The best FX trading strategy is any trading system that follows currency pairs’ pure supply and demand. If you can read what buyers and sellers are doing by implementing your trading system, you are on the right track.

In any currency pair, the unique feature is that it has buyers and sellers at every level. When we talk about currency trading, we consider the global economy, where many businesses and institutes have to buy or sell currencies to run their international business. Its higher liquidity and institutions involvement makes supply and demand trading profitable. But if you cannot understand which levels are essential, you are on the wrong track.

There is good news for you if you struggle to find the best strategy for consistent profit. Today we will see a test of the trading system whether it is profitable or not. If your strategy passes that test, you can surely gain with it in the long run.

How to make consistent profits in forex trading?

When we talk about FX trading, consistency is the key. No matter how many dollars you earn daily or how many pips you gain per trade, you will lose all of your investment unless you maintain consistency.

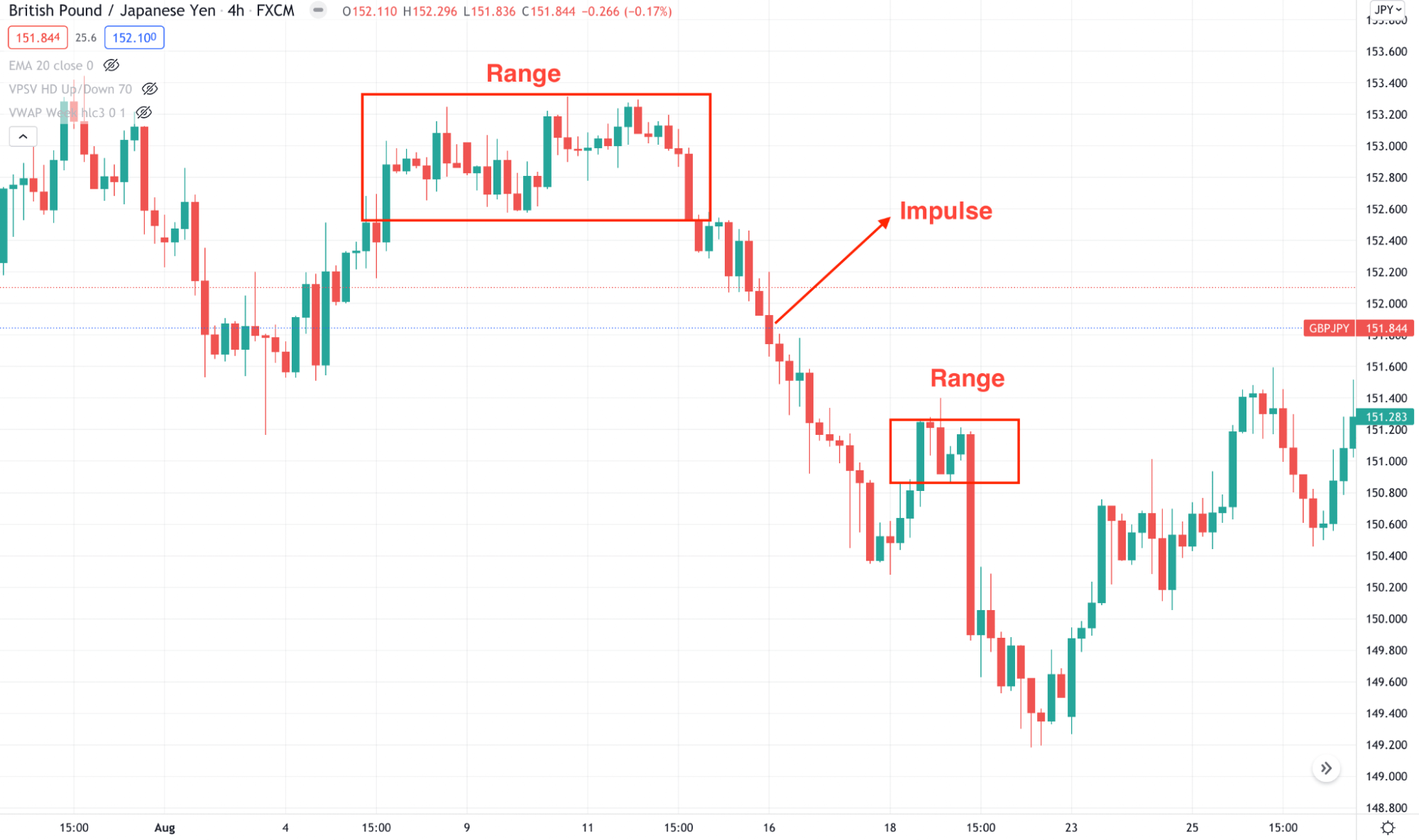

When buyers’ momentum exceeds sellers’ in the FX chart, the price shows a sharp bullish movement, known as a bullish impulse. Similarly, if the seller’s momentum becomes more robust, the price will move with a strong bearish movement, pointing out an extreme selling pressure, known as a bearish impulse.

Is your trading strategy capable of identifying the impulse? If not, please check trading conditions and update.

Now come to a happy market. When the price remains in a range, we may see a corrective market buy at low and sell at high. The corrective market is the order building phase, where institutes build orders phase by phase.

