Arbitrage is a profitable trading strategy where trades can make profits without having direct participation in the technical analysis. It is easy to make money by looking at the price difference of the same stock on different platforms. You can easily see the price list online and initiate your trading activity.

Making money from convertible arbitrage needs close attention, especially the current rate in different exchanges. Later on, you should follow a simple calculation to get the instant profit. The following section will see the complete convertible arbitrage trading guide, including an exact trading method.

What is convertible arbitrage?

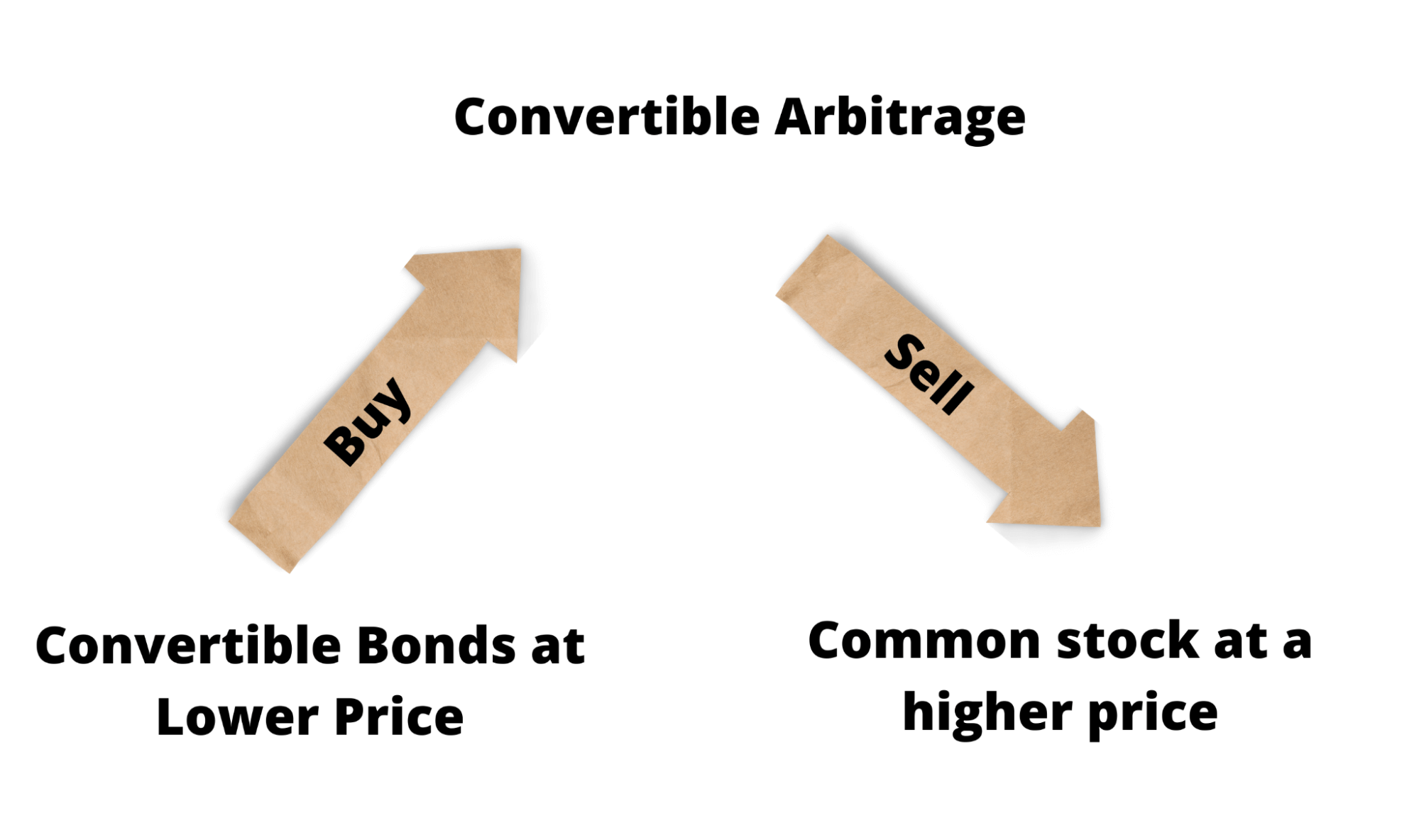

Like other methods, arbitrage is a process to make money from financial trading. Arbitrage happens when the price of a trading instrument is trading at different prices on different platforms. This process includes buying an asset from a place with a lower rate and selling it at a higher rate from another platform.

