Cost averaging is a familiar term in investing. Investors use this strategy typically when the price of a particular asset is falling and they are figuring out a way to enter at bargain prices. While investors employ this method in investing, you can utilize a similar strategy in currency trading. This is what you are going to learn in this article.

What is cost averaging in forex?

As in the case of stock trading, you will enter multiple trades with similar amounts or volume until you have opened your desired market position. For example, if your capital allocation to one currency pair is 0.05, you will open 0.01 volume every time the price is in a discount zone. So this will continue until you have five open trades in total with 0.01 lots each. When price reverses after opening one or two trades, that is a good thing.

Cost averaging risk

Thus the risk of cost averaging lies in not using a stop loss to limit your market exposure. Since the method is applied in investing, usually, you would not set a stop loss to every trade. Even if you open five trades, you will think of the whole basket as one position.

If you use this technique, you expect the market to reverse in your favor at some point. What if the market does not change even after you have taken your full position? You would probably close the absolute position at a loss after a while.

Alternatively, you could hedge your entire position until the market establishes a clear trend. However, the open positions are still in negative territory. Unless you have contingency plans in place beforehand, you will find it hard to liquidate your position and might not get off from your predicament scot-free.

Practical application of cost averaging

Despite the risk discussed above, there is still a way to apply cost averaging in currency trading. The process is quite complex. It would be best if you had a lot of trading knowledge and experience to attempt its use. To do it, you must understand the following ideas:

- Use a tool that can accurately gauge the long-term trend.

- Identify significant value or discount areas where you can place trades in the overall trend.

- Use proper lot sizing to control the risk.

- Learn a hedging strategy to exit the whole position in profit.

- Use a program to monitor the floating gain.

Determining the trend direction is always the million-dollar question. If you can muster a battery of tools that will accurately give you the market bias, you are already ahead of the 80 percent of traders. One tool that is effective at trend identification without subjectivity is moving average.

