The financial market involves many mathematical invincible strategies. It enables traders to make more accurate entry/exit positions besides increasing profitability and reducing loss. Traders who use quant trading techniques can employ many methods, from simple to complex.

However, when you want to trade with quantitative trading methods, you must acquire adequate knowledge as it often involves complex trading techniques. This article will introduce you to the quant trading strategy. We describe two quant trading processes besides defining what quant trading is and how it works.

What is quant trading?

This term uses quantitative algorithms and methods to generate profitable trade ideas. ‘Quant trading’ is the short form of quantitative trading which is usually a data-based trading system.

A trader who uses quant trading methods works with mathematical formulas to identify potential trading positions or predict the future price movement of certain assets. Often investment banks and hedge fund managers use quant methods as executing trading techniques. You can refer to this type of trading method as the ‘market making’ concept as it provides liquidity for particular assets in the marketplace.

Leverage information may not be available in quant trading; instead makes it easier to buy/sell certain assets to participants. This market keeps the market running smoothly, especially when it is volatile. You can define any trader who uses quantitative methods or mathematical trading strategies as a quant trader. Quant trading often involves a large amount of computational power, so it suits financial institutions and hedge funds, but nowadays, it is becoming popular among individual traders.

How to trade with quant trading

Such trading involves complexity when it comes to algorithms and mathematical trading systems. Four essential components of quant trading are:

- Identification of the strategy

- Backtesting of the strategy

- Execution system and

- Risk management

Identification

First, define the trading strategy — the working procedure and concept of the trading method to understand the potentiality. For example, high-frequency trading may allow you to trade within the same day; meanwhile, low-frequency trading may involve long-term trading.

Backtesting

It requires backtesting the strategy to eliminate biases, analyze the strategy performance and further optimize the system. Backtesting any automatic trading system is essential before applying to real trading, although backtesting doesn’t guarantee any future profit from the strategy. Backtesting can fail for unpredictable price movements and inaccurate historical info.

Execution

In this step, check on the execution system of the strategy. Execution can be automatic or manual. Automated trading involves the quick execution of trades that manual trading can’t afford. This execution part includes minimizing transaction costs related to top slippage, commission, tax, and spreads.

Risk management

There are always some risk factors on any trading strategy when trading financial assets that involve volatility. So quant trading also contains some risks. Any obstacle that can interfere with the success of this strategy is a risk factor. For quant trading strategy, capital allocation is an important part.

A short-term quant trading strategy

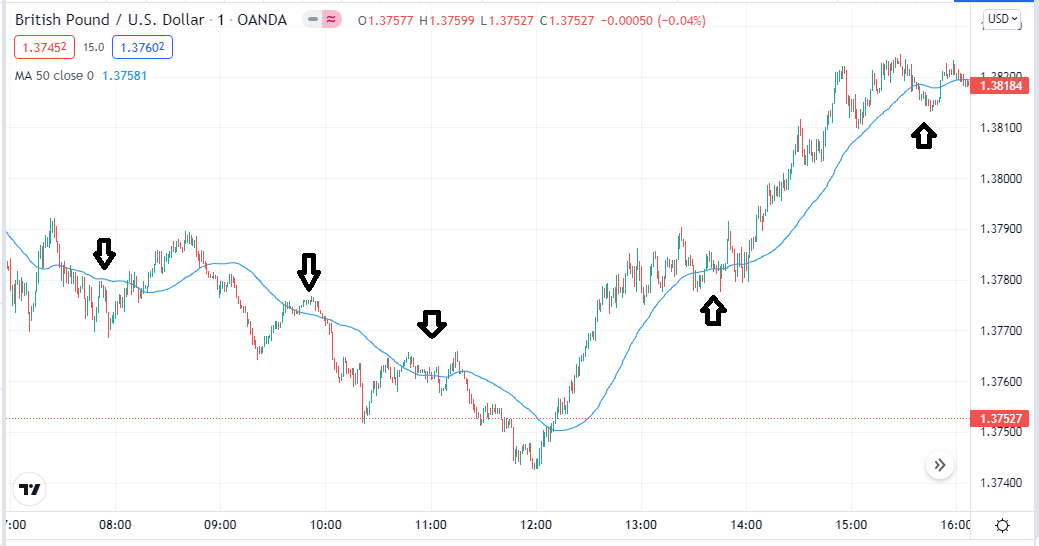

There are many short-term quant trading strategies; mean reversion is one of the best among that quant trading strategies. Mean reversion is a financial theory that involves price coming to a point and may revert from that point by following a long-term trend. Quant trading writes codes to execute trades when the price comes to a certain point and returns from it. For example, look at the figure below.

