The PAMM is an FX trading account that allows investors to earn money with the possibility of enabling other people to follow their trading activity and make additional money.

Retail trading has become famous in FX due to the growth of the internet. Now people can earn money through trading without going outside. Moreover, the possibility of managing other people’s funds makes trading more attractive to traders.

Thanks to PAMM features to automate the system. Now market participants can make trades on their accounts that will be copied to clients’ accounts automatically. However, it is often hard to manage accounts because it takes time to take trades from more than one account at a time.

The following section will grab detailed knowledge about PAMM account FX brokers, including how we can find these and what we should consider in choosing the perfect PAMM account for you.

What is the PAMM account?

The PAMM or percentage allocation management module is a trading account type available in a forex brokerage that allows having multiple accounts as a follower under a mother account. The FX broker works as a mediator between the mother account and follower accounts in this account type.

- The mother account holder will trade on his account.

- The broker will copy these trades to follower accounts proportionately.

In general, if you want to manage other people’s investments, they should share their trading credentials with you. After that, if you find a proper trading setup, you should open the position in all accounts by login individually. But what if you have 100 people’s accounts to control?

It is often impossible to execute the same trade in 100 trading accounts at a time. Therefore, the requirement of a PAMM account comes where traders can manage trades under the mother account with automatic profit distribution.

However, finding a good broker with such an account facility with strong regulations is not easy. Still, if you know what characteristics you should find a forex broker to open a PAMM account there, you can easily find a suitable opportunity for you.

