ICT or inner circle trader is a trading strategy from Micheal Huddleston, a forex trader, and mentor. The main aim of the ICT trading strategy is to combine price action and the smart money concept to find the optimal trading entry. Moreover, the core strength of this method is that it is not limited to finding a trading point only. Instead, it can explain the market in the best way so that traders can combine the price structure with their trading method.

Let’s discuss everything a trader should know about the ICT trading method, including buying and selling strategies with examples.

What is the ICT trading strategy?

The method, which is based on the market structure, can explain institutional traders’ appearance in the market. Therefore, investors can avoid the retail trading trap related to making a loss.

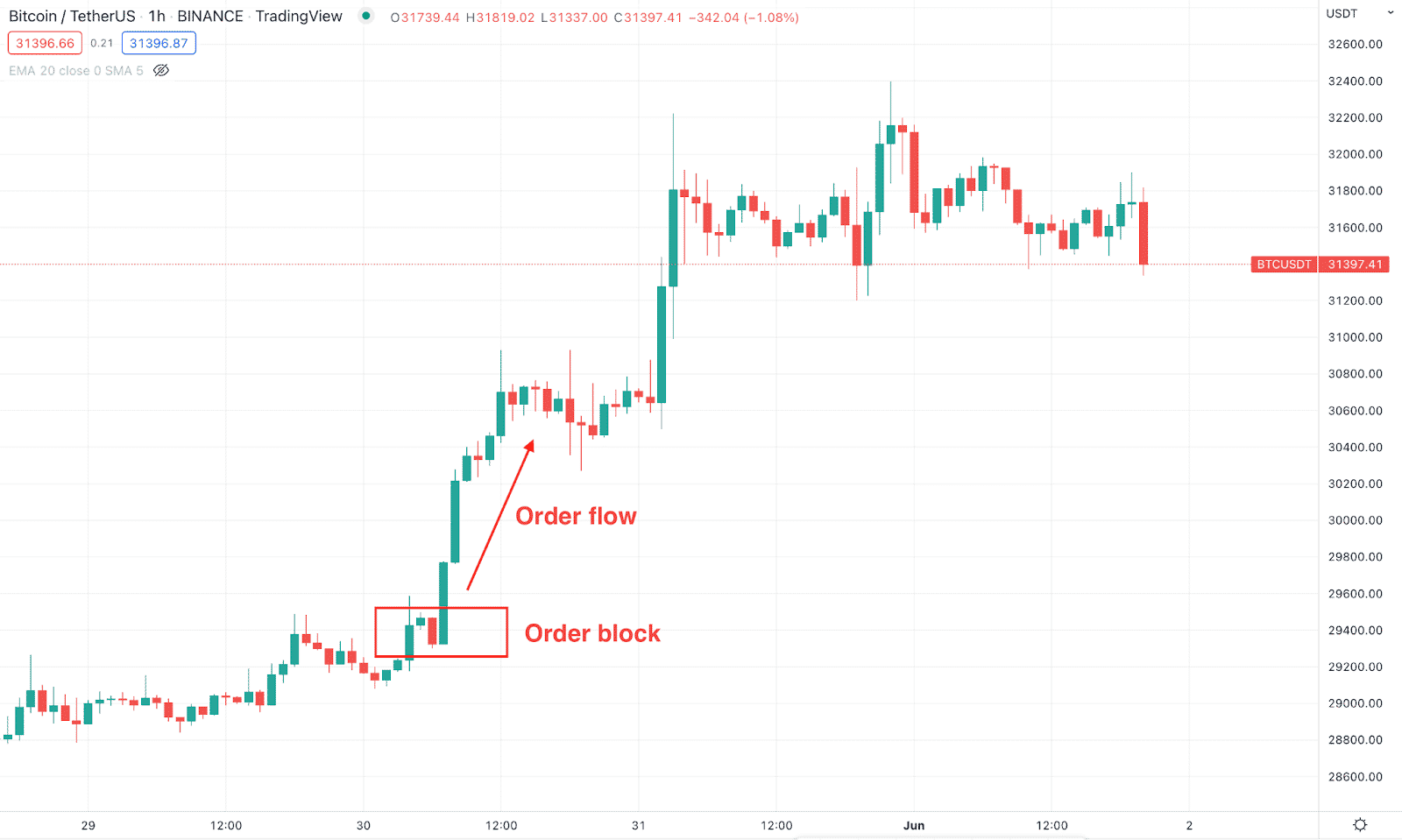

In the financial market, larger players need to build orders before making the price move in any direction. In the order building phase, the price remained within a correction, where violations of the near-term supports and resistances are seen. On the other hand, when the price is ready to move, it will indicate which candle the order flow started.

