Every element in forex trading is based on a calculation created by a brain superior to an average. Alligator is such an indicator, created by Bill William, and it is very effective for any financial market.

The perfect use of Alligator may make your trading journey fruitful, where you will get a chance to make a massive profit from both short-term and long-term trading. However, making money from the Alligator strategy often requires additional knowledge of trade management and risk tolerance.

Let’s check a detailed overview of the Alligator strategy with an exact short-term and long-term trading method that might enrich your trading knowledge.

Why is it worth using an Alligator strategy forex?

The success in using trading indicators depends on how effectively the tool is explaining the market. Based on this concept, we can easily rely on alligators from the famous mathematician Bill Willam.

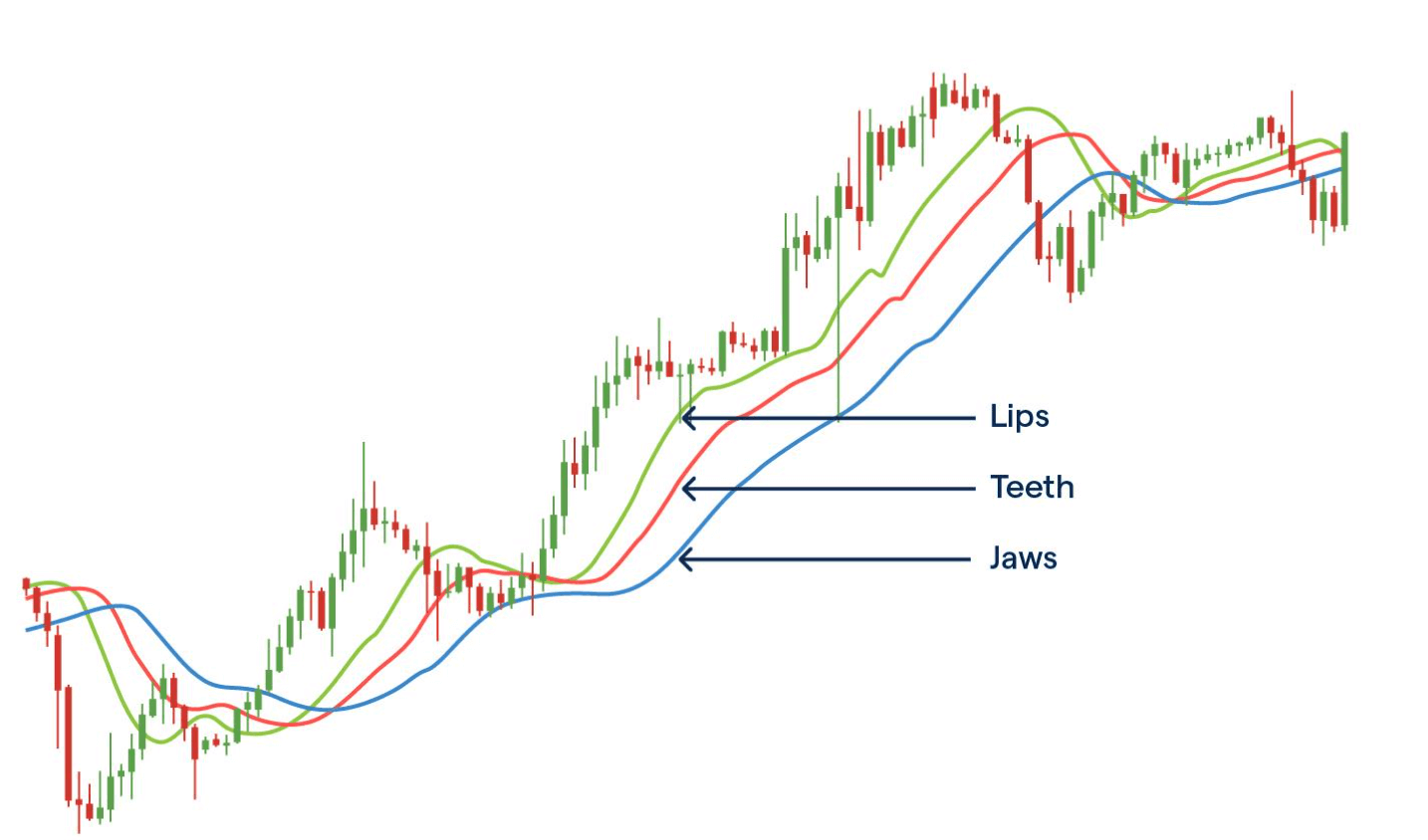

This strategy identifies the market trend using several moving averages (MA), like other trend trading elements. This indicator uses three MAs to represent three parts of the Alligator:

- Teeth

- Jaw

- Lips

We can measure the red line as teeth, green line as lips, and blue line as jaw in the default color.