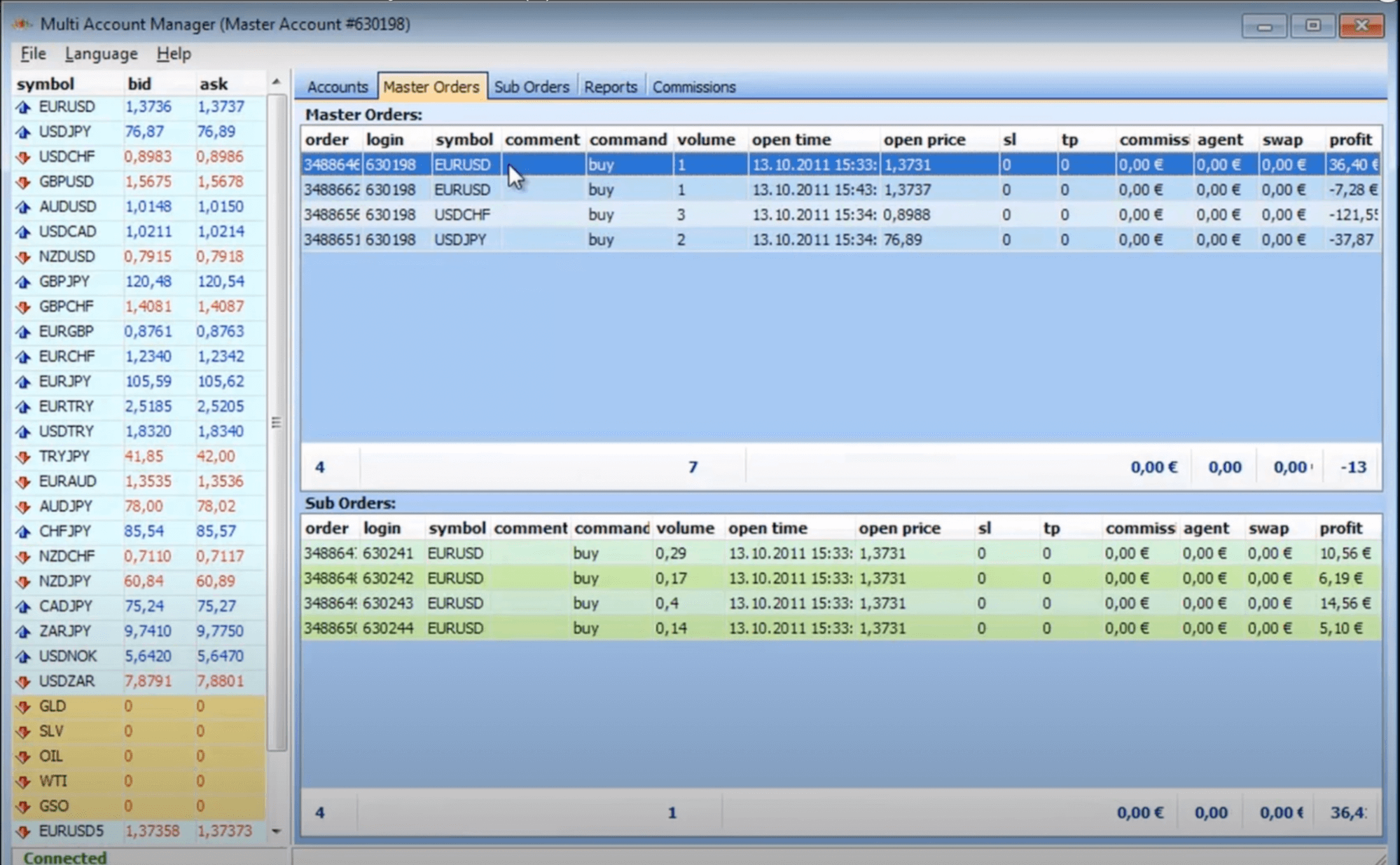

Let’s see what a PAMM account software looks like.

PAMM account software

How does a PAMM account work?

Ordinary forex brokers provide this account facility with an opportunity to manage multiple accounts within the same broker. In particular, the PAMM account has three major components:

- Investor

- Asset manager

- Brokerage house

In the PAMM system, investors can open usual accounts and allow the asset manager to trade for them. The interesting fact about this feature is that the trading position is distributed following the investment.

For example, Tom, Dick, and Harry want to make money from forex trading, but Tom knows how to trade while Dick and Harry have no idea about trading.

Can they make money together?

Tom to be the asset manager and trades for Dick and Harry. In that case, they should invest under a broker that has a PAMM facility. When Tom takes trades, these will automatically copy Dick and Harry’s accounts, proportional to their investment.

Key features of a PAMM account broker

In this section, we will see what we have missed in the above part. First, we have to identify which broker offers such accounts along with solid regulation. We cannot compromise with the regulation as it is the only way to ensure funds’ safety.

Many brokers have PAMM account facilities regulated by a local or international authority and finding a suitable one is not hard. Later on, it would help if you focused on the functionality of the PAMM feature.

Most of the brokers with the PAMM facility provide enough leverage to maximize profitability. However, investors should remain cautious about using leverage as it is associated with the risk of losing all investments. Therefore, make sure to find a broker house where the leverage is satisfactory with other functionalities.

Lastly, like other brokers, PAMM account brokers should provide free educational resources to their clients. There are trading courses, technical analysis, fundamental analysis, weekly market overview, etc.

Pros & cons of a PAMM account broker

Pros |

Cons |

|

|

What is the best PAMM broker for you?

First, you have to make a list of PAMM brokers that have the most strong regulation. Among highly regulated brokers, you should focus on a service without any hidden cost. Some brokers offer attractive trading conditions, but in reality, they take a higher charge from traders.

Furthermore, good PAMM account brokers do not require minimum solid deposit requirements with leverage functionality. Moreover, it would help focus on concrete customer support and deposit and withdrawal flexibility while choosing the best PAMM account FX broker.

A trader should have extensive technical and fundamental analysis knowledge to get the maximum output from financial trading. Moreover, theory should achieve the ultimate trading psychology to get the full benefit.

Lastly, whether you trade with other people’s funds or allow your fund to other traders to trade, make sure to follow strong risk management rules for every trade. Traders should minimize the risk by allotting a small percentage of their investment in a single trade.

Final thought

There is no such thing as a “perfect broker” in the world. For example, one might offer you an attractive PAMM account service, but you may get scammed. On the other hand, you may find a well-regulated broker but might not have PAMM account facilities.

Therefore, you should balance the service and cost. Before trading, you must gather sufficient knowledge and be aware of risk factors controllable by selecting the right broker.

Comments