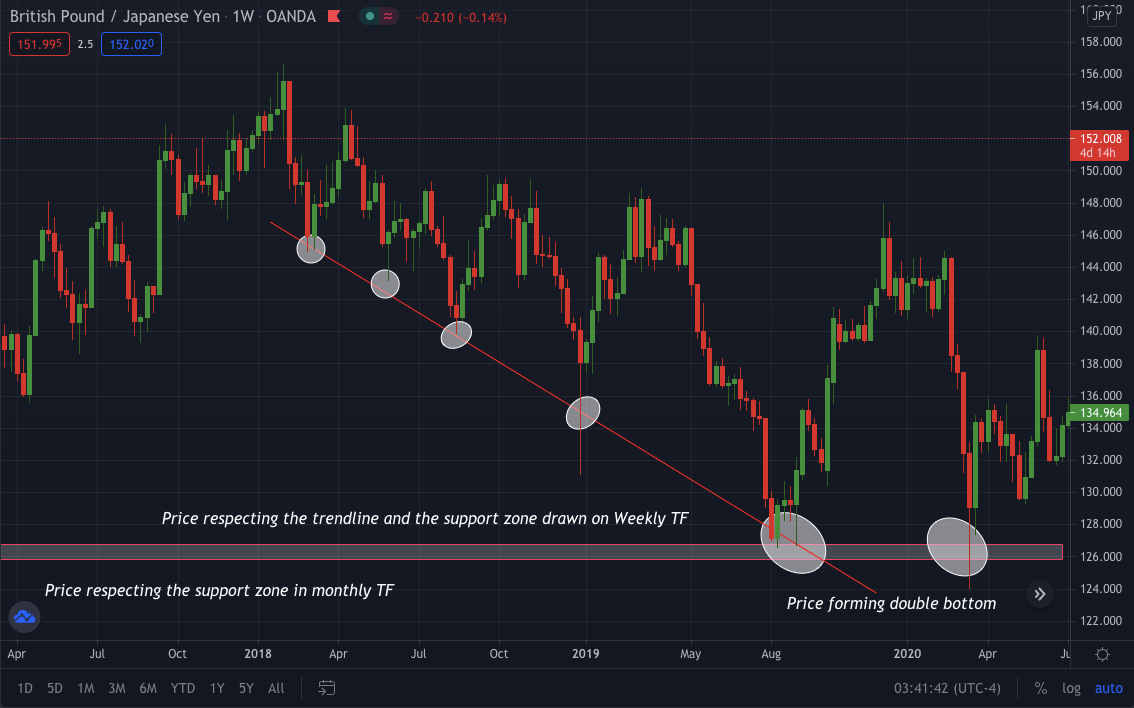

| Weekly TF analysis |

|

| The daily TF for trade confirmation |

|

Limitation

There is no drawback of the top-down approach as such, but it does have some limitations. As most of the time, you will get the correct predictions, but a very volatile market will break the support, resistance, and trendline. These levels or zone breaks can also be fake, stooping you out of the trade.

Conclusion

Using the top-down trading approach will give you an added advantage in your trading by raising your winning strike. Traders can use this strategy in addition to indicators for confluence.

Once you know the overall trend, you need to keep your eyes on the candlestick pattern formation like the double top, double bottom, head and shoulders. In the top-down approach, you move to a lower time frame to look for rejections near the support and resistance as a confirmation.

As trading is risky, nothing is 100% here. You need to use proper risk management in any trade setup.

Comments