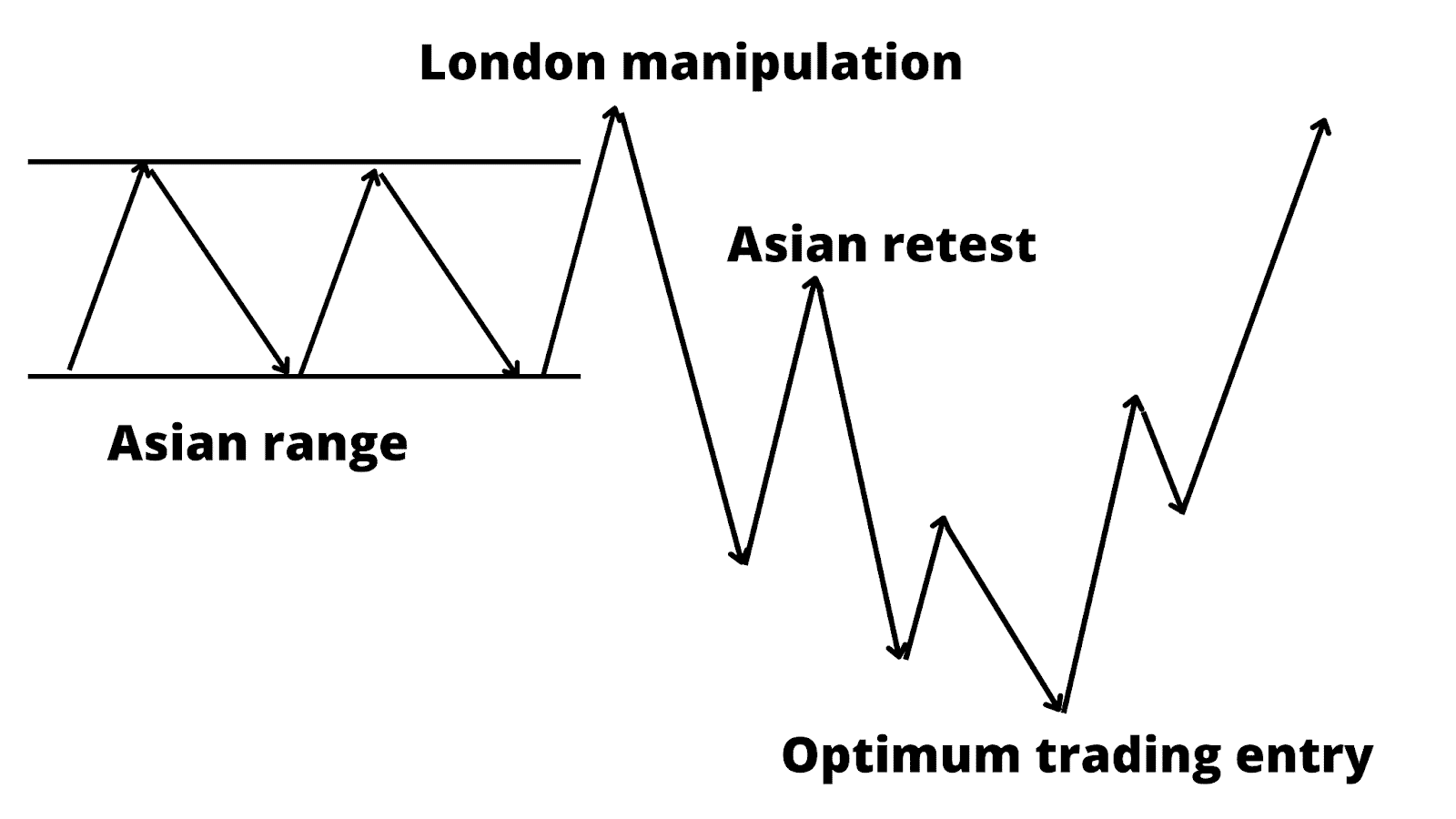

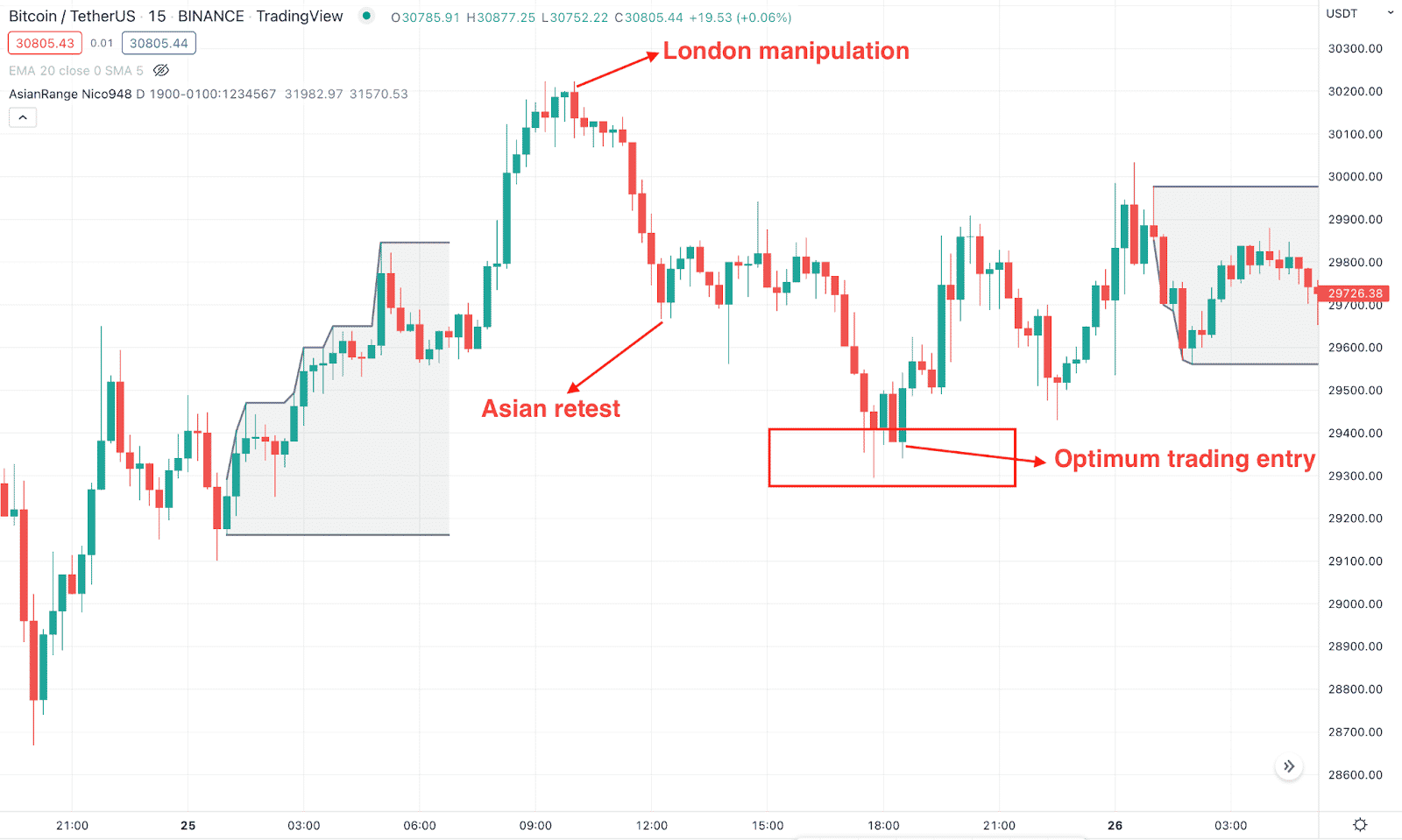

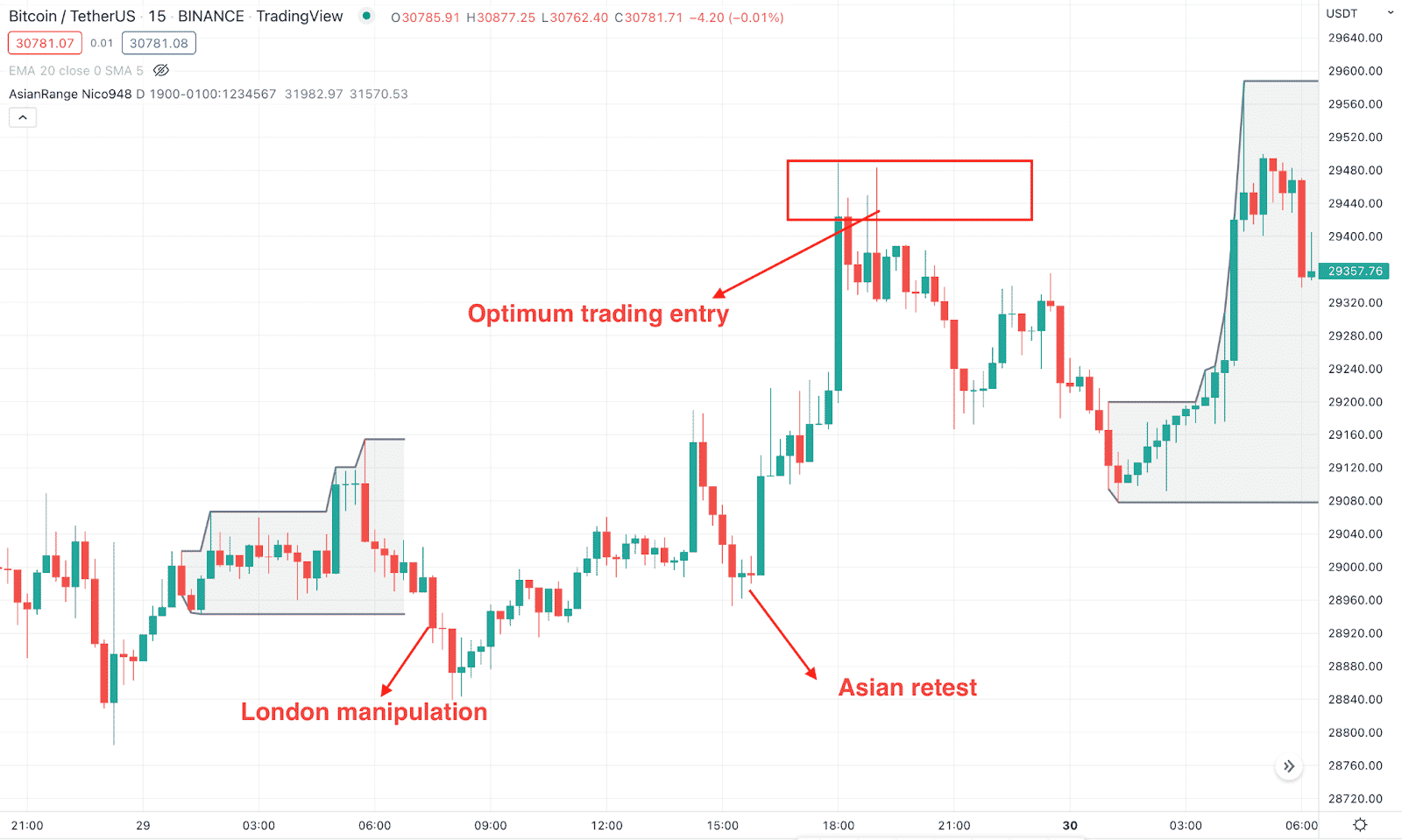

Moreover, the financial market follows a sentiment in 24 hours trading, starting from the Asian range. Traders can identify the intraday price sentiment from this behavior and make money by taking trades from the optimum level. Later on, London manipulation and New work move complete the circle.

