Volume represents the number of orders on a special price, which is one of the essential elements in forex trading. A trader aims to open the buy and sell position towards the direction where most investors are heading. Therefore, opening trade from the high volume area is more likely to match the order of more prominent market participants.

When discussing the volume trading strategy, we should confirm the best volume use with other trading tools. If you follow the guideline below, you can make yourself a pro in creating a trading plan using the volume strategy.

What is the volume trading strategy?

It is a method to consider volume in a trading method and make it more effective. In any trading strategy, we use several tools to increase the trading probability where the volume is one of the premium elements. Among other tools, we will use the supply-demand concept that represents the core structure of the market.

The supply and demand level is a price zone from where institutional traders open their position. It is like a zone from where the market changes its direction with impulsive pressure. Institutional traders like banks cannot open a trade immediately as they require enough buyers to sell and enough sellers to buy.

As a result, they buy in a sell market and sell in a buyers market, ultimately creating the swing. As volume traders, we see how the volume moves in those areas before opening the trade.

Let’s see a practical example of the supply-demand in the real market.

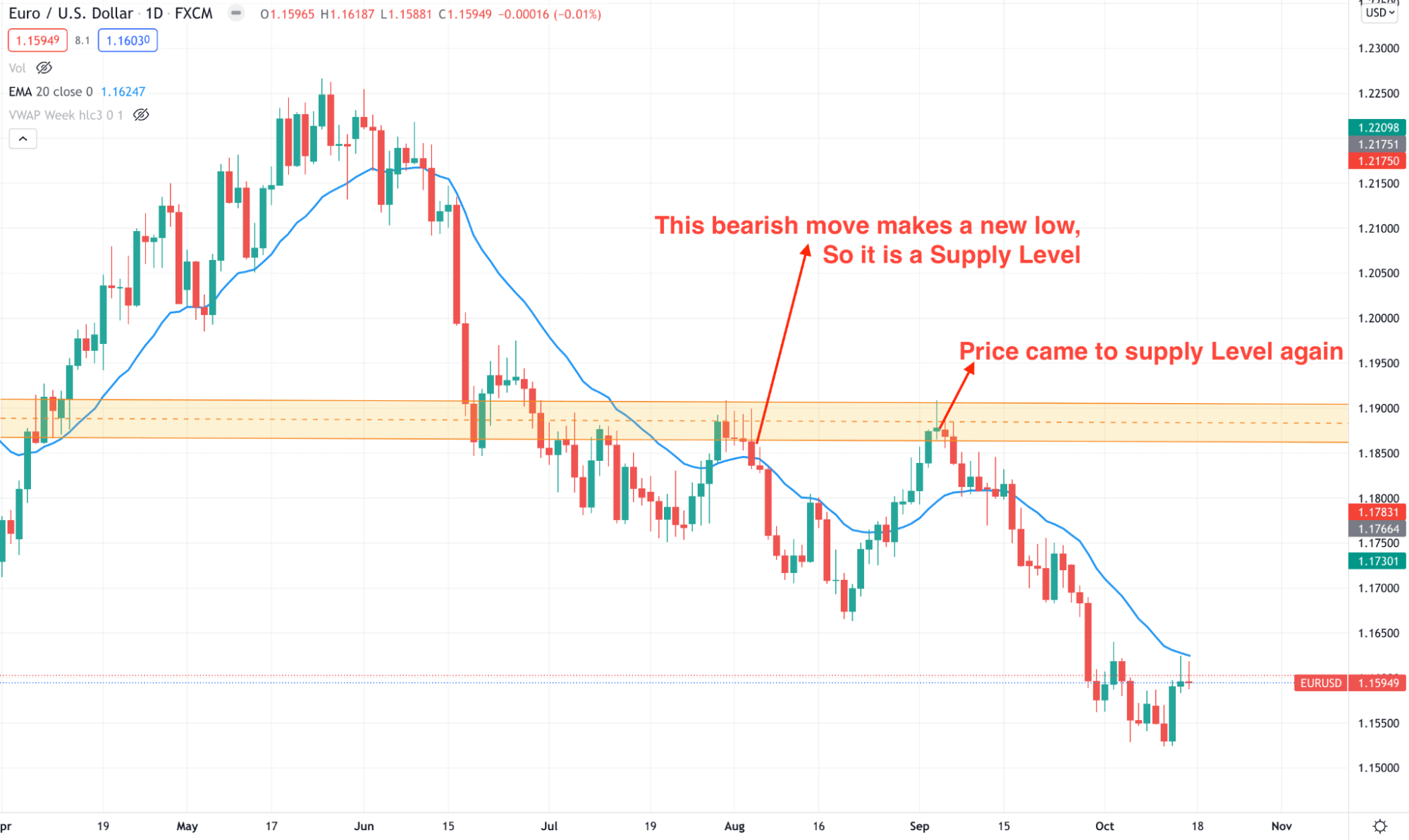

Supply level example

The above image shows that the EUR/USD supply level made a new low in the price as we said in the above section that institutional traders could not open trade at once. Therefore, they need the price to come back to the supply or demand area to open more orders.

In that case, the EUR/USD price came back to the 1.1900 supply level before showing the strong bearish movement.

How to use volume in a trading strategy?

Volume works as a strong indicator. Less volume is a sign of less activity, whereas high volume signifies higher activity. Therefore buyers and sellers fight to take the price in their direction in any major reversal area. So the possibility of getting higher volume in the reversal zone is higher than a corrective trend.

