Making money from forex trading is the ultimate target for market participants that allows them to roam every possibility from technical analysis to arbitrage trading. Besides, the forex market includes a wide range of trading instruments representing significant countries in the world. Therefore, making money from cross-trading became possible with the triangular arbitrage trading concept.

If you wonder how arbitrage works or start trading from the traditional trading broker, the following section is for you. In today’s lesson, we will see the complete trading guide that may enrich your knowledge of the FX market whether you follow this method or not.

What is the forex triangular arbitrage?

It comes from discrepancies between several currencies, coming from the unmatched exchange rates. Therefore, it is a quick money-making scheme that needs advanced knowledge about programming and automated trading.

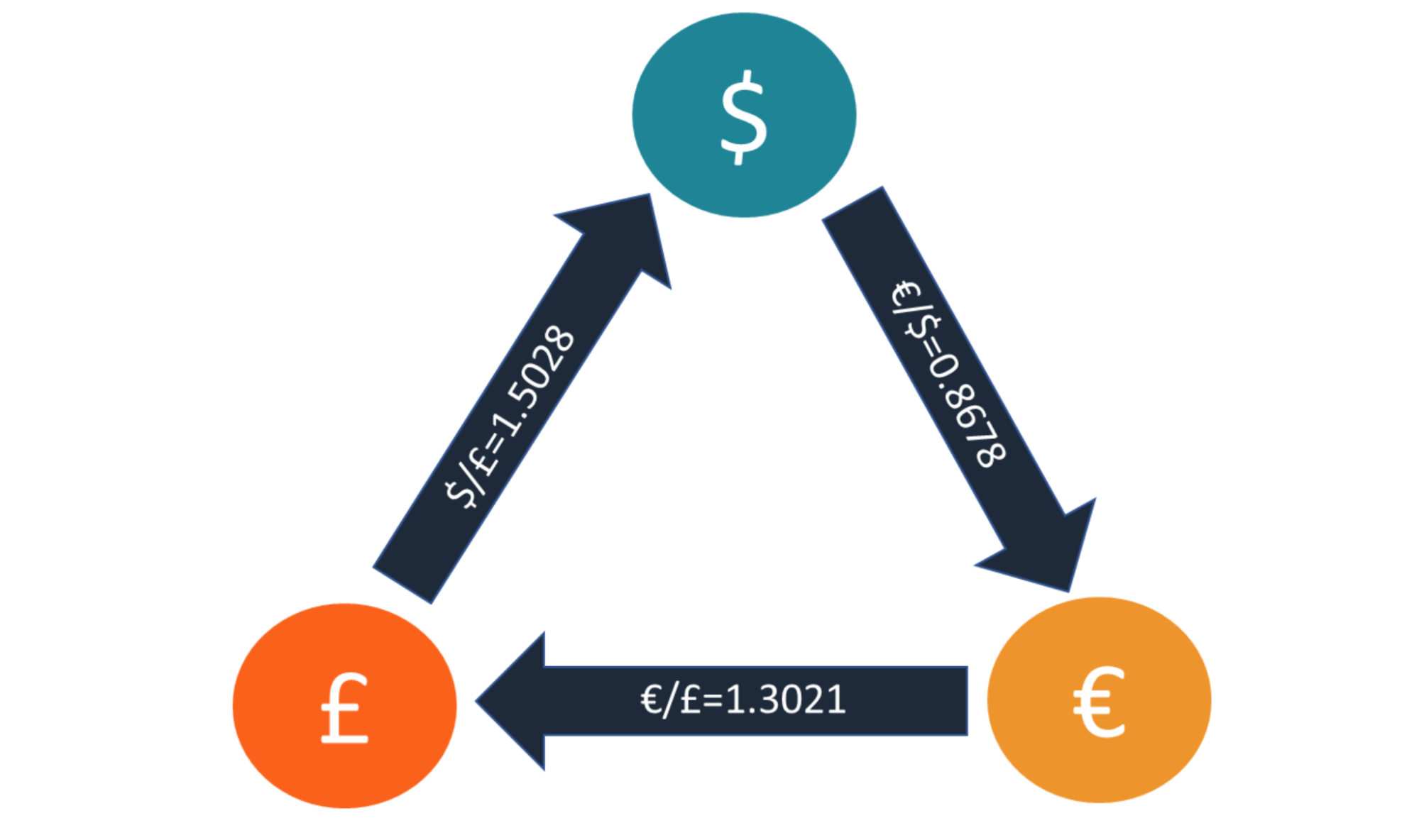

Let’s see an example of triangular arbitrage for better understanding.

