An excellent trading strategy will guide you to execute constantly profitable trades. It enables market participants to achieve complete trading positions, including entry/exit points. Speculative tendencies are common among FX traders to make big profits with low risks.

However, executing speculative trades requires particular skills besides following rules or guidelines when choosing trading strategies or making trade decisions. This article will discuss the speculative trading concept and tips or guidelines to make big profits.

Later we brief trading strategies with chart attachments and the top pros and cons of speculative trading.

What is speculative trading in forex?

Speculative trading takes more risk than traditional trading techniques to gain significant profits from a particular price change of any financial asset. The goal is to take maximum advantage of the price fluctuations of a specific asset.

Spactulators seek trading positions in a volatile and widespread marketplace. In the forex market, speculating involves executing trades in the direction of the big boys, riding the trend with banks and financial institutes, which are the market movers.

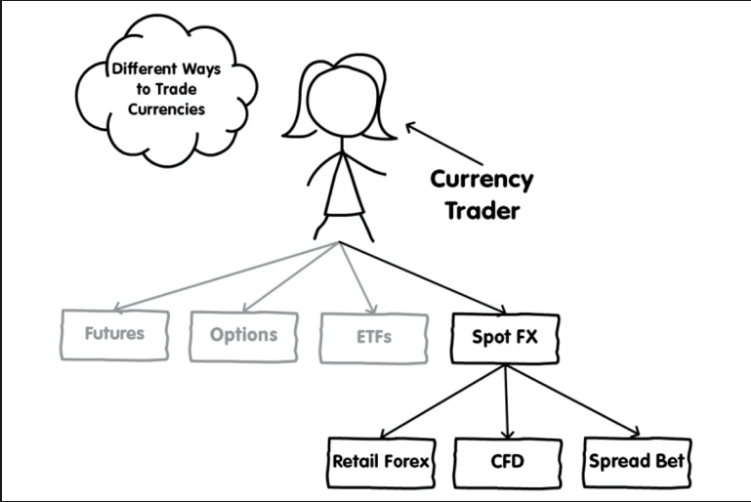

Different forex reading concepts

The commercials and investment banks conduct most of the trades in the forex market on behalf of their clients, enabling individual traders to perform speculative trades by observing their trade decisions. Many traders may level speculation and gambling as duplicate, which is entirely wrong. Gambling is wagering money on any event that has uncertainty; any outcome is possible. Meanwhile, speculating involves discipline trading ideas depending on specific calculations.

Speculative forex trading tips

In this part, we list the best trading tips to execute speculative trades.

Choosing method

The first step is to choose strategies that you are comfortable with or have clear concepts. So you will have confidence in making trade decisions.

Mindset

Build a mindset to take risks when performing trades. Most successful traders take a 2% risk of their trading capitals. Create a great mindset or winner attitude to be out of fear when making trade decisions. Execute trades with discipline to avoid revenge trades or emotional trades.

Avoid frequent trading

Don’t make frequent trading positions without calculating the potentiality and risk. Have some patience on trading. Wait till the price reaches the levels as your strategy suggests entry/exit points.

Long-term trends

Always keep focusing on the long-term trends. A birds-eye view on price movement will enable you to get more accurate trading positions.

Isolate trading

Always try to make your trade decisions in isolation. A group discussion or following forums to generate trade ideas can be a reason to confuse and mislead you while making trade decisions.

Work hard, not smart

Always stick to the plan. Spend time to develop good trading skills but when it comes to trading, don’t give too much afford to determine trading positions. Keep your trade plans simple besides your technical analysis.

Edge trading

Try to determine the edges of trends to execute trades. Try to buy positions near the bottom and sell positions near the top.

Return expectations

Always try to preserve your capital. Learn when to avoid trading or sort out risky environments. Keep your return expectations realistic. You cannot expect to make a 500$ profit by investing 100$. Use stop loss for each order on reasonable levels.