Let’s see the impulse and correction in a price chart for better understanding.

Impulse and correction

In a consistent trading system, the ability to find the impulse & correction is crucial. If you already have a trading system, check its capacity to discover these price behaviors now.

How to choose the best consistent trading strategy?

There are thousands of trading methods globally, and you must find the suitable one. Let’s see the basic checklists to find the best trading system.

Checklist 1: Market behavior

Retail trading in the forex market means trading CFDs on leveraged instruments. It is entirely different from the traditional stock or commodities. Therefore, the FX trading strategy should have some feature that applies to currency trading only.

In that case, build a trading system that is specially made for trading.

Checklist 2: Understand risk

As said above, the FX instruments are leveraged, and these should follow a robust risk management system. You cannot buy a currency pair and hold it forever with hope. You have to close your position with loss at a particular level. So, a long-term investment strategy is not profitable here unless you have a huge fund.

Checklist 3: Risk and reward

The common myth in FX trading is that the reward should be higher and low risk. However, it depends on the accuracy of your trading system. For highly accurate systems, you can break the RR law. So find a system with higher accuracy with higher risks or lower accuracy and lower risk.

How to test the best consistent trading strategy?

In this section, we will see a complete trading system based on supply-demand nature. If you follow it, you can make a profitable return from the market.

Before that, check out the above three conditions with your personal trading strategy and confirm its consistency. You should backtest your system with more than six months’ charts to check the consistency.

