Moving average is a standard indicator for market participants. From novice to professional traders frequently use this indicator to obtain market data and predict the future movement. A 50 day moving average (50 day MA) is a standard parameter on any financial asset chart, and traders choose this parameter for its remarkable positive features.

In this article, we will discuss this indicator and how to use it for successful trading. Later, we will list the top pros and cons to reveal potentiality.

However, it is mandatory to learn the functionalities when preparing a complete trading method using any technical indicator with a particular parameter.

What is the 50 day moving average?

Several types of MAs are available such as Simple moving average, Weighted moving average, Exponential moving average, Arnaud Legoux moving average, etc.

Moreover, you can use different parameters of price candles such as opening, closing, highs, lows, etc., besides setting different values of the MA line. Financial traders use some most popular periods moving averages such as 20 day MA, 50 day MA, 100 day MA, 200 day MA, etc.

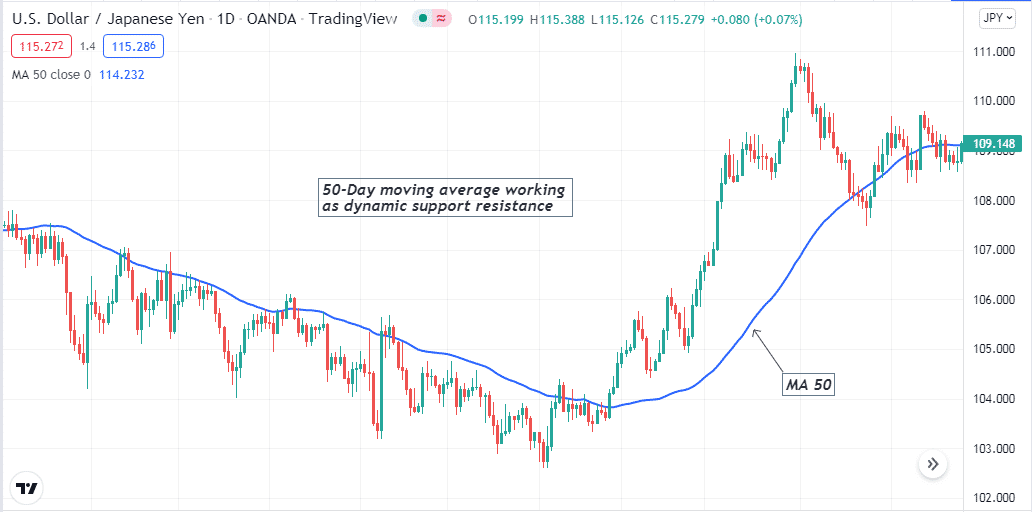

The 50 day MA on a daily chart of USD/JPY

So you may be thinking about which value is the best to use in trading. The answer is simple; none exists as the best value, because it always depends on the market context and time frames alongside methods.

How to use a 50 day MA for trading strategy

It is suitable for any trading instrument that shows support resistance levels in the D1 chart. You can use it to determine trends, support resistance levels, or even use it to identify entry/exit points of trades.

For example, the price crosses above the 50 day MA line and remains above it; it stays on an uptrend. Every time price touches the MA line and bounces back on the upside declares buying opportunities. You can use it as a standalone indicator or combine it with other technical tools and indicators to create sustainable trading methods.

