In forex trading, institutions are key players as they have enough liquidity to make the market move. On the other hand, retail traders are vital in the number, but retailers’ trading volume is not much. Therefore, it is wise to follow how institutional order flows work to follow their footprints.

Many people struggle in FX by trying technical and fundamental strategies and end up trading by losing all the investment. The key to success in financial trading is to have a system that matches the direction with the institutional order flow. The following section will see everything you should know about order flow, including a complete trading method.

What is the institutional order flow?

Institutional order flow is a sharp market movement that happens once institutions have completed their order and made the price ready to move.

Retail trading and institutional trading are not the same. You might be good at drawing trend lines or Fibonacci levels, but all of your activities are effortless if the market direction does not match the Institution’s direction.

How do big institutions trade?

When banks and prominent financial institutes enter the market, they need many buyers to sell and a lot of sellers to buy. Therefore, when the price moves down, the retailer’s perspective is to open the sell position as the current market trend is bearish. The more the price comes down, the more people will join the sell trade. On the other hand, institutions will see the market as a buying opportunity on the selling market.

But how?

If you have enough apples in your basket, you have to sell them to people who do not have apples. On the other hand, if every person in your locality has enough apples to eat, you cannot sell your apple to them.

“Institutions need enough retail sellers to buy and enough retail buyers to sell.”

Once they complete their order, the price starts to move with an impulsive pressure, known as Institutional order flow.

How to use the institutional order flow in trading strategy?

Order flow analysys

Institutional order flow is not an exact trading strategy that you can use to find a buying and selling position. Instead, investors can use this tool as an additional confirmation to a trading strategy to increase the probability. Thus, a simple trading strategy towards institutional order flow might provide more profits than an ordinary technical analysis without bias.

In financial trading, we aim to predict the market movement based on the possible bias. In this manner, the ultimate goal is to remain correct while forecasting the market movement with higher accuracy. Indeed, you cannot make profits from your every trade, and no one can give you a 100% guarantee on a market direction. Sometimes we make mistakes, but remaining overall profitable is the ultimate target.

The use of institutional order flow is logically based on what banks are doing with the price. As they are key market movers, following their direction can make your trading fruitful.