Bullish trading strategy

Bullish trade example

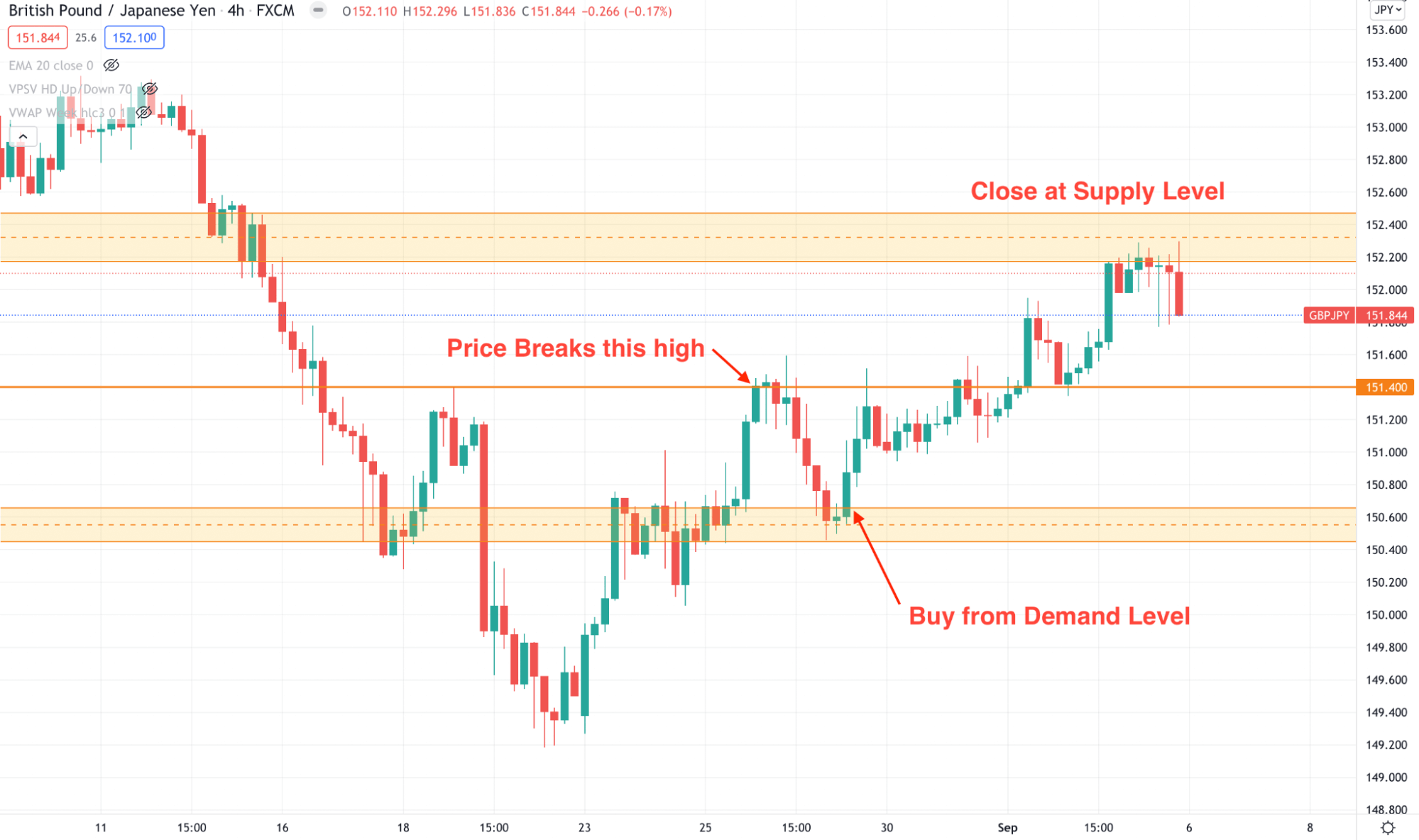

In the buy trade, we will find the buying market or a bullish trend where the price is making higher highs. Therefore, we will skip any sell setups and follow buy trades only.

Bullish trading conditions

- The price is within a bullish trend on higher time frames.

- The price is above any significant support level and aiming higher.

- In a lower time frame, the price broke the near-term high and came back to the demand zone.

- The trading entry will be valid if the price moves up from the demand zone.

Best time frames to use

We will use the daily chart for higher time frame direction, and for taking a trade, we will use the H1.

Entry

Open the trade after a bullish candlestick from the demand area. Make sure that the candle closes, and you can open the trade manually or automatically.

Stop loss

Put the stop loss below the demand zone and make sure to consider the near-term swing levels.

Take profit

The ultimate target is the next supply level, and partial profit-taking should be from near-term resistance.

