Are you interested in making money from a trending market? Welcome to the Grid trading strategy, where you will see a reliable trading method effective for the forex market.

In trading, there is no alternative way to make money without having a strategy. It does not matter; your method is automated or not. The ultimate approach is to remain profitable at the end of each month. Moreover, besides making money from a trading system of your own, it would be great to boost profitability by using automated strategies like Grid.

In today’s guide, we will see an extensive understanding of Grid trading strategy, including the core concept behind it and an exact way to take buy and sell trades.

What is the Grid trading strategy?

It is a famous approach in trading as it can produce decent profitability from the market in both bullish and bearish market conditions.

Grid trading is an automated system, but it is also applicable on the manual chart. In the manual Grid method, investors should have close attention to the most recent price, pending orders, and trade management. Moreover, this method is effective in volatile markets like forex, stocks, and cryptos, where it does not require where the broader market direction is heading.

Other key features of the Grid method are mentioned below:

- It works in any time frame and any trading assets.

- Traders don’t have to understand the broader market direction using the market context.

- Although this feature is attractive, there is no guarantee that you can implement it successfully.

- Developing an automated software to trade the Grid method needs programming knowledge.

How to use the Grid in trading strategy?

This trading method can make money from a sideways movement by implementing buy and sell stops orders after a gap. In this method, levels are not fixed on the same side that allows it to call a double Grid method.