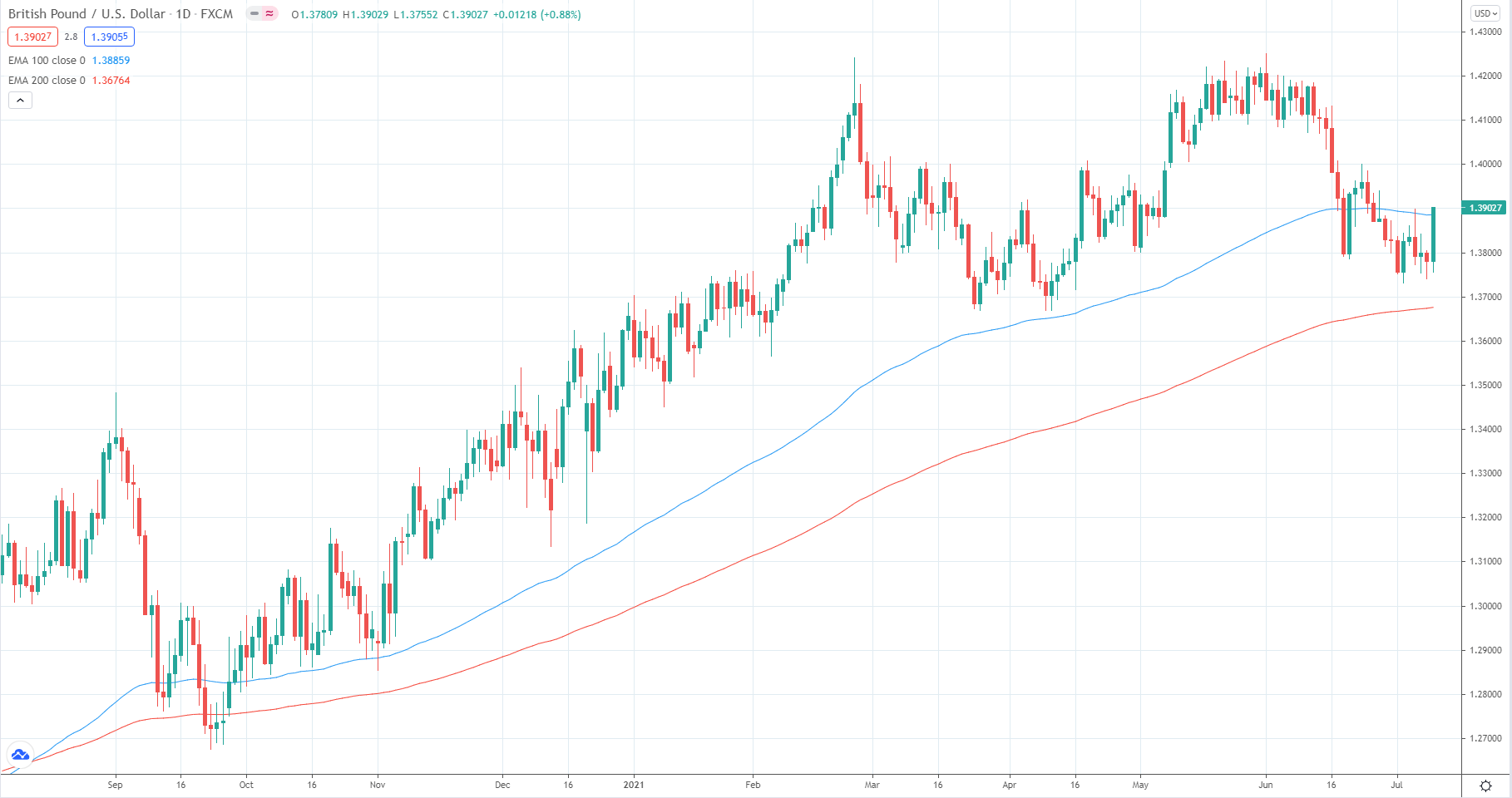

Since you will use cost averaging, you must employ one or two long-period moving averages such as 100 or 200. The type of moving average does not matter. The go-to kind of them is exponential (EMA). Just apply this EMA on the daily chart, and you are good to go.

Just do not overstay the welcome. At some point, the trend will change even on the long-term chart, such as the daily time frame. The above daily GBP/USD chart shows a market with a healthy bullish trend as provided by the 100 and 200 EMAs.

