Trading gold in a traditional way involves enormous resources, investments and is time-consuming. However, nowadays, it has become easier to trade precious metals with the availability of technology. You can trade this commodity with a small investment, and it allows transactions over some simple clicks in these modern times.

However, trading commodities like gold requires deep skill, understanding, and proper strategy. So it would help if you have some basic understanding of this precious metal marketplace before starting trading.

In this article, we describe the influencing factors of the gold price. Moreover, this article will introduce you to both short-term and long-term trading strategies for trading gold. You can choose anyone that suits your trading style or make your own by realizing these facts.

Why trade gold?

Gold is a precious metal that has been used for trading goods for centuries. Investors across the world see this commodity as a safe-haven asset. When any uncertainty comes, the price of this metal goes up with increasing demand. Investors put money on gold to hedge the risk of fiat currencies.

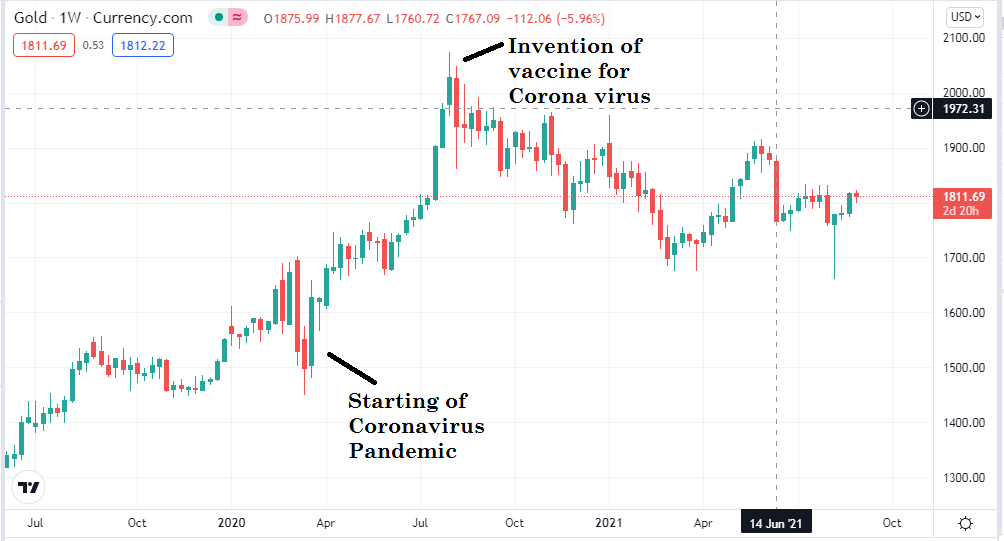

For example, the recent coronavirus pandemic hit the world economy. Meanwhile, the gold price reaches its peak.

Gold price during the Covid-19 pandemic

You can trade gold for both long-term and short-term strategies. It is a non-renewable fossil commodity. Many think the price of gold will go up more upside in the future. Microeconomic crisis and depreciation value of national currencies have an inverse correlation with the gold price.

What influences the price of gold?

The commodity market is a volatile marketplace. Gold is one of the most active and widely accepted metals among them. The main participants of this yellow metal are the IMF and other funds, central banks, individual investors and traders, gold producers, gold consumers, commercial banks, exchange-traded funds, and investment, etc. So several factors such as supply-demand, interest rate, and inflation, the USD, uncertainty, etc., affect the price of gold.

Supply-demand

Like all other commodities, supply-demand influences the price of gold. Increasing demand and decreasing supply are reasons to raise the price of gold and vice versa.

Interest rate and inflation

Investors get small returns from investing in assets such as bonds and cash when any nation’s currency has a lower interest rate. So they may invest in gold as it is a safe-haven asset, so the price goes up. On the other hand, the increasing interest rates may attract investors to invest more in cash and bonds or other financial assets rather than commodities like gold.

Similarly, increasing inflation means a weaker currency. So investors put their money in gold to protect the wealth value.

The USD

People trade gold worldwide by the USD. So it is common that there is a correlation between these two assets. The rising value of the dollar is a reason for the depreciation in the gold price. Meanwhile, the bearish movement of the dollar tends to rise in the gold value.

Uncertainty

Any uncertainty such as war or any global crisis influences the gold price. Investors get worried about geopolitical issues or major crises; they put their money in gold as a safe-haven asset.

Gold trading strategies

In this part, we discuss a long-term and a short-term trading strategy to trade the gold futures. There is no invincible strategy to trade gold, but these strategies will help you know some technical and fundamental methods to trade precious metals.

The symbol for gold is XAU. The pair is XAU/USD, where the graph shows the price per ounce of gold in USD. One standard lot of XAU/USD equals 100 troy ounce gold price in dollars.