A trader wants to exchange one rate of EUR/USD using the arbitrage method; he should convert it again to EUR/GBP and finally convert back to USD/GBP. This method is known as a risk-free way to make money online, eliminating the cross rates. Banks usually become unable to exchange cross currency pairs in the currency market due to the discrepancies between currency rates. As a result, they use triangular arbitrage to eliminate the risk and make money from the under and over-valued currency pairs.

Triangular arbitrage illustration

The above image explains how triangular arbitrage works in forex trading.

Key takeaways

- Triangular arbitrage is an automated trading system, which comes from the strong difference between exchange rates.

- This method includes trading with higher volume and lower profit targets.

- Due to triangular arbitrage, the rates of a currency pair in different exchanges remain stable.

How to use triangular arbitrage in trading strategy?

It is an automated system that needs additional attention to programming and software making in forex trading. If you are interested in building a program that will trade for you using arbitrage, the following section is for you. However, forex traders who employ technical or fundamental analysis in their strategy might find this method ineffective as you cannot take trades from the MetaTrader 4 or MetaTrader 5 platform after researching the market.

However, suppose you understand the process regarding how this arbitrage works. In that case, you will be able to use this knowledge in your trading or better understand the market context.

A short-term strategy

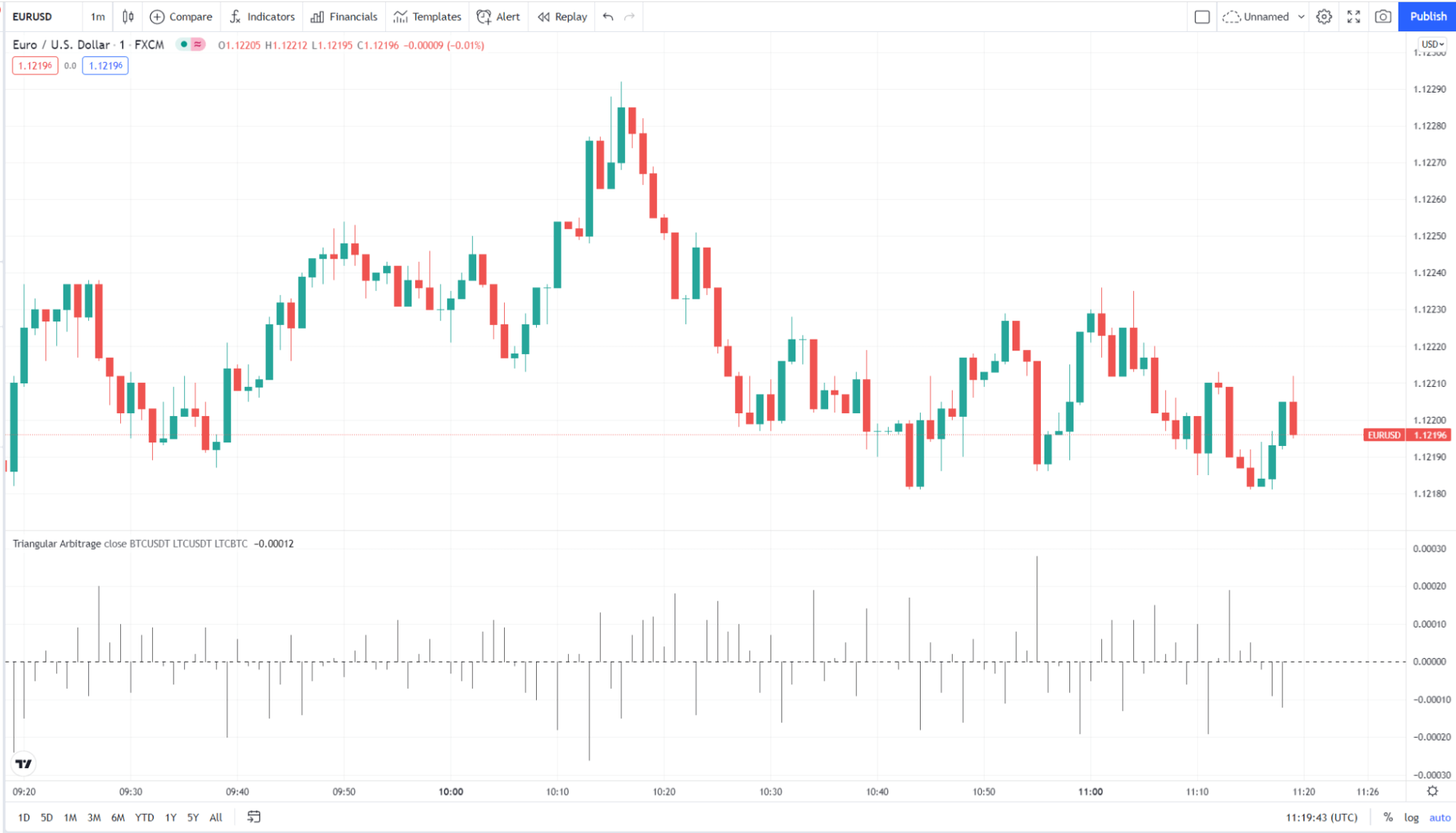

EUR/USD chart

In the short-term method, we will see an example of the triangular forex arbitrage. Make sure that this method includes several thor party services that show the price discrepancies from several brokers. In addition, this method comprises immediate action where making money is instant.

Best time frames to use

You can stick a 1 minute or 5 minutes chart where the profit target is tiny for short-term trading.

Entry

This method uses two trades where it will eliminate the middle currency. For example, if you want to buy one standard lot of GBP/USD, you cannot do it due to unfavorable trading conditions or expenses. Therefore, the approach opens a direct buy trade in the EUR/USD and a sell trade in the EUR/GBP. By doing this, you are ultimately eliminating the EUR from both trades and buying GBP/USD.

Stop loss

This method is quicker to make money from the price discrepancies that do not involve any stop loss. However, following a parameter to minimize the risk of the trading balance is essential.

Take profit

As for the above example, we buy EUR/GBP and sell EUR/GBP instead of buying the GBP/USD. However, the take profit can be set by looking at the GBP/USD price, particularly after opening the trade close it when the price reaches any critical price level.