Different price movements

We implement a 50 SMA on a 1-min chart of GBP/USD. It shows how price reacts at certain levels. When the price stays above the SMA line, it indicates bullish price movement, and the price comes back to the SMA line and rejects the quant trading code upwards to place a buy order at that place.

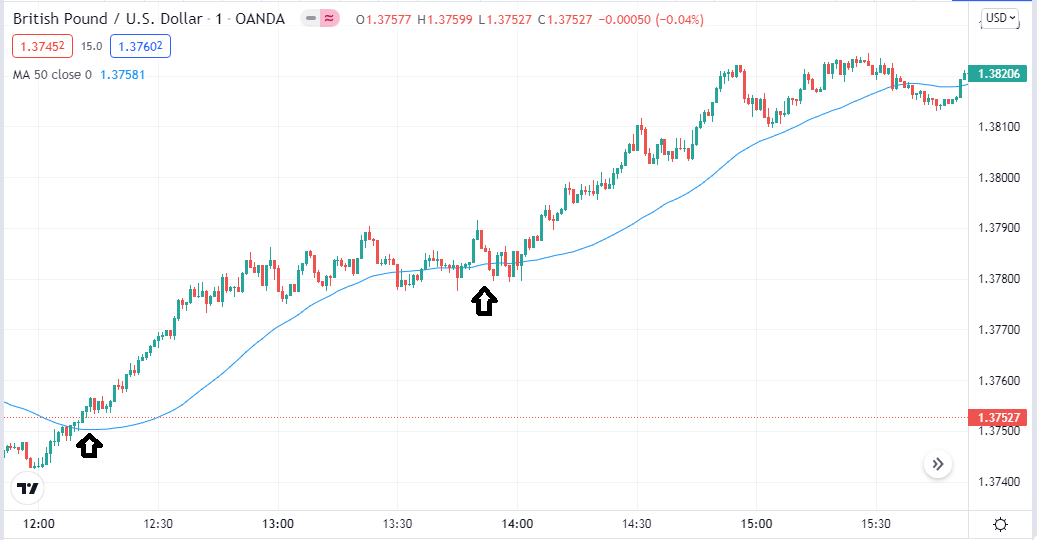

Bullish trend scenario

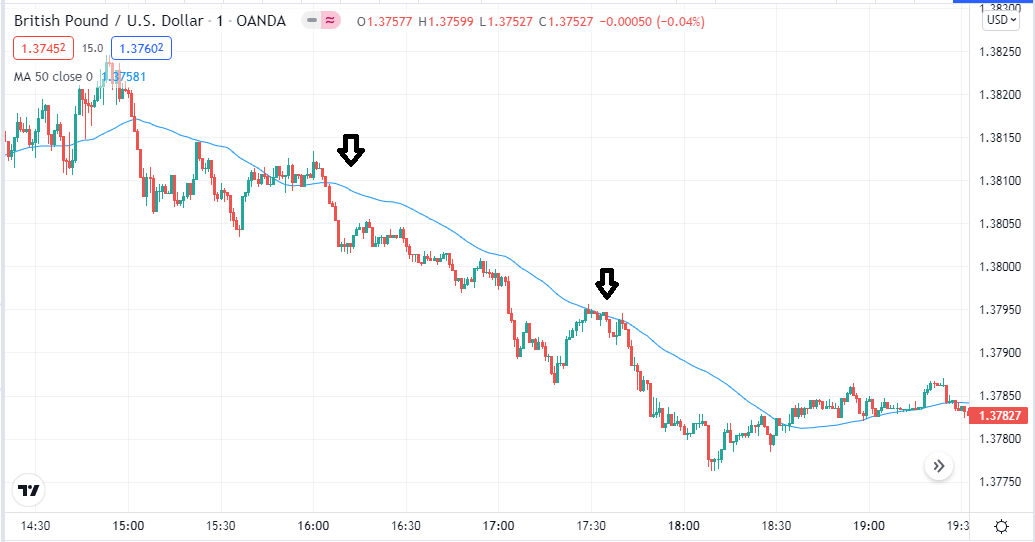

Meanwhile, when the price is below the SMA line, it indicates a bearish scenario. The price returning to the SMA line and starting to decline again can be an excellent opportunity to sell the asset.

Bearish trend scenario

This intraday means reversion works fine in a trendy price movement of any financial asset. It is a trading strategy combined with an SMA line price that comes to the SMA line and generates a trade idea. It won’t work for price movement when there is no strong trend present.

A long term quant trading strategy

You can use popular indicators such as moving average convergence/divergence (MACD), moving averages, Relative strength index (RSI), Bollinger Bands, etc., to short out the momentum and trends. Trend following strategies are simple; they identify the trends and ride them till the trend remains intact.

There are many techniques to determine the direction and riding trends through quant trading. For instance, you can monitor institutional traders’ sentiments and build methods to follow those sentiments of buying/selling certain financial assets.