Short-term strategy

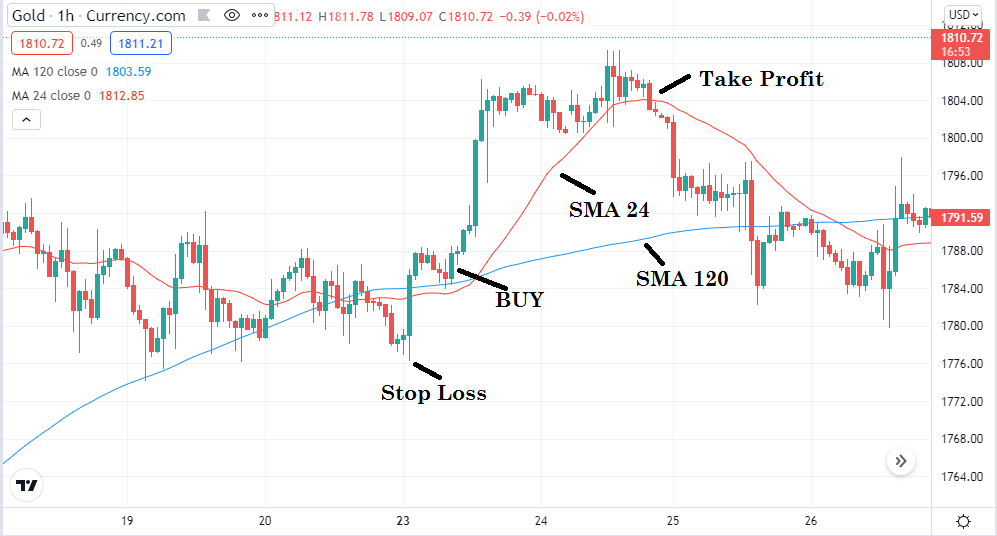

You can trade gold for the short term by using two simple moving averages. This strategy works fine on an hourly chart. You need to implement two SMA periods of 24 and 120 on your chart.

Gold H1 chart

The figure above shows SMA 24 as the red line and SMA 120 as the blue line on the hourly chart of the gold.

- When the red line crosses above the blue line, it declares a bullish environment on the price movement and good to place buy orders.

- Stop loss will be below the recent swing low. Remember to place a buy order when the price candle closes above both 24 and 120 SMA.

- Your buy order is safe till the price remains above the 24 SMA line.

- Close the buy position when candles start to close below the 24 SMA line. You can shift your stop loss above or at the breakeven to reduce risk after the price makes a swing high.

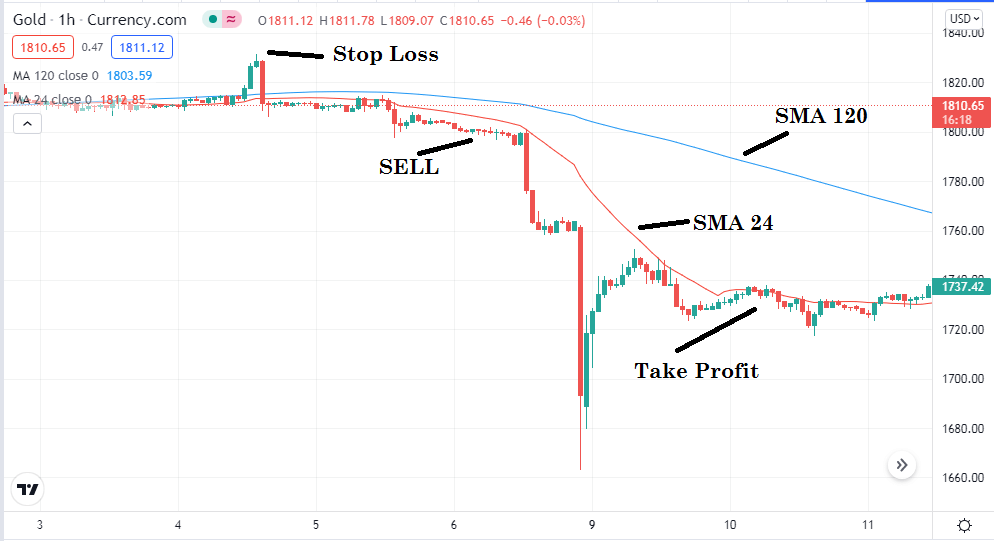

Gold H1 chart

- The figure above shows the bearish trade setup by SMA crossover strategy on the hourly chart.

- The bearish setup is just the opposite of the bullish strategy.

- Place sell order when the red SMA crosses below the blue SMA and price closes below both SMA lines. Initial stop loss will be above the recent swing high, and the order is valid till the price remains below the red SMA line.

This strategy will help you to catch potentially profitable orders with a 1:2 risk ratio in most cases.

Long-term trading strategy

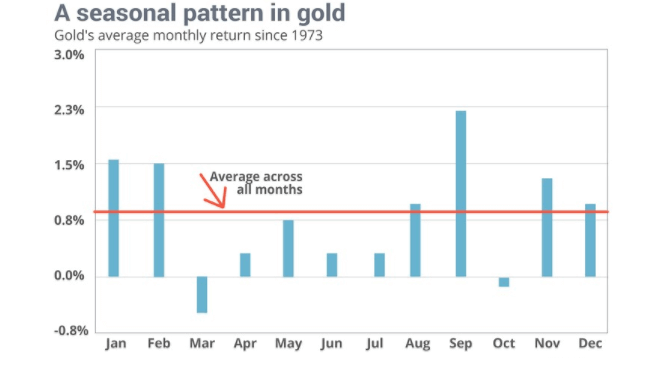

Professionals use this type of technique to invest in particular assets. First, look at the chart below to understand the seasonal behavior of gold price movement over few decades.

