Finding and trading a reliable system or strategy has been a never-ending search for every trader. If you have been trading the currency markets for a while, you must have understood that jumping from one system to another is not the best policy. You have to find one system that looks promising and polish it slowly over time.

In this article, you will learn about another trading system that is simple but powerful. If you do not have a trading strategy or trading plan yet, you can use this system and build on it. Be aware that it is not the number of indicators that make a successful strategy. The most critical element to your trading success is you, that is, how you use the system.

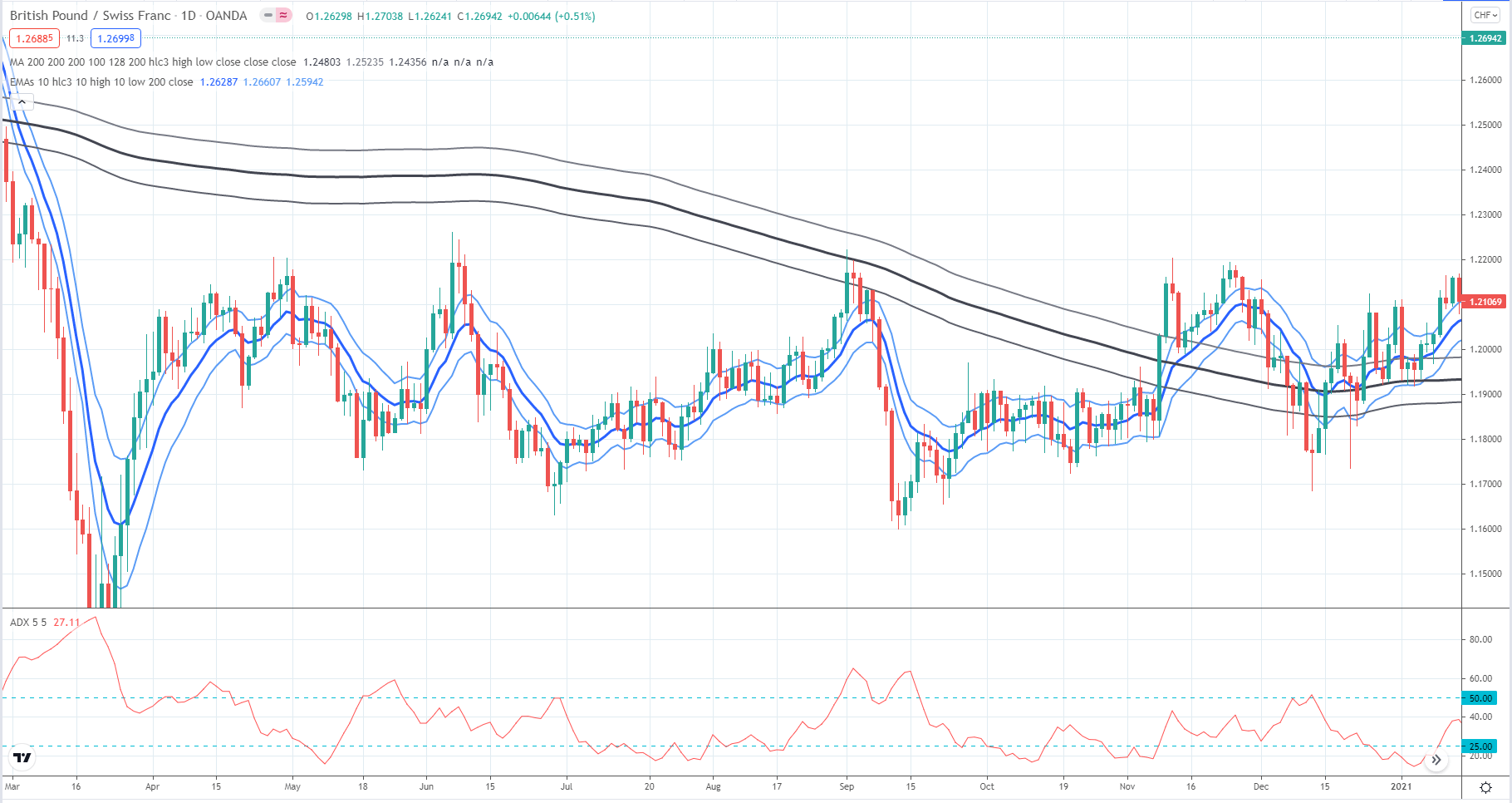

Chart setup

With this trading system, you will need a few indicators, so your chart is clean and effortless to read price action. The whole system uses three types of indicators, although you might see seven indicators at first glance.