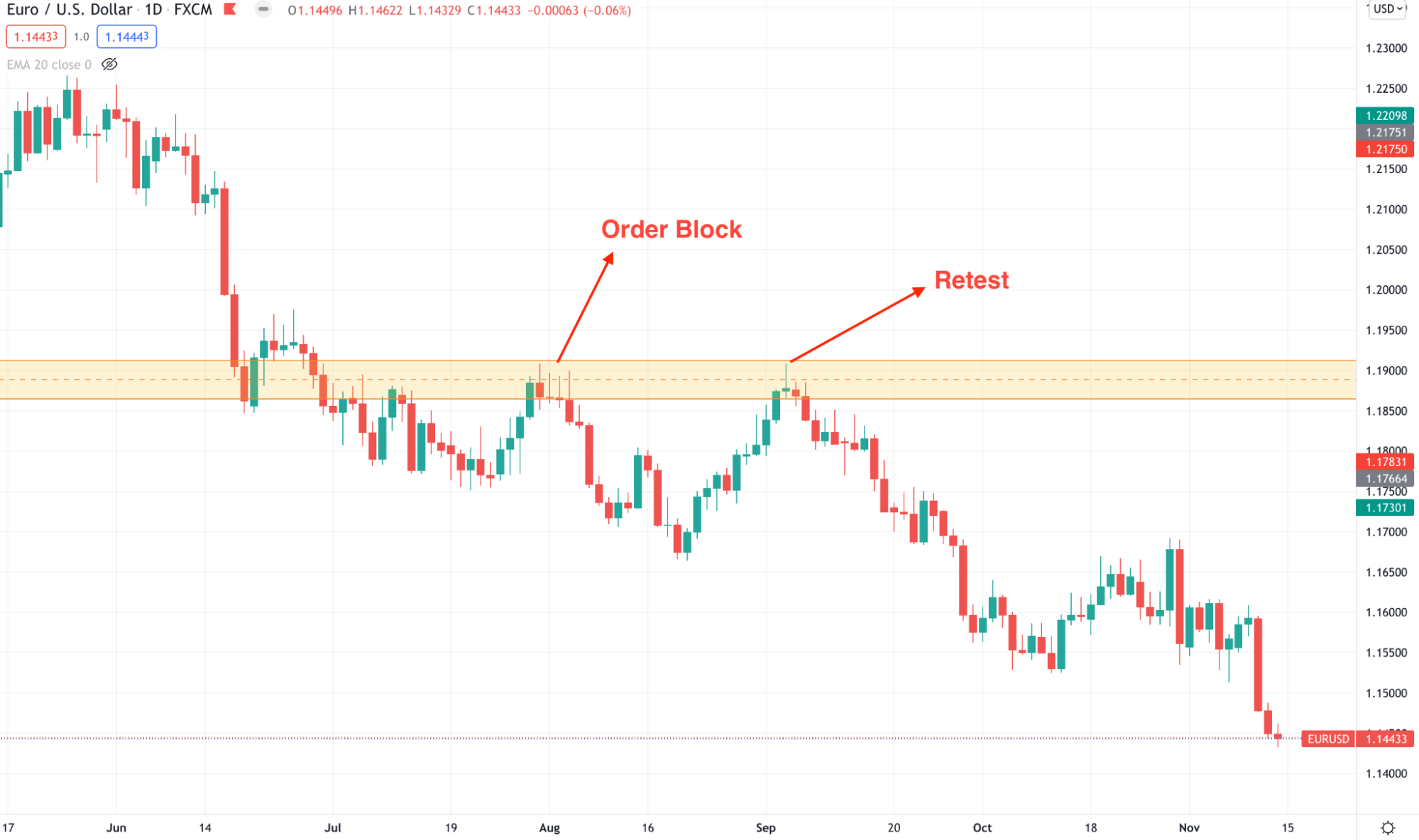

Let’s see an example of the institutional order flow and order block from the real price chart.

Institutional order flow

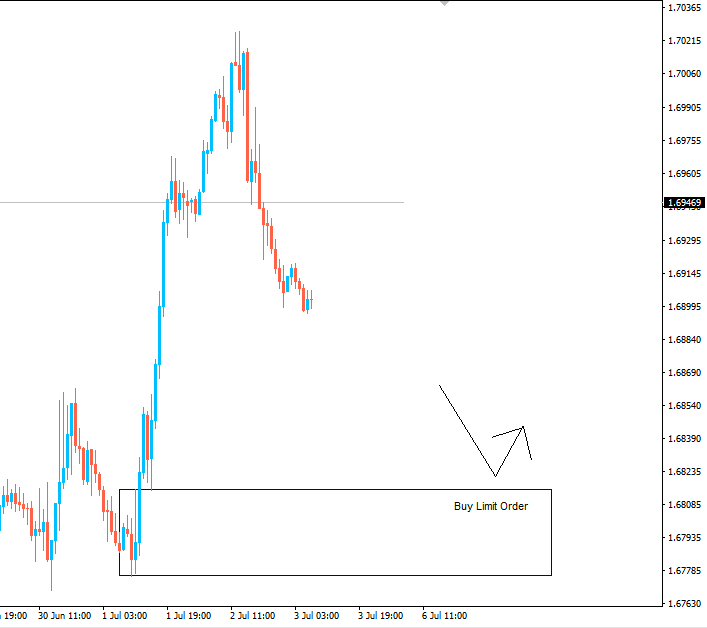

The above image shows a ranging phase of the market, known as order block. In this order block, institutional traders accumulate orders, and when orders are filled, the price is ready to move and start moving up with an order flow.

A short-term strategy

Institutional traders are present in long-term and short-term time frames, so it is not hard to follow their direction. This short-term strategy will find the order block in the lower time frame while the higher time frame is within a strong order flow.

Best time frames to use

This trading method is suitable for the 15 minutes time frame, but it is also applicable on 5 minutes charts.

Entry

Open a trade once you find the following condition in the chart:

- The H4 trend is within a strong order flow where the price made new swings with impulsive pressure.

- In the m15 time frame, the price retraced lower and formed an order block.

- The price should move from the order block with a strong pressure but do not open any trade. Wait for the price to come back to the order block again.

- Once the price returns to the order block, it should reject the range with a reversal candlestick. Then, open the trade after the rejection is complete.

Short-term strategy

Stop loss

For a buy trade, the stop loss is below the order block with some buffer. On the other hand, the stop loss should be above the order block for a sell trade.

Take profit

You can close the partial trade after reaching the 1:2 risk vs. reward ratio and keep the profit run until it reaches any significant barrier.

A long-term strategy

The long-term strategy applies in the daily charts where traders can use this method as a substantial investment opportunity. In that case, investors should monitor where the weekly order flow is heading.

Best time frames to use

This method is perfect for a daily time frame as it can eliminate intraday volatility.

Entry

The primary condition to open a trade is that the price should remain within an institutional order flow in the weekly chart. However, for a sell trade, make sure that the overall market trend is bearish, and for a buying opportunity, the weekly trend should be bullish.

Open a trade once you find the following condition in the chart:

- In the daily chart, the price was retraced lower and formed an order block.

- The price should move from the order block with a strong pressure but do not open any trade. Wait for the price to come back to the order block again.

- Once the price returns to the order block, it should reject the range with a reversal candlestick. Then, open the trade after the rejection is complete.

Long-term strategy

Stop loss

The stop loss should be based on the low and high of the order block. In that case, traders should use some gaps with the order block to avoid the unexpected touch of the SL level.

Take profit

The ideal take profit of this method is based on near-term support or resistance level. Moreover, traders can extend the profit if the movement is sharp.

Pros and cons of trading strategy with the institutional order flow

| 👍 Pros | 👎 Cons |

| This trading strategy perfectly explains institutions’ involvement in the forex market. | This method needs additional attention to the higher time frame that might make traders confused. |

| The risk and reward ratio in this strategy is affordable. | Although it is a profitable trading method, it needs additional attention to the trade management. |

| This method is applicable in any financial market and any time frame. | During economic instability, this method might not work well. |

Final thoughts

Institutional order flow is the basic concept of forex trading that every retail trader should know. The simple supply-demand concept is used here that is very effective in any financial market. However, in economic uncertainty, any strategy may fail. Therefore, a vital precaution about trade management is essential in this method.

Comments