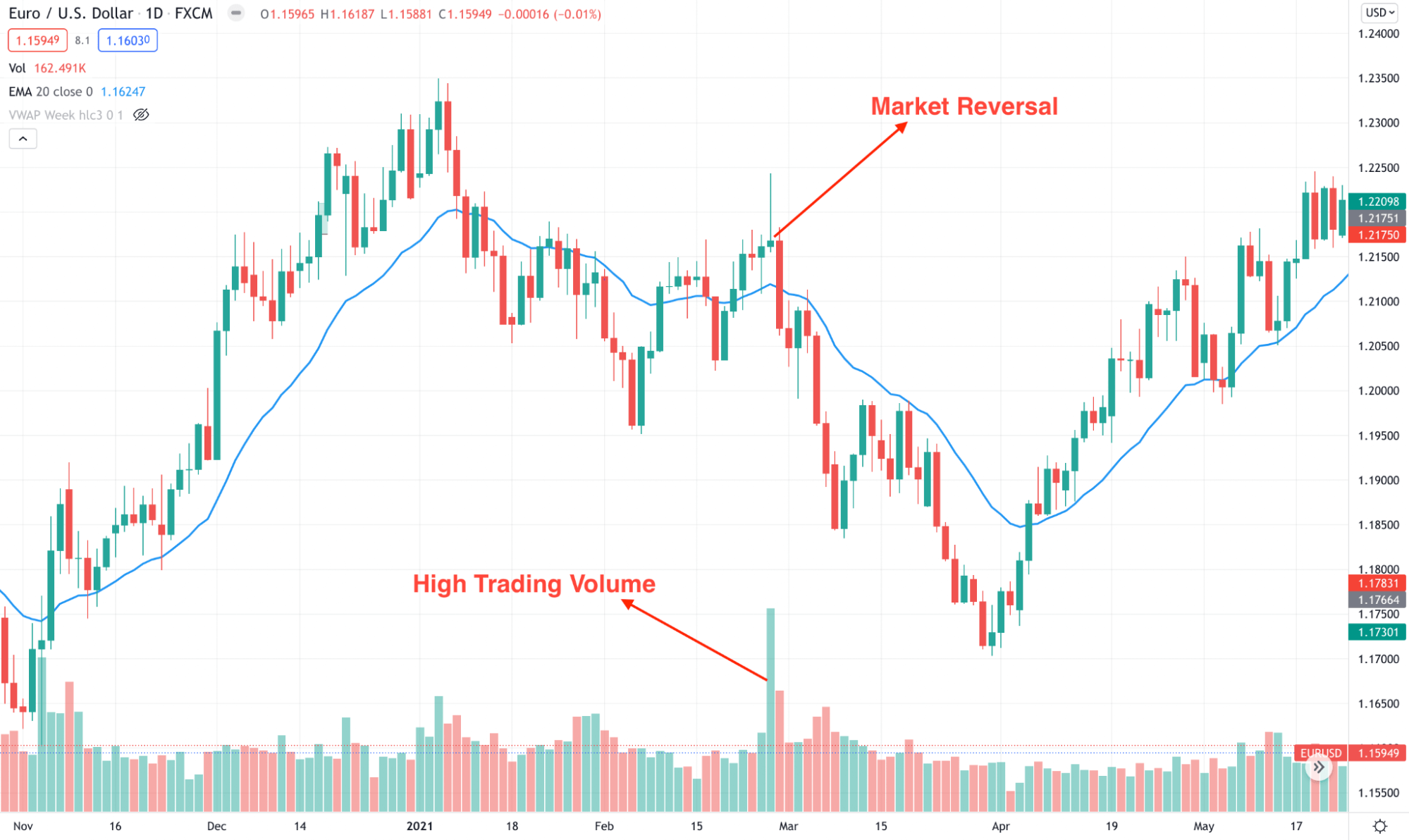

Example of high volume

So in the volume strategy, we need to find the price to struggle by showing higher volume in the supply or demand area. However, we will follow the major market trend, and any reversal should happen towards the trend.

Otherwise, it has a higher possibility of getting stopped out. Moreover, to complete the strategy, we will consider the near-term support and resistance level, candlestick pattern, and price patterns. This method does not require any specific candlestick pattern but finding a reversal formation on the supply or demand zone is essential. It could be with a pin bar, two bar, engulfing, or other reversal patterns.