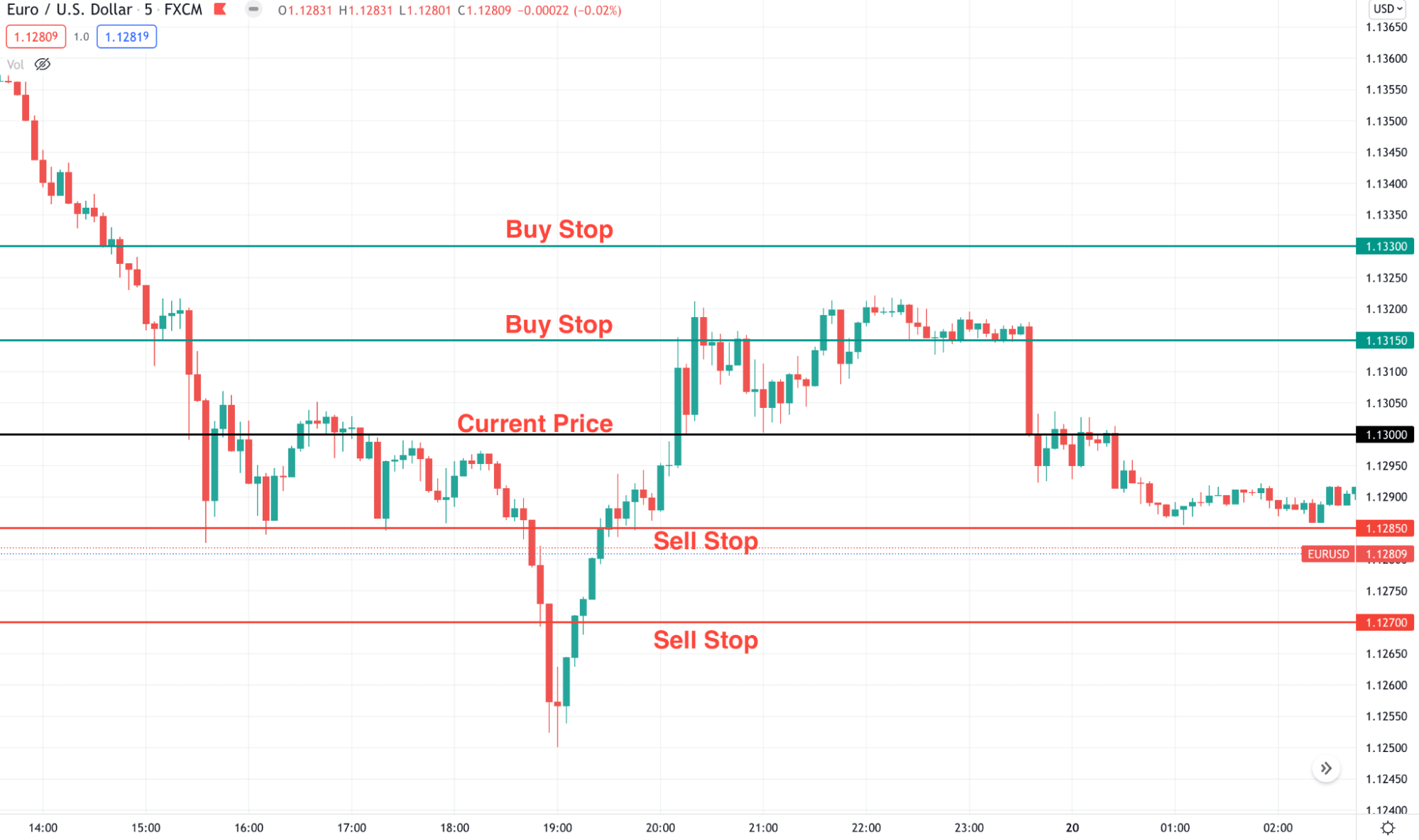

However, the method is effective in both the ranging and trading markets. For example, if you want to apply the Grid method in the EUR/USD chart, you have to open multiple buys and sell stop orders below and above the current market price.

EUR/USD chart

The above image shows the 5 minutes chart of EUR/USD where the current market price and pending orders are marked within 15 pips gap.

After inputting buying and selling orders, you must wait for the market to show a reliable trending direction. Moreover, another approach is to use the buy limit orders below the current market price and sell limit orders above the current price. It would open profit-making opportunities even if the price remained within a range.

The ultimate success in the Grid method depends on how the price is trading. It uses several buys and sell stop orders; it needs a consistent price movement in one direction. On the other hand, trade management is an essential part of this method where investors should closely monitor when they should get out of the trade.

A short-term strategy

We have mentioned in the above section that the Grid method works well in any market condition, from trending to ranging. Therefore, if you are interested in making money from the short-term correction of the Asian session, this method would be an effective way for you.

Best time frames to use

In this short-term method, investors need to open a 5 minutes chart to see a clearer view of the market gap of 15 pips.

