A carry trade strategy opens room for thinking differently in financial trading. Instead of focusing on price charts, investors can make money by observing the interest rate differentials. Buying a high-yielding currency using the funds of low-yielding currency is very common and effective in forex trading.

If you know the details and understand the core logic behind the carry trade system, you would make a decent profit over time. Moreover, all trading information related to carrying trading is available online that everyone can see.

Let’s see what it means to win a carry trade strategy and make a decent profit using it.

Why is it worth using a carry trade strategy?

Carry trade is one of the popular methods in trading that involves buying high-yielding currency using low-yielding currency. The concept is similar to the “buy from low, sell at high.”

There are considerable opportunities in carrying trade from the FX market where the most benefit comes from currency pairs like AUD/JPY and NZD/JPY.

The interest rate spread between JPY and NZD is high. As a result, investors can easily make money by putting money towards the high-yield currency. In that case, the primary step is to identify the trading asset where yielding is high and low.

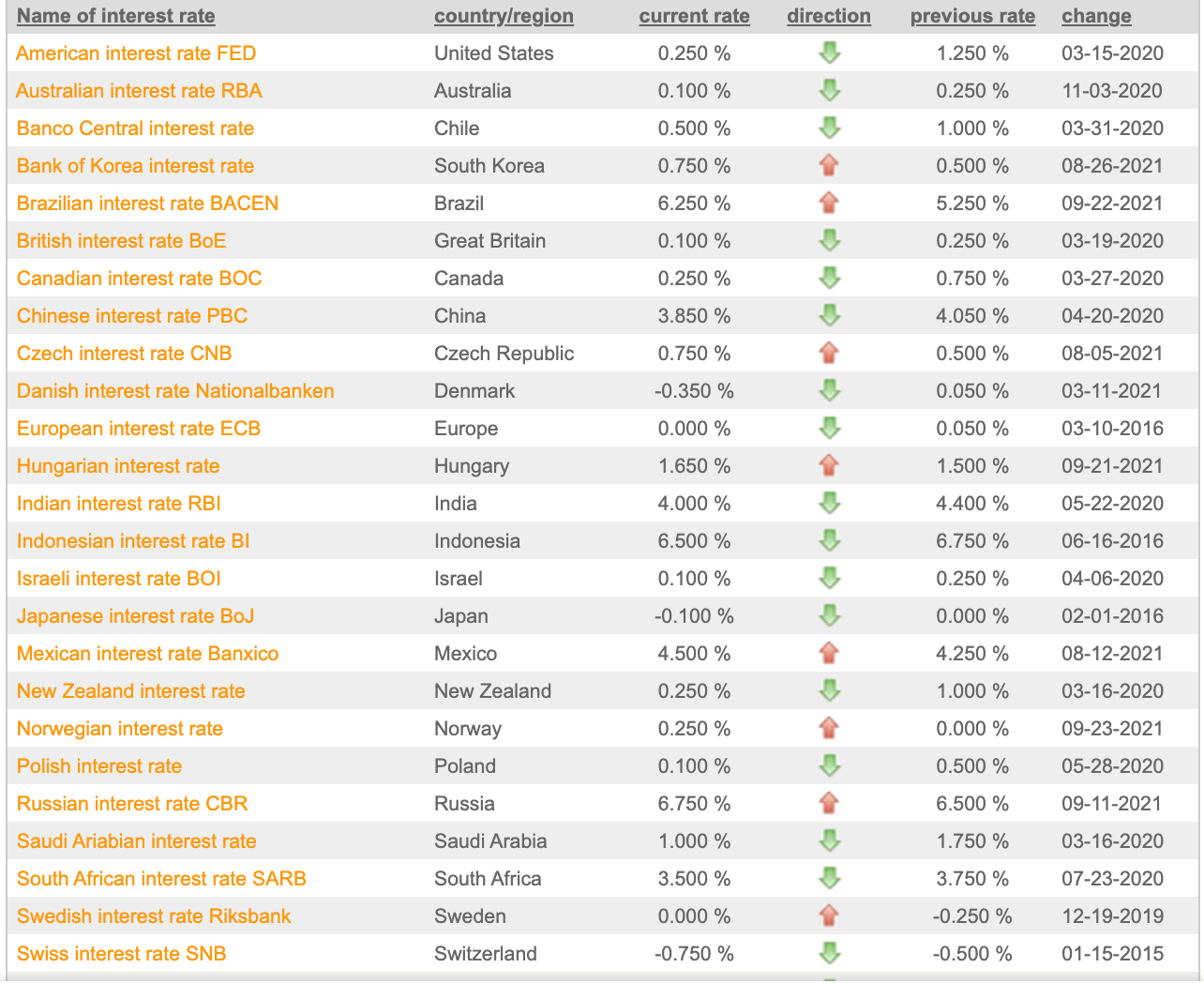

You can simply find a list of trading currencies with the interest rate and consider the higher interest rates and lower interest rates to calculate the carry trade.

Interest rates

After finding the interest rates, you can create currency pairs by combining the high and low yield currencies. Make sure that the interest rate is not fixed all the time. The central bank may appear and change the rate at any time to achieve its financial goal.

In the present world, New Zealand offers the highest yield against Japan’s lowest. Moreover, Australia remains in the second position in terms of delivering higher yields. In that case, if you buy AUD/JPY or NZD/JPY, you probably achieve a decent profit from carrying trade.

A short-term strategy

Although the time frame is not a significant deal for trading like carrying trade strategy, you can earn short-term profits by trading in this method.

First, identify the high and low yield currencies. For example, if AUD provides a 4% yield and JPY 0.5%, the aim should be to gain the difference between them or 3.5%.