Find discount or value areas for entry

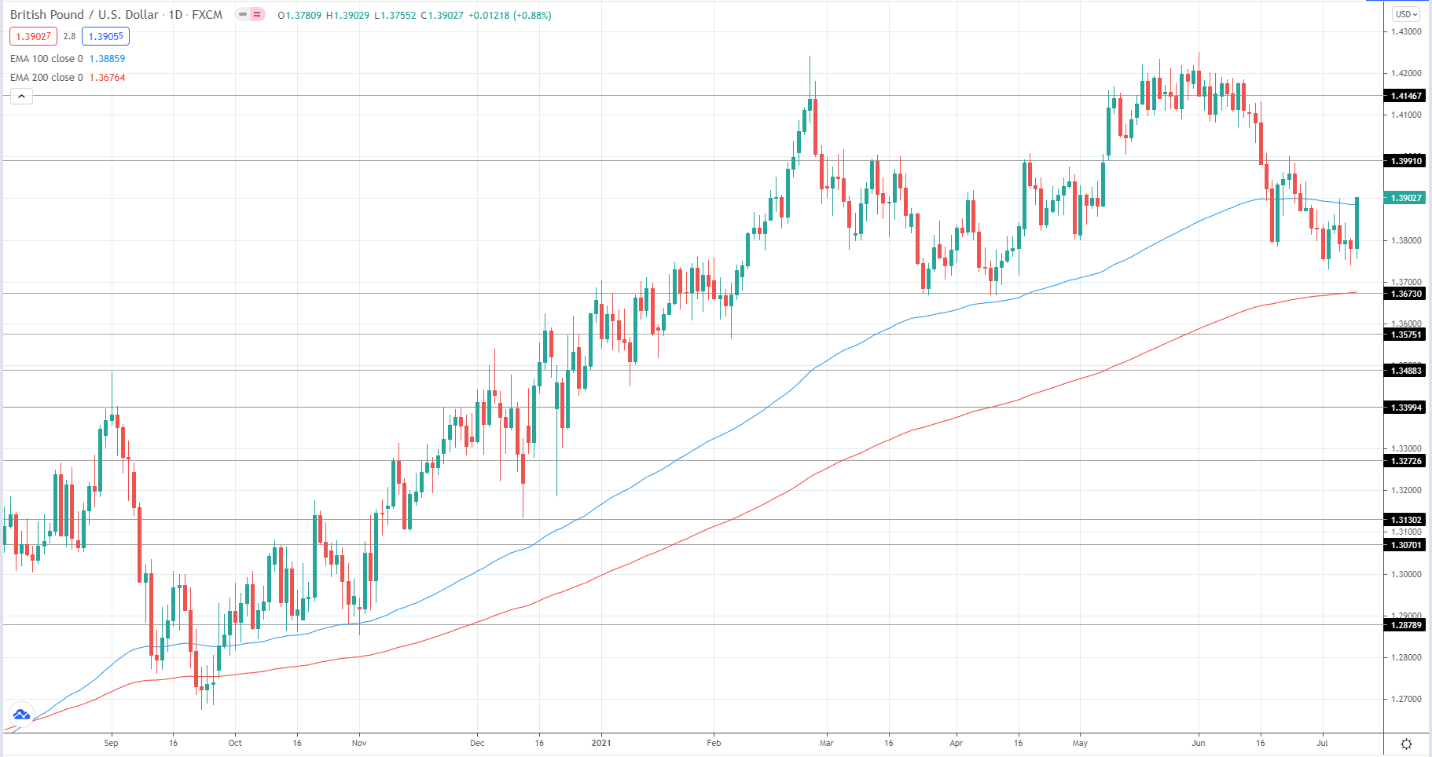

If the daily chart is trending, you would like to enter a discount, value, or pullback area in the context of the trend. Therefore, you must wait for the price to give you cheap entries. For example, if the bias is bullish, you want to place buy trades at support areas. The area between two long-term moving averages such as 100 and 200 is also a value area where you can initiate trades.

Using the daily trend as a guide, you can go down to the hourly and four-hour charts to find support and resistance areas and place trades there. Going down to even lower time frames is often not advisable. The above daily GBP/USD chart shows plenty of support and resistance lines. Since the trend is bullish, as the EMAs depict, you can open one trade at each level.

Set the lot sizes properly

Since you will not use protective stops, each trade in the anticipated position should have the correct lot size. For instance, if you use 0.01 lot for each trade and open a total of five trades, what percentage of the account does the whole position take? Since there is no stop loss, the trade risk is not fully defined. Still, it would help if you controlled risk in this manner.

