The Spinning top is a candlestick pattern with a long wick upside and downside, generating a reliable price direction. If you are a price action trader, you should know the basic structure of candlesticks like spinning top, including how it works and when to use this candlestick to get the highly profitable trades.

Trading in the financial market involves additional knowledge and trading tools. Therefore, the success of this candlestick depends on utilizing it with other trading tools. The following section will see the complete Spinning top trading guide that may enrich your trading knowledge.

What is the Spinning top candle?

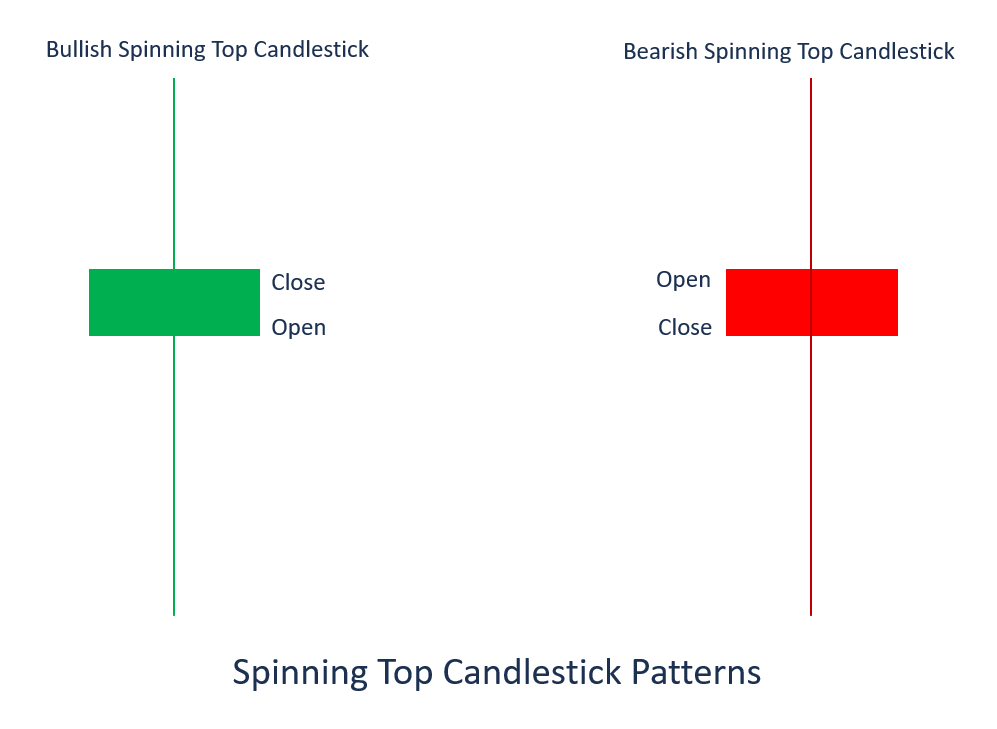

It is a candle pattern that is easily visible with the long shadow and smaller body. It is a sign that both bulls and bears attempted to regain momentum but failed. As a result, the price moved up and down but ended the trading period by remaining near the opening price.

This candlestick pattern indicates the probability of a trend continuation towards the bullish and bearish direction. Moreover, it also represents a story where market participants become aggressive with a lot of uncertainty during the economic report release.

The above image shows what the Spinning top candle looks like. Although it is a neutral pattern, it has both bullish and bearish formations, available at the bullish, bearish, and sideways markets.

How to use the Spinning top in trading strategy?

The spinning of trading strategy is a reliable way to identify the market direction in any trading instrument. Therefore, you can build a reliable trading strategy using this candlestick pattern like the traditional candlestick trading method. Moreover, this trading method needs additional requirements from market trends, context, fundamental outlook, and indicators.

Let’s see the step-by-step approach to use the Spinning top trading pattern.

