In the FX market, so many terminologies can make your head spin. When you first read about them, you say, “Oh no! Why am I in this mess”?

But you cannot get away from this jargon, as they are part and parcel of trading. If you want to be in the market for the long run, you need to understand these concepts. However, not all strategies are born the same. Some you can grasp in a day.

One of these concepts is carry trading. Don’t run away if you haven’t heard of this trading style before. This guide will explain what carry trading is and how you can use it as part of your trading strategy.

Carry trade explained

It consists of buying a high-interest currency against a low-interest currency. The carry trade aims to give you profits on the change between these interest rates.

There are two types of carry trading:

- Positive — you buy high-interest rate currency against the low-interest-rate currency.

- Negative — it allows you to buy at a low interest rate against the high interest.

Let’s define this with an example. Assume you went to your buddy and borrowed $100. Your buddy is quite a generous fellow, and his interest rate is 1%. You use that $100 in your business and make a tremendous profit of $10. So, what is your profit? Simple, 10 – 1 = $9.

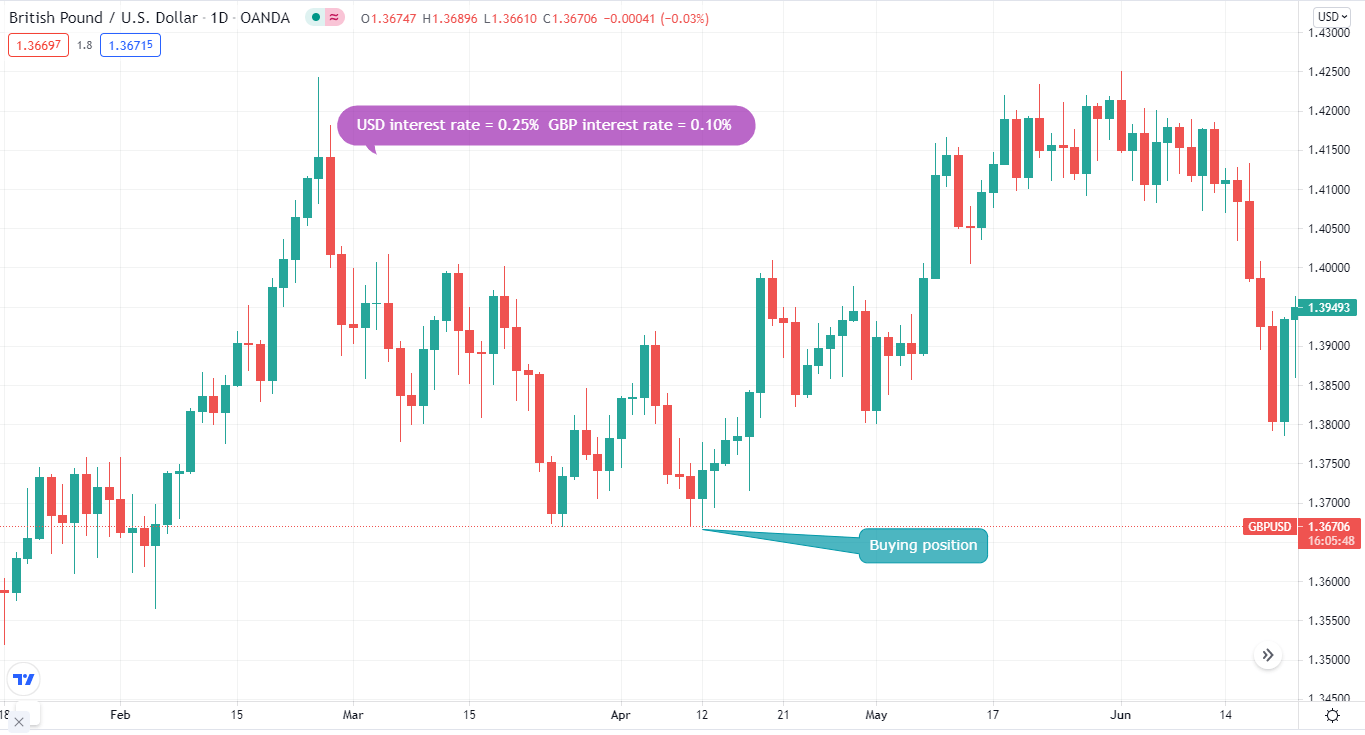

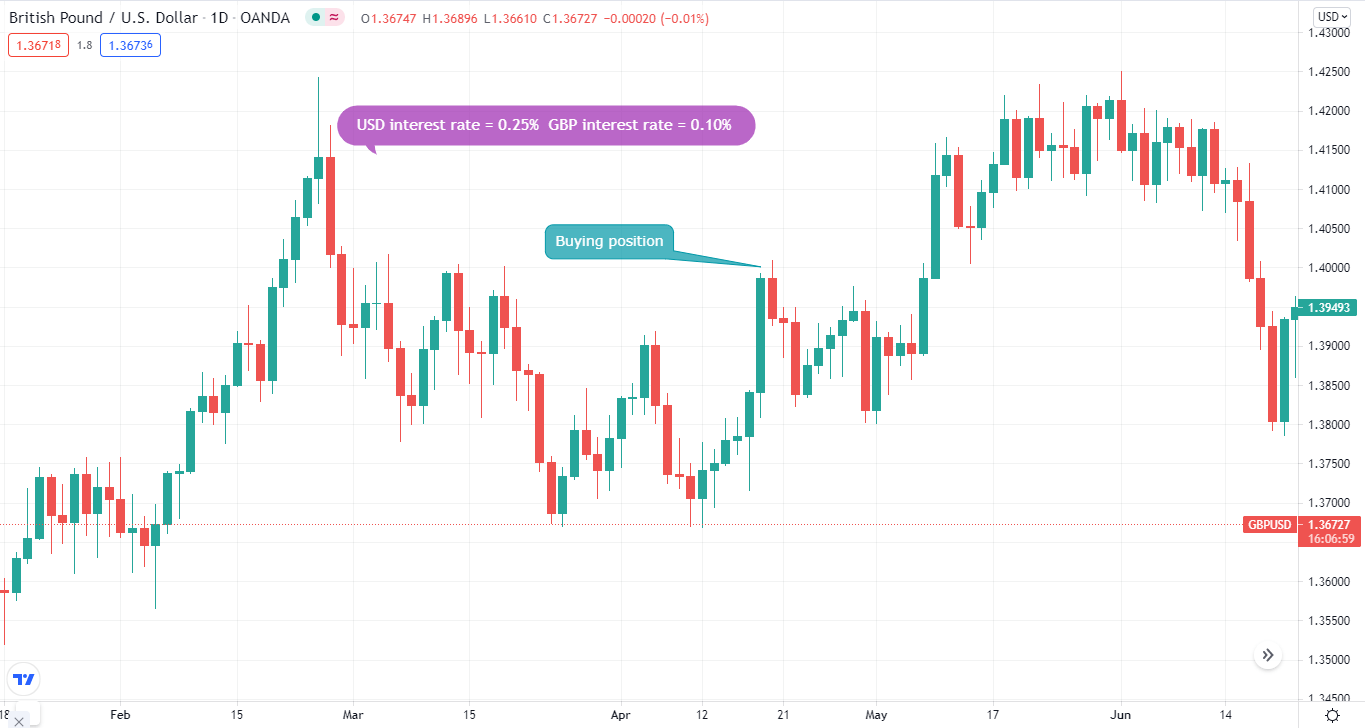

Now let’s give an illustration by applying the carry trade on the FX market. Say you are trading GBP/USD. The current interest rate of GBP is 0.10%, while the USD has an interest rate of 0.25%. You take the buy position and go long on the pair. The pair rises.

Can you guess what your profit will be? It’s 0.15%. This is an example of the positive carry trade.

With leverage, you can trade with higher capital with a little invested amount. FX brokers provide you with different leverage ranging from 1:1 to 1:2000.

The thing with leverage is they act as a two-edged sword. Your profit of 0.15% from the earlier example can give you large returns if you are using 1:500 leverage. On the other hand, if you lose the trade, you lose large sums with high leverage.

Like with any other FX strategy, the risk factor comes into play when this kind of trading. It would help if you defined your risks.

