Have you ever thought of flying to a country where your current currency would be worth more? Maybe you would stay in luxury hotels, buy more clothes or end up paying way less for food? Ever thought about why it happens?

The law of supply and demand works in the FX just like any other market space. Without understanding the role of supply and demand, it would be like hitting in the dark.

Having a sound knowledge of supply and demand will give you a boost in your forex investing career as it will give you the ability to look for better and important fundamental happenings around the world rather than useless everyday news. So, let us dive into the article to get complete knowledge about the topic.

Understanding supply and demand

It is an economic model between buyers and sellers that determines the price in the market. In similar terms, it measures the quality of goods a seller has to sell and the rate a consumer/buyer wishes to buy.

The law of supply and demand affects the price equilibrium between the buyers and the consumers.

In simple terms:

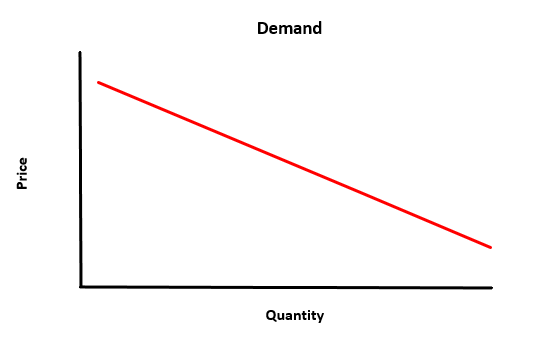

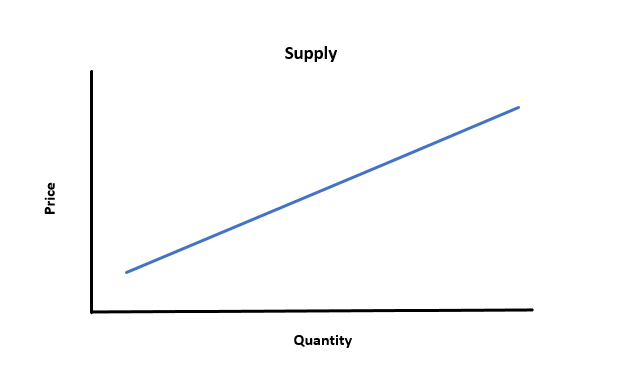

- Supply = selling

The supply area refers to the zone which has selling pressure, and due to this selling pressure, the price will fall.

- Demand = buying

It is a zone with buying pressure, which leads the price to rise.

Influence of supply and demand in FX

FX is all about buying/selling currency simultaneously, which in terms is called currency exchange. So, for example, in the EUR/USD pair, you cannot say you bought EUR because when you buy the base currency, you always sell the quote and vice-versa.

Let us get a little deeper into how it all works. So, every country has its currency, and these countries have to carry out trades for different goods and services. However, to make these trades, one country has to exchange its currency to the other country from which it is importing goods. Some big companies have their branches all across the globe. These companies need to send the money to their employees in their national currency.

A simple example would be traveling. Let’s say you like Europe and went on holiday to the USA. Then it would be best if you exchanged your EUR for USD as America does not use EUR; they use USD.

Here supply and demand play an important role. For example, if too many countries, companies, and people from Europe want to convert their currency to USD, the demand for USD increases. So the rate of the USD will increase concerning the EUR.

Demand of currency

It is acquired from:

- The demand for that country’s exports

- Companies’ involvement in carrying out their operations

- Venturers are looking to profit on changes in currency value

Supply of currency

A country’s supply of currency is dependent on the demand for the imported goods. For example, when the US imports automobiles from Germany, it must pay in EUR, and to buy EUR, it must sell or supply USD. The more Germany will export, the greater the supply of USD onto the FX.

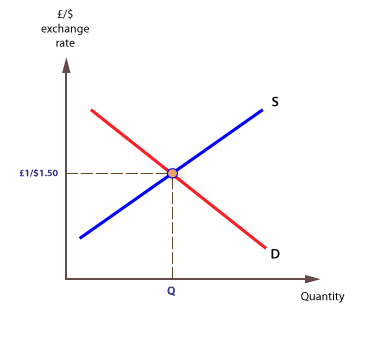

Exchange of currency

The exchange rate is the price that equates demand and supply for a particular currency against another currency. Thus, the exchange price is like an equilibrium price between the buyers and sellers, making the quantity of demand and supply equation.

