In the fast world of financial markets, you don’t have to take a traditional approach every time. Sometimes you need a different trading approach to add a bit of flair to your trading. And you are ending up with winners in the process.

When searching about these kinds of strategies, you’ll see that arbitrage trading pops up every time. This guide will explain all the nitty-gritty of arbitrage trading and how you can play some of its strategies.

Arbitrage trading explained

Arbitrage is when you buy or sell an asset to gain from the price difference. The prices you see on your trading platform differ from institutional prices. However, there’s a minor gap between both prices, and that’s where the profit factor kicks in.

You buy low through institutional pricing and sell at regular prices. It’s like a traditional “buy low, sell high” style, but with a topping of automation.

A trader who deals through arbitrage is an arbitrageur. The concept of arbitrage is well-suited for the FX market rather than stock or other markets.

Why may you be asking?

The thing with forex is it is a decentralized market. So there exists a gap between the price you see on your platform and central bank prices. As an arbitrageur, you search up the central banks’ price and sell it high on the market.

Everything happens in a matter of seconds in arbitrage trading. You blink an eye, you yawn, or your dog distracts you, gone. Often many traders consider arbitrage trading a “risk-free” strategy.

Let’s illustrate arbitrage trading with an example

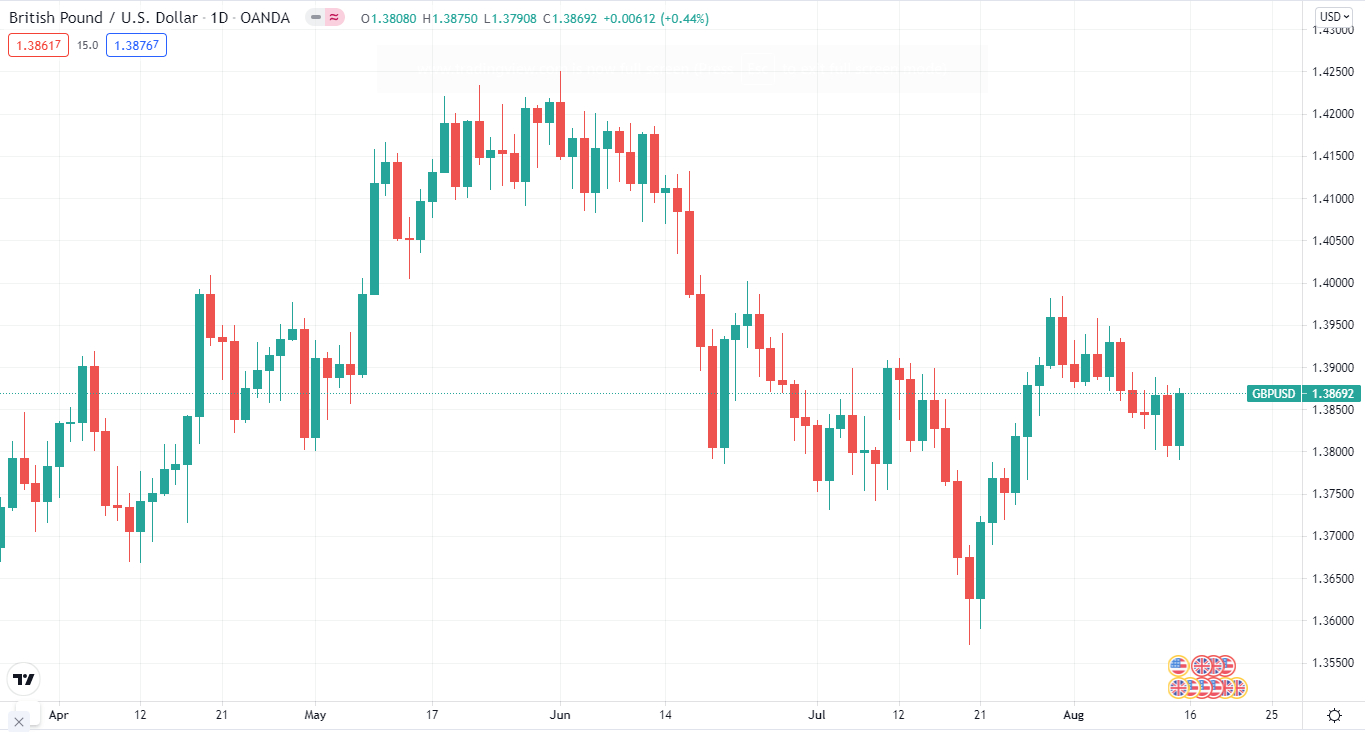

Suppose you see the price of GBP/USD at 1.3869 on your platform. You did some digging and found out that the Bank of London is quoting the price at 1.3868. You would buy at Bank of London rates, sell it in the market, and make a cool one pip profit.

GBP/USD

Now you may be thinking: “Only one pip. I can make it without doing anything.” Well, arbitrage opportunities frequently occur so that these small profits can add up big at the end of the day.

But here is the thing with arbitrage, you are not the only smart cookie out there. Many large financial institutions also join the arbitrage party, and with all the resources, they profit more than a retail trader.

The importance of arbitrage

With everyone rushing to the market like a “gold rush,” arbitrageur boosts markets’ efficiency. You see, as traders buy and frequently sell, the difference between institutional pricing and regular pricing shrinks. This way, liquidity increases, and retail traders get more hold of the market.

All of this sounds like a fairy tale, but how can you find price differences?

Well, you can do this with the help of an arbitrage calculator. Think of it as a standard calculator that tells you the price differences. The best thing is you don’t need to spend thousands of dollars for the calculator; almost all brokerage firms have it.

