Daily forex signal indicator is a custom MetaTrader 4 (MT4) tool that shows a trading instrument’s exact buying and selling point. Traders can quickly increase the probability by using this indicator besides having a trading strategy.

There is no way to ignore a trading strategy that includes the overall market context and action. Moreover, traders can increase the probability by using additional tools or indicators, which is strongly possible with the Daily forex signal indicator. Therefore, whether you are an indicator-based or price-action trader, this tool might enrich your trading journey by providing more profitable setups.

If you are interested to know details about this particular indicator, the following section is for you. Here we will briefly discuss the formation, setups, installation, and use of this indicator for the MT4 platform.

What is the Daily forex signal indicator?

It is a custom indicator available for free to all traders. It shows a list of trading pairs in a separate window with exact buying and selling positions and possible profit levels. However, it is not wise to blindly follow this indicator as there is always a possibility of having wrong signals. Nevertheless, if you use a good trading strategy and match the system with the Daily forex signal indicator, you can consider the setup has a high probability.

Let’s have a look at the indicator appearance.

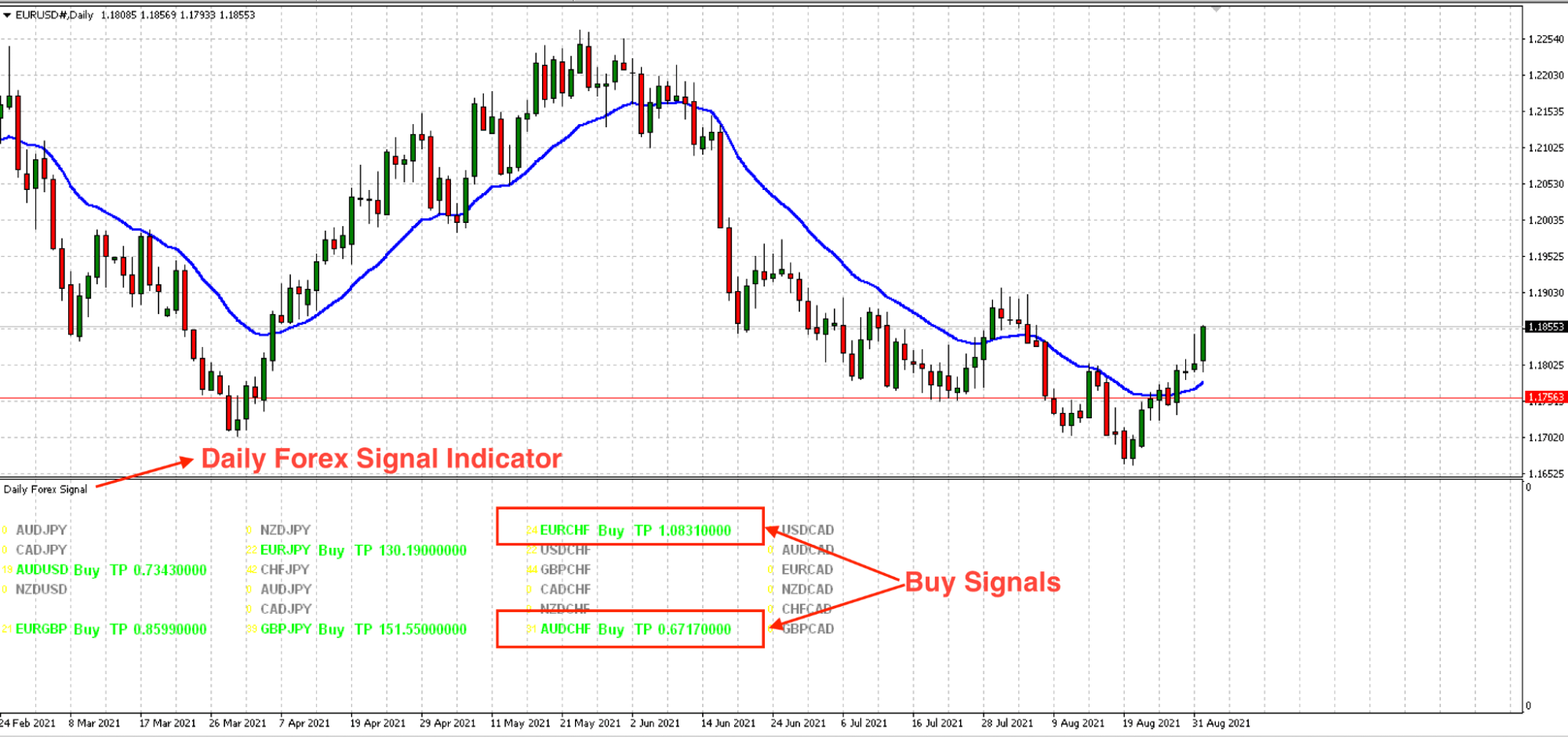

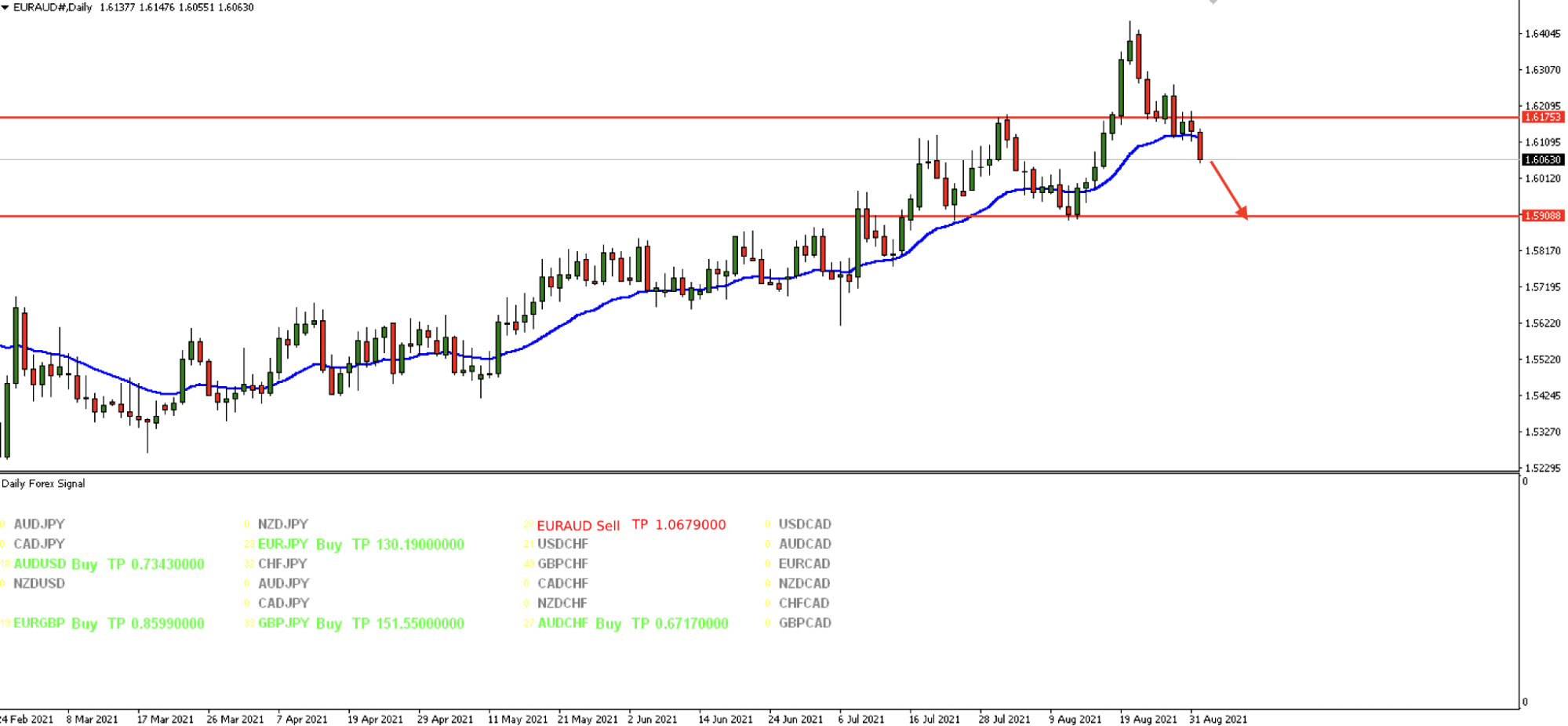

Daily forex signal indicator

The above image shows the daily chart of EUR/USD; the indicator is shown in a separate window. It shows the buy signal in some pairs with a profit target. Once your trading strategy matches its direction, you can take the trade.

As it is a custom indicator, it is not available in the MT4 platform, and you have to download the *.ex4 files and save them in the indicator directory. After extracting the zip file after download, follow the File> Open Data Folder> MQL4> Indicators, and paste it here. After completing the installation, make sure to restart the trading platform.

