This trading system is a very profitable strategy based on the ATR band indicator for MT4. This indicator is more likely to combine two well-known ATR indicators (Average True Range) and Bollinger Bands.

This strategy is effective at every major or crosses currency pairs in 15 mins or higher time frames. Thus, this strategy is suitable for any level trader from entry-level to pro.

ATR Channel Breakout trading system

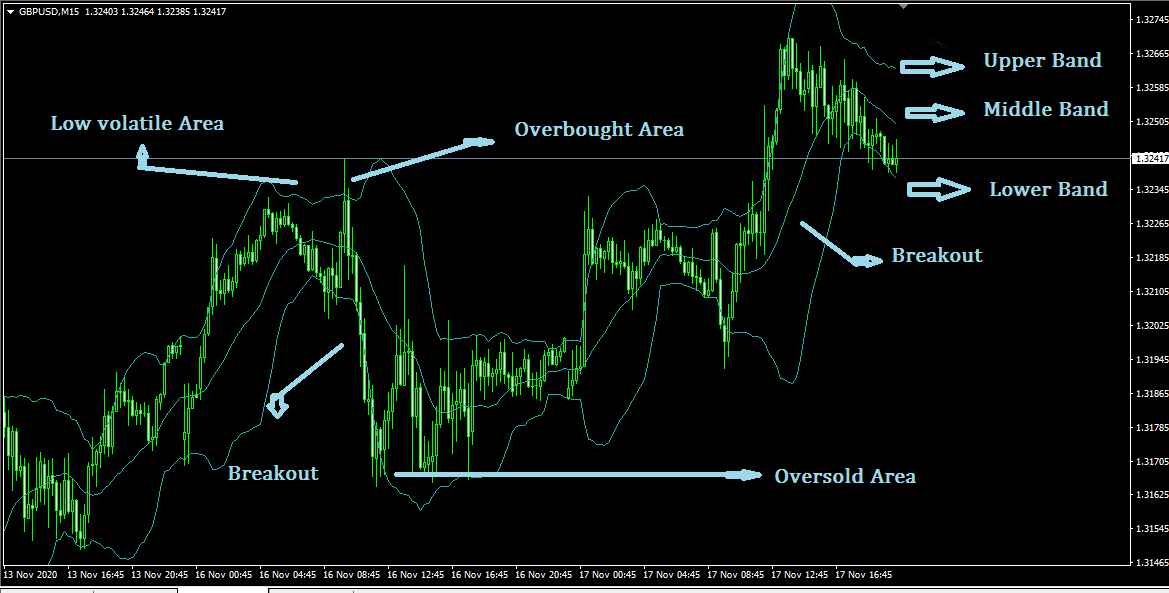

It is the strategy where ATR provides volatility to the price. Professionals use many volatility indicators for decades to get better trading results. Volatility measurement came from price changes at a certain number of periods and profit by the volatility cycle.

We will see a transformation or up-gradation Bollinger Breakout System using the ATR for volatility measurement in this system. ATR doesn’t define the direction of the breakout but generally indicates meaningful breakout points. The center of the ATR channel is the additional Exponential Moving Average (EMA) of closing prices.

The ATR channel works like Bollinger Bands to determine the entry and exit points of trading positions.

The upper bands remain above the price and work as a dynamic resistance level, while the lower bands stay below the price and work as a dynamic support level.

- When the price crosses the upper band, it’s possibly an overbought condition.

- When it crosses the lower band, it commonly indicates an oversold market condition.

Besides, when the upper and lower bands get closer together, it identifies low volatility or consolidating phases of the market.

In most cases, a breakout occurs with a high volume from here. Breakout with higher volume is an indication that price will continue in the breakout direction.

Let’s have a look at trading preconditions for this strategy:

- Currency pairs: this strategy applies to all major and cross-currency pairs

- Tools/indicator: ATR channel

- Time frame: 15 mins or higher

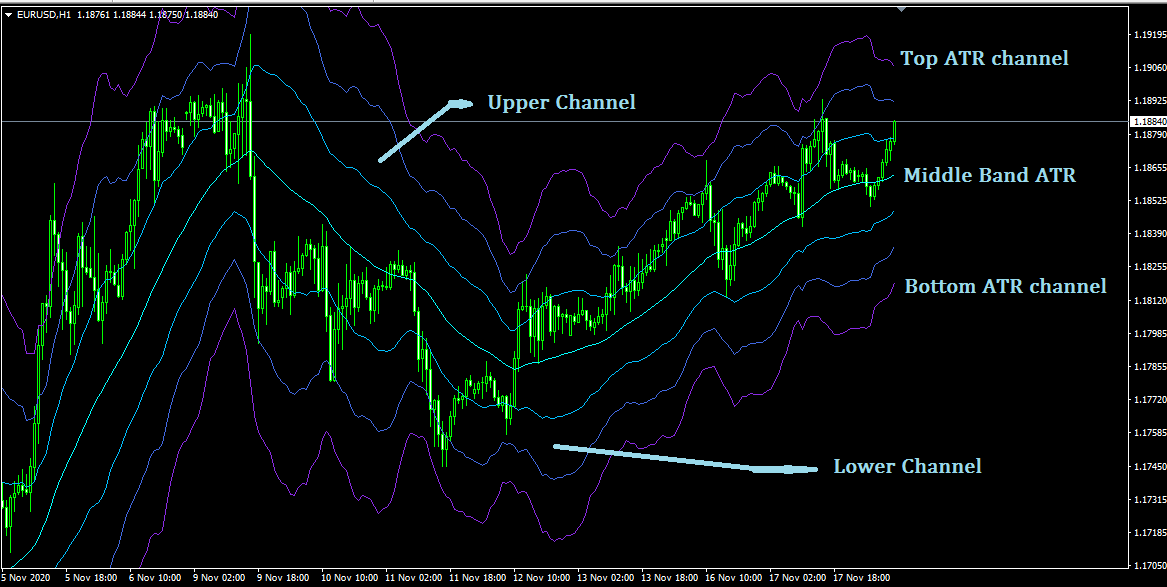

ATR Channel Breakout trading system is a straightforward and efficient trading strategy, similar to Bollinger Bands Breakout system with four, two upsides, two downsides, extra bands and ATR (Average True Range) in central.

The central band (ATR) enters or finds out the movement, bullish or bearish, of the price.

- When price crosses the ATR upside line and remains at the upper channel, it’s merely an uptrend market.

- When the price crosses the ATR downside line and remains at a lower channel, this strategy assumes a downtrend market movement.

When bands get closer, it is a sign that volatility is reducing in the price, and a breakout may happen soon. However, ATR Channel doesn’t indicate the breakout’s direction, just the area from where it may happen.

The center of the ATR channel is simply an EMA (Exponential Moving Average) of the closing price of a particular period where the width of the channels (upper or lower) or other bands defines the range/volatility.

Since this system is built on some basic and obvious market movement attitudes, this strategy applies to any significant or cross pairs at time frames 15 min or higher.

As per John Bollinger, “high volatility begets low, and low volatility begets high” is a beneficial quote to remember for the traders who might use this strategy.

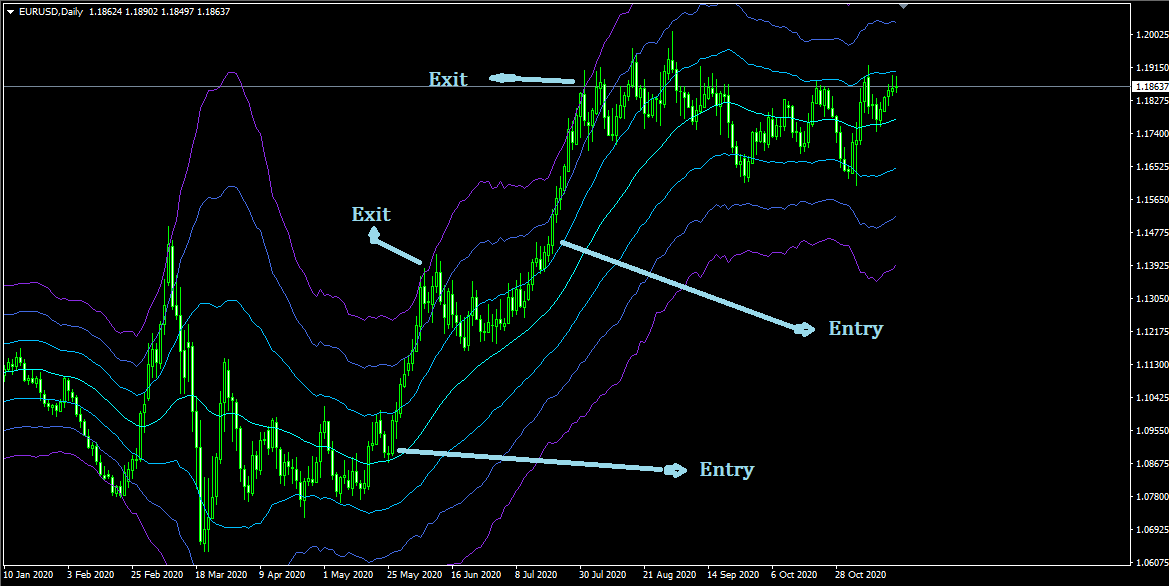

Bullish trading strategy

This is a straightforward strategy as the price crosses the middle band or upside and remains at the upper band channel until the phase or volatility of the market shifts.