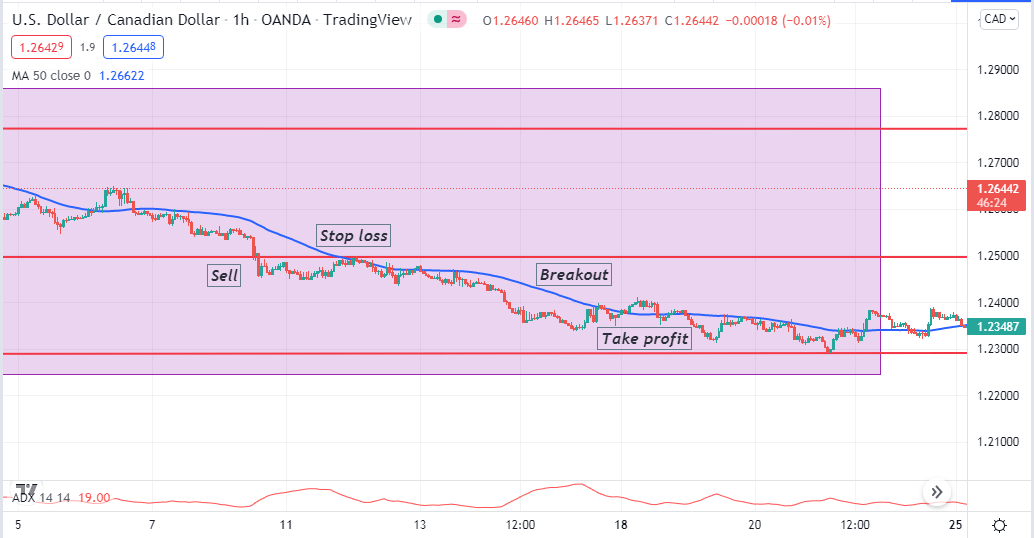

A short-term trading strategy

We use the 50 day MA to determine the trend in our short-term trading method. Then we use the ADX and support resistance levels to spot entry/exit points of trades. Trade executions occur by following some simple steps:

- Determine the current trend using the indicator on the daily chart.

- Mark supports resistance levels, weekly, monthly open-high-long-closing, and historical levels from upper timeframe charts.

- Seek entry/exit points on a 15-min or hourly chart using the ADX and the basic levels you draw on upper time frame charts.

Bullish trade scenario

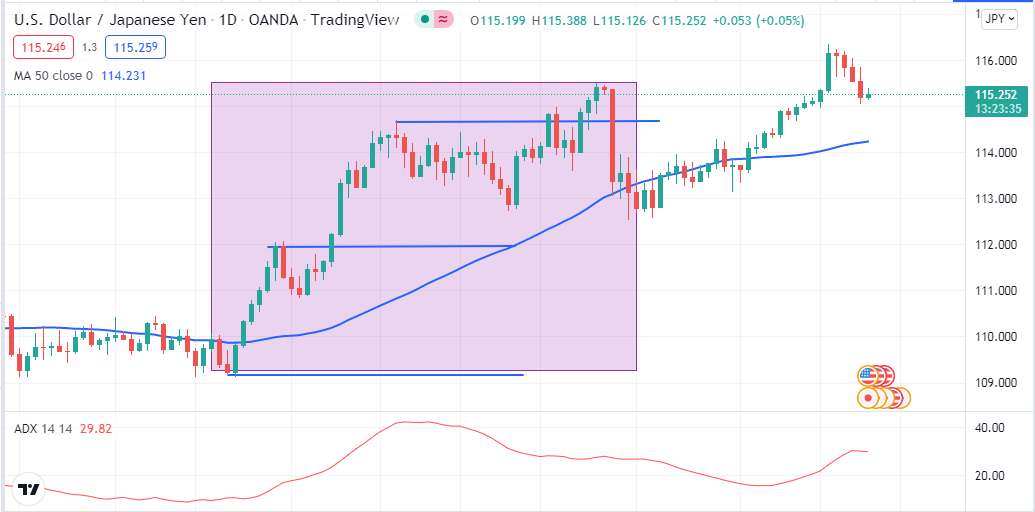

Confirm the current trend is bullish from the daily chart as the price crosses and remains above the 50 day MA.

Bullish trend and support resistance levels on a daily chart

Then seek open buy positions at lower time frame charts when:

- The price breaks above any support resistance level or bounces back on the upside from any support level.

- The ADX value is above 20.

