The most exotic fact about currency trading is that you can make money only by following simple strategies. The FX market is full of opportunities for any individual from anywhere around the globe. Choosing good currency pairs and understanding the price movement will open the door to a successful trading career.

Although there are lots of instruments in trading, many of them are not suitable. Before choosing to trade, you must check on some attributes, such as volatility, costing, availability, etc.

Let’s look at the primary factors that you should check before choosing currency pairs. Moreover, we will list the best currency pairs to trade and also the reasons behind choosing.

How to choose the best currency pair?

Check on these steps to verify whether you should trade a pair or not.

Step 1. Liquidity

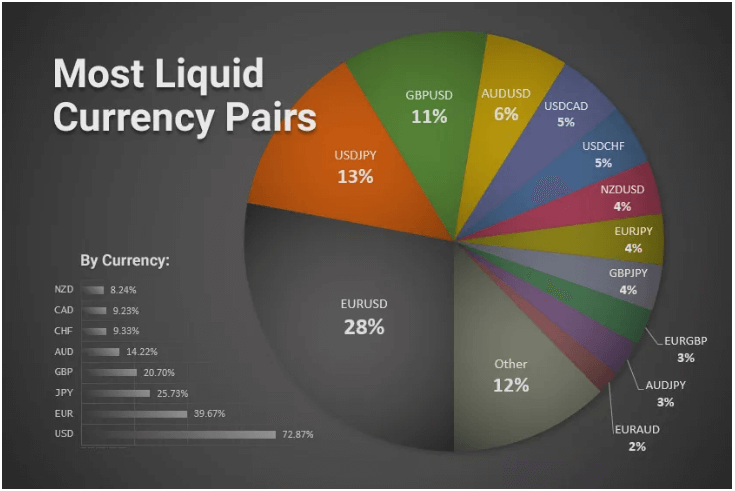

First, check the liquidity of the trading elements in the foreign exchange platform. It is how fast you can make transactions of that currency. Trading pairs with higher liquidity represent more market participants. The involvement of banks and institutional traders helps the pair to have higher liquidity. It is a sign that the pair has enormous buyers and sellers that help them find a stable trend and price action.

Liquidity of currency pairs

The above image shows that the EUR/USD is the most liquid instrument, so any trading strategies based on any analysis may work well in the EUR/USD pair.

Note: the figure won’t be absolute forever, but the error won’t be more than 5-10% of the total info. There are many other currency pairs in the FX market, but possibly nobody knows the minor liquid currency pair. The liquidity of those pairs is very little or maybe none in comparison to the major pairs.

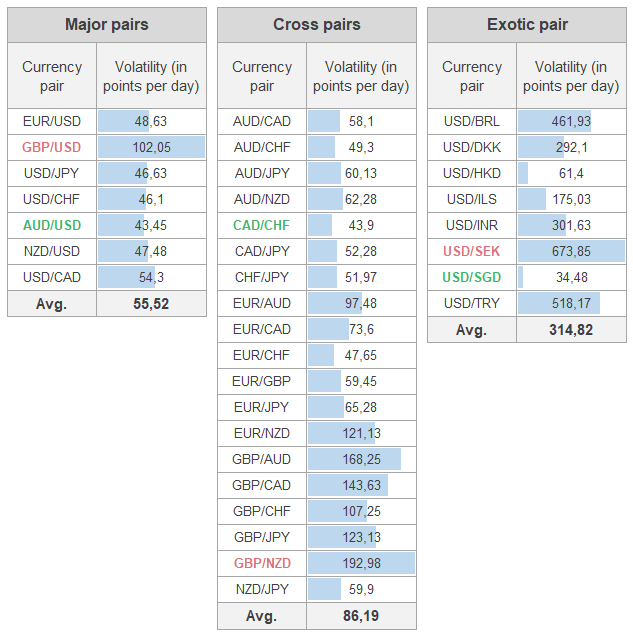

Step 2. Volatility checkout

In the next step, check out the volatility of the currency pair. Always choose pairs with good volatility, which depends on the supply-demand or indirectly on the liquidity of the pairs. Higher volatility represents maximum daily movement in pips. Therefore, you can earn more money at a time by trading on volatile pairs.

The figure below shows the volatility of the FX pairs.