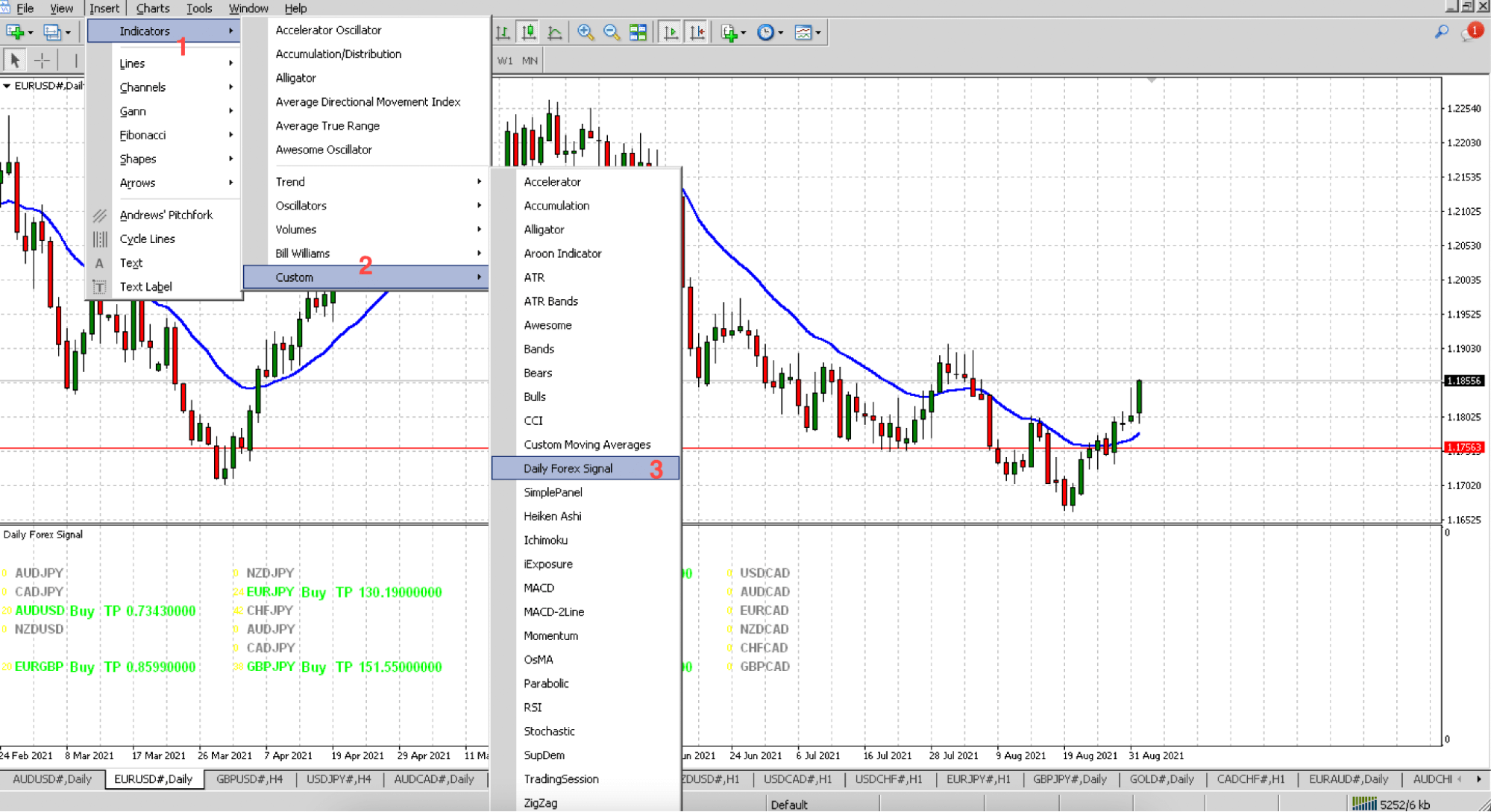

Now the indicator is visible on the list on your MT4 platform, as shown below.

Indicators list in MT4

The above image shows how to insert the indicator from the following path: Insert> Indicators> Custom> Daily Forex Signal.