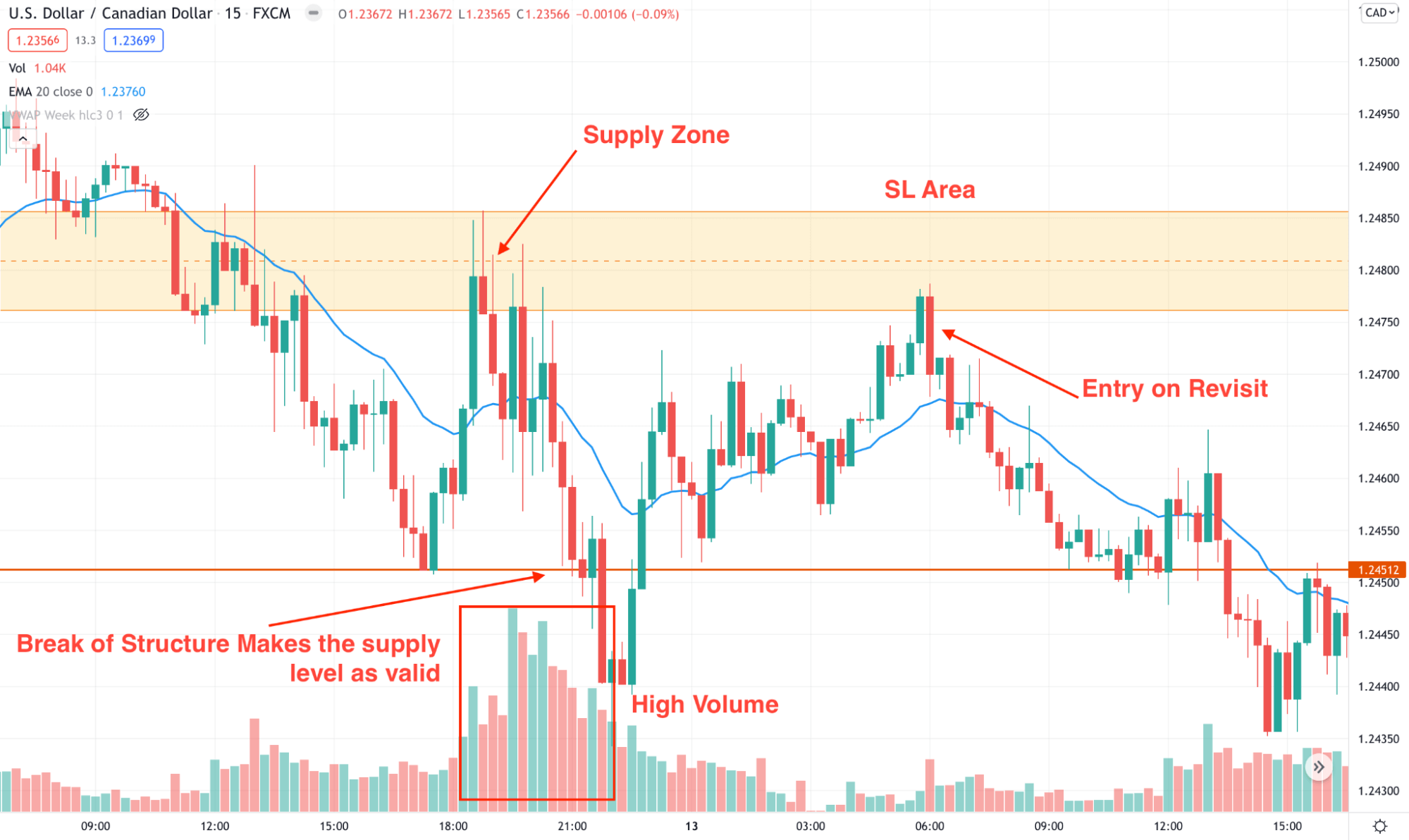

A short-term strategy

It is applicable in any time frame from five minutes to 30 minutes. However, this system does not require the market trend from higher time frames. Besides the lower time frame price action, investors should know where the major market trend is heading. It might be based on the larger time frame or economic events.

The core concept of this method is to identify the supply and demand levels. Remember that these levels are only valid once the price makes a sharp movement by breaking below or above the near-term level. Later on, we will monitor the volume at the supply-demand level with candlestick confirmation.

Best time frames to use

The short-term method applies to 5 minutes to 30 minutes time frames.

Entry

- The price reached the supply and demand level after breaking the near-term high or low.

- Price reverses from the supply-demand level with a candlestick pattern.

- The volume should be higher at the reversal zone than the opposite swing.

Short-term example

Stop loss

The ideal stop loss is above the supply or demand zone with some buffer of 10 to 15 pips. Therefore, if the high of a supply area is 1.1900, the stop loss should be at the 1.1915 level.

Take profit

Timing is critical in this method. Any aggressive movement from the entry will indicate that the trend will stay longer. In that case, traders can hold the trader for higher gains. On the other hand, taking a partial profit is essential after getting a 1:1 risk: reward.