Several types of volatile pairs

Step 3. Availability of information

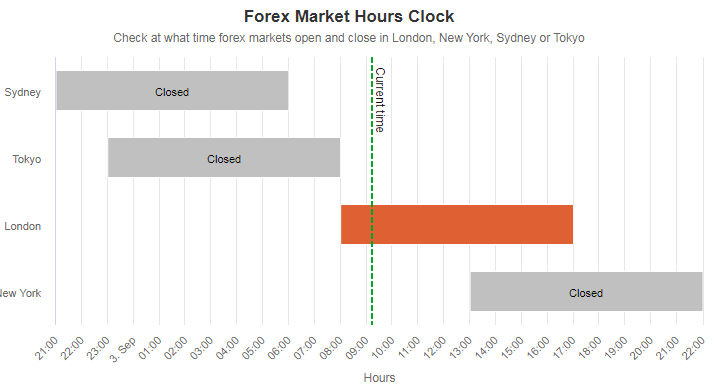

In this step, you have to check on the data release time. Check when the major participants take trading actions and news releases. You have to check on the market hours of active pairs.

The best part is that the trading news and fundamental data are available for free. Anyone from anywhere in the world can access economic releases through an internet connection. Moreover, it is a 24/5 market, and you can trade any time at any session.

Market hours on GMT

For example, the JPY and AUD pairs will remain active during the Asian session while the pound, euro, etc. pairs will remain active during the European and American sessions, so you should check the best and worst times to trade. Trade specific currency pairs before making a decision.