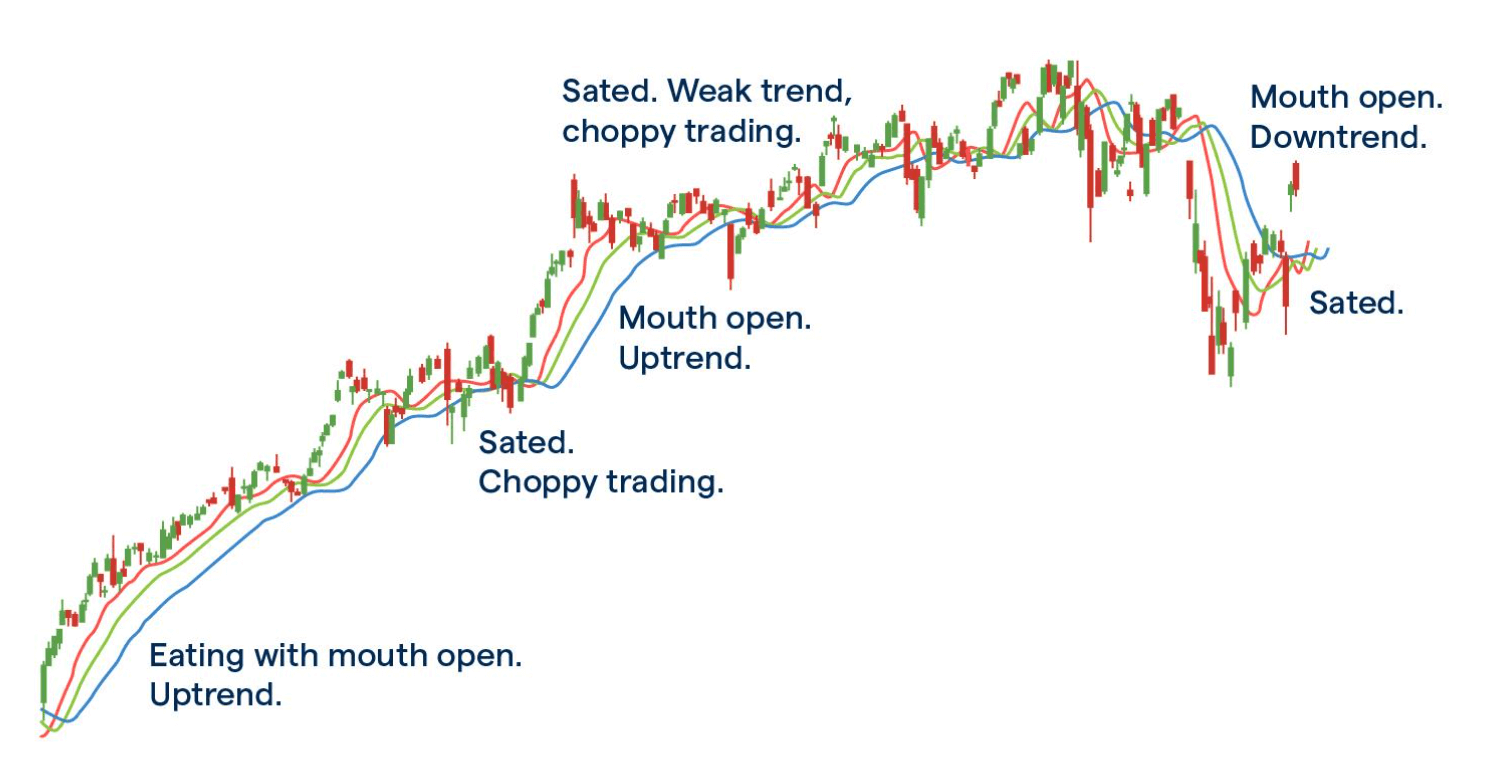

The best part of this indicator is that it represents a market story, which is very logical and practical. It can match the market context with nature perfectly. When the teeth, jaw, and lips are close together, we can consider that the price is tired and sleeping — pointing out a corrective market.

Moreover, it is a sign of profit-taking where the current trend’s strength is fragile and needs further correction to continue the momentum.

On the other hand, the Alligator becomes hungry when it sleeps. Therefore, when it wakes up, it will try to hunt bulls and bears. Thus, it will show a sharp move, either upside or downside, until it is sated when it opens its jaws. When the hunting is complete, it loses interest in taking food; it will close its mouth and start taking rest.

Based on the above concept, we can explain the market directly through this way:

- Choppy market

When all alligator elements remain significantly closer.

- Beginning of a trend

The red and green lines show the same direction while the green MA line crosses over them.

- Stable trend

The trend will be vital as long as three MA lines are moving within the same direction parallelly. In an uptrend, all ma lines will head upwards by keeping comparatively the exact distance between them. As a result, we can define it as a strong bullish trend and focus on buy trade only.

A short-term strategy

The FX market has become a blessing to traders as the market context is the same in both higher and lower time frames. When we find a breakout in a 5-minute chart, it will work like a breakout in the daily chart. Therefore, the alligator strategy works well in any timeframe from 1 minute to the weekly chart.

However, the intraday market contains a lot of volatility that often makes trading hard. In that case, finding an active trading session is essential. Based on our findings, the alligator strategy works well in London and New York sessions when institutional traders remain active.

Best time frames to use

We are looking for a trend continuation setup that is very effective in the 5-minute chart.