A long-term strategy

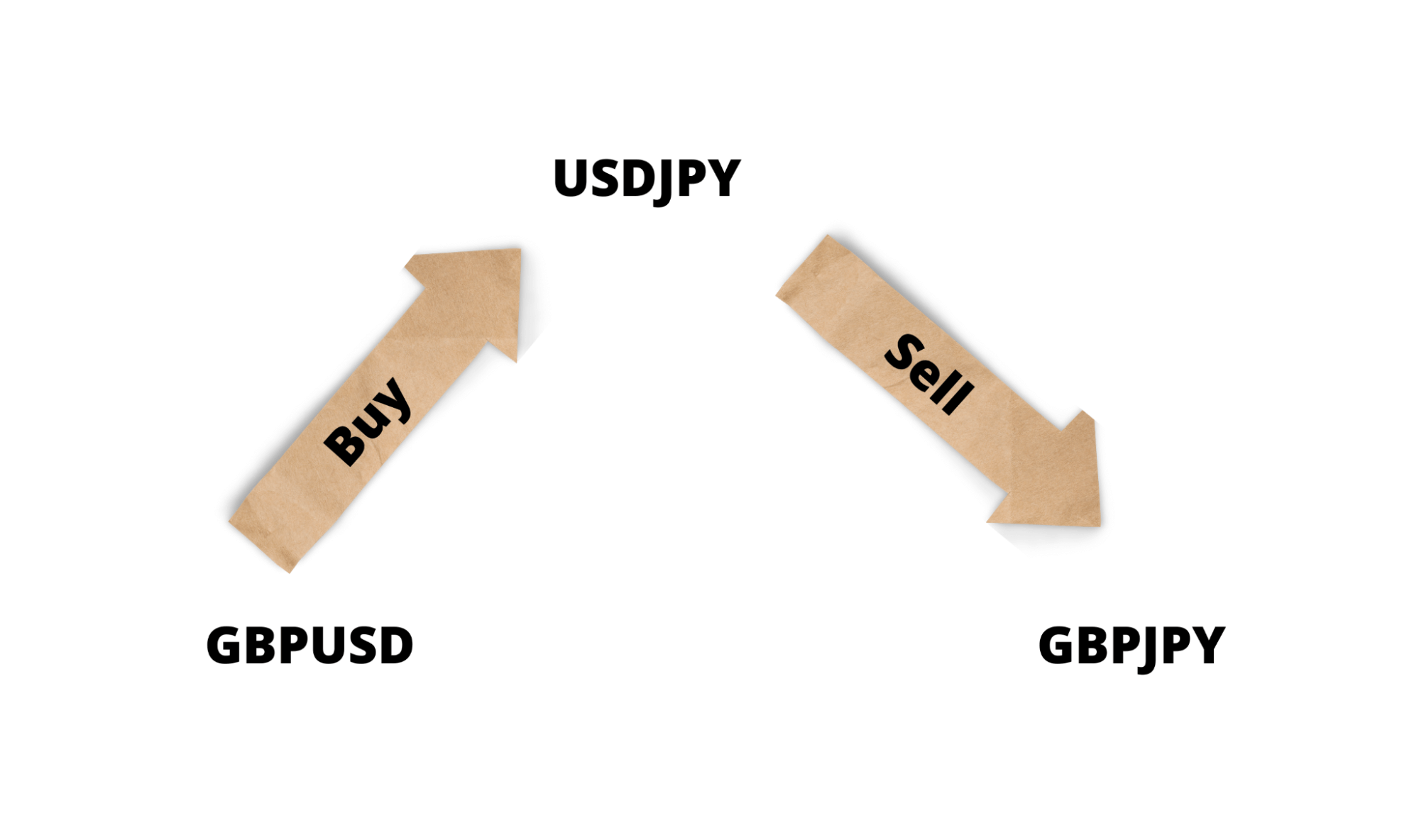

It is often hard to take trades in cross pairs in institutional trading due to insufficient liquidity. In that case, opening trades in multiple currency pairs to match the direction is very common.

For example, if a bank wants to buy GBP/JPY pairs and does not have sufficient liquidity it is unable to take the trade. Therefore, if the bank opens a buy position in the GBP/USD and a sell position in the USD/JPY, it ultimately buys the GBP/JPY.

GBP/JPY triangular arbitrage

The above image explains how the arbitrage works in forex trading where the buy of GBP/USD and sell of USD/JPY indicates a sell in GBP/JPY.

Best time frames to use

This method involves trading in any time frame, but for having long-term benefits, investors should stick trading within 4 hours to a daily time frame to get the maximum benefit.

Entry

This method needs immediate market action by buying a currency pair and selling another at a time. While taking the trade, make sure to find the price at an affordable rate.

Stop loss

The ideal stop loss is based on the ultimate currency pairs’ direction. Therefore, you can mark important price levels and set the stop loss above or below the near-term level with a buffer.

Take profit

Setting the take profit level needs additional attention to price action and trend analysis. However, you can get out of the market after getting your desired profit at any time.

Pros and cons of forex Triangular Arbitrage trading strategy

| 👍 Pros | 👎Cons |

| Triangular arbitrage is profitable in any trading instrument. | This trading strategy needs close attention to trade management. |

| This method is applicable in both automated and manual systems. | It needs additional expense on finding the price discrepancy. |

| There is no complexity that a new trader would not understand. | This method does not work well in the volatile market structure. |

Final thoughts

In the above section, we have discussed extensively how the triangular arbitrage method works in forex trading. If you are willing to build a trading method with the help of manual and automated systems, this strategy should be your first choice.

However, the forex market involves some risks that a trader cannot ignore. Therefore, remaining cautious while investing money in this sector would increase profitability.

Comments