Step 1. Identify the price direction

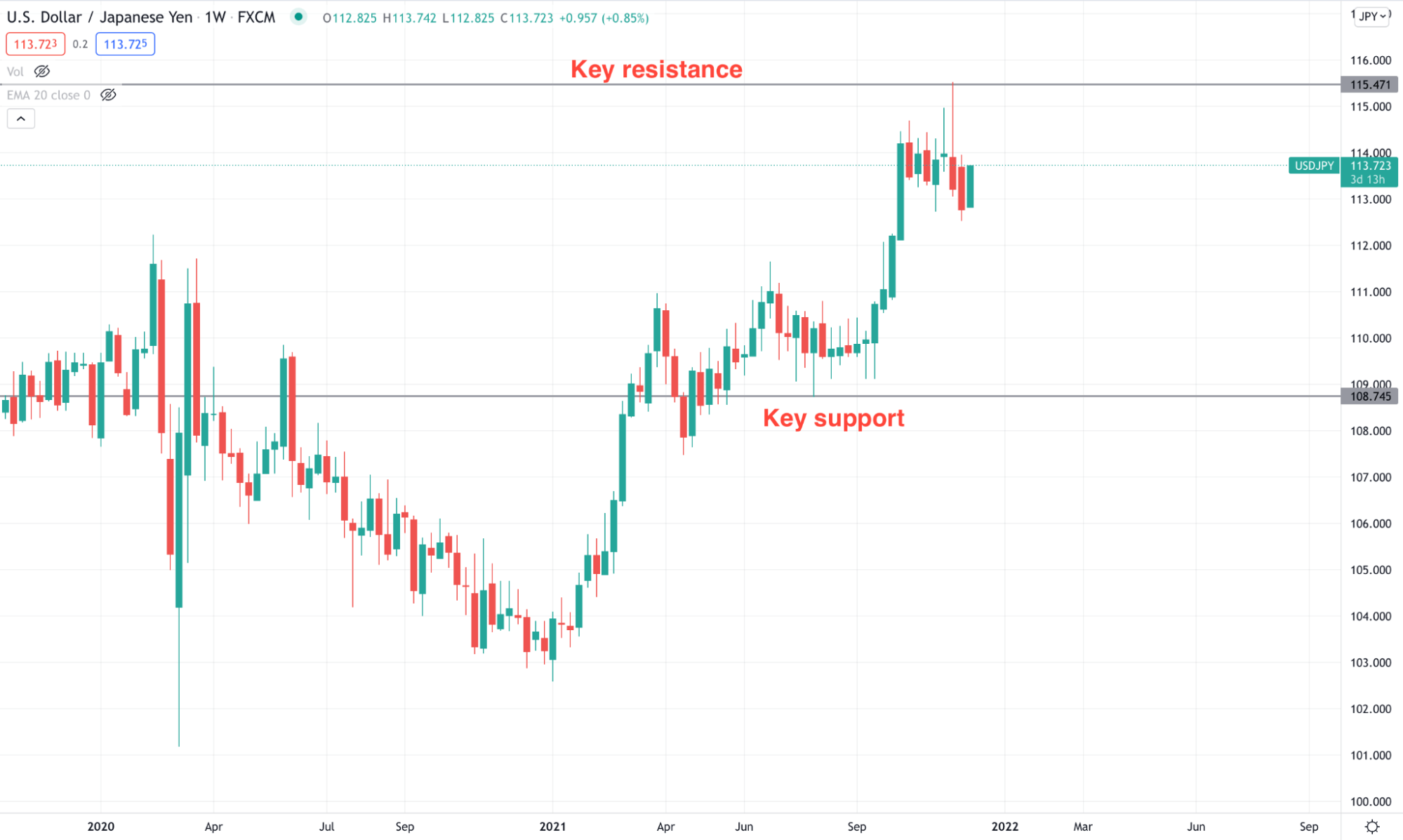

Before opening a trade, it is wise to identify where the broader market direction is heading. Any trade setup towards the broader market trend has a higher possibility of working out. We will use the top to bottom analysis by looking at the price location in this method. If the price moves up from any key support level, we will consider buying below any critical resistance level.

The key support and resistance level

Step 2. Following the direction

Once we define the broader market direction, we should follow it from a reliable risk and reward ratio. In this step, finding a price zone where the stop loss will be lower is important. You cannot open a trade from a random place. The Spinning top formation should be in the right place and affordable.

A short-term trading strategy

The short-term method is applicable in any currency pair. The ideal time frame of this method is one minute to 30 minutes, depending on the capital and trading personality. In this method, traders should know the broader market direction and join the direction from a minor correction.

Best time frames to use

As it is a short-term scalping or intraday trade, the ideal time frame for this method starts from five minutes to 30 minutes. Moreover, this method works well from the London Open to New York close.

Entry

Let’s see how to take a buy trade using the candlestick:

- Broader market direction is bullish.

- The lower time frame is still bullish, where the recent bullish leg breaks the recent high.

- The price came back to support level and formed a Spinning top.

- Open the buy trade as soon as the candle closes.