Best time frames to use

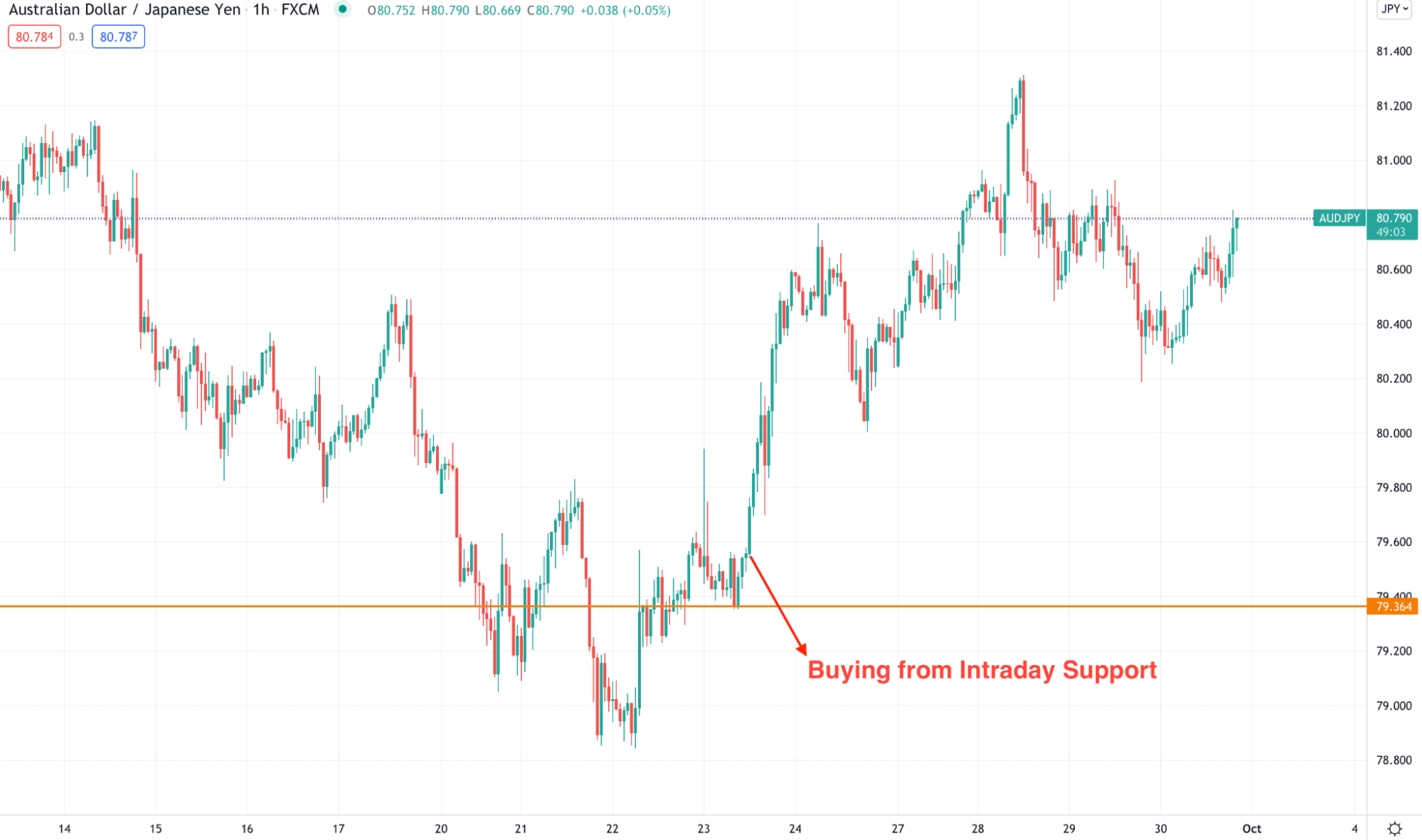

The primary idea is to invest; you can do it by observing H1 candle or H4.

Entry

As the AUD has a higher yield than the JPY, we expect a bullish move in this pair. In that case, finding a bottom in the intraday chart would be the best buying opportunity. The best approach is to find the AUD/JPY price at a significant intraday support and wait for a bullish rejection with a candle close. Then, open the trade as soon as the candle closes and wait for the desired profit to come.

Short-term strategy

Stop loss

In any case, if the AUD reduces the yielding rate or JPY increases the yielding rate, the profit from this pair might become inefficient. However, the potential loss depends on how much the interest rate differentials come.

Take profit

The trade is valid until the interest rate changes. However, you can close it manually after achieving the targeted profit.

A long-term strategy

The long-term strategy is similar to the short-term, where the primary approach is to buy high yield currency using the low yield currency. There might be three scenarios after taking the trade:

- If the AUD’s yielding rate becomes higher, you will earn more profit than the differential.

- If the AUD’s yielding rate becomes low, you will earn fewer profits than the differential.

- If the AUD’s yielding rate remains unchanged, you will earn profits similar to the differential.