Below is a list explaining the indicators:

- Simple moving averages (typical, high, and low; 200 period)

- Exponential moving averages (typical, high, and low; 5 period)

- Average directional movement index (typical price, 5 period)

Once you attach the above indicators, your chart should look like the chart below.

British Pound/Swiss Franc

The band of moving averages (MA) in black is the 200 SMAs, while the envelope of moving averages in blue is the 10 EMAs. The MAs identify the trend. If the moving averages are moving up, the trend is bullish, and if they are moving down, the trend is bearish.

The ADX complements the two MAs bands. It tells us the trend’s strength, here for the past five candles, without regard to the trend direction.

- When the ADX line is moving up, it means that the trend is getting stronger.

- If it is moving down, it means the trend is getting weaker.

You can also see two levels on the ADX. If the ADX line is below 25, it means there is no trend, but if above 50, it means an extreme trend condition.

Entry rules

This section will learn the three-step entry rules for taking a trade using the MADX cobra trading system. Make sure that you stick to the rules and do not digress a single time. Consistency is your key to success in trading.

№ 1. Determine the major trend

The trading system attempts to put you on the correct side of the market. That is why we only trade in the direction of the overall trend as specified by the 200 SMA.

- If the MA is moving down, the trend is down, and we will look to sell entries only.

- If the MA moves up, the trend is up, and we will only look for buy entries.

№ 2. Wait for the major and minor trends to align

We will use the 10 EMA to define the minor trend. In the same way as the 200 SMA, you can tell the short-term trend by considering the price position relative to the 10 EMA.

- If the price is above the 10 EMA, the trend is up.

- If the price is below the 10 EMA, the trend is down.

However, we do not base our entry on the alignment of the two moving average bands per se. After determining the major trend, we wait for the price to break up or down the 10 EMA in the major trend direction.

There are two advantages to this method:

- It allows us to take high-probability trades because we trade only when the major trend and price action are in sync.

- We can take trend trades early. This happens when the price breaks the 10 EMA in the trend direction.

№ 3. Apply a trade filter

We want to reduce losing trades as much as possible. It is a fact that bad trades come once in a while. This is a normal part of trading. However, too many losing trades will affect the profitability of the system. That is why we need a filter for our entry. That is the role of the ADX.

This is how we should use the ADX:

- Reject a trade signal if the ADX is below 25.

- Enter a trade signal if the ADX is above 25.

