Marubozu, in Japanese, signifies “bare head” or “shaved head.” It seems as though it is a block implying that it doesn’t have any wicks. It is a great candle that you want to focus on each time it shows up on the chart. Chart traders are continually searching for things that might give a few hints to the market’s opinion at an exact time.

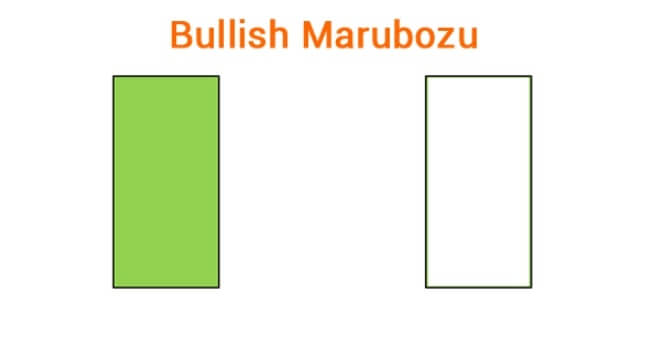

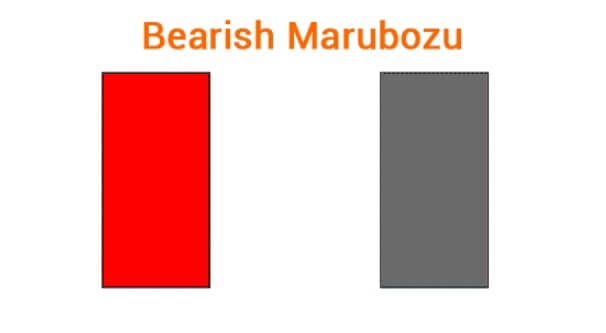

It’s straightforward to recognize a Marubozu candle since it is a solitary candle with a natural body with no shadows. Commonly, when bullish, they are white or green on the chart and black or red while bearish. In bullish Marubozu, the open and close prices will remain more packed together. In bearish, the opening price is equivalent to a high price, and the closing price equals a low price.

Getting the hang of utilizing Marubozu in the analysis will assist you with trading FX all the more viably. This pattern explicitly explains the purchasing and selling movement during the period it covers.

What is the Marubozu candlestick pattern?

Marubozu signifies “uncovered head” in Japanese. This is displayed without any wicks or shadow on the candle, which implies that the opening or closing price will be similar to the candlestick’s highest prices. The non-existence of shadow exhibits that the trading meeting opened at an exorbitant price and closed at a low price toward the day’s end, or maybe the opposite can happen. The Marubozu candlestick can give a logical understanding of the upcoming direction of the asset price.

Furthermore, you can comprehend two or three precious things from utilizing this pattern in your analysis. To begin with, its arrangement demonstrates that an asset has been trading unequivocally in one way. Additionally, the Marubozu candlestick can provide some helpful understanding to foresee the future course of the asset price, clearly to be affirmed by consolidating different instruments.

How to identify Marubozu candlestick pattern?

Generally, this candle has an extremely long body. This unique candle pattern without any shadow is just one body with a single tone. There are two sorts of Marubozu:

- The tones are green for bullish Marubozu

- The red for bearish Marubozu

In real market situations, an ideal Marubozu is occasional. Hence there is a minor distinction – typically under 0.01% of the candle zone, between the open/close prices with high/low price is dismissed while recognizing a Marubozu.