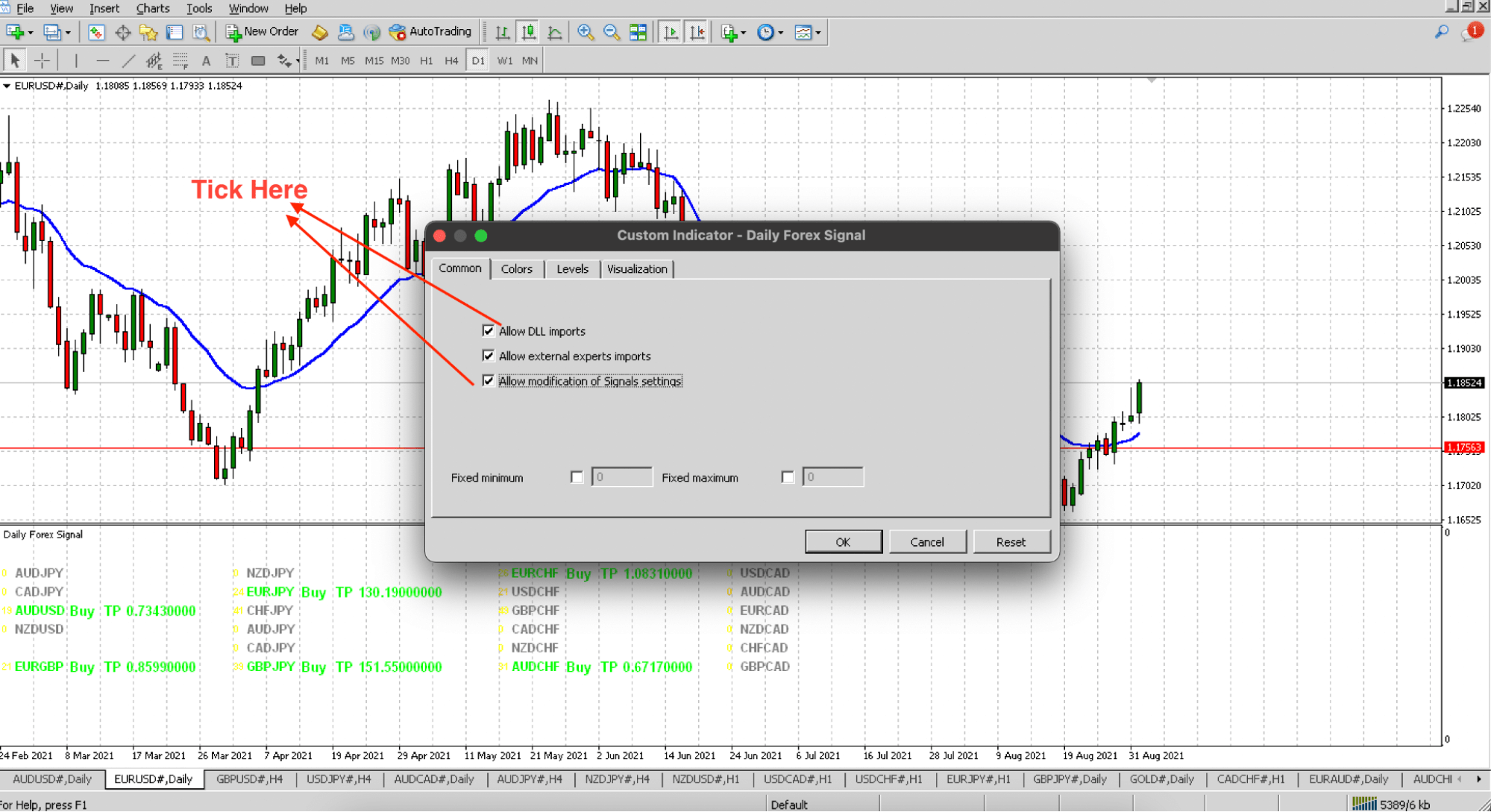

Now come to indicators settings. When you click the indicator from the list, you will see the box where you have to tick two options, as shown in the following image.

Daily forex signal setting

The DLL import will allow the indicator to get data from the system and show them on the chart. So now you are ready for this indicator, let’s see how to implement it with a trading strategy.

How to use it for MT4?

As mentioned above, this indicator lacks, and it is not perfect to use the system without any confirmation. Therefore, we have to use other trading tools and the Daily forex signal as an additional confirmation.

We need a trading system to use the static support and resistance levels with dynamic 20 EMA. The dynamic 20 EMA will provide the average price of the last 20 candles they will buy if the price moves above it. On the other hand, the horizontal levels will help us to understand the market context.

Bullish setup

For taking a buy entry, make sure to have the following condition:

- The price is above a significant support level

- The price moves above the dynamic 20 EMA

- Daily forex signal shows the signal for the opening buying position

Let’s see an example of the buy trade.