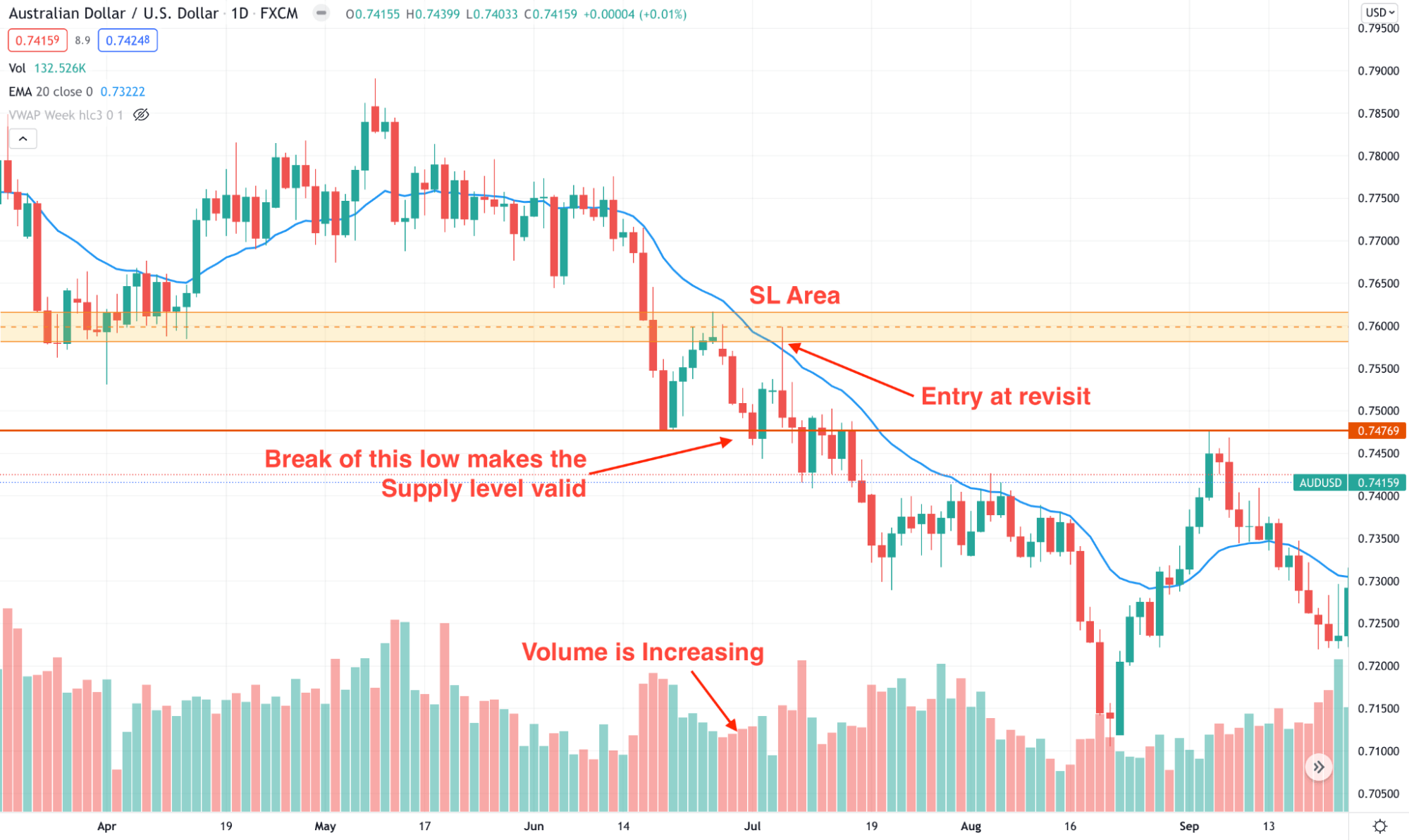

A long-term strategy

It is applicable on the daily chart, where traders can use it as a high probability swing trade. This method is simple, like the short-term strategy where traders find the major market reversal from the supply-demand zone and open trades on the price to revisit those areas.

Best time frames to use

This method applies on H4 to the weekly time frame but sticking to the daily chart is highly profitable.

Entry

- The price reached the supply and demand level after breaking the near-term high or low.

- Price reverses from the supply-demand level with a candlestick pattern.

- The volume should be higher at the reversal zone than the opposite swing.

Long-term example

Stop loss

The ideal stop loss is above the supply or demand zone with some buffer of 10 to 15 pips. Therefore, if the high of a supply area is 1.1900, the stop loss should be at the 1.1915 level.

Take profit

Timing is essential in this method. Any aggressive movement from the entry will indicate that the trend will stay longer. In that case, traders can hold the trader for higher gains. On the other hand, taking a partial profit is essential after getting a 1:1 risk: reward.

Pros and cons of volume trading strategy

Let’s see the strength and weaknesses of the volume trading method.

Pros |

Cons |

|

|

|

|

|

|

Final thoughts

The volume trading method is a highly profitable system as it can explain the price in a way where buyers’ and sellers’ activity reflects perfectly. However, in intraday trading, investors should remain cautious about the volatility from news releases to stay aware of the uncertainty.

Comments