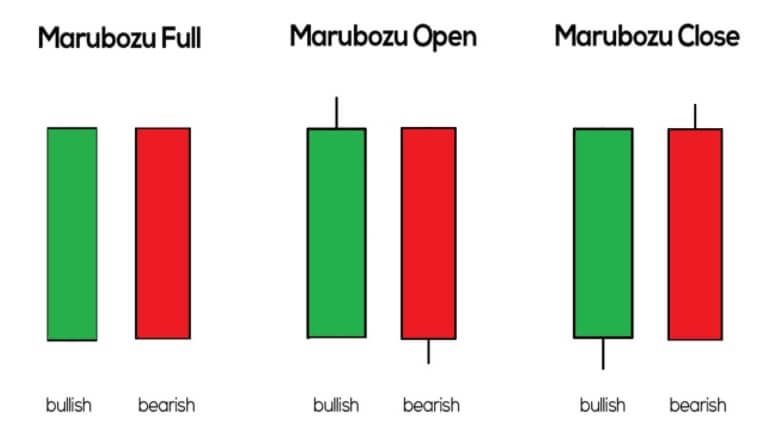

Apart from the fundamental kinds of this pattern, forex traders are additionally keen on different varieties of Marubozu. In the matter of proficiency, Marubozu without the wick or shadow gives the most elevated precision.

Bullish Marubozu

It shows a sharp expansion in prices. The buyers rule and overpower the sellers. The initial price concurs with the minimum price. Also, the closing value matches the maximum price. Bullish Marubozu is a forecast signal that the prices can rise robustly later on.

Bullish Marubozu

Bearish Marubozu

It depicts a strong reduction in values. The initial cost matches the maximum price. Furthermore, the closing price corresponds with the minimum price. Bearish Marubozu signal foretells that values can diminish strongly later on.

Bearish Marubozu

Variations of Marubozu

Open and close Marubozu can also be bullish and bearish. To spot a Marubozu, the ideal sign is that it has a real colossal body, and both sides are without any shadow. Also, the tone of the candlestick has a significant meaning. The simplest method for remembering that the Marubozu line is flat in every case either at the open or at the close. Also, for a full Marubozu, the open and the close lines are flat.

Marubozu patterns types

A short-term trading strategy

Marubozu candlestick best works on a lower time frame, like 15 minutes time frame. You can find many scalping opportunities on M15, which can provide good risk/reward ratios. Based on this pattern, we can execute trades in harmony with the upcoming market trend. Moreover, it would help if you opened a buy trade when a bullish Marubozu appears. On the contrary, execute a sell order when a bearish Marubozu appears.

Bullish trade scenario

Entry

Open a trade for buying after the green candle.

Stop loss

Your stop loss should be at the nearest support level before the bullish Marubozu pattern appears.

Take profit

Take the profit when the price touches upcoming resistance, or based on at least 1:3 risk/reward ratio.

Short-term buy entry

Bearish trade scenario

Entry

Open a sell trade when the candle closes with a bearish Marubozu.

Stop loss

Your stop loss should be at the nearest resistance level before the bearish Marubozu pattern appears.

Take profit

Take the profit when the price touches upcoming support or based on at least 1:3 risk/reward ratio.

Short-term sell entry

Long-term trading strategy

In the long-term Marubozu trading strategy, we will look for breakouts on the current trend. If the trend is bullish, we will look for a previous high to break with a daily pattern. On the other hand, we will look for a previous low to break with a daily Marubozu bearish pattern in a sell trend.

Bullish trade scenario

Entry

Enter a buy trade when the price breaks above the recent high with a daily bullish Marubozu pattern.

Stop loss

Stop loss order should be placed below the breakout candle.

Take profit

Take the profit when the trade achieves a 1:3 risk/ reward ratio.

Long-term buy entry

Bearish trade scenario

Entry

Enter a sell trade when the price breaks below the recent low with a daily bearish Marubozu pattern.

Stop loss

Stop loss order should be placed above the breakout candle.

Take profit

Take the profit when the trade achieves a 1:3 risk/ reward ratio.

Long-term sell entry

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

Marubozu candlestick methodology takes practice. However, it carries you nearer to price action. Not just that, the price action reading abilities you get will be helpful when you continue to concentrate on various other patterns.

These exceptional candles draw in the interest of the market. Subsequently, seeing how the market responds to them provides gigantic analytical worth.

Comments