How to trade with arbitrage strategies?

Now that you understand the concept of arbitrage trading, let’s find out how you can implement some of its strategies.

1. Arbitrage algorithmic trading

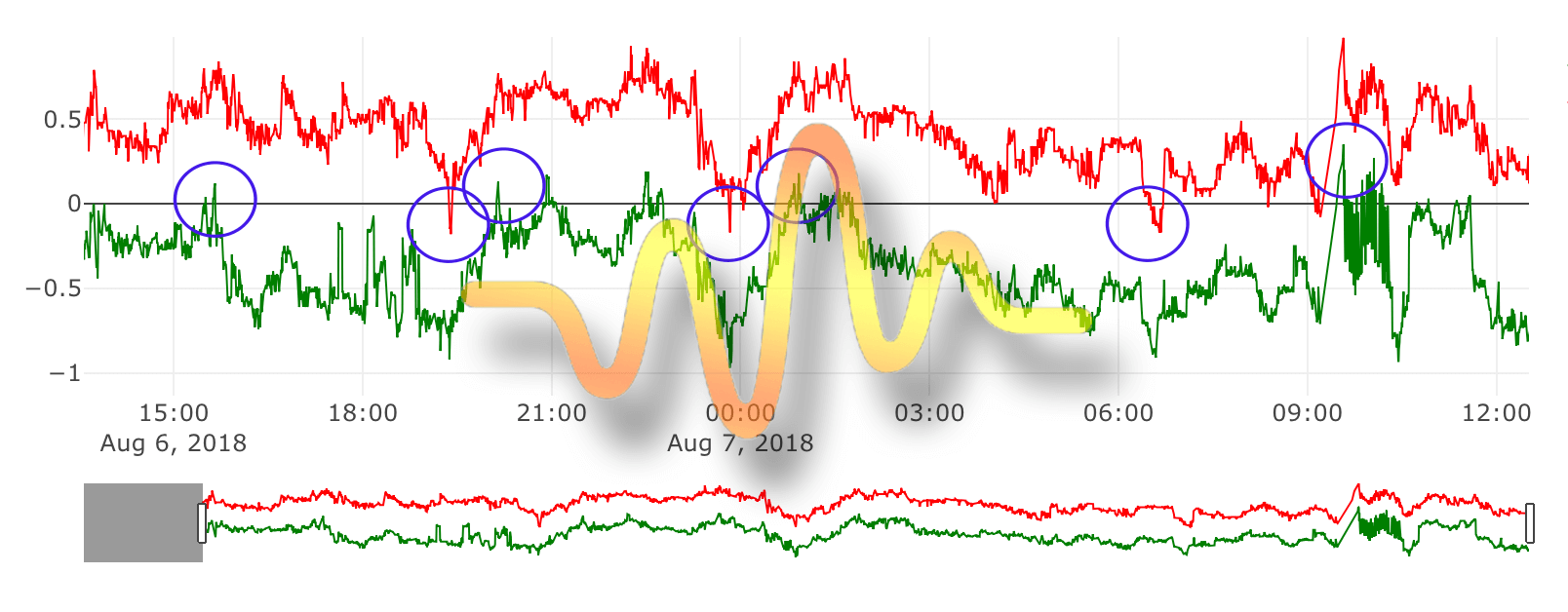

While working on arbitrage trading, you often need to apply automated trading. You can do this step with algorithmic trading. As the name suggests, algorithmic trading applies an algo to automate the trading process.

An algo consists of mathematical models that go deep into the historical data and execute trades according to it. You don’t have to do anything with arbitrage algorithmic trading, as everything is automated. This removes the stress of looking at the charts every second.

2. Arbitrage covered interest rate

This is probably the most simple arbitrage strategy. In this approach, you pick a strong currency like the USD, or GBP, and then sell it as a forward contract. Your profits come from the difference in the exchange rate. Covered interests can be a bit of a hassle if you don’t know much about forwarding contracts.

So, you can choose an uncovered interest rate strategy. With this, you can buy and sell without any contract. You buy the currency at a lower rate and then sell it at a higher rate. But an uncovered approach comes with more risks. This only works if the more significant interest rate currencies don’t drop the interest rate gap.

If they do, the uncovered strategy loses money, as when the exchange rate converts, it values less than the original amount.

3. HFT

HFT trading wasn’t a thing in the past, but since its development in the late 1990s, it has become a big thing in financial markets. HFT, aka high-frequency trading, involves automation to execute trades. Because of its ability to solve complex data in a matter of seconds, HFT combined with arbitrage is a perfect combo. This is a set-and-forget strategy. All you have to do is to set up a high-frequency trading outfit and sit back and relax.

However, with institutions having a faster and better computer, HFT arbitrage may not work for you.

Are there any drawbacks of arbitrage trading?

Remember, we mentioned earlier that arbitrage is a “risk-free strategy.” However, as no strategy is perfect, arbitrage has its flaws also. Arbitrage opportunities frequently appear on the charts, emerge in seconds, so a delay in execution means a missed chance.

If your trading platform is a bit slow, then good luck implementing arbitrage, as you’ll miss all trading opportunities. As an arbitrageur, you need to buy currency at a risk-free rate. However, this is only possible for large financial institutions. Even small banks and brokerage firms can’t trade at a risk-free rate.

Final thoughts

So, there you have it — arbitrage trading activeness on the trader’s part. Blink or sneeze; you’ll miss an opportunity.

But considering all the arbitrage strategies, algorithmic trading can play best for you. First, it digs deeper to present you with profitable trades, and second, it removes emotions from trading.

Comments