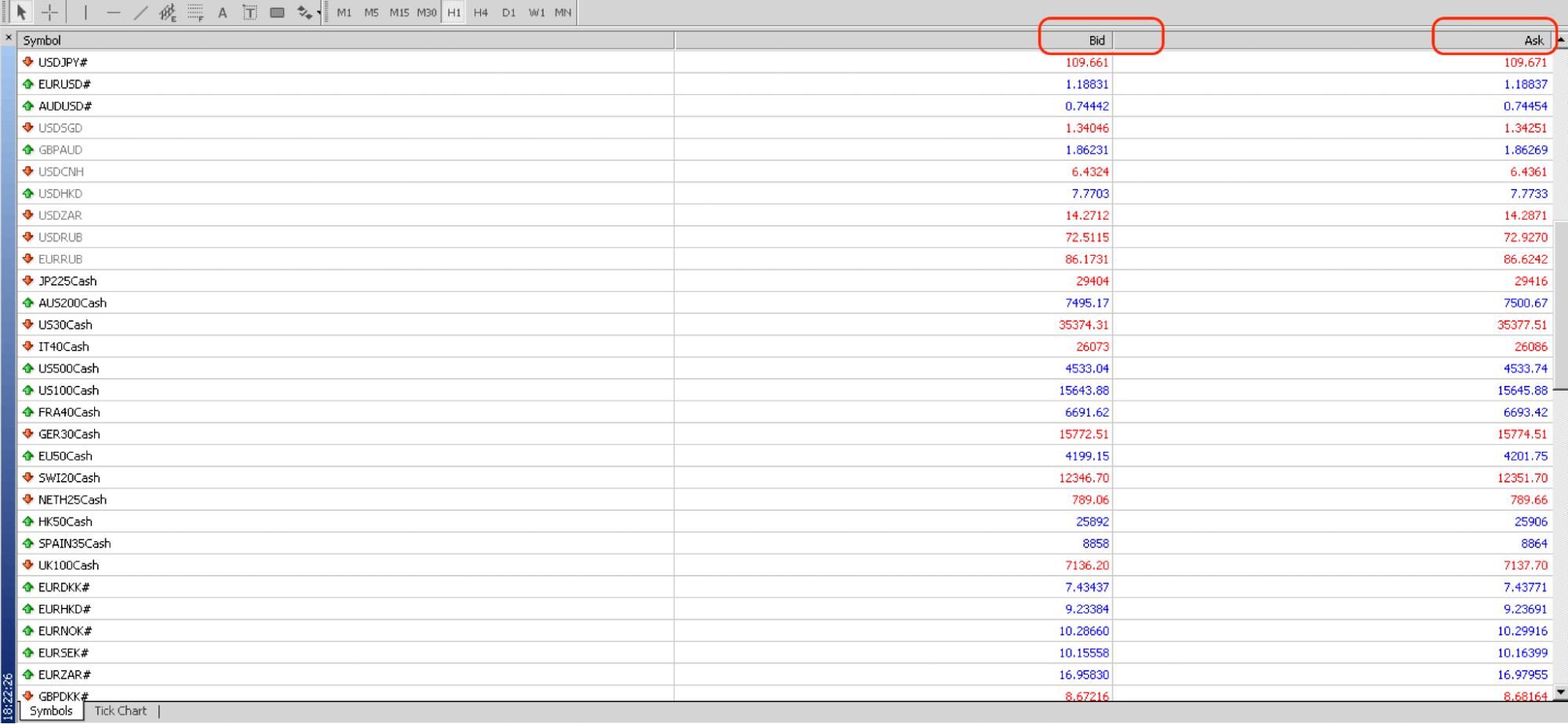

Step 4. Trading cost

Another important fact is the costs associated with trading. On the FX chart, the gap between buying and selling certain pairs is spread. You will find that the spread on the major currency pairs is small compared to the other pairs. Another negotiating price is the exchange; you can avoid it.

As a trader, you need to find a broker who will allow you to trade with minimal trading costs. However, brokers are cheaper than the traditional stock market.

Let’s see the list of pairs with bid and ask prices from the MetaTrader 4 platform.

Bid and ask price

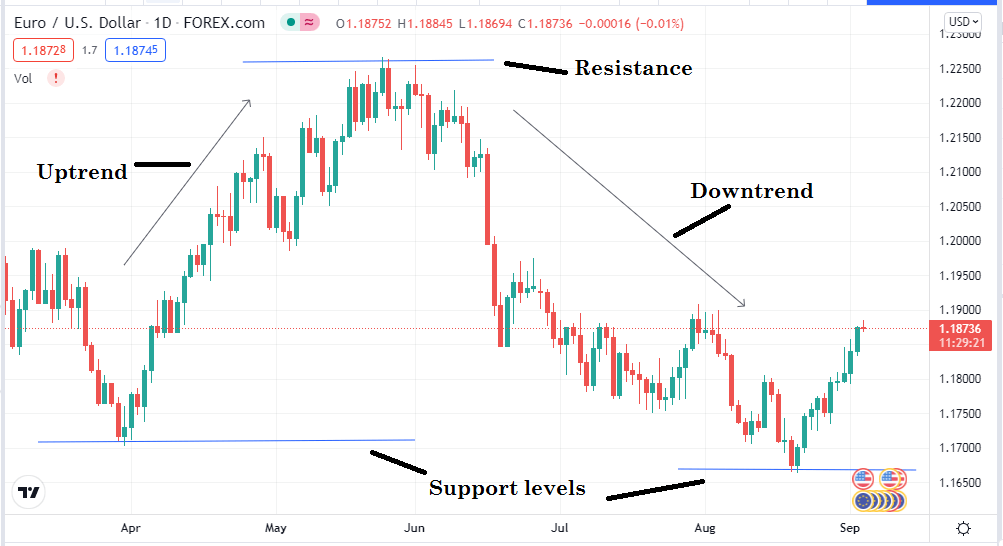

Step 5. Technical analysis

In this step, you need to perform a technical analysis of your target pairs. To know the profitable trading position, you need to check the technical data on the charts, such as B.

Support resistance zones, pivot points, trends, etc. The main focus of using analysis is identifying the next price direction by looking at what happened on the chart above.

Technical views on EUR/USD daily chart

What is involved in trading currencies?

In this part, we list the currency pairs that might suit your trading style. The USD is the world’s reserve currency. Therefore, pairs with USD are the most profitable. Others are currency pairs that are not insolvent with the USD.