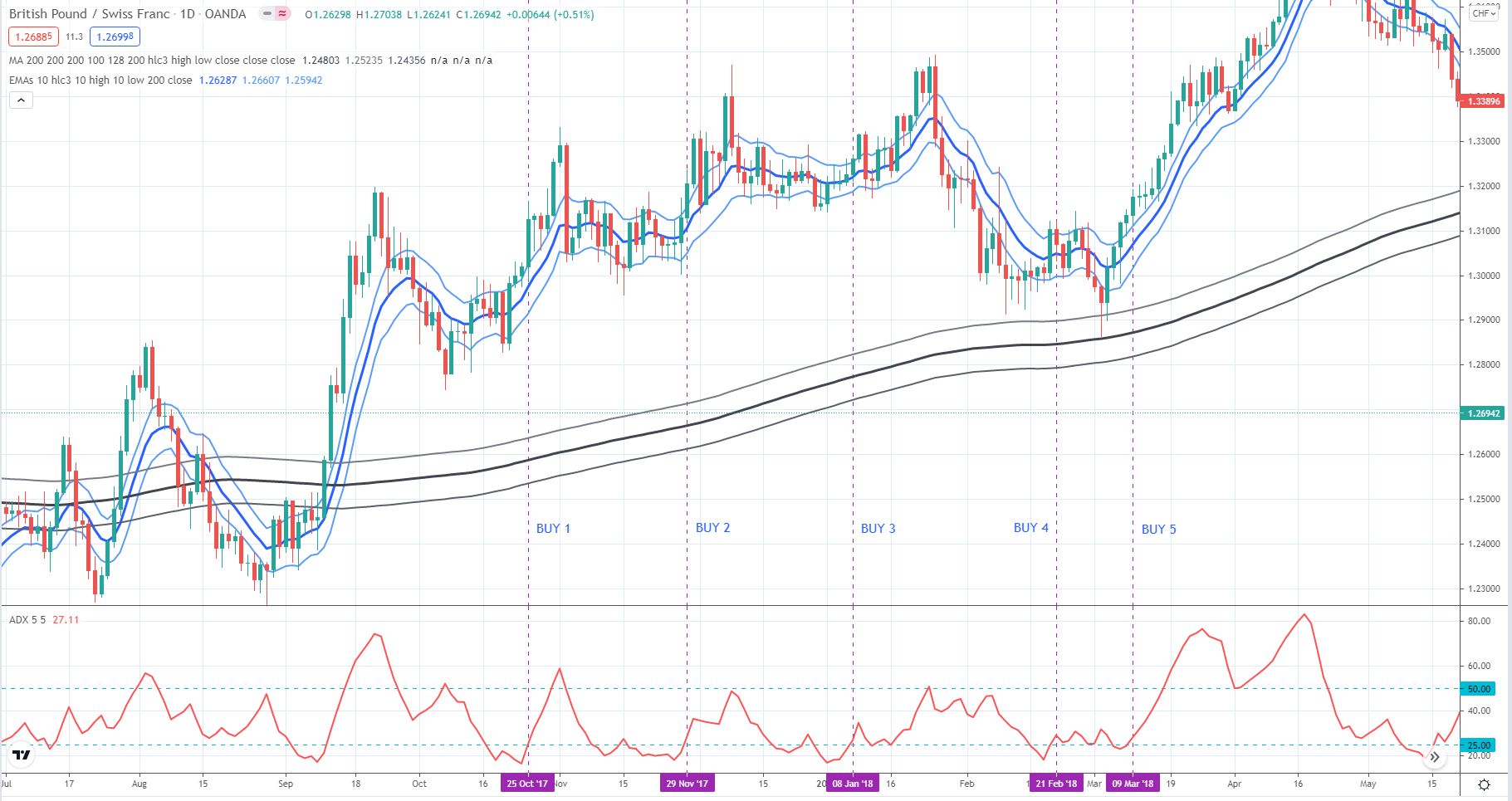

British Pound/Swiss Franc

You can see four buy trades in the above chart. Each entry satisfies the entry rules:

- The price is above the 200 SMA.

- Price breaks above the 10 EMA.

- ADX is above the 25 level and is inclined upward.

Waiting for the ADX to turn upward is a good filter as it allows you to avoid trading when momentum is not yet aligned with the short-term trend direction. Some trades were losing as the price did not rally after the entries. We will determine the exit rules next.

Exit rules

Many people think that entry is more important than exit. That is a mistaken idea. Exit matters more than entry. That is why you have to define the level at which you exit your trade-in a loss if your entry is wrong. Also, you need to specify the level at which you close the trade in profit if your entry happens to be correct.