Entry

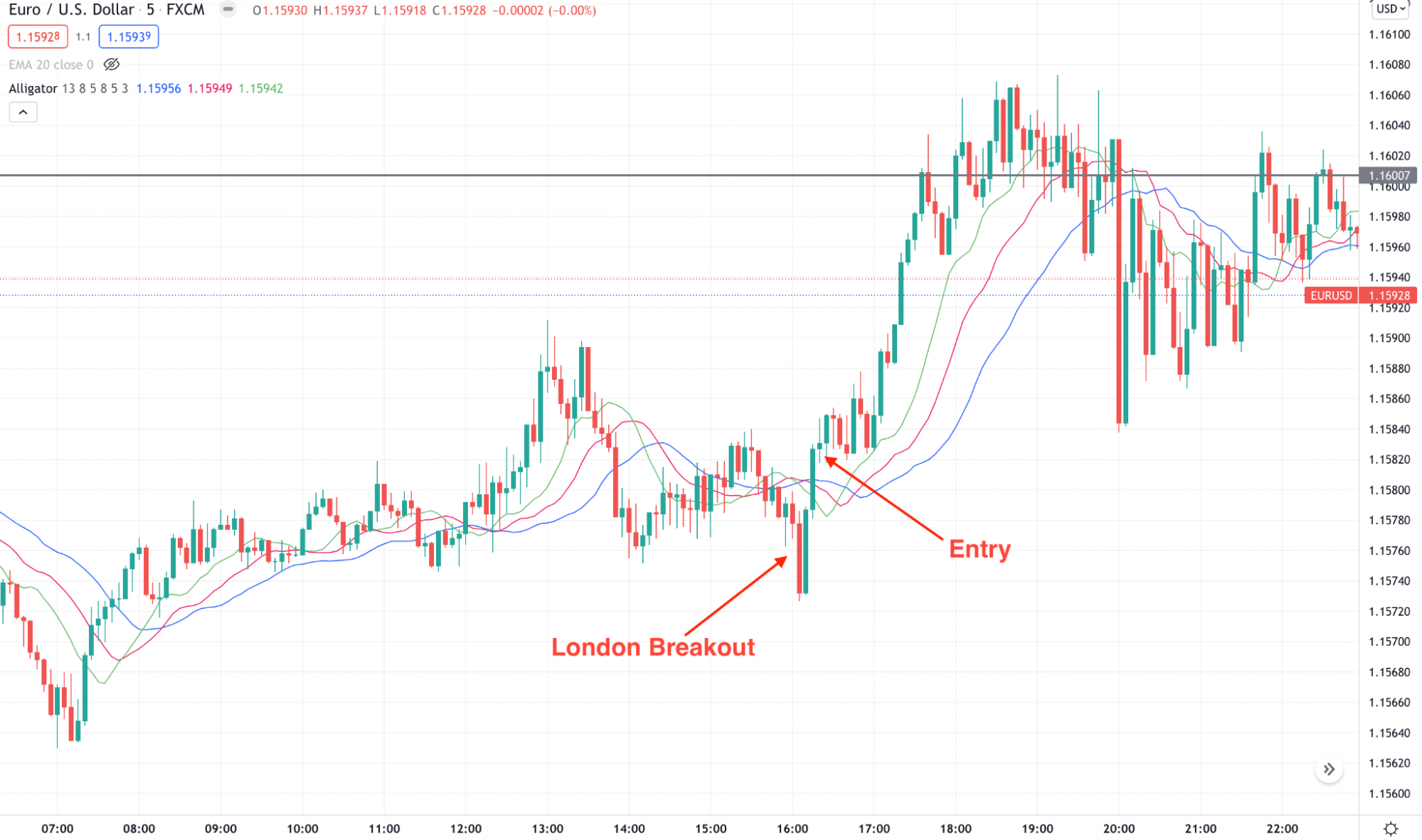

The trading strategy is valid from the London opening to the New York closing. First, find the market trend from horizontal levels and swings and wait for a London breakout. If the London breakout happens on the downside, the trading entry will be bullish. On the other hand, for a bullish breakout, the trading entry will be bearish.

The trading entry is valid if the price moves up or below all MA levels in the Alligator indicator. Open the trade as soon as the candle closes.

EUR/USD chart

Stop loss

The stop loss will be based on the swing level. Therefore, for a buy trade, use swing low, and for a sell trade, use swing high.

Take profit

It is a short-term scalping; try to close 50% of the profit after reaching 1:1 and keep the trade running until it hits any significant support or resistance level.

