FX trading is prevalent around the globe, with a total of ten million traders making it the largest financial market. Parallel to the FX, we also have a commodities market. The two markets have some resemblance as well as some differences.

The basic ideology of forex is that we tend to trade majors, minors, and exotic currency pairs while trading agriculture, metals, and energies in commodities.

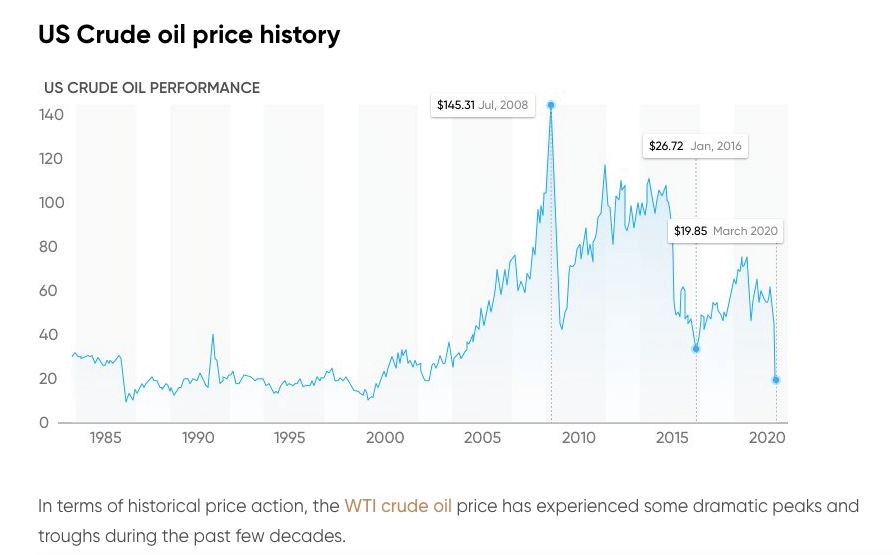

Oil is one of the energies that are substantially traded in the commodities market. Oil is traded mainly by oil producers and refiners, countries at large, institutions, and retail traders. There is a rise in the energy market, especially oil, in recent years, giving traders and investors magnificent opportunities to profit in nearly all market conditions due to its unique standing within the world’s political and economic systems.

This article will discover oil trading, including how the oil market works and how to trade it.

What is oil trading?

Crude oil is the world’s most traded energy, making it a highly volatile asset to trade. Trading oil is just like trading Gold or any other commodities in which you buy or sell the asset to make a profit. What makes oil an excellent commodity to trade is its volatility caused by supply and demand in the overall market.

There are numerous types of crude oil, and each of these has its individual properties, and depending on their character, they have their higher or lower market value.

There are two benchmarks for crude oil:

-

West Texas Intermediary

The primary standard for oil prices, to measure supply and demand prices worldwide.

-

Brent oil

This crude oil is the leading global price benchmark for Atlantic basin crude oils. Brent oil is light and sweet.

You can choose to trade oil on the CFDs, ETFs, options, and futures.

How does the oil market work?

The Organisation of Petroleum Exporting Countries (OPEC) produces a large share of the worldwide oil supply. The organization sets the benchmark on how much oil to produce to meet global demand and influence oil price by increasing and decreasing output. Millions of barrels of oil are traded, and the price is settled at the end of the day.

The oil market works on the functionality of supply and demand on the global market. The significant crude price movement is because of the supply and demand of crude in the worldwide market. The oil market works future contracts allowing institutions and traders to trade at a given set price. When refiners, oil producers, institutions, and traders buy or sell crude leads to oil price calculation at a particular moment in time.

Pricing in the oil products market

The oil varies in quality. Since its grades have different densities and composition, petroleum products’ cost is extra.

The price of oil is the value of a futures contract to supply it in the next month. The following factors affect the price of petroleum products:

- OPEC concept aimed at controlling oil production quotas. If OPEC reduces quotas, supply decreases, hence the price increases.

- The unstable situation in the country is related to politics and economy and approval of new legislation.

- Natural disasters.

- The number of oil reserves in the storage facilities of a country.

- Changing rates of economic development: the higher they are, the more oil is needed to meet production requirements.

- Dollar exchange rate. The more stable its position, the lower the price of oil.

Trading the oil

Most professional market participants generally have their strategy to trade the market. They first understand the fundamental factors that affect oil price and use a trading strategy that suits their trading style. Every trading strategy is different and unique; some use indicators while others use nacked price action.

