The concept of ‘trading in the online marketplace’ is so easy that it was never before. Pre-market trading allows trading at the time before the opening of the central market. Transactions occur in seconds, and the market remains available for a certain period open for specific regions. Moreover, volume and liquidity change with the demand of certain assets during a particular period.

However, if you want to participate in pre-market trading, you need to learn the time and assets that are potential or available. Moreover, proper strategies to trade at the pre-market and make continuous profits. This article will introduce you to pre-market trading and profitable trading methods during that time.

What is pre-market trading?

It is mainly trading activities before the regular market session. Many brokers allow making positions during the off-hours, which is pre-market trading. It occurs during after hours and early hours of the regular trading sessions. In general, you can count 8:00 am- 9:30 am EST. You can count pre-market sessions between 4:00 am- 9:30 am as many assets are available to make orders through some brokers and financial institutes. Pre-market trading often involves low liquidity as most of the participants are not active during that session.

Moreover, pre-market trading often involves large spreads in comparison to regular sessions. On the other hand, pre-market trading allows participants to enter a stable market with less volatility. These trading strategies are only for skillful and experienced traders.

How to use a pre-market trading strategy?

You have to identify the time frame and choose brokers that allow pre-market activities. Make desirable orders and wait till the opening session. There are also some chances to modify or exit before opening the market. When the regular session starts, wait until the order is active, and modify the order if needed.

A short term strategy

It is about trading Indian stocks at a specific time. You will have a 15min window to make an order, modify or cancel. That 15min has three segments as entry session, order matching session, and buffer session.

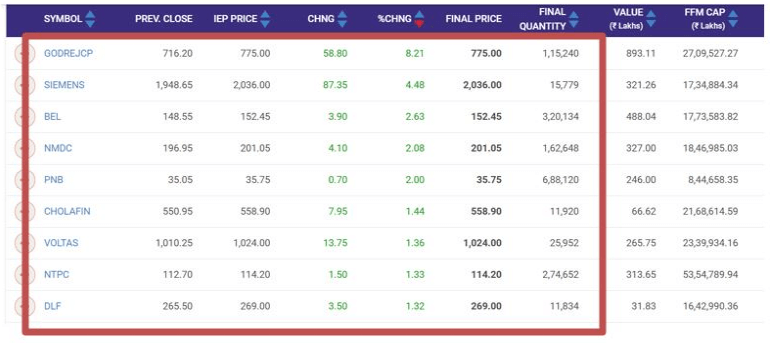

Potential stocks

Entry session

It lasts for 8 min (from 9:00 am-9:08 am). During this time, you can buy/sell stocks. After time passes, you won’t be able to make any new positions or modify your order.

Order matching session

It lasts for 4 min (from 9:08 am- 9:12 am). You can match your orders during this period but can’t modify or change your order.

Buffer session

It lasts for 3min (from 9:12 am- 9:15 am). During this period, the initiation of market opening occurs.

How to identify the instrument

To identify potential stock match these:

- Select the target instrument from the FnO list by looking at the performance.

- Choose stocks that have at least 10,000 volumes during the pre-market session.

- VIX is over 20.

- Select stocks that have at least price change average 1.3%.

Initiation and entry/exit

When all criteria above meet with your target stock, you can place an order. You can place a buy order above five paise of the high of 15 min candle. If you place a sell order, then place it below five paise of the 15min candle.

The profit target will be 1%; meanwhile, stop loss will be 1% of this trading strategy. This strategy allows no new trades after 2 pm. In case, no stop loss or take profit hits till 3 pm, exit from the order.

Long-term trading strategy

It is beneficial for financial traders with sufficient fundamental knowledge. Many news releases occur at the last moment of regular sessions besides without conducting significant participant’s actions. You have to short out those trading assets for this strategy and make entries according to the news suggestions.

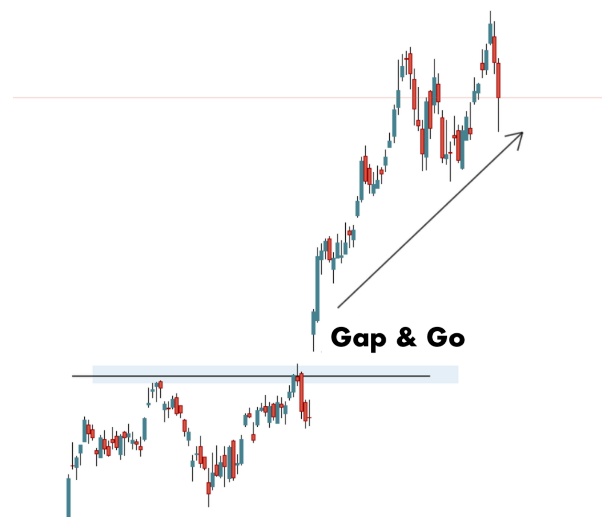

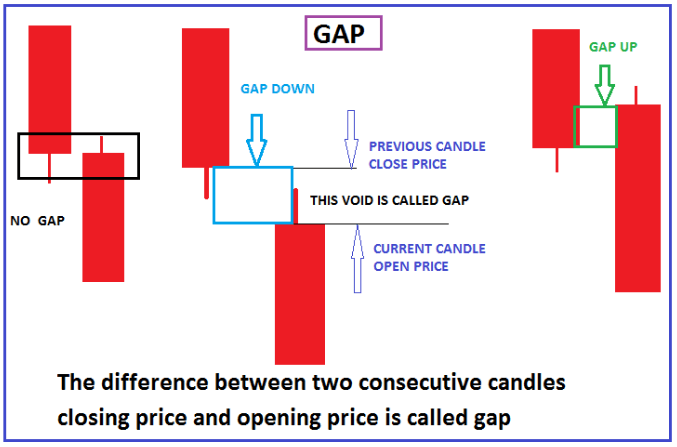

Gap at the asset price

This trading method is similar to the ‘Gap’ trading strategy. A gap occurs at the price movement by the participant’s actions. Once a gap appears at the price movement, it remains at that trend for a particular period. Seek the gaps in the daily chart of the target asset.

Bullish trading strategy

When the news release suggests a future upward movement, place a buy order before opening the regular session. After the market opening, if a gap occurs, the difference between the current day’s opening price is higher than the previous day’s closing price.

Bullish gap example

Continue the buy order till downward pressure comes up. Stop loss will be below 15-20 pips of the gap.

Bearish trading strategy

If it suggests a downward or declining asset price at the market’s opening, place a sell order. The gap will be opposite to the bullish setup. The opening price of the current day will be lower than the last day’s closing price.

Bearish gap example

It indicates a bearish pressure on the asset price. Continue the sell order until the buyers return with sufficient buying interest to push the asset price more upside. Initial stop loss will be above 15-20pips of the gap.

Tips

You can make thousands of pips using this strategy, but you have to keep in mind some factors: gap can occur for distribution, accumulation, broker adjustment with the actual market, etc. Only enter when there are significant resources that support your order type. Moreover, often the gap fills up immediately after making it, so don’t lose hope and be strict with the plan.

Pros and cons

| Pros | Cons |

|

|

|

|

|

|

Final thought

Finally, these strategies are very effective in making profits. We suggest achieving sufficient knowledge and applying these strategies at demo trading before using any of these strategies in real trading.

Comments