The seasonal tendency on the gold price

According to the study, gold prices remain bullish in the first and last quarters of the year, and the best time to buy gold is in September. It is a fundamental study but no confirmation without any technical or other supportive information.

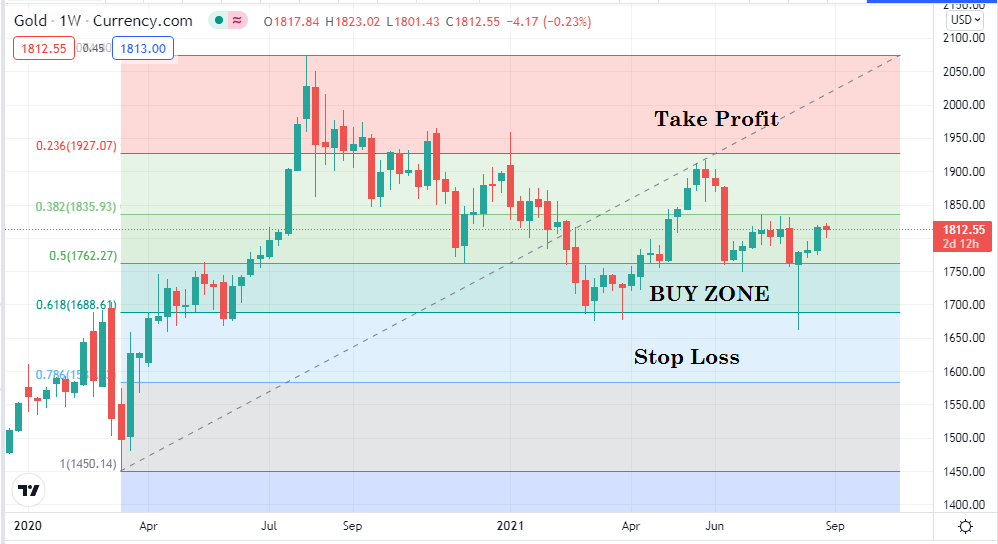

Now check the Fibonacci retracement level from the previous swing low to swing high. If the price bounces at near 61.8 retracement level, it is an excellent place for buying orders. This strategy will frequently work on the daily and weekly charts.

Gold weekly chart

The figure above shows the bullish confirmation by our long-term strategy. Initial stop loss will be below the recent swing low, and profit-taking level will be near the previous swing high. The bearish setup is just the opposite of this bullish setup.

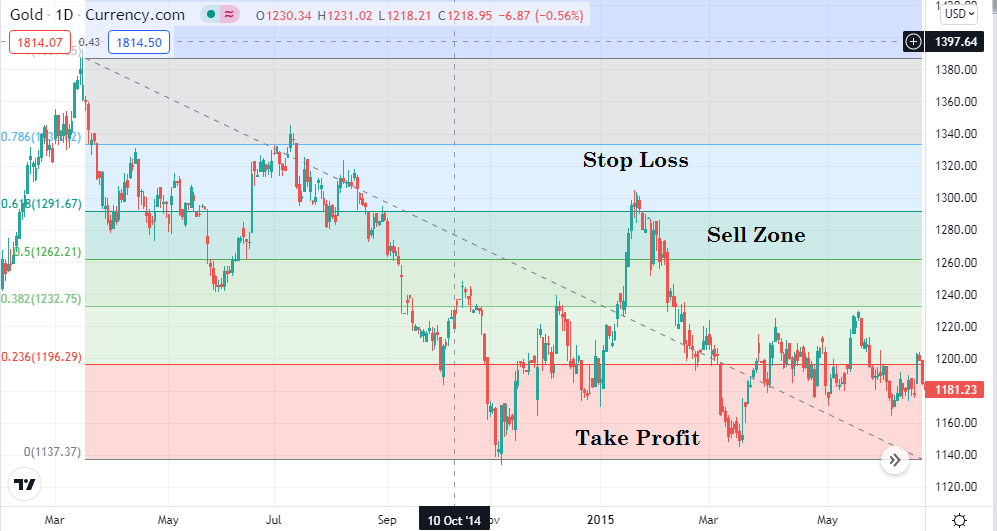

Gold daily chart

The figure above shows the bearish setup by our long-term strategy.

Pros and cons of the gold trading strategies

You will find in trading gold strategies the advantages and also some limitations.

Pros |

Cons |

|

|

Final thoughts

Finally, now you know the reasons to trade gold — the influence factors of gold price and two types of strategies. We suggest following proper money and trade management basics to trade gold. Otherwise, you can end up losing capital in this volatile marketplace.

Comments