The forex market is the largest financial market in the world. The big boys of the market are central banks that produce banknotes and coins. Major participants of the FX are:

- Banks

- Big/small financial institutes

- Export importers

- Tourists

- Immigrants

- Hedge funds

- Firms, etc.

Even the individual traders also play a significant role in it nowadays.

The market operates almost twenty-four hours of the day and five working days of the week. So it’s a place of opportunity and hope where anyone can make money without any limit. However, a proper mindset, stable strategy, money management, punctuality, technical knowledge, and experience are all individuals needed to make money from the forex market. Besides technical expectations, several macroeconomic: social, political, and financial key factors drive the FX.

However, some hidden truths about the FX that novice traders may don’t know or keep the focus on. In this article, we’ll discuss those hidden truths about the market. So the traders can be aware of those facts and avoid losing money.

Key features of FX

FX is the most prominent online place that involves buying/selling currencies of different countries around the globe. It is a decentralized and most liquid financial market, where no one controls it.

Additionally, the forex is just a system that has no physical location. It is a zero-sum market where traders buy and sell currency pairs. These pairs move with the relative strengths and weaknesses of the following currencies.

-

Dynamic market

The FX is a dynamic market that involves price movement in both ways. When the base currency is stronger than the quote currency, the trend is upward, and it is downward if the quote currency is stronger than the base currency. You can make money from both types of movement, know the direction, and place trades at specific price levels.

For example, if we talk about EUR/USD, the base currency is the euro, and the quoted currency is the dollar.

-

Operates 24 hours

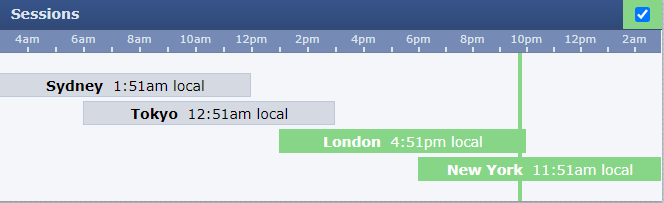

This dynamic market operates 24 hours a day during five working days of the week. As the countries start their days, the market eventually ends then the market moves to the next time zone. For example, when the Asian market closes, the European market opens, continuing as a restless market.

In the above image, we can see the market opens with Sydney and closes with New York.

-

Market transparency

The FX contains high information efficiency, which records transactions electronically and quickly updates the market. A transparent market means all past and present prices are displayed, and no opportunity to manipulate the price by any participants.

-

High liquidity

The foreign exchange market processes 6.6 trillion dollars transactions daily. As a result, it is known as a market with high liquidity. There are always participants to buy/sell currencies across the globe.

-

Dollar dominated market

Another essential feature of the forex market is USD availability. It is a widely traded currency around the globe. The USD is the United States currency, and many other countries outside the US frequently accept it. Simply the majority of trades carried out in the forex market involve USD.

-

Lower trading cost

The other feature related to costing makes the forex market more favorable. Transaction cost is low for the FX compared to any market, such as the equity market.

Hidden truths of FX

Before you determine to exchange any currency with another, you must check the technical outlook and any announcements that could impact the price movement. What you must know before start to trading:

-

Trading volume

Information about the trading volume is vital for any trading asset as it involves the total amount of assets purchased over a certain period. The trading volume is reported incessantly as the recipients take entries or exits from orders. Therefore, you can quickly get the direction of price movement by looking at the trading volume.

-

Smart money concept

Simply the funds under the control of central banks, institutional investors, market mavens, hedge funds, and other financial entities and individuals are known as smart money. Two groups identify traders as intelligent traders and dumb traders.

Any price index is measured by the daily price movement of a particular asset. The smart money concept suggests investors follow the smart money, not the dumb money, cause it is the view of the big boys and participants. It would help if you learned their way to be a consistently profitable trader.