Entry

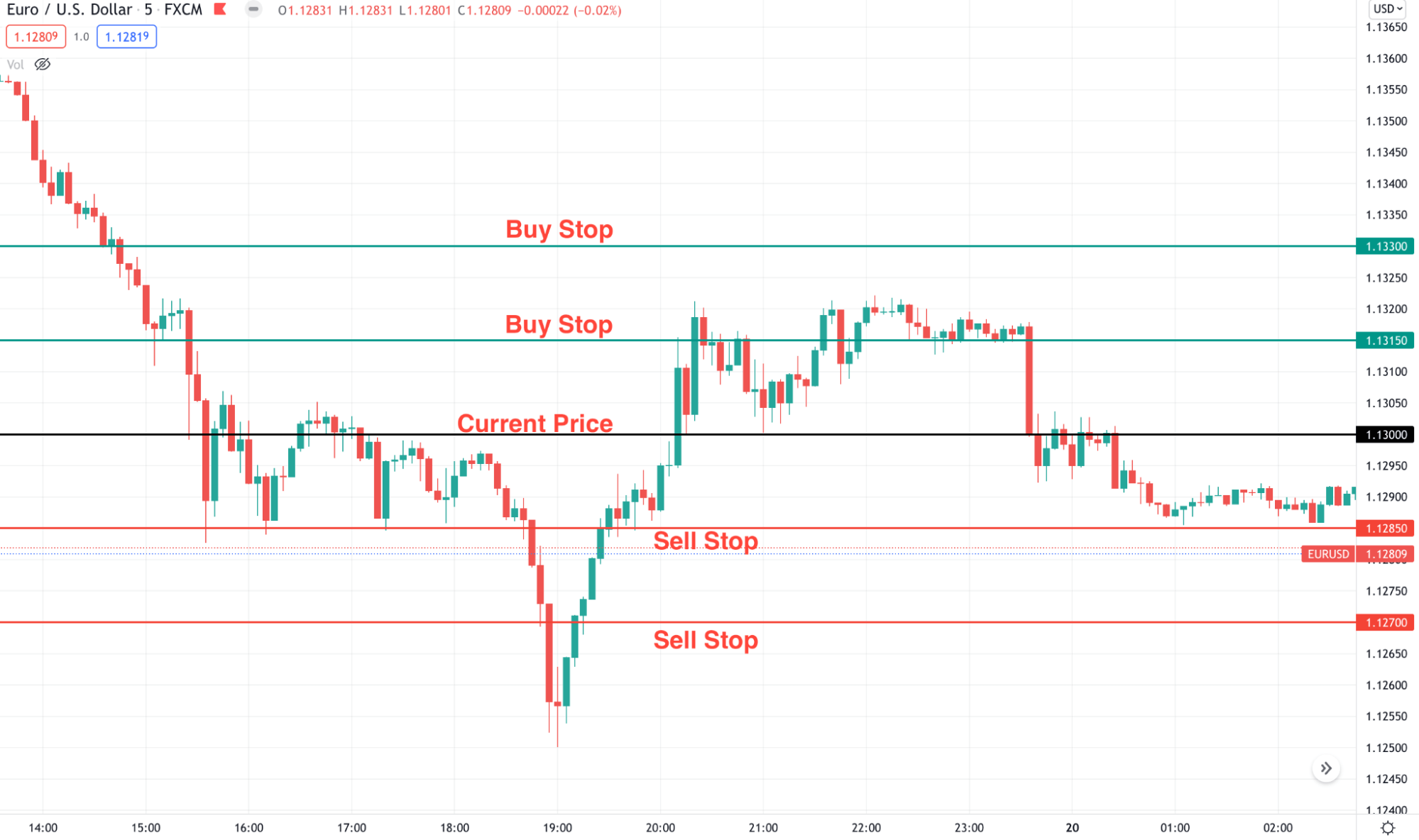

In the 5 minutes chart, wait for the market to open in the Asian session and open buy stop orders above the CMP and sell stop orders below the CMP, just like the image below.

EUR/USD chart

After that, investors need to see the price to move one or two steps before managing the capital.

Stop loss

If the sell stop orders hit, close all buy orders, and after making ten pips gain, move the stop loss at breakeven.

Take profit

If you want to boost profitability, you can take multiple sets at a time to close the trade. For example, if two steps get hit in the sell trade, set the first step’s stop loss at breakeven and make additional money from the second step.

A long-term strategy

In the long-term method, Grid trading might work as a decent profitable method where making money is easy. Although it is a long-term method, you can implement it in the manual system. In this section, we will focus on the manual Grid trading system only.

Best time frames to use

In the long-term method, the time frame is not a fact as this method focuses on taking trades from an interval like 10-20 pips. However, sticking to a 1 hour to 4-hour time frame is good for building an intraday trading system.

Entry

While taking the trade, make sure to follow these steps:

- Identify the price interval. It could be ten pips, 15 pips, or 20 pips.

- Find the beginning Grid level.

- Choose the trend following or against the trend Grid.

- If everything matches, you are ready to open trades with the above-mentioned interval.

Stop loss

Trailing stop loss is best for this system. When you have achieved one or two steps in the Grid, make the trade risk-free by moving the stop loss with the price.

Take profit

The ideal take profit is based on the market momentum. For the trend following Grid, use ATR to identify the potential trend reversal point. Hold the profit until it stops moving up.

Pros and cons of the Grid trading strategy

| 👍 Pros | 👎Cons |

|

|

|

|

|

|

Final thoughts

Finally, we are at the end of today’s lesson, where we have seen how to take trades using the Grid trading method. In the end, we can say that this method is profitable and perfect for those who want to extend profitability by adding another path to the trading portfolio.

However, trading in the financial market involves uncertainty and risks that you cannot ignore. So make sure to use proper trade management for everything besides syncing the trading method with the fundamental direction.

Comments