ICT optimum trading entry

How to trade using the ICT in trading strategy?

Several trading strategies are built on the ICT concept, but sticking to intraday and higher time frame swing trading would be more profitable than others.

We will open buy or sell trades from the weekly chart’s order flow in swing trading and find the optimum trading position from the daily or H4 order block. On the other hand, the intraday approach finds the optimum trading entry after completing the London manipulation.

Order flow and order block

A short-term trading strategy

The short-term strategy aims to find the buying/selling positions from the optimum trading entry after the London manipulation.

Bullish trade scenario

Short-term buy example

The bullish trading entry is valid once the daily trend is bullish and the current price remains within the weekly order flow.

Entry

The intraday buy trade is valid once these conditions are present:

- The price is trading within the order flow in the higher time frame chart.

- The previous day’s closing appeared above any significant support level in the daily chart.

- The next day, the price formed the Asian range, London manipulation, and moved to the optimum price level.

- The price formed a bullish reversal candle at the optimum areas order block from where the bullish entry is valid.

Stop loss

Please stop loss should be below the reserve swing low of the optimum trading area with some buffer.

Take profit

The primary take profit will be the near-term swing high, but investors should monitor the higher time frame order floor to identify its bullishness. If the higher time frames by section allow the second take, profit can be extended.

Bearish trade scenario

Short-term sell example

The selling entry is valid once the daily trend is bearish and the current price remains within the bearish weekly order flow.

Entry

The intraday sell trade is valid once these conditions are present:

- The price trades within the bearish order flow in the higher time frame chart.

- The previous day’s closing appeared below any significant resistance level in the daily candle.

- The next day, the price formed the Asian range, London manipulation, and moved higher to the optimum price level.

- The price formed a sell candle at the optimum areas order block from where the bearish entry is valid.

Stop-loss

Please stop loss should be above the previous swing high.

Take profit

The primary take profit will be the near-term swing low but it can be extended if the price action allows.

A long-term trading strategy

The long-term trading approach is to find a swing trading opportunity using the Inner Circle traders concept. This trading metal is applicable on any train friend from a five-minute chart sticking to H4 or daily chart would be more profitable.