-

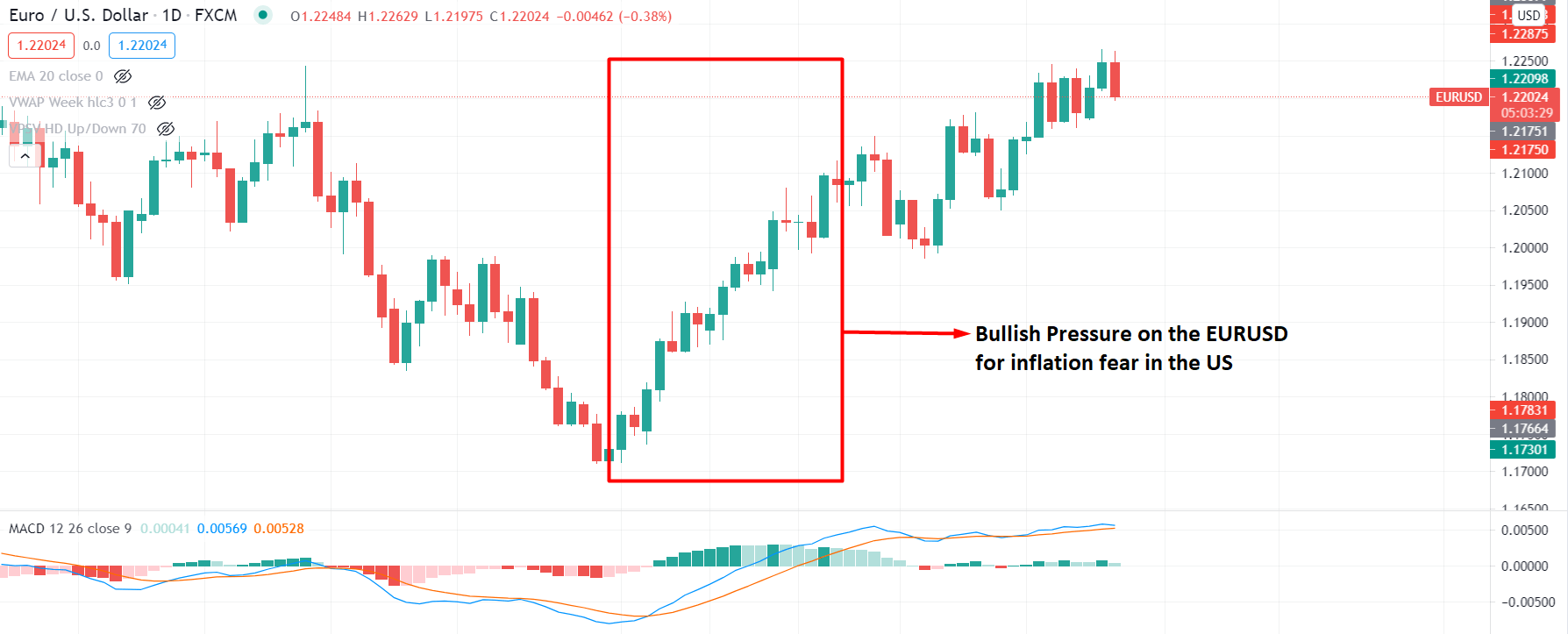

Central banks intervention

The FX is affected by several macroeconomic factors, and the central banks are the controller and producers of the banknotes and coins. Therefore, any forex trader must remain updated about the central bank’s intervention, such as interest rate, inflation-deflation, purchase information, and so on. They are the big boys of the FX, so following them is a wise step to increase profitability.

For example, when the inflation rate is high, then the price will fall for that currency for its availability and vice versa when the inflation rate is in control. Additionally, intelligent traders always follow the interest rate as demand increases for a particular currency, causing investors to want to invest in a stable economy and seek more return at investment.

So it’s self-evident for any forex trader to learn and follow the central bank’s decisions and effective movements about the currency before determining to place an order.