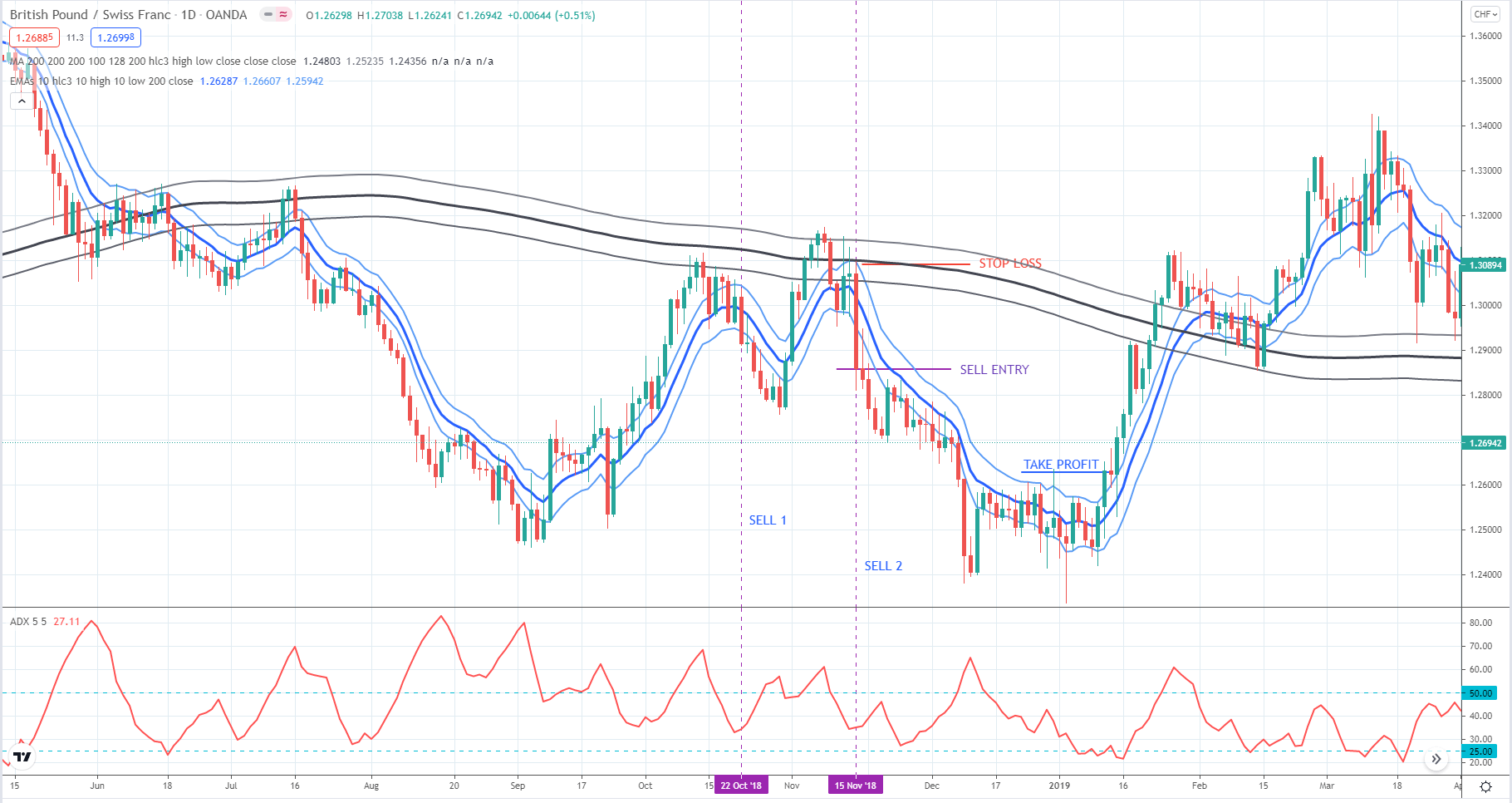

№ 1. Stop loss

For this system, you should put your stop loss a little beyond one of the outer bands of the 10 EMA.

- If your trade is a buy, place your stop loss a little below the lower 10 EMA.

- If your trade is a sell, put your stop loss a little above the higher 10 EMA.

№ 2. Take profit

At the time of entry, it is not possible to specify the take profit objective just yet. This is because the “take profit” is not a factor of the trade risk. It depends on price action. You want to see a specific condition before you close the trade. Therefore, you have to monitor your trade from time to time after it goes live.

British Pound / Swiss Franc

You can see two potential sell trades in the above chart. Here you can see that price is generally below the 200 SMA, the price broke down the 10 EMA, and ADX is above 25 and sloping upward. Although not labeled on the chart, the first sell entry could have resulted in a loss. Meanwhile, the second sell entry is a win. The stop loss was a little above the 10 EMA high, and you closed the trade when the price broke above the 10 EMA.

Final thoughts

This article shows you a powerful but straightforward trading system you can apply right away. Due to the limited number of samples, this might not be evident to you. If you want to give this system a shot, scour your charts and apply the indicators required. So this will help you see firsthand if this system holds water and might help with your trading campaigns.

Comments