Bullish trade scenario

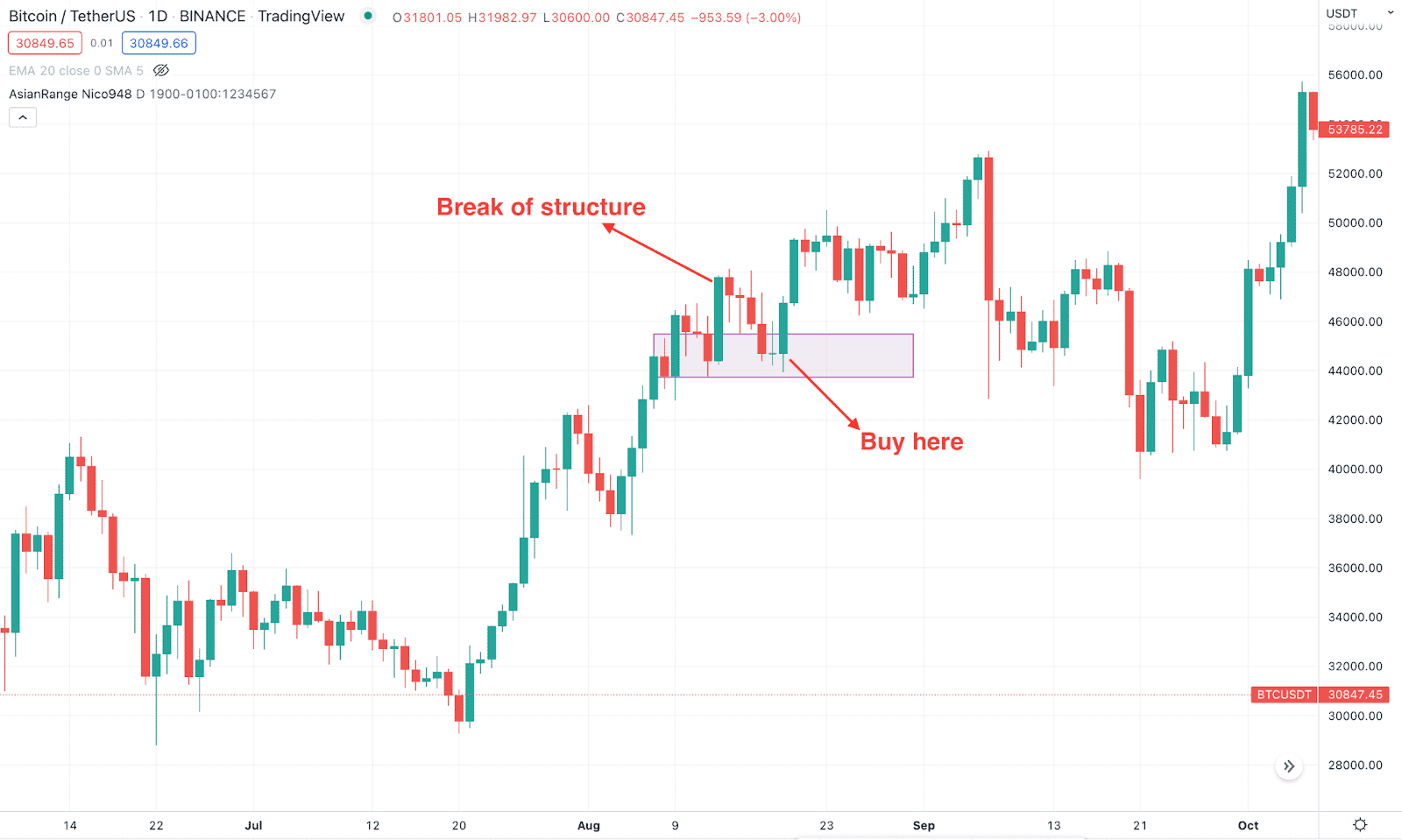

Long-term buy trade

The price should move within the weekly bullish order flow in the bullish trade. However, we are interested in buying trades once the correction has appeared.

Entry

The buy entry is valid all these conditions are present in the daily chart:

- In the weekly chart, the current price trades within the bullish order flow.

- After making a bullish break of structure, the price moves down to the near-term order block.

- The first trading entry is after reaching the order block and the second trading entry is from the 50% of the order block.

Stop loss

The trading entry is valid as long as it remains within the order block. Therefore, the stop loss is below the OB with some buffer.

Take profit

The main aim is to hold the trade as long as the higher timeframe order flow is valid.