Arbitrage strategy follows the classical trading method: buy at low and sell at high. Now move to an example of arbitrage trading in the financial market:

Let’s say a stock is trading at $10 on the LSE. At that time, the same stock was trading at $12 on the NYSE. Therefore, if you buy the stock from LSE and sell it at NYSE, you have made an arbitrage with $1 profit for a single trade.

Although the method looks simple, it includes advanced technologies to find the opportunity as early as possible. Moreover, modern technology allows brokers to provide nearly the same price that reduces the arbitrage opportunity. Therefore, you will not make profits all the time, and there is a possibility of making losses.

How to use convertible arbitrage in trading strategy?

Convertible arbitrage is a long-term trading method suitable for hedge funds and institutions to get a lower degree of risk in every trade. In addition, it will open profit possibilities if the price of a trading instrument keeps falling.

On the other hand, if the stock keeps moving, the short position will be capped since the profit on convertible securities is offset. In the case of trading at part, the debenture or convertible securities will keep profit at the coupon rate. Therefore, it will ultimately offset the trading cost on the short stock.

The hedge ratio is an essential factor in convertible arbitrage trading that a trade should not ignore. It compares the position value and the whole hedge compared to the place.

For example, if you invest $10,000 in foreign equity, you can consider the investment as a forex risk. Therefore, if you use $5,000 of the equity as a currency position, the ratio would be 0.5. In this way, you can eliminate 50% of the investment from the exchange rate risk.

A short-term strategy

In the convertible arbitrage trading system, investors should have a clear idea about the different markets. You can limit the loss from forex to stock or stock to bonds or debentures.

Like traditional bonds, convertible bonds pay regular income through dividends, but it acts as a trading instrument in the financial market. For example, if the $1,000 convertible bonds have a 7.5% interest rate with an opportunity to convert into 25 shares of stock. If the stock price moves above $40, convertible holders will make more money than ordinary shareholders.