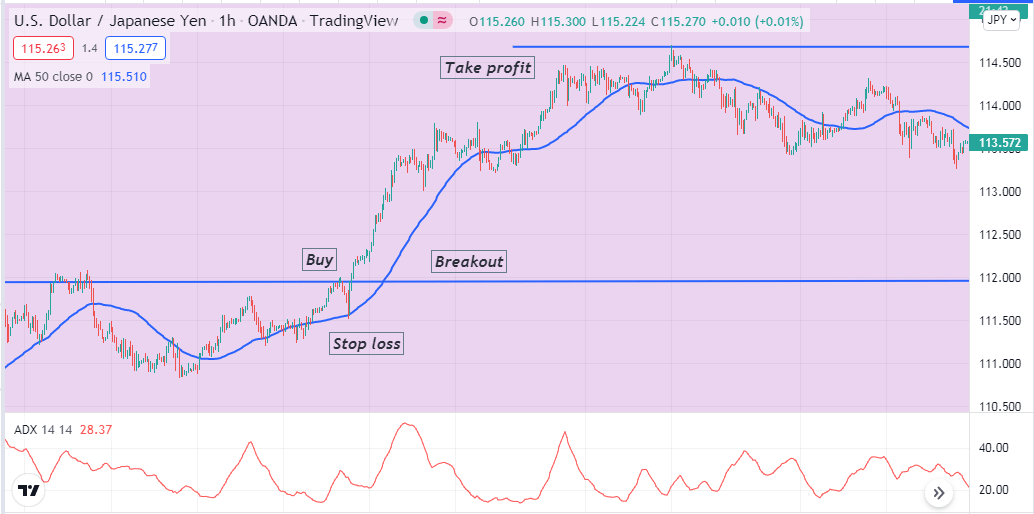

Bullish setup

Entry

Match these conditions above and open a buy position.

Stop loss

The initial SL is below the breakout or the support level.

Take profit

The initial profit target will be below the next resistance level. You can continue the buy order if a further breakout occurs on the upside.

Bearish trade scenario

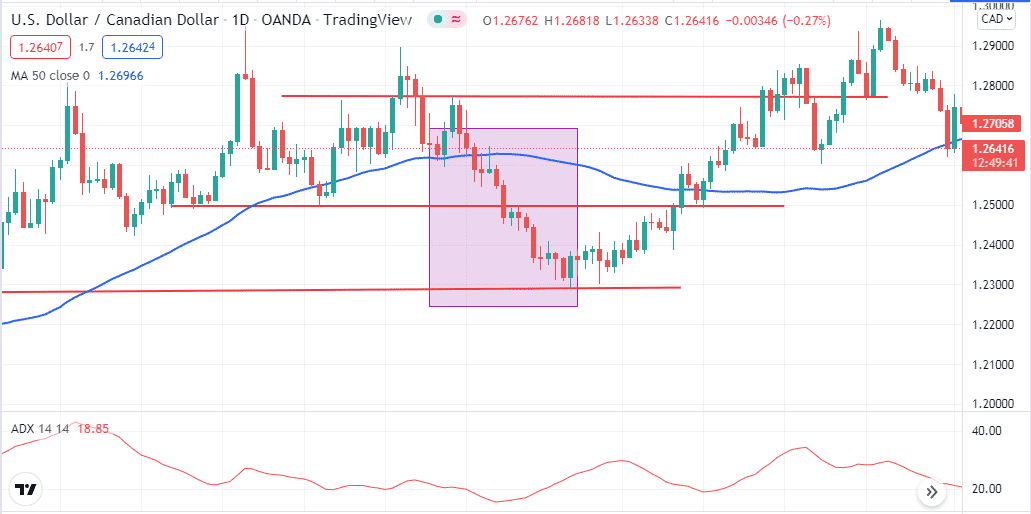

Confirm the current trend is bearish from the daily chart as the price crosses and remains below the 50 day MA.

Bearish trend and support resistance levels on a daily chart

Then seek open sell positions at lower time frame charts when:

- The price breaks below any support resistance level or declines back from any resistance level on the downside.

- The ADX value is above 20.

Bearish setup

Entry

Match these conditions above and open a sell position.

Stop loss

The initial SL is above the breakout or the resistance level.

Take profit

The initial profit target will be above the next support level. You can continue the sell order if a further breakout occurs on the downside.