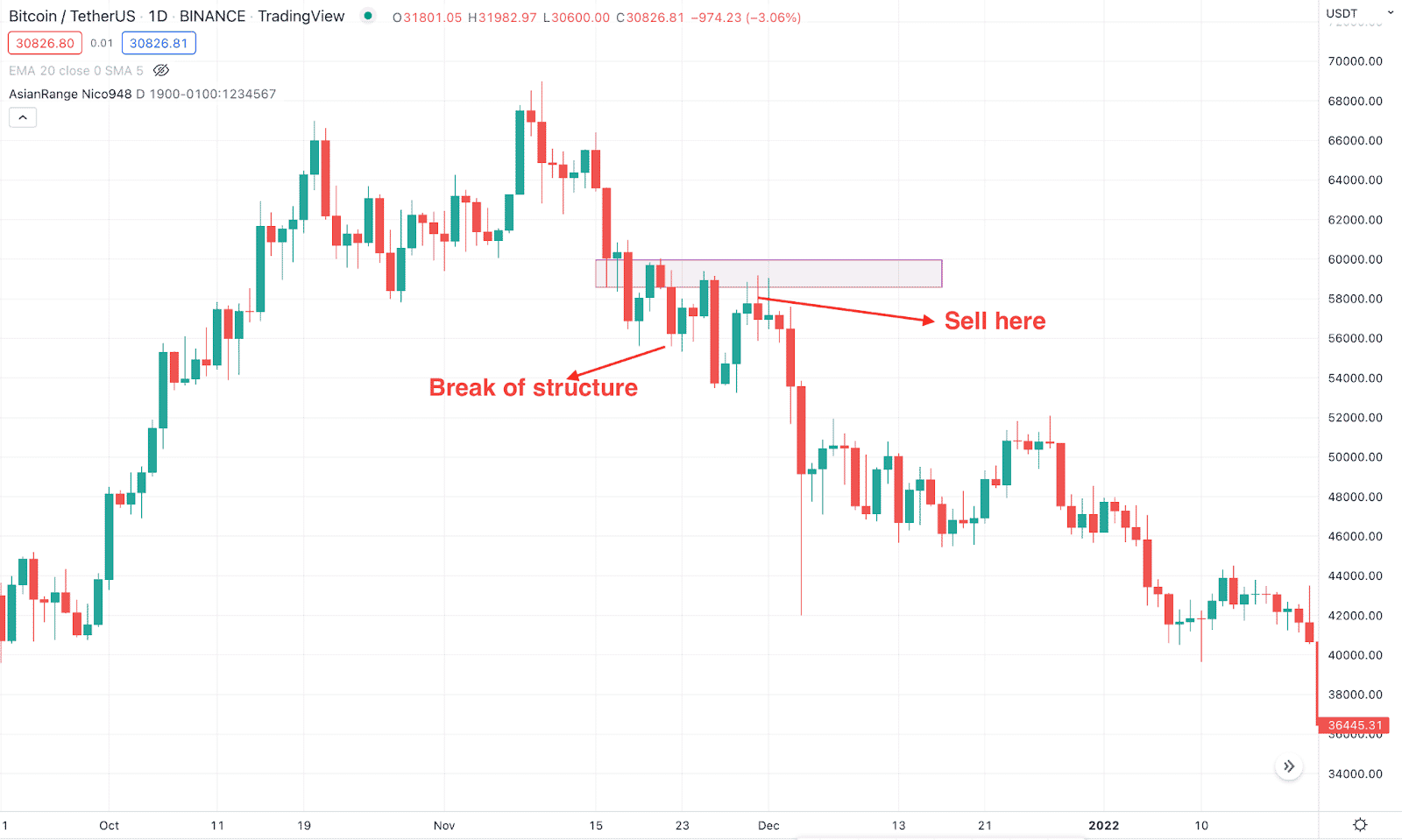

Bearish trade scenario

Long-term buy trade

The price should move within the weekly bearish order flow in the long-term sell trade. However, we are interested in selling trades after the bullish correction is over.

Entry

The long-term bearish entry is valid; all these conditions are present in the daily chart:

- The current prices are trading within the bearish order flow in the weekly chart.

- After making a bearish structure break, the price moved up to the near-term order block.

- The first trading entry is valid after reaching the order block, and the second trading entry is from 50% of the order block.

Stop-loss

The trading entry is valid as long as it remains within the order block. Therefore, the stop loss is above the OB with some buffer.

Take profit

The main aim is to hold the trade as long as the higher timeframe order flow is valid.

Pros & cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

The above section shows how the ICT trading method works in the crypto market, where finding a buy or sell position is easy after finding order flow and order blocks. However, finding the optimum trading entry is the hardest part of this method, which needs a lot of practice to master.

Comments