-

Reliability of technical analysis

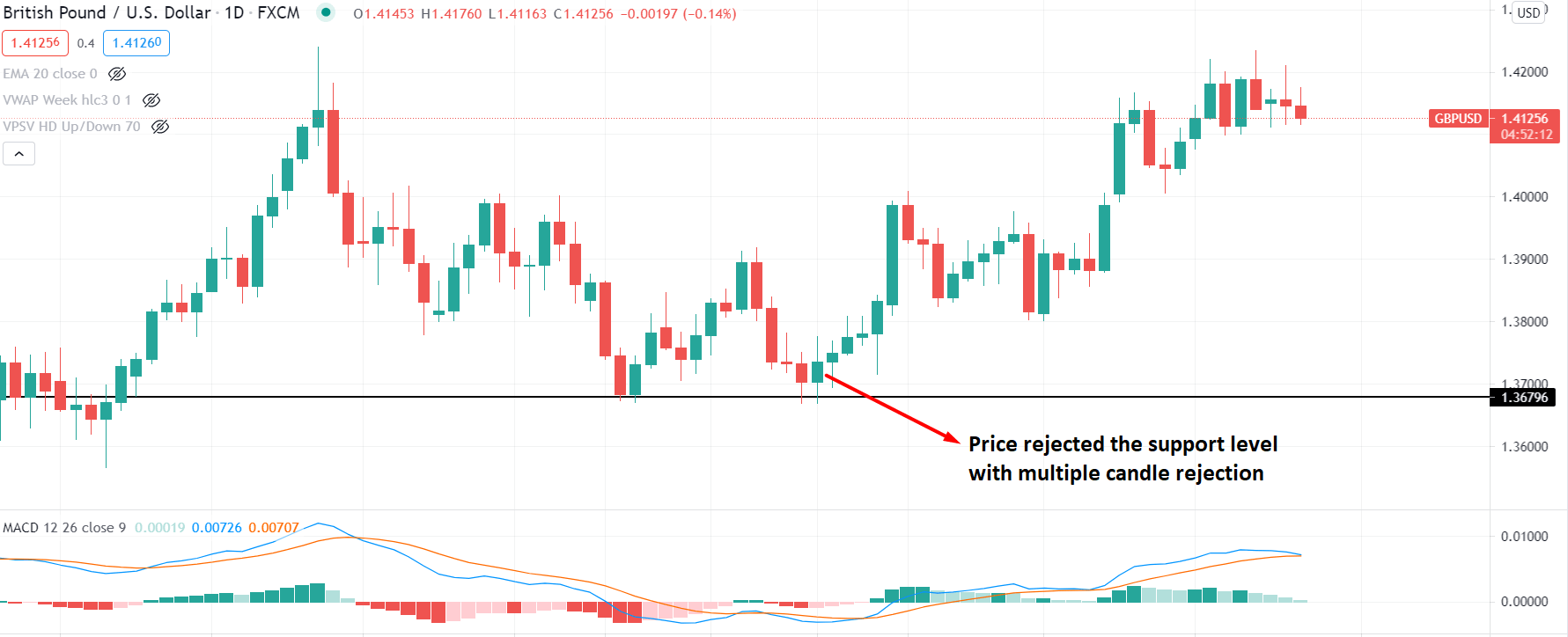

We already know that forex traders generally use technical & fundamental analysis to predict the price movement. Although history repeats itself, price moves in the FX by following well-defined patterns and structures. So you can’t always expect price movement as your technical outlook.

- First of all, fundamental facts drive the market, and the actual impacts sometimes don’t respect the technical levels.

- Second, again the market structure is different at different timeframes. So the price predictions aren’t always the same for institutional and individual traders.

The simple technical analysis approach is to buy from support and sell from resistance with an appropriate candle confirmation.

-

Broker’s price manipulation

An individual trader must know the broker type and how they deal with the price. For example, market maker brokers trade against individuals. In addition, some brokers manipulate the price during fundamental news or events.

So it is wise to check the broker profile related to price manipulations before making any deposit or start trading with any broker.

Final thought: is forex trading more reliable than stock?

Finally, trading forex involves a lot of opportunities, but it is always different from stock trading. However, the forex market is less reliable than the stock market as the market structure and participants are different. In addition, although the FX is decentralized, individuals lose more money in the FX than in the stock market.

Comments