When the price touches the ATR channel’s top upper band is an overbought situation and time to exit or hold a breath before placing another buy order.

Bullish trading conditions

- The price is moving higher in the higher time frame by creating a higher high in the price, pointing out that the overall market structure is bullish.

- The price closes above the middle band of the ATR channel. It is an indication that the bullish pressure in the price is starting.

-

Entry

After completing the trading condition, wait for a candle to close and enter the trade as soon as a bullish candle appears.

-

Stop loss

As it follows the strategy, we can expect the price to move higher as long as it makes higher highs. Therefore, the stop loss will be 2-3 pips below the first band ATR channel.

-

Take profit

In this strategy, we can expect the maximum benefit from the market. Therefore, we will focus on these rules to determine the take profit level:

- When the price crosses or touches the top ATR channel, it’s an overbought condition, and you can take some profit from this level or get out of the trade.

- If the price reaches some strong resistance or event level, we can expect some correction to close the full trade.

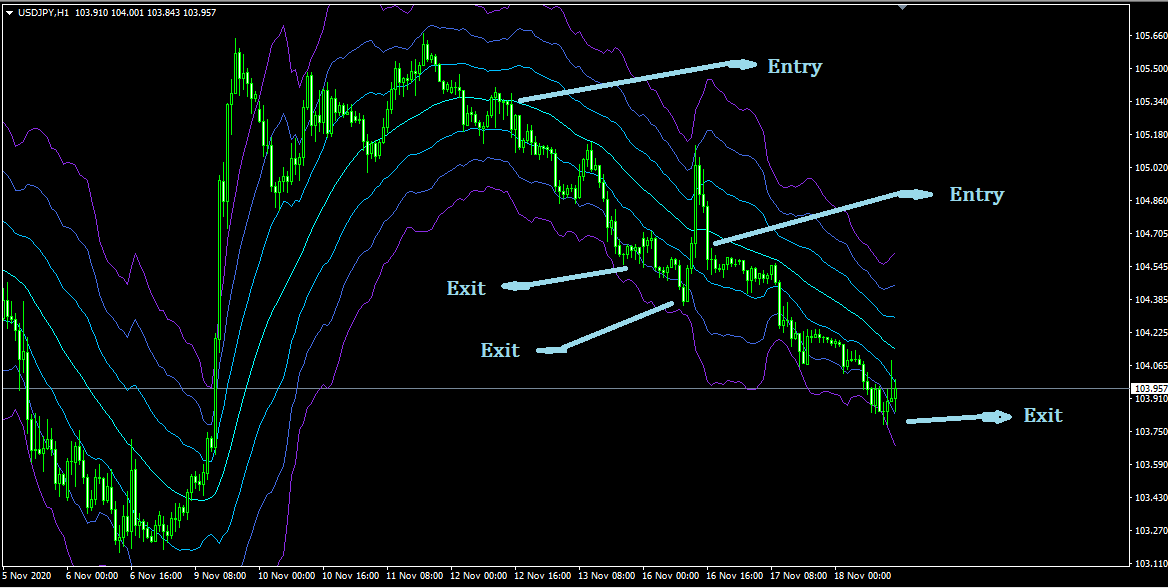

Bearish trading strategy

This is a straightforward strategy as the price crosses the middle band or downside and remains at the upper band channel until the phase or volatility of the market shifts.

When the price touches the ATR channel’s top lower band is an oversold situation and time to exit or hold a breath before placing another buy order.

Bearish trading conditions

- The price is moving lower in the higher time frame by creating a lower low in the price, pointing out that the overall market structure is bearish.

- The price closes below the middle band of the ATR channel. It is an indication that the bearish pressure in the price is starting.

-

Entry

After completing the trading condition, wait for a candle to close and enter the trade as soon as a bearish candle appears.

-

Stop loss

As it follows the strategy, we can expect the price to move lower as long as it makes lower lows. Therefore, the stop loss will be 2-3 pips above the first band ATR channel.

-

Take profit

In this strategy, we can expect the maximum benefit from the market. Therefore, we will focus on these rules to determine the take profit level:

- When the price crosses or touches the top ATR channel, it’s an oversold condition, and you can take some profit at this level or get out of the trade.

- If the price reaches some strong support or event level, we can expect some correction to close the full trade.

Conclusion

This strategy shows market phase, volatility, and range at all types of currency pairs, major or cross at time frames higher than 15 min. Therefore, it is straightforward to get hundreds of winning trades at lower or medium time frames by getting confirmation at bigger time frames.

Comments