A short-term trading method

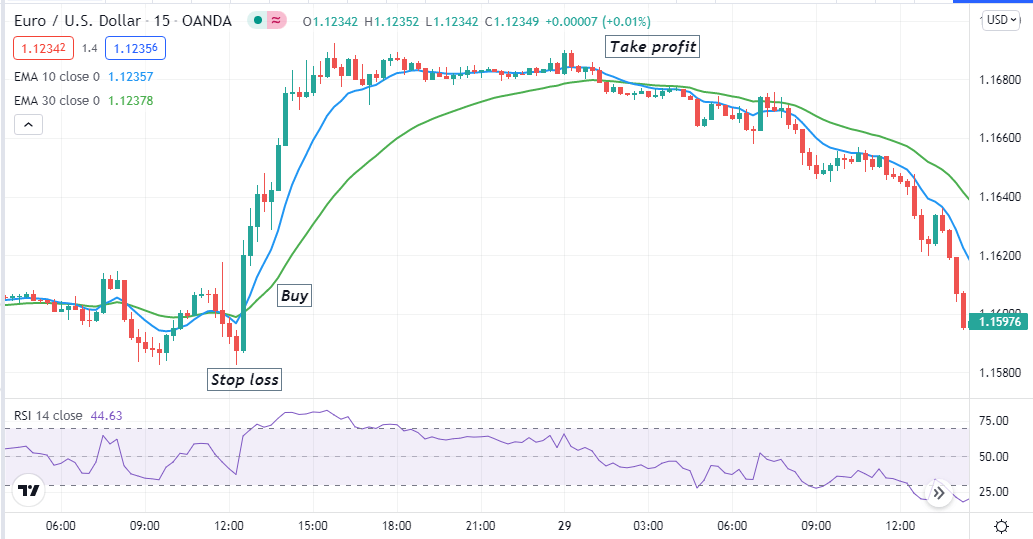

Our short-term trading method involves using MA crossover besides the RSI indicator to determine entry/exit positions. We use EMA 10 (blue) and EMA 30 (green) crossovers in our trading method. This strategy suits any trading asset with sufficient volatility. We recommend using this method on 15-min or above time frame charts to obtain satisfactory results.

Bullish trade scenario

Confirm the current trend is bullish from upper time frame charts. Then check:

- The blue EMA crosses the red EMA on the upside.

- RSI dynamic line is at or above the central (50) line heading toward the upside.

Bullish setup

Entry

When these conditions above match with your target asset chart, place a buy order.

Stop loss

Set an initial stop loss for your buy order below the current swing low.

Take profit

Close the buy order when:

- The blue EMA crosses below the green EMA.

- The RSI dynamic line is heading back downside after reaching the upper (80) line.

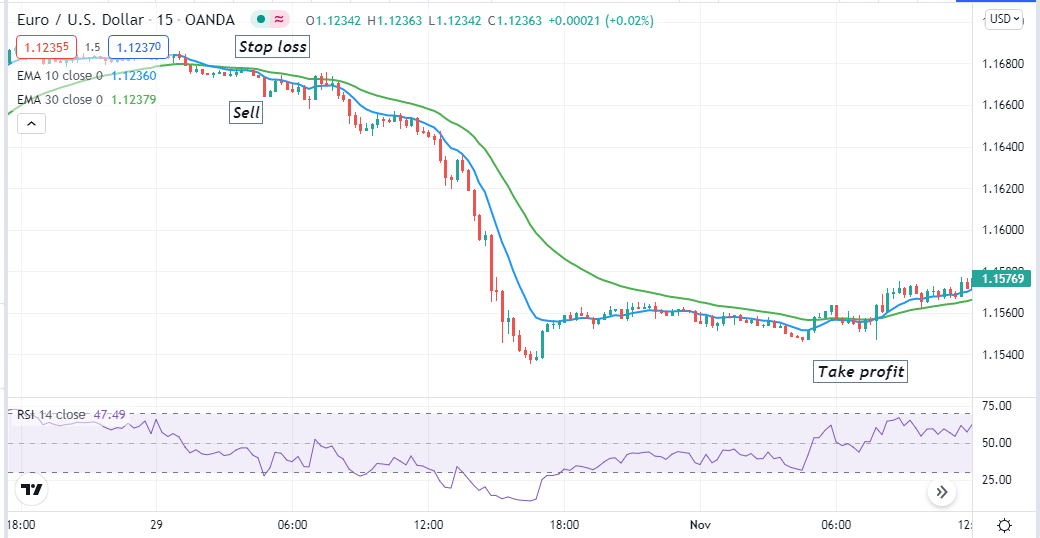

Bearish trade scenario

Confirm the current trend is bearish from upper timeframe charts. Then check:

- The blue EMA crosses the red EMA on the downside.

- RSI dynamic line is at or below the central (50) line heading toward the downside.

Bearish setup

Entry

When these conditions above match with your target asset chart, place a sell order.

Stop loss

Set an initial stop loss for your sell order above the current swing high.

Take profit

Close the sell order when:

- The blue EMA crosses above the green EMA.

- The RSI dynamic line is heading back upside after reaching the bottom (20) line.