Inversely, you can find patterns that will help you to identify new trends and volatility breakout signals. You can easily create invincible long-term quant trading methods that will work fine on daily charts using these suggestions. For example, the RSI indicator uses the formula.

RSI = 100 – 100 / (1 + RS)

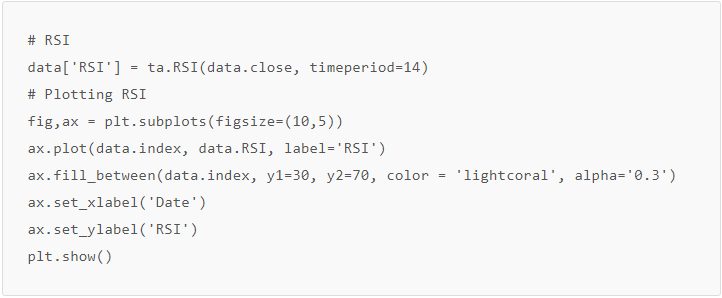

Meanwhile, the python code for the RSI indicator is below.

RSI indicator python code

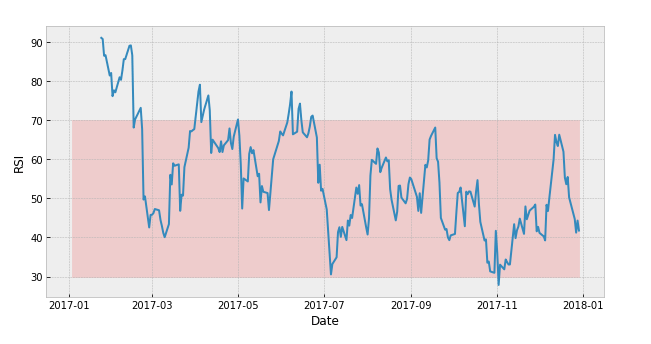

When applying this RSI code on the chart, it will look like the chart below.

Price chart after applying RSI indicator

Now, you can make a trend following trading method using this code of RSI indicator. Create a code to enter a buy order when the price enters a bullish zone and a sell order when the price comes to the bearish zone.

Pros and cons of quant trading

| Pros | Cons |

| You can analyze the market data historically. | It requires more skills than average traders. |

| Traditional traders may look at specific areas doing analysis where quant traders work with vast market information. | Often requires more computational power. |

| Quant trading supports removing emotional trading. | Quant trading depends on only mathematical terms. |

Final thought

Finally, quantitative trading has potential and uses statistical models to sort out the trading opportunities. It is a combination of using mathematical background data, computational, and coding for trade suggestions.

Institutional traders use these methods for their trading execution. Recently many individual traders are also following quant trading methods. We suggest following the components of quant trading carefully for better experience and success using quant trading.

Comments