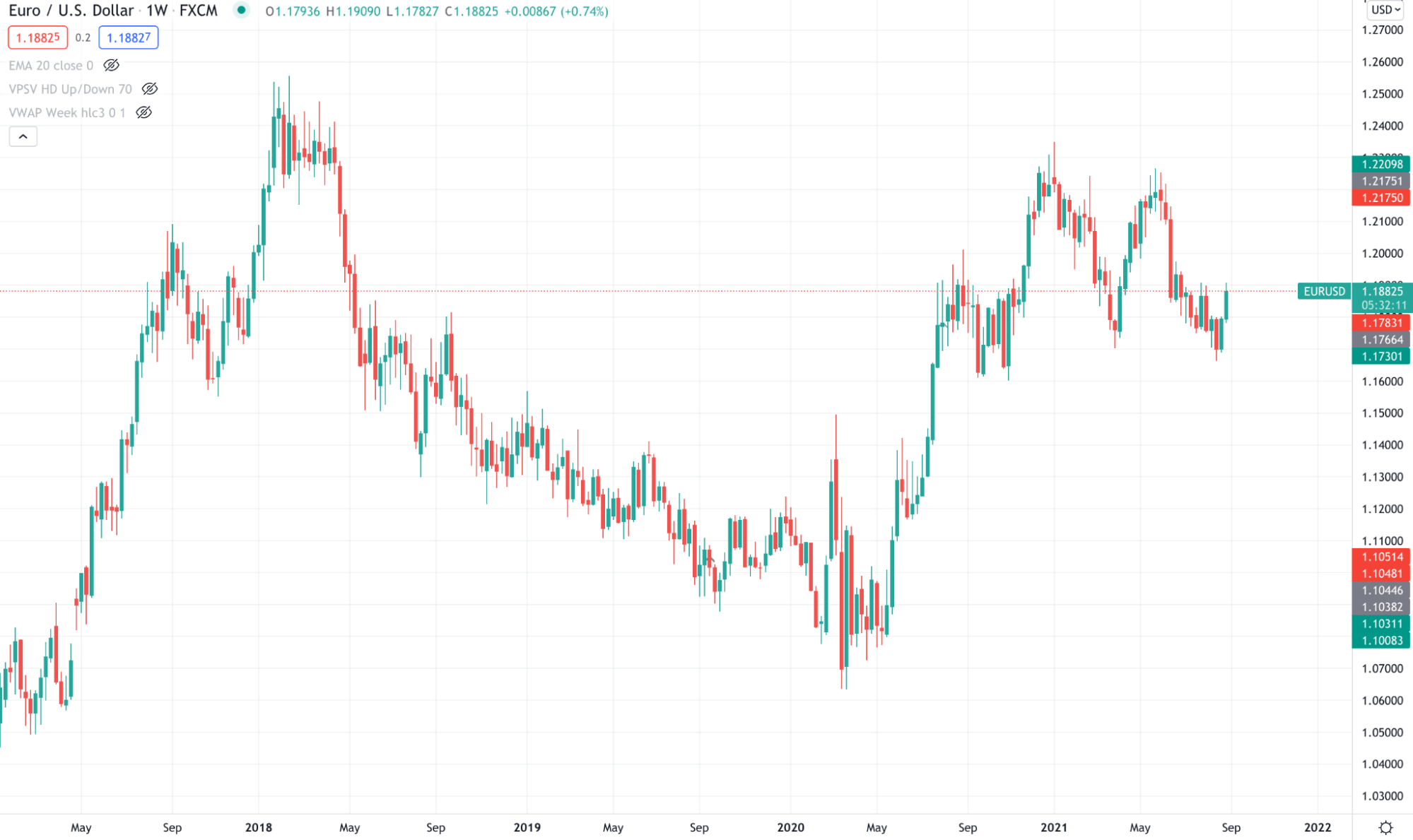

EUR/USD: the fiber

The EUR/USD pair remains active during US and European trading hours. The euro versus the dollar is the most popular pair with the highest liquidity and average volatility, averaging 70 to 80 pips per day. The spread is also tiny on the EUR/USD; it is a currency pair preferable to large banks, financial institutions, and retailers.

EUR/USD weekly chart

GBP/USD: the cable

The second-best currency pair is the British pound against the US dollar. This pair remains in the volatile category, so it has both risks and opportunities for higher returns. Investors also often use this pair as a cable, which has acceptable volatility and is popular with traders. You will find that this pair is active during the American and European sessions. Hopefully, you can find plenty of resources for this pair online.

GBP/USD weekly chart

USD/JPY: the gopher

USD/JPY represents the US dollar against the Japanese yen. It is the second-largest liquidity and is also popular with traders as a safe haven currency pair. The Japanese yen is not trending downward and vice versa. Political ties between the Far East and the United States affect this pair’s price movement. The gopher remains active during the Asian session.

USD/JPY weekly chart

USD/CAD: the loonie

The US dollar against the Canadian dollar is also known among traders. CAD is a commodity currency that correlates with oil prices. When the price of oil goes up, the CAD goes up and vice versa. This pair negatively correlates with other pairs like EUR/USD, GBP/USD as CAD is the currency quoted in the USD/CAD pair.