For example, if we assume the UK and Japan both produce goods that the other wants, they will wish to trade. However, Japanese producers require payment in yen, and British producers require prices in pounds sterling.

Therefore, both need payment in their local currency to pay their production costs in their local currency. Thus, FX allows both Japan and British producers to exchange currencies so that trades can take place, creating an equilibrium exchange rate for each currency, where the demand and supply of currencies equals.

Using supply and demand concept in trading

Supply or support zone

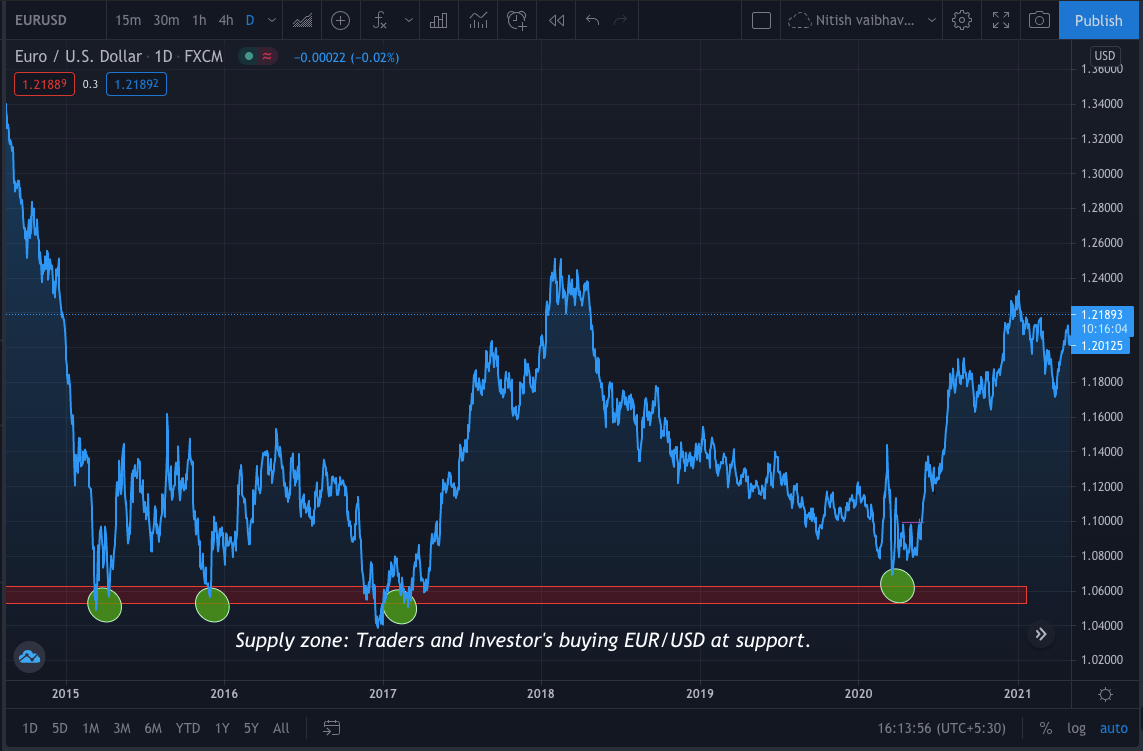

In the FX, we use the supply/demand zones to trade. In technical terms, we also call it support and resistance zones. Let us now see a quick strategy that you can use in your daily trade hunting.

When you start trading, you will first see the overall market trend. Once you know the trend, you will only trade in the direction of the movement. If it’s an uptrend, you will take buy calls, and if it’s a downtrend, you will take a sell call.