Bearish trading strategy

Bearish trade example

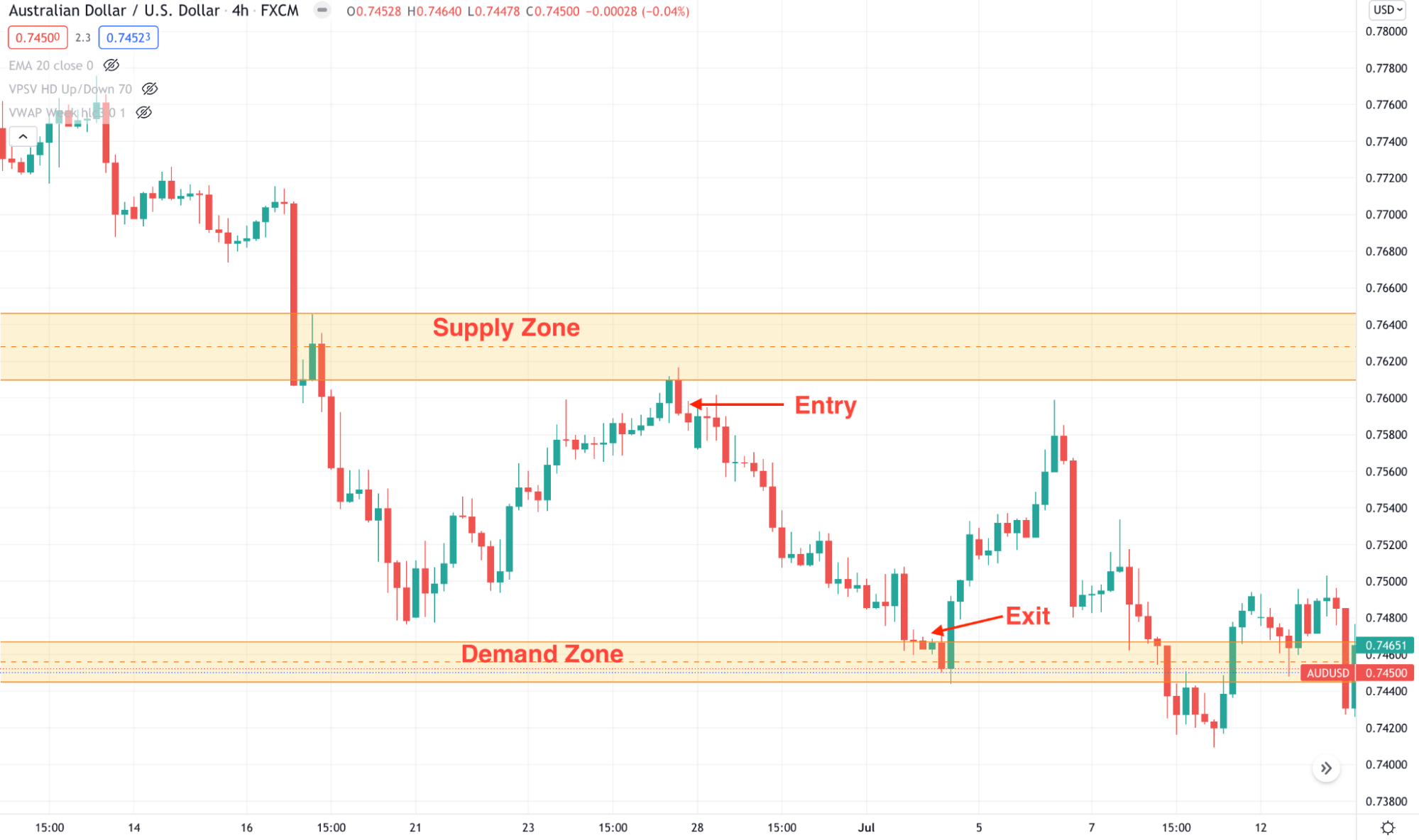

We will find the bearish market or a bearish trend where the price is making lower lows in the sell trade.

Bearish trading conditions

- The price is within a bearish trend on higher time frames.

- The price is below any significant resistance level and aiming lower.

- In a lower time frame, the price broke the near-term low and came back to the supply zone.

- The trading entry will be valid if the price moves down from the supply zone.

Best time frames to use

For higher time frame direction, we will use the daily chart, and for taking a trade, we will use the H1.

Entry

Open the trade after a bearish candlestick from the demand area. Make sure that the candle closes, and you can open the trade manually or automatically.

Stop loss

Put the stop loss above the supply zone and make sure to consider the near-term swing levels.

Take profit

The ultimate target is the next demand level, and partial profit-taking should be from near-term resistance.

Pros and cons of the best consistent trading strategy

Pros |

Cons |

|

|

Final thought

In the best forex trading strategy, the ultimate approach is to find the supply-demand where institutional order flow remains. Then, if you can catch the broader market trend with institutions’ orders, it would be a fantastic journey through trading by making consistent profits.

Comments