Apart from the trading strategy, risk management is also an essential component to consistent trading and leverage and avoiding top trading mistakes.

You can trade oil using these three basic trading strategies:

There are two major perspectives of fundamental analysis when trading oil:

- Supply-and-demand

- Geopolitical factors

The certainty is elementary to understand that supply & demand balance largely dominates all commodity futures prices. In contrast, oil’s strategic role for almost every country determines that oil price is bound tightly with geopolitical factors.

American Petroleum Institute, OPEC, Energy Information administration are also some news events that should be on your watchlist while trading oil by keeping in mind factor-like few factors inflation and market expectations.

How many indicators are better to use?

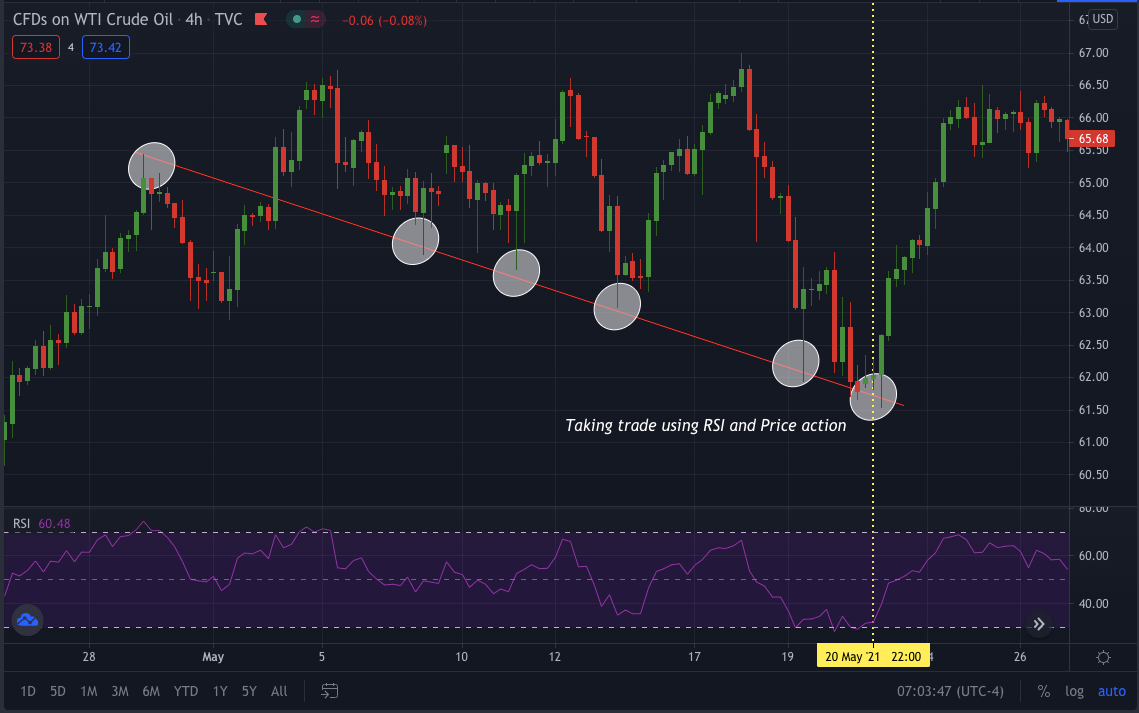

Once you know how to trade oil using fundamentals, you can then master the chart using the technical analysis, either using indicators or price actions and patterns. Here both the indicators and price action analysis can give a good buy or sell signal to execute a trade in the market.

According to successful traders’ understanding, using too many indicators on the charts makes it difficult for traders to look at the actual happenings in the market. So, it is always better to use fewer or no indicators and trade using price action.

Above is an example of WTI crude oil trading using RSI and price action. The price has been respecting the trendline six times before breaking the previous high. At the same time, there was a confirmation from the RSI, price coming from oversold towards the price zone.

Managing your risk is the first thing you should master as a trader because it is vital to losing less. You can do it according to the account size you are trading with, and it is good to use 2% to 3% of your capital as a risk.

Final thoughts

Trading oil can give an excellent opportunity to make a profit in the FX. However, as involving your hard-earned money in any financial trading is risky, you must know the pros and cons before entering the market. You can choose any strategy to trade the oil market, whether technical, fundamental, or by using price action or indicators but trading it using the confluence will make your trading more effective.

Many traders also use trading signals available on various websites and social media, but they are not always accurate. You can leverage a few of them and match them with your analysis.

Comments