Convertible arbitrage

Best time frames to use

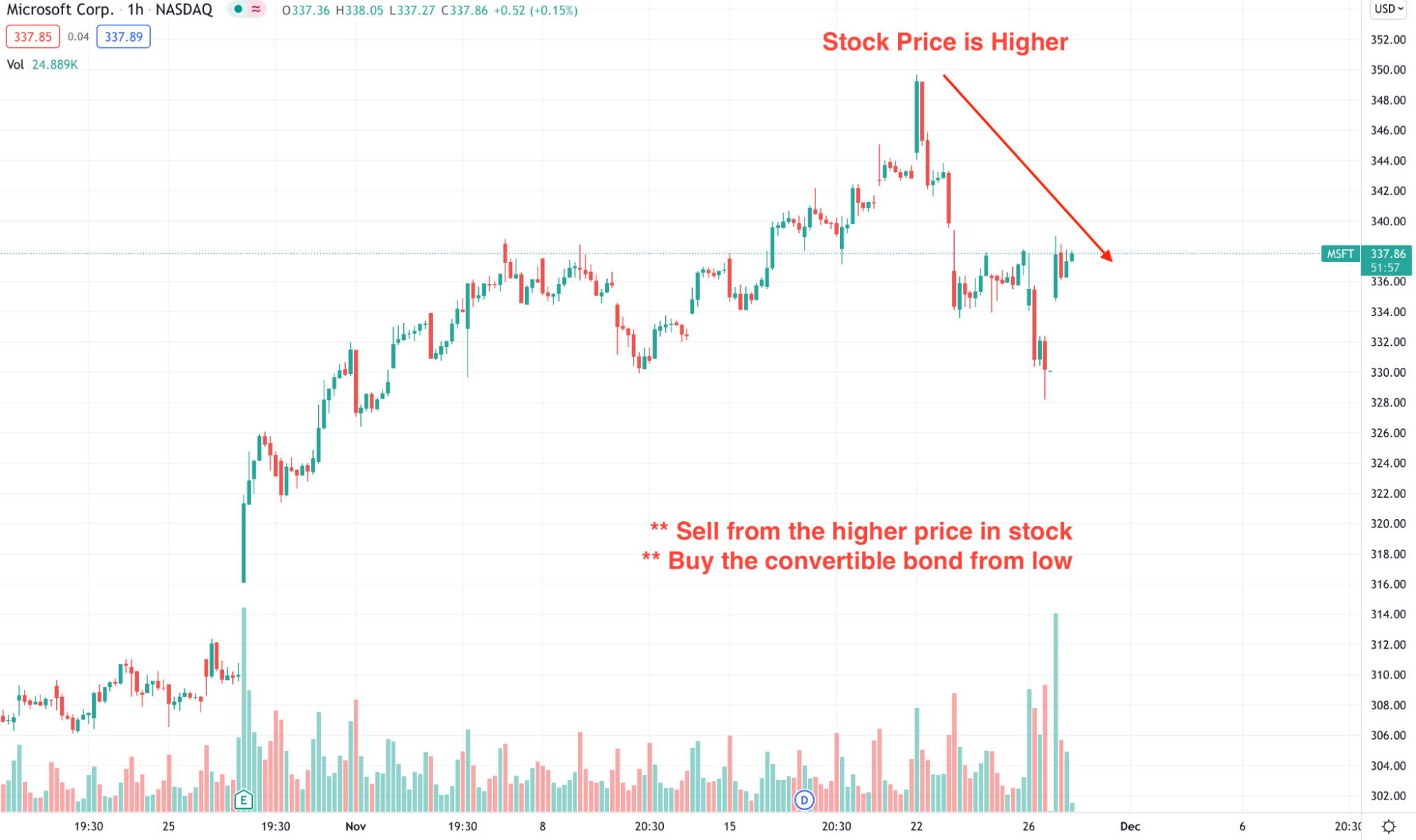

As it is short-term for trading, sticking to time frames from one minute to 1-hour chart is profitable.

Entry

In this approach, traders should use the technical analysis knowledge to find a buying and selling opportunity at a time in a particular company’s stock and bond.

- Find a convertible bond that is selling at a lower price than it should trade.

- Find that the company’s common stock trading at a higher price.

- Open a buy position in the convertible bond and a buy position in the common stock.

Stop loss

In this method, inventors can earn profits from booth buy and sell trades. You can hold the trade until the negative movement reaches an intolerable level. In that case, using a stop loss level based on support-resistance level is good.

Take profit

The take profit level for this method depends on how long the divergence between the convertible bond and the common stock remains alive. Therefore, mark the near-term critical static level, and when the price reaches any important area, make sure to book some profit.

A long-term strategy

The long-term approach is almost similar to the short-term method, but the long-term method needs the broader market outlook where gain and risk are higher than the short-term trading.

The idea of long-term trading is the same, where investors should buy the convertible bond from a lower price and sell the common stock from the higher price to gain profits from both sides.

Best time frames to use

It is a higher time frame, so trading any trading chart from H1 to daily would be a good investment opportunity.

Entry

Follow these steps in the higher time frame to open a convertible arbitrage strategy:

- Find a convertible bond that is selling at a lower price than it should trade.

- Open a buy position in the convertible bond and a buy position in the common stock.

Stop loss

Set the stop loss based on near-term levels.

Take profit

After opening the buy and sell trade, draw important static levels from where the price may reverse. Then, later on, close the trade if the price shows any rejection from those levels.

Convertible technique from the chart

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

Convertible arbitrage is a profitable trading method that includes everything you need to know to enrich your trading career. You can implement this method to earn quick profits from the market or have it as a partial strategy besides your regular trading method.

Comments