Best time frames to use

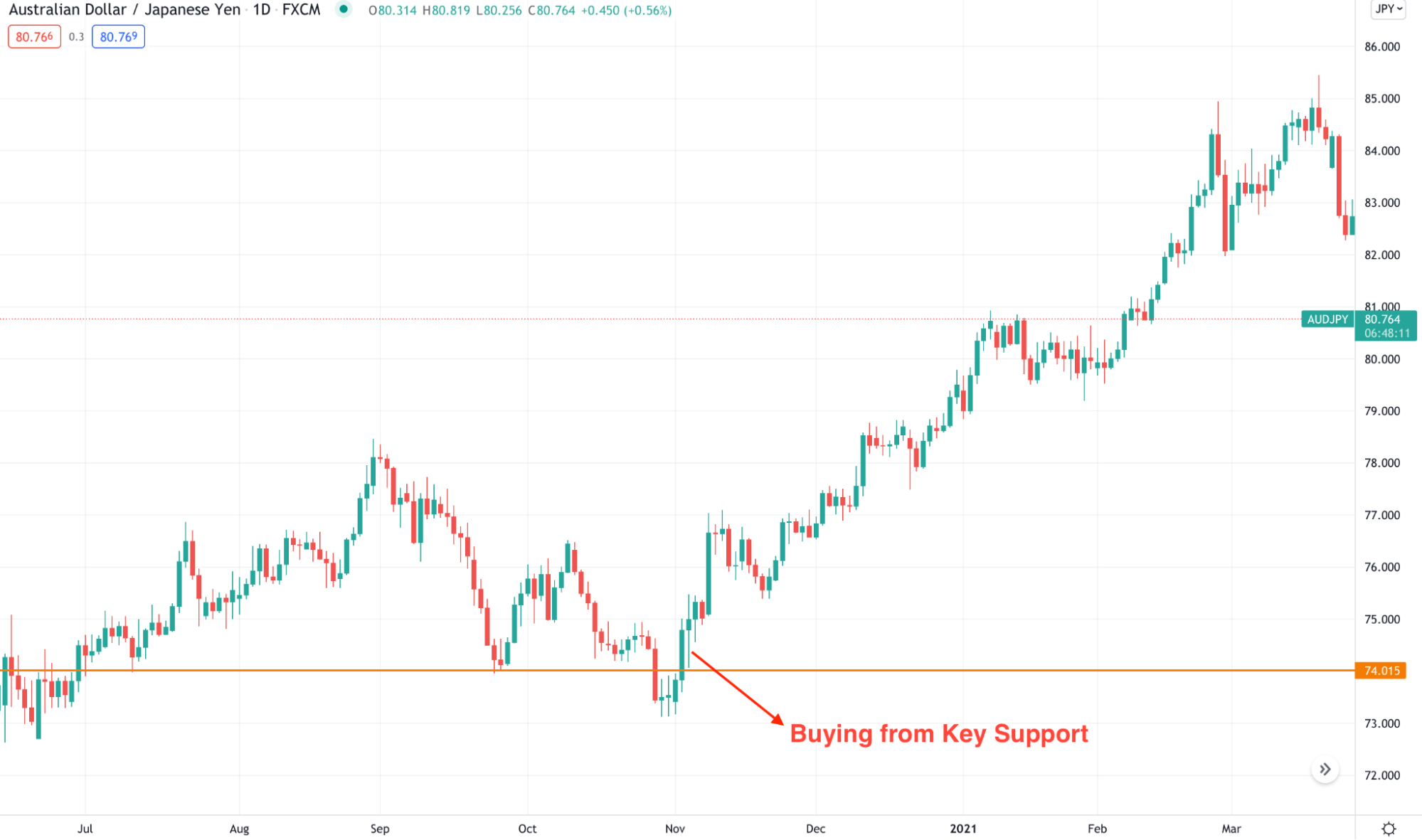

You can use a daily or weekly time frame to find the key price levels.

Entry

You can open a buy position in any high/low yielding pair. However, you may have to HODL depending on the simple price action method you trade as this aims to earn money from long-term price changes. So, identify the price at a critical level and open a buy position with a candlestick confirmation.

long-term strategy

Stop loss

The trade will be invalid if the interest rate changes significantly on the opposite side. However, the possibility of such a movement may require enough time to get several opportunities to manage the trade.

Take profit

The interest rate changes quarterly, and central banks often provide hints before raising or decreasing the rate. Therefore, you can close the trade after achieving the profit target or monitoring it followed by the interest rate decisions.

Pros and cons of a carry trade strategy

Carrying trades are associated with some risks that no one can ignore. Let’s find them in the section below.

Pros |

Cons |

|

|

|

|

|

|

Final thought

The price stability in the financial market significantly affects the carry trading method. The interest rate is associated with some other factors like inflation or external events. Therefore, even if the interest rate differentials are in play, other factors might cause a loss. Therefore, monitoring the trade and using price action to define the market direction is mandatory in any carry trading method.

Comments