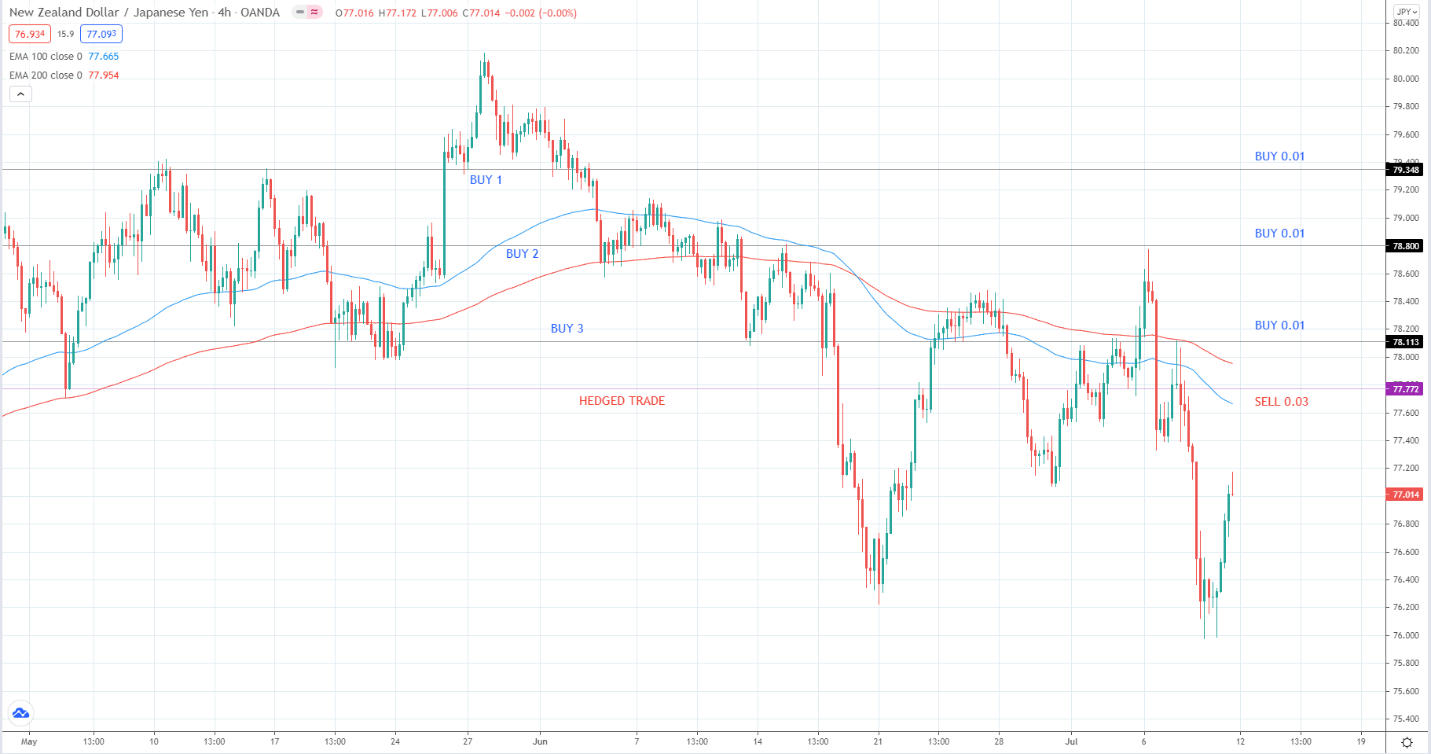

Hedging is an effective tool to lock your whole position if the market did not move in your favor. If you intend, for instance, to open five trades and the market continues moving against you, you will open the same lot size on the opposite side. If your trades are long, you will open one 0.05 lot sell trade to hedge the full position.

The next question is, “How long are you going to keep the hedge position?” This question has no easy answer. One piece of advice is to close the hedged position and add trades to the original position if the market shows clear signs of reversal. One sign is when the market prints a series of higher-high and higher-low. Another sign is a bullish 1-2-3 pattern.

The above graphic is the four-hour chart of NZD/JPY. It also shows an example of a position with three buy trades. If the market does not reverse after the third entry, you can open a hedged trade to protect the position if high-impact news is on the horizon.

Monitor the trades automatically

To prevent disasters, you can use a program such as an expert advisor to monitor the floating profit. When the market does not go in your favor, and the price goes beyond your last entry, the robot can open the hedged trade for you without your direct involvement.

On the other hand, the expert advisor can check the floating profit to determine if the position is winning. The robot may close the position with your input after gaining a certain amount or number of pips. It can even trail your whole position to maximize profits.

A robot doing these simple functions is often not difficult to develop. Many developers are willing to write the code for you at a minimal cost. The more you add processes like exit strategies to the robot, the more the robot development will cost you.

Final thoughts

Cost averaging is uncommon in currency trading because it often entails no protective stops. Still, a small portion of the trading population employs it. Compared to martingale lot sizing, cost averaging is the lesser evil risk-wise.

As long as you understand the risk in any trading method, you can use it in trading. It all boils down to trading style. Whatever works for you, go for it. Besides, the end goal of every trader is to make money.

Comments