USD/CAD weekly chart

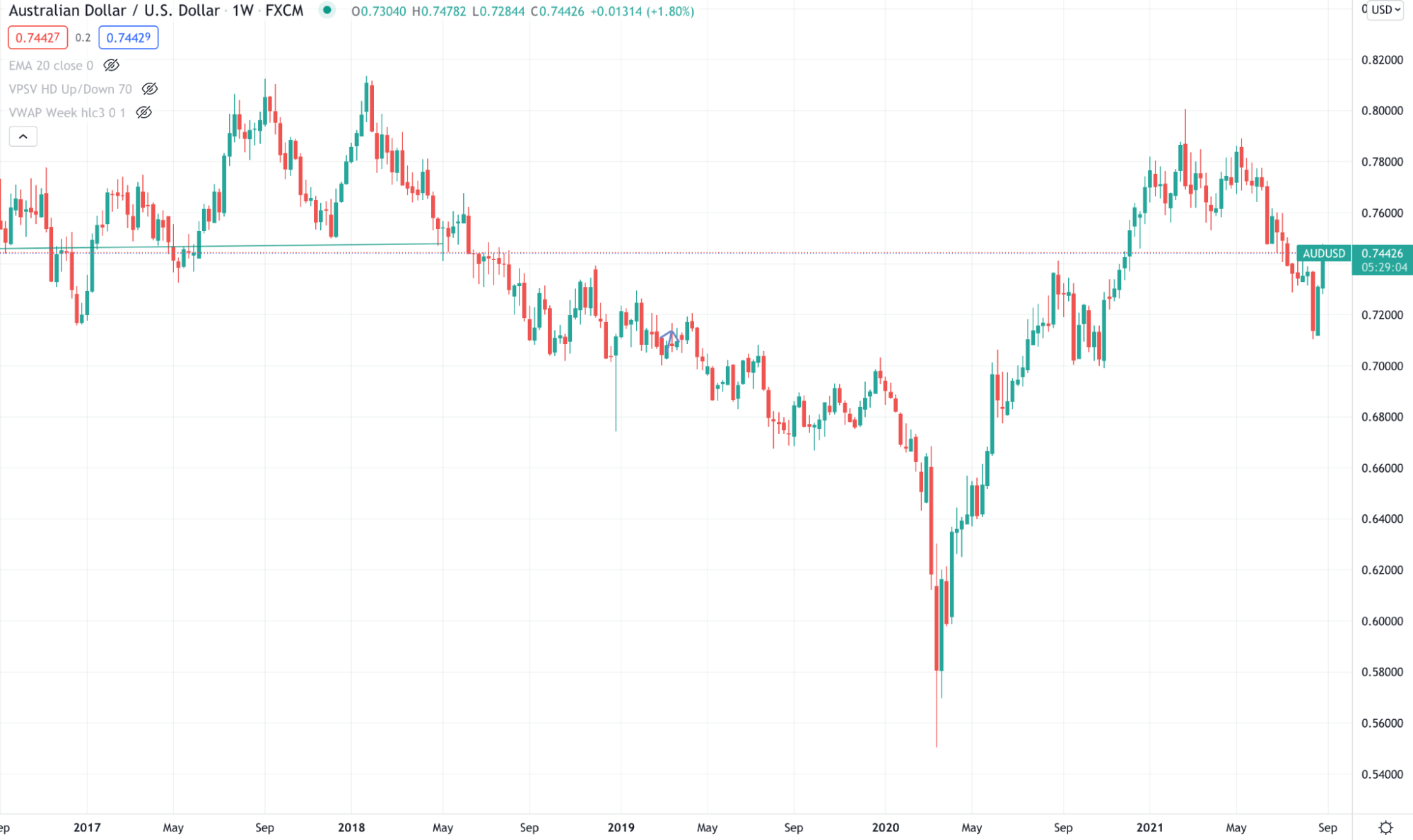

AUD/USD: the Aussie

Aussie dollar vs. the US dollar is another pair to hit the Asian market. This pair has similar behavior in price action with NZD/USD. Many market participants call them AUD/USD and sister currency pairs NZD/USD. These two dollars have a positive correlation.

AUD/USD weekly chart

Final thoughts

The forex market is a marketplace with enormous liquidity, which is full of opportunities for individuals. Choosing the best pair is a significant factor to the individuals that include several checking factors.

We suggest mastering effective strategies, money, and risk management techniques before starting trading.

Comments