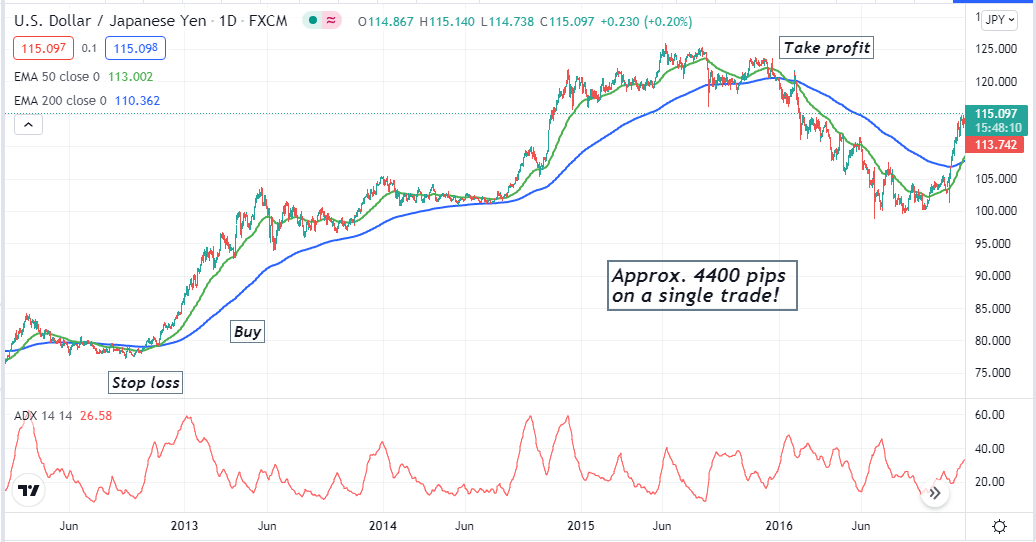

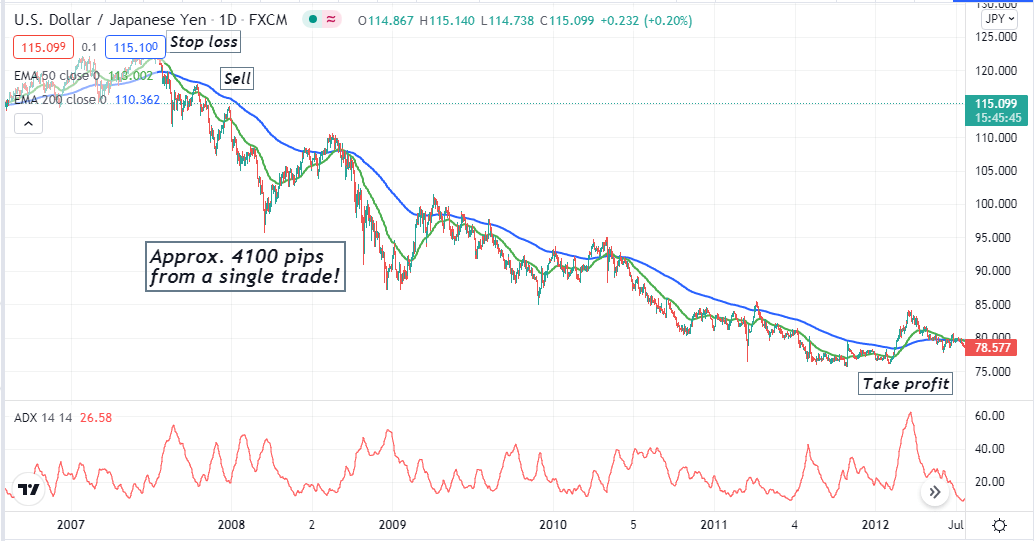

A long-term trading strategy

Our long-term trading contains the golden crossover beside the ADX indicator. The golden crossover is between two EMA lines, which are EMA 50 (red) and EMA 200 (blue). This strategy is suitable on a daily chart.

Bullish trade scenario

After applying those indicators, seek to place buy orders at the daily chart, when

- The red EMA line crosses the blue EMA line on the upside.

- ADX value is above 20.

Bullish setup

Entry

When these conditions above match with your target asset chart, place a buy order.

Stop loss

Set an initial stop loss below the current swing low.

Take profit

Close the buy order when the red EMA crosses the blue EMA on the downside.

Bearish trade scenario

After applying those indicators, seek to place sell orders at the daily chart, when:

- The red EMA line crosses the blue EMA line on the downside.

- ADX value is above 20.

Bearish setup

Entry

When these conditions above match with your target asset chart, place a sell order.

Stop loss

Set an initial stop loss above the current swing high.

Take profit

Close the sell order when the red EMA crosses the blue EMA on the upside.

Pros and cons

| 👍 Pros | 👎 Cons |

| Allow you to make trades according to significant participants. | Speculative trading requires sufficient skill. |

| Allow obtaining significant return from investment. | You need to follow some rules to execute speculative trades successfully. |

| You can perform speculative trading on many financial assets. | Speculative trading techniques can fail due to other fundamental reasons. |

Final thought

Finally, if you want to be a successful speculative trader, be strict with your trading plan, well-disciplined, and follow other rules listed in this article. Use reasonable leverage, protect your capital, start with small capital when going on live trading, keep excellent and clean records. Moreover, take trading as other businesses, forex is not a money-making machine.

Comments