Spinning top buy example

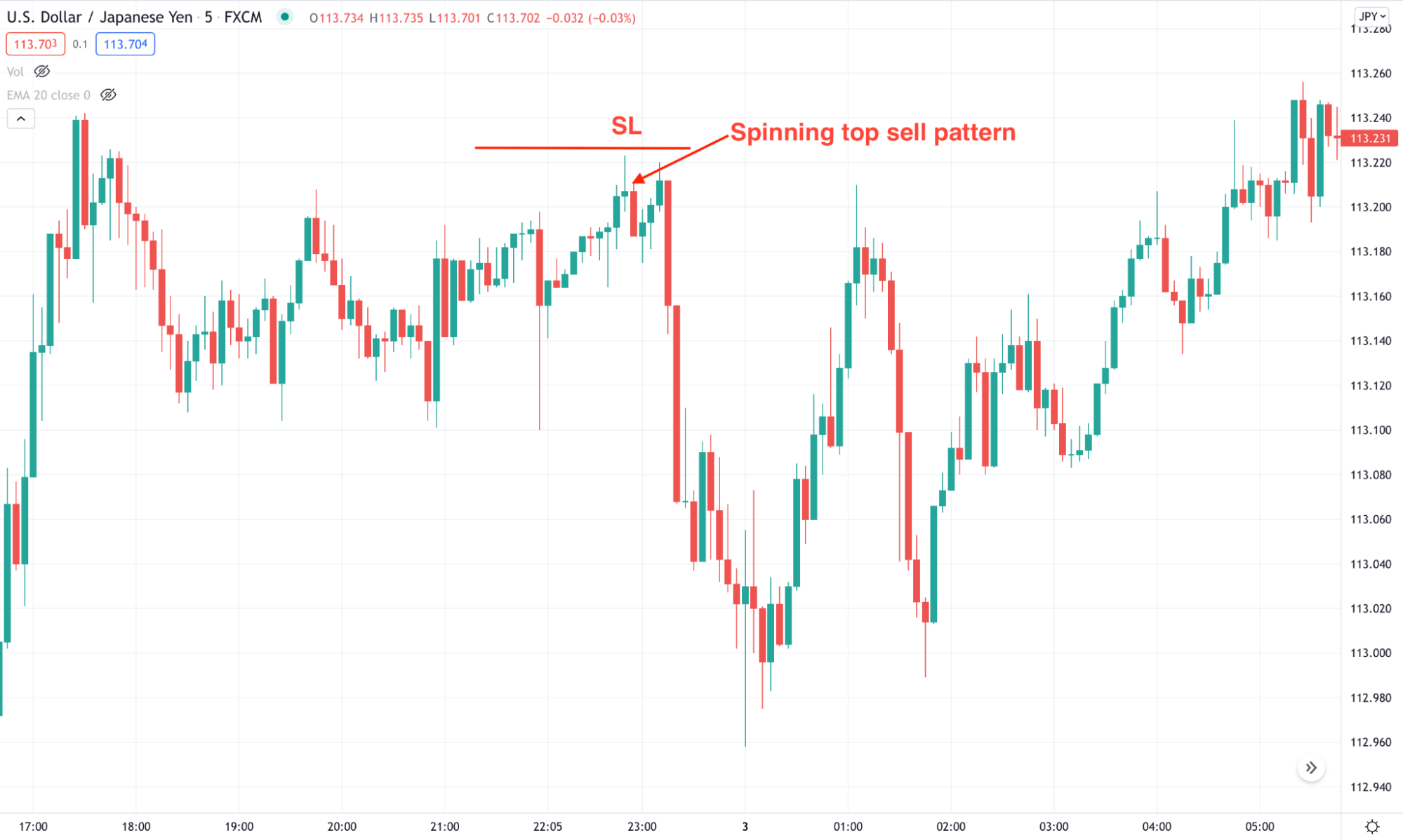

Now move to the selling conditions:

- Broader market direction is bearish.

- The lower time frame is still bearish, where the recent bearish leg breaks the recent low.

- The price came back to a resistance level and formed a Spinning top.

- Open the sell trade as soon as the candle closes.

Spinning top sell example

Stop loss

The aggressive approach sets SL below/above the Spinning top candle. Ensure a few pips of the gap with the wick and the SL.

Take profit

If the price moves from the Spinning candle with an impulsive pressure, you can hold the trade until it reaches any important support/resistance level and shows a rejection.

A long-term strategy

The long-term method applies to finding an appropriate swing trading idea. Therefore, if you are a beginner or expert in forex trading and want to perfect your trading, you can use this candlestick in your strategy.

Best time frames to use

The long-term method is applicable on time frames from 4 hours candle to weekly chart.