For instance, let’s go back to our example of GBP/USD. What if your trade went the other way? Your sweet profits will turn into bitter losses.

When does the carry trade strategy work best?

Carry trading strategies work perfectly when the overall market outlook is positive. You selected the currency pair of respective countries to need to have a positive outlook. For instance, if GBP/USD is your pair, then the UK and US general view has to be positive.

When doesn’t this trading style work?

When markets are uncertain, traders do not buy high-interest currencies, or they sell high-interest rate currencies.

Traders look for safe-haven currencies like the Japanese Yen or the US Dollars with indecision. This is because these currencies have lower interest rates than others. It happened during the 2008 financial crisis when the JPY significantly increased against all other currencies.

When choosing a currency pair, you need to look for three things:

- Choose a pair with a high interest rate difference.

- Find a pair that is trending higher. This will allow you to hold your trading positions for a longer time and give you greater profits.

- Remember that the economic and political scenario of a country changes daily. So you never know when the safe-haven USD will start being in the traders’ bad books.

So, you need to understand the importance of economic and political factors. One way to keep an eye on the interest rates is to follow the policies of central banks. With the tighter monetary policy, you have interest rates. Therefore, it provides you with an opportunity to the positive carry trade.

Which currency pair is better to choose?

Many traders don’t pick the right pair, choosing some fancy pair, and don’t get the results they expect.

The currencies that work best with this kind of trading are:

- GBP

- USD

- EUR

- AUD

- CHF

- JPY

- NZD

- CAD

Pairs like NZD/CHF are highly profitable with a carry strategy. A key point to add here is your trading pair depends on the positive and negative carry.

NZD/CHF is an example of the positive carry trade. This means you are long on the pair. Conversely, major pairs like EUR/USD or the GBP/AUD are examples of the negative carry trade, which means you need to go short when trading these pairs.

Pros of carry trading

- As the FX market runs round the clock, your trading positions keep open. So you’ll not only profit from the difference in interest rates but also from currency rising or falling.

- Leverage and this kind of trading is a deadly duo. With leverage, you can open large-sized positions with a small amount, and your profits can be substantial.

Cons of carry trading

- The most significant risk of this trading is the changing exchange rates.

- The whole point of this trading style is the interest rates. So any change can cause you a loss. This is particularly important when you are a long-term trader. If the trade went against you, your carry trading strategy would go down the drain.

Risks of the carry trade strategy

-

Change in interest rates

Everyone knows that the interest rate in most countries is a dynamic indicator that changes depending on the macroeconomic situation. If the interest rate is sharply raised, then the prices of government bonds will respond with a decline, the strength of which depends on the duration. If the carry trader wants to sell government bonds ahead of maturity with a sharp rise in rates, he may suffer losses.

-

Currency risks

Fluctuations in some currency pairs are also quite significant. Often, hedging instruments are used to mitigate currency risks – futures and options; however, they are not free.

-

Default risks

Of course, the most reliable instruments for this strategy are selected, but the probability of a default by the state cannot be completely ruled out. If the country in which the carry trader bought government bonds defaults on its debts, he will be left with a massive loss on bonds and a loan that still needs to be repaid.

-

Other costs

A carry trader should be reasonably well versed in all possible commissions and tax costs that he will face. This point is more relevant to private investors trying to conduct such arbitration but forget to consider all fees for transfers, conversions, etc.

-

Political risks

We live in a period of a rather tense geopolitical situation in the world when sanctions and trade wars are typical. A carry trader needs to assess the country’s current position in the international arena, the likelihood of imposing sanctions against it, the degree of influence of sanctions on the national currency exchange rate, and the ongoing monetary policy.

Final thoughts

This trading style, with all its potential benefits, carries a lot of risks. Market participants often resort to trading, not one or two currency pairs but whole “baskets” of currencies to reduce these risks. With this strategy, possible losses from unsuccessful trades are often compensated by income from other orders, to which the market situation was more favorable.

However, this kind of trading requires a lot of capital and a team of professional traders and analysts who will effectively manage the currency basket, dynamically changing its composition and ratio of components. Therefore, carry trading is practiced primarily by large investment companies and banks, while this strategy is not very popular among small traders.

Comments