A long-term strategy

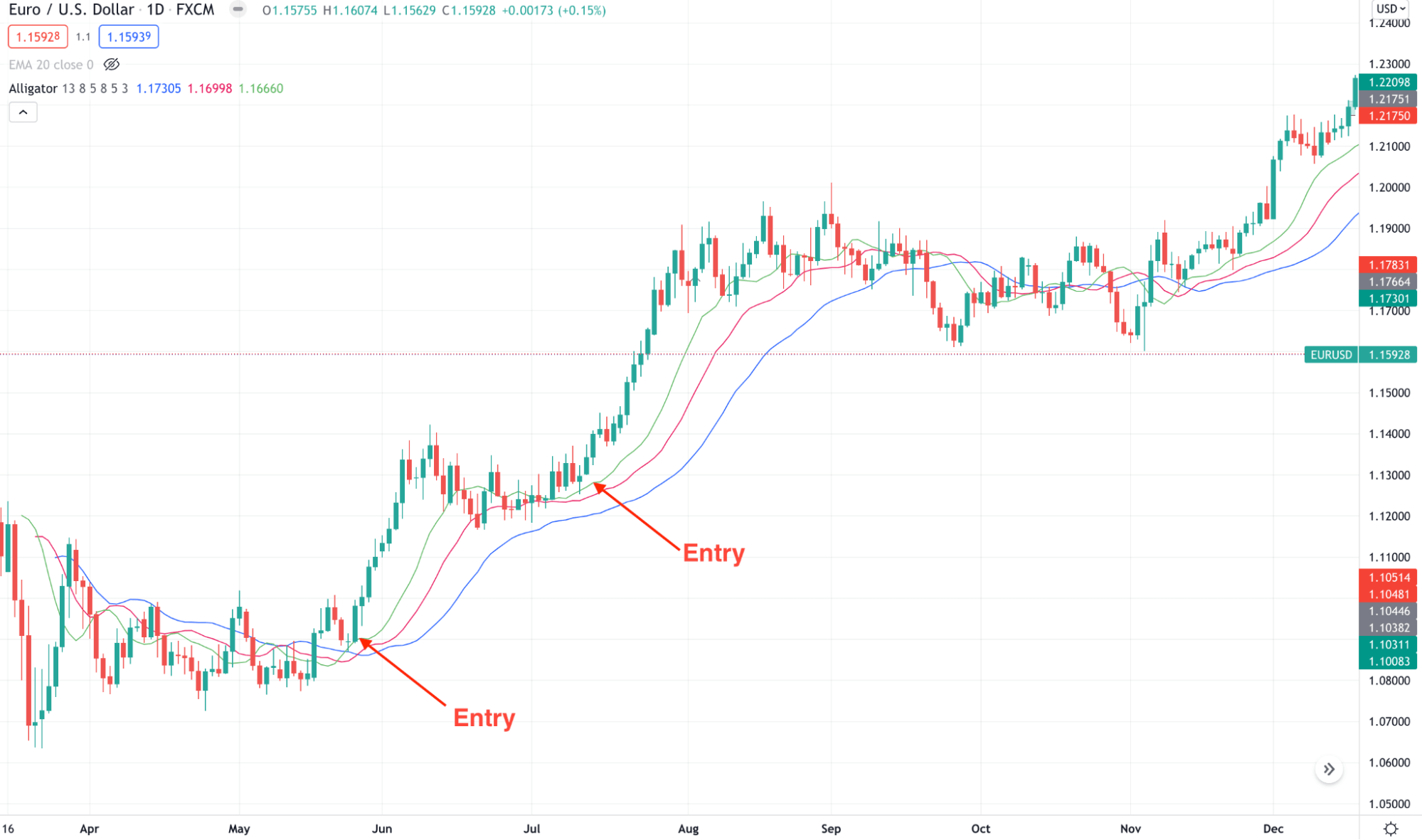

It is quite different from short-term trading, where traders don’t have to find the market trend from the higher time frame chart. This method will use pure Alligator when the trend is strong and catch the juice only from the trending portion.

Best time frames to use

This method is suitable for H4 and daily charts but sticks to the daily time frame.

Entry

For a buy trade:

- The price is above all MA levels.

- All MA levels are moving up by keeping a parallel distance.

- The price shows a bullish rejection.

For a sell trade:

- The price is below all MA levels.

- All MA levels are moving down by keeping a parallel distance.

- The price shows a bearish rejection.

EUR/USD chart

Stop loss

The stop loss should be below or above the Alligator line.

Take profit

Like the short-term trade, try to close 50% of the profit after reaching 1:1 and keep the trade running until it hits any significant support or resistance level.

Pros and cons of the Alligator strategy forex

Pros |

Cons |

|

|

|

|

|

|

Final thought

Alligator is an effective trading tool in the FX market that is free to use in any trading software. The user-friendly and straightforward interface might help you grow your trading account. However, the best use of this method comes with strong trade management rules.

Even if you follow a suitable trading method, you cannot ignore the market volatility and uncertainty. Your A+ trade setups might become effortless at any time. So focus on building a trading portfolio with a risk management system.

Comments