Entry

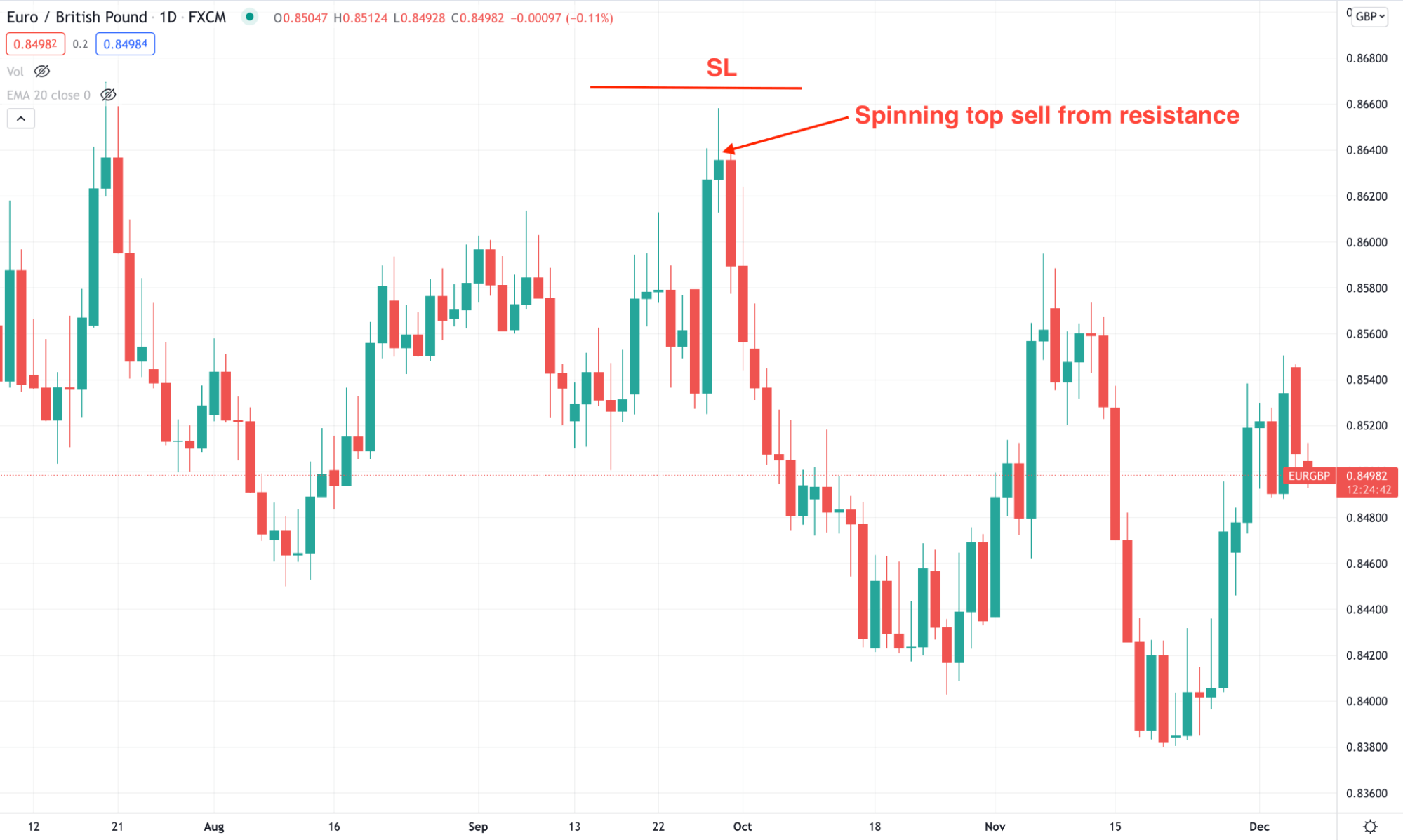

Like the short-term method, you should identify where the broader market direction is heading. Make sure that you are taking trades in a broader market direction. The Spinning top should form at resistance for a sell trade, and for a buy trade, it should appear in support.

Spinning top sell example

Stop loss

In the top pattern, the long wick represents a higher/lower price during the order building phase, which is present until the price before making a sharp movement. Therefore, the ideal SL would be below or above the Spinning low/high with some buffer.

Take profit

As it is a trend-following method, you can hold it as long as possible. If you see any rejection from a significant S/R level, make sure to close the trade.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

Finally, we have seen how this candlestick works in lower and higher time frames and how to open a Spinning top trade with proper risk management. Although this candlestick is profitable, you should use additional indicators like RSI, stochastic, or MACD to increase the trading accuracy.

Comments