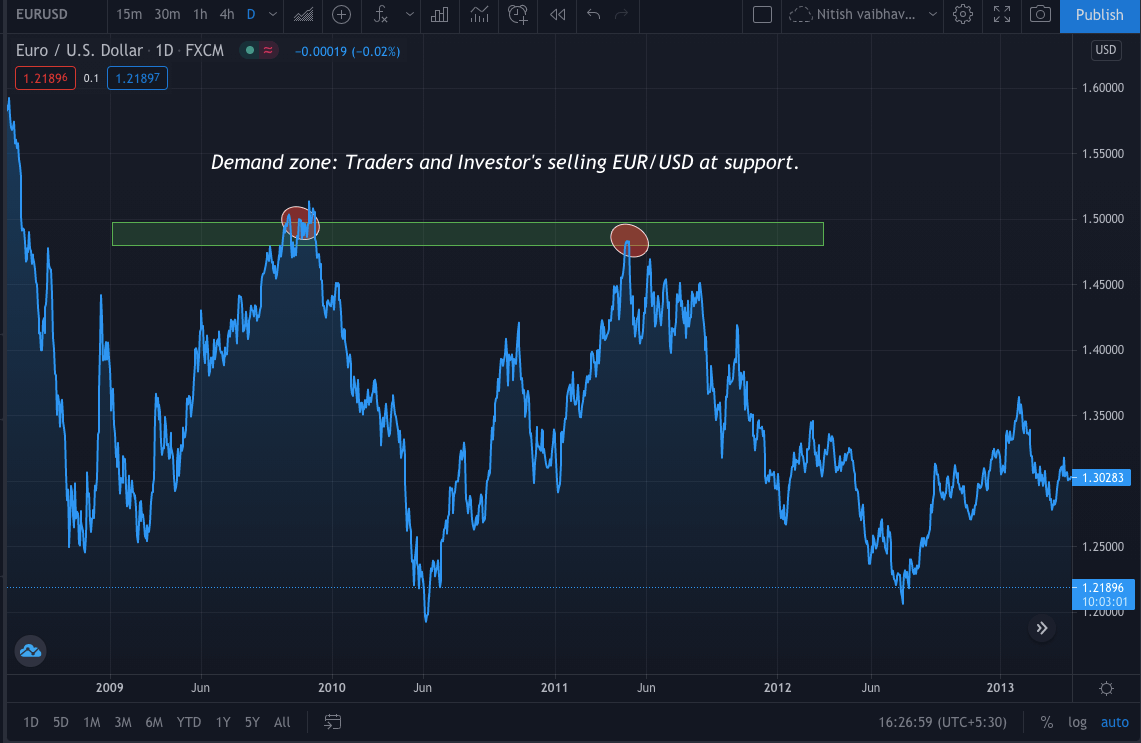

As you can see in the image, you will first draw your demand zone on the chart. So you need to make sure your demand zone has at least three candle touches to call it a strong zone. As we know, trading history repeats itself. So once you see the market coming to your demand zone, you can have an opportunity to buy.

Demand or resistance zone

You will similarly apply demand or resistance as you did in the support. Once you have identified your strong resistance zone, you will wait for the market price to touch the zone.

Trading just using support and resistance won’t be sufficient, and you will need a candlestick supporting your analysis. However, price action strategy with addition to support, resistance, trendline, and candlesticks can help you trade and understand the market better.

When zones work well, and when do they not?

Zone work best on days when there is increased trading activity. Thus, when vital news appears, it can be expected, with increased trading volumes and volatility and significant movements of interrelated instruments: raw materials, currencies, indices.

Additional confirmation of the zone’s existence can be large orders in the order book at this price. This suggests that these price points guide prominent participants.

On the contrary, on days of low activity and dominance of the sideways trend in the market, the levels are often “cut.” It means the price moves around the designated mark, not giving signals about the further direction of movement. Therefore, you should be especially careful and consider not a specific price as support/resistance on such days but the range of values around it.

Conclusion

Both investors and traders need to have complete knowledge of the market they are involved in. Supply and demand feed you with the understanding that talks about the market happenings and sentiments. With this, we can identify value areas and can begin to capitalize on them. The law of supply and demand is not just in trading but everywhere.

Comments