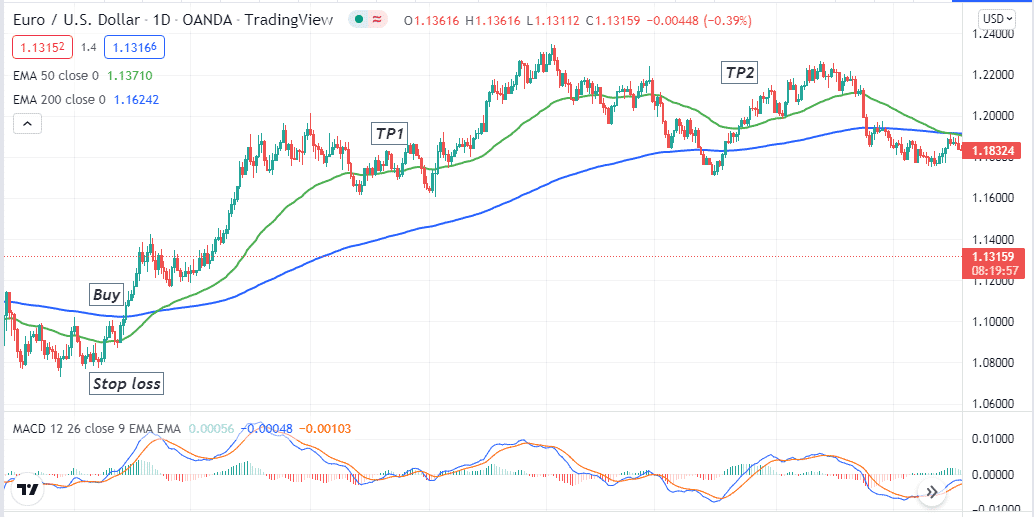

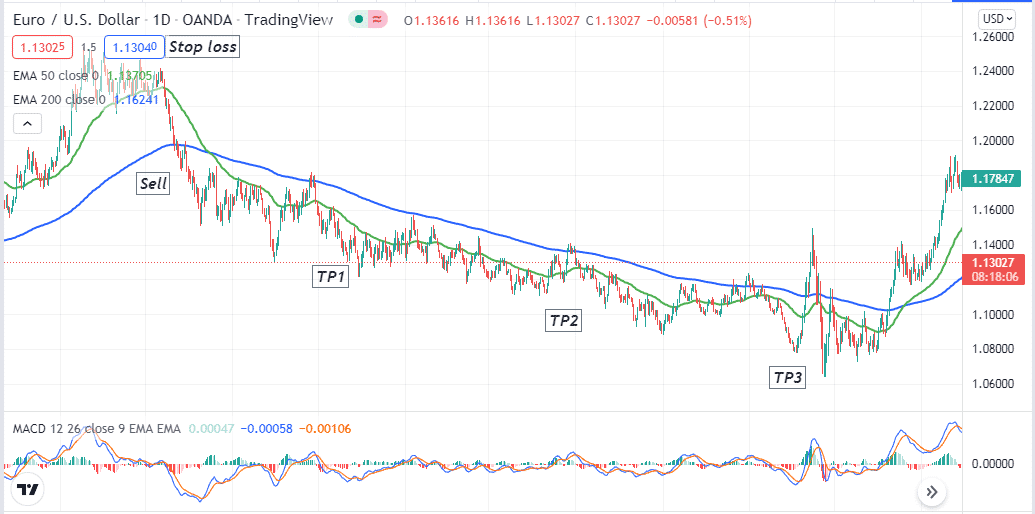

A long-term trading strategy

We use the famous golden cross and death cross concepts alongside the MACD indicator. It uses two MAs, EMA 50 and EMA 200. When the EMA 50 crosses above the EMA 200 line, it declares bullish momentum, which you can consider a golden crossover. On the other hand, the exact opposite is the death crossover that claims bearish momentum. This method suits the daily time frame chart.

Bullish trade scenario

When a golden crossover occurs, observe the MACD window:

- The dynamic blue line crosses above the dynamic red line on the MACD window.

- Green histogram bars take place above the central line of the MACD window.

Bullish setup

Entry

These conditions above indicate sufficient bullish pressure on the asset price. Place a buy order here.

Stop loss

Place an initial SL below the recent swing low.

Take profit

Continue the buy order till the bullish momentum remains intact. Close the buy order when the death crossover occurs between the EMA lines.

Bearish trade scenario

When the death crossover occurs, observe the MACD window:

- The dynamic blue line crosses below the dynamic red line on the MACD window.

- Red histogram bars take place below the central line of the MACD window.

Bearish setup

Entry

These conditions above indicate sufficient bearish pressure on the asset price. Place a sell order here.

Stop loss

Place an initial SL above the recent swing high.

Take profit

Continue the sell order till the bearish momentum remains intact. Close the sell order when the golden crossover occurs between the EMA lines.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

Finally, the indicator is a widely acceptable parameter to financial traders for its positive results. We recommend using proper money and trade management concepts while using these methods. You can execute constantly successful trades by implementing these strategies using this tool.

Comments