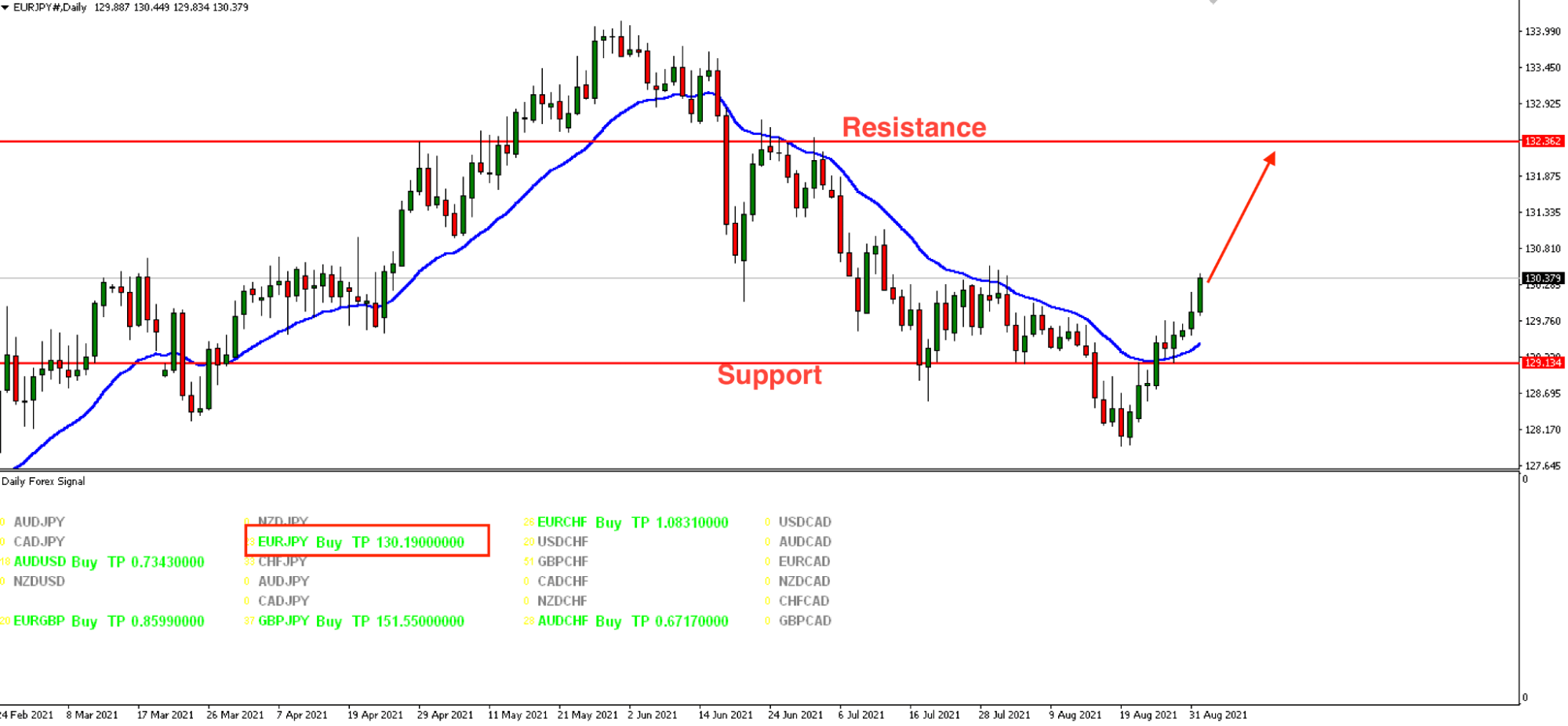

EUR/JPY daily chart

Entry

The buy entry is valid as soon as a buy candle appears above the dynamic 20 EMA. Make sure that the candle closes while the higher time frame direction is bullish.

Stop loss

The aggressive stop loss is below the dynamic 20 EMA, and the conservative stop loss is below the previous swing low. So make sure to use some buffer in every trade.

Take profit

The final take profit is the ultimate resistance level from which the major reversal may happen. However, make sure to book some profit after reaching 1:1 risk vs. reward.

Bearish setup

For taking a buy entry, make sure to have the following condition:

- The price is below a significant resistance level

- The price moves below the dynamic 20 EMA

- Daily Forex Signal shows the signal for the opening selling position

Let’s see an example of the sell trade.

EUR/AUD daily chart

Entry

The buy entry is valid as soon as a sell candle appears below the dynamic 20 EMA. Make sure that the candle closes while the higher timeframe direction is bearish.

Stop loss

The aggressive stop loss is above the dynamic 20 EMA, and the conservative stop loss is above the previous swing high. So make sure to use some buffer in every trade.

Take profit

The final take profit is the ultimate support level from where the major reversal may happen. However, make sure to book some profit after reaching 1:1 risk vs. reward.

Pros and cons of the Daily forex signal indicator

Pros |

Cons |

|

|

Final thoughts

The Daily forex signal is a custom trading indicator that is profitable only when implemented with other trading tools. Moreover, some unavoidable risks in FX trading need smart decisions to handle. There is a possibility of making losses even if you use multiple indicators and trends. Therefore, using a money management system is the key to success.

This indicator is not the ultimate tool that can bring you success from FX trading. You need to